There are dozens of cards out there to accelerate your travels, but two stand out from the rest of the pack: *amex platinum* and the *csr*.

These aren’t introductory cards for the average Joe or Jane, but rather powerful weapons for the frequent traveler. And while the hefty annual fees may scare some off, they come with top-of-the-line perks that could easily justify the higher out-of-pocket cost.

With travel demand as high as it's ever been, it's time to put these two titans of travel rewards back under the microscope. Which card comes out on top? Which premium perks win out?

We'll break it down, category by category for beginners or even advanced travelers to decide which premium travel credit card suits them best.

- Amex Platinum vs. Chase Sapphire Reserve: Welcome Offer

- Amex Platinum vs. Chase Sapphire Reserve: Earning Points

- Amex Platinum vs. Chase Sapphire Reserve: Redeeming Points

- Amex Platinum vs. Chase Sapphire Reserve: Annual Fee

- Amex Platinum vs. Chase Sapphire Reserve: Lounge Access

- Amex Platinum vs. Chase Sapphire Reserve: Statement Credits and Travel Perks

- Amex Platinum vs Chase Sapphire Reserve: Travel Insurance

Amex Platinum vs. Chase Sapphire Reserve: Welcome Offer

Getting a big pool of points for signing up might be reason enough for many to consider applying for one of these cards. And we can't blame you for that – there's no better way to jumpstart your points and miles travel fund than by capitalizing on a huge welcome offer.

Both of these cards provide a bonus that's worth going after, but one can certainly be more lucrative than the other.

Amex Platinum

Exactly what welcome offer you're eligible for will vary, but you can now earn as high as 175,000 points after spending $8,000 in the first six months. After you submit your application – but before you accept the card (if you are approved) and your credit is pulled – Amex will let you know the exact welcome offer you are eligible for.

Chase Sapphire Reserve

bonus_miles_full

Winner: Which Card Has the Best Welcome Offer?

No matter which route you take, the winner is obvious: The Platinum Card from American Express has the best welcome offer. And it isn't close.

Learn more about *amex platinum*.

Amex Platinum vs. Chase Sapphire Reserve: Earning Points

Of course, those big point bonuses are alluring, but both of these cards offer the opportunity to earn even more points on your ongoing spending.

Here's what you can expect to earn with one of these cards in your wallet.

Amex Platinum

The American Express Platinum Card gives you an unbeatable 5x points on airfare booked directly with the airline or through its travel portal for up to $500,000 spent on this category each year. That’s an easy way to rack up extra points if you frequently travel by air. In addition to the points you'll earn on airfare purchases, you'll also get 5x points on hotels booked through Amex Travel, the company's travel portal.

Chase Sapphire Reserve

With the Chase Sapphire Reserve, earning extra points is even easier. First, you'll get 8x points per dollar spent on travel booked through Chase Travel℠ (Including The Edit℠), 4x points on flights and hotels booked directly, plus 3x points per dollar spent on dining worldwide, and 2x points per dollar spent on all other eligible purchases.

Winner: Which Card is Better for Earning Points?

The fact that you can earn extra points on more purchases gives Chase’s top card a narrow win here. But that could easily flip if you’re frequently buying flights.

Learn more about the *csr*.

Amex Platinum vs. Chase Sapphire Reserve: Redeeming Points

Booking flight deals like those you find in your inbox with your Thrifty Traveler Premium subscription is one of our favorite ways to use points. And one of these cards is the clear favorite for doing that.

But there are other ways you can (and should!) use your points – transferring them to travel partners can unlock some serious value, and both Chase and American Express have some great options.

Amex Platinum

With the Amex Platinum, you can redeem your points for statement credits, gift cards, or even purchases through the Amex Travel portal. But the real value of these points is unlocked when you transfer them to a travel partner to complete an award booking.

Both of these cards share a handful of airlines and hotels as transfer partners, like Singapore Airlines, Air France/KLM, Air Canada Aeroplan, British Airways, and Marriott. But overall, American Express has more options for moving your points than Chase, including some alluring opportunities.

It's one of the main reasons why we think Amex points could edge out Chase points in the battle between Amex vs. Chase points. That includes ANA, which offers a way to fly in business class to Japan for roughly the same amount of miles you’d pay for economy on other airlines … or fly to Europe in business class for just 88,000 miles roundtrip. But perhaps the greatest ANA sweet spot of all is the ability to book round-the-world business class tickets from just 105,000 miles. That's right, you can circumnavigate the globe – in business class – and still have points left over, by applying for this card through Card Match!

Other standouts include Delta, Virgin Atlantic, and Avianca LifeMiles.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

And American Express travel partners frequently offer bonuses when you transfer points – something we don’t see quite as often with Chase. That includes excellent promos like a 30% bonus when transferring points to Virgin Atlantic. Or bonuses as big as 50% when transferring points to British Airways.

Two quick caveats about transferring American Express points. First, through American Express you will be charged a very small fee (.06 cents per point) on transfers to domestic airlines. So if you transfer 100,000 points to Delta or JetBlue, you’ll get charged $60. These fees are capped at $99. And unlike Chase, there are a handful of transfer partners like JetBlue to which your points won’t transfer on a 1:1 basis.

Read our full guide to Amex transfer partners for more information!

Chase Sapphire Reserve

If you're unsure how to use your Chase Ultimate Rewards, we can't fault you. No bank gives cardholders more options for using their points than Chase. If you want to take the easy way out you can redeem them for cash or a statement credit on your card. You could also use them for gift cards or even Apple products.

But since we're a travel website, you know that's going to be our favorite use. And the Chase Sapphire Reserve allows you to redeem your Chase Ultimate Rewards points for one cent each booked through Chase Travel℠.

And although Chase Travel℠ is nice to have for booking cash flights, just like with Amex, the real value of Ultimate Rewards comes from their ability to be transferred to partners for award bookings.

Here are the more than a dozen partners you can move your Ultimate Rewards to:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

Similar to Amex, there are many valuable options in Chase's stable of transfer partners. Some of the highlights from this list are United (for simple domestic bookings), Air Canada's Aeroplan, and of course, the World of Hyatt program.

With redemption rates starting at just 5,000 points per night, Hyatt is easily the most lucrative hotel loyalty program and can make for great use of your Chase Ultimate Rewards points.

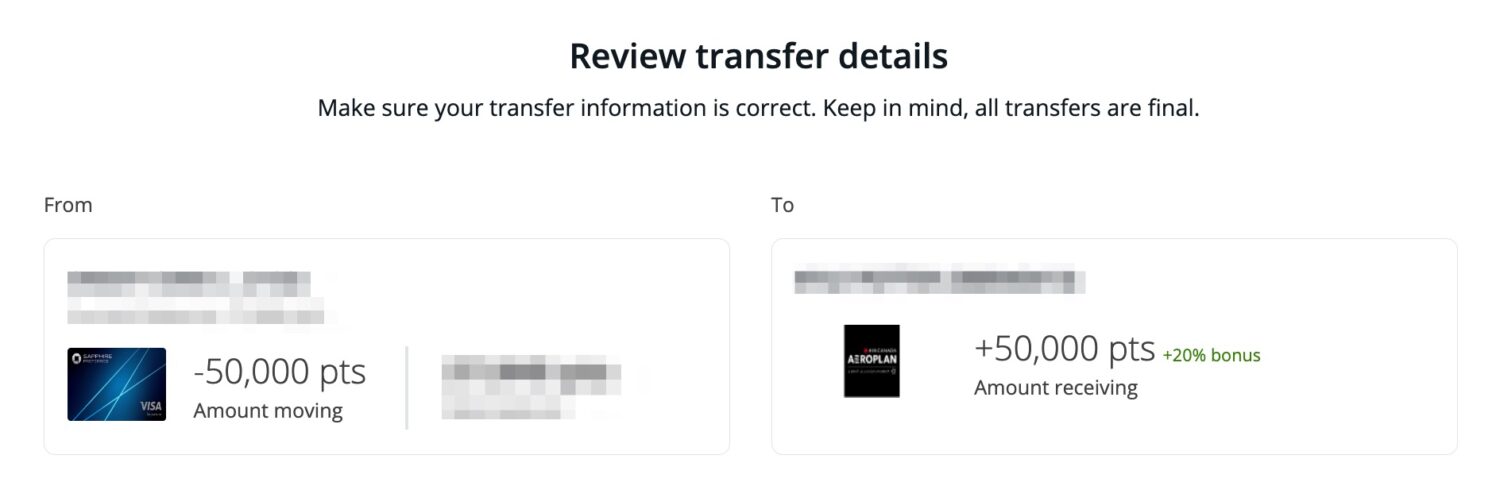

While maybe not quite as frequent, Chase has also started to match Amex on the transfer bonus front, with deals like a 30% bonus when sending Chase points to Virgin Atlantic or a 20% transfer bonus to Aeroplan.

Read our full guide to Chase transfer partners for complete details!

Winner: Which Card is Best for Redeeming Points?

In the battle of best point redemptions, the nod has to go to Chase and the Sapphire Reserve Card. Whether you're transferring to partners, booking travel through Chase Travel℠, or even redeeming for cash, there is no shortage of options for using your Ultimate Rewards.

Learn more about the *csr*.

Amex Platinum vs. Chase Sapphire Reserve: Annual Fee

Let’s get the sticker shock out of the way first: With both of these cards, you'll be out-of-pocket more than $500 each year in annual fees.

But just like you can't judge a book by its cover, you shouldn't judge either of these cards solely based on their annual fee. It's what's on the inside (earning points and providing travel benefits) that truly counts!

Amex Platinum

If you opt for the Amex Platinum Card, you'll be on the hook for a $695 annual fee each year. That's no small sum of money and one that could scare off many travelers considering a new card.

But with that high annual fee comes over $1,500 in available statement credits on an annual basis. It would be foolish to value those credits at full value because you likely wouldn't be spending money on all the things they cover without being incentivized, but even if you get half of that back each year you'd have the card's annual fee covered for you.

Chase Sapphire Reserve

With the Chase Sapphire Reserve, you'll need to pony up $795 each year of card membership.

In order to offset such a high annual fee, Chase gives card members an annual $300 statement credit for travel purchases. This statement credit is much easier to use than those that come with the Platinum Card and in my opinion, should be valued at the full $300 – after all, if you're considering either of these cards it should be a given that you'd spend at least $300 each year on travel. With this credit, the Sapphire Reserve effectively has a $495 annual fee, making it a much more manageable option.

Winner: Which Card Wins on Fees?

There's no denying that the Chase Sapphire Reserve is the more economical choice when it comes to these two cards. Still, depending on how much value you place on the slew of Amex statement credits, you might actually be out-of-pocket less with that card.

Learn more about the *csr*.

Amex Platinum vs. Chase Sapphire Reserve: Lounge Access

When it comes to getting lounge access, both of these cards will do the trick. But one is going to open far more doors than the other – putting it at the top of our list of best cards for airport lounge access.

Let's start with The Platinum Card from American Express. With this card, you’ll get access to the growing network of Centurion Lounges, which are easily some of the best domestic lounges in the country and they've even got even more in the works. And you can also access smaller lounges like the Escape Lounge Centurion Studio, which is one of our favorites at our Minneapolis-St. Paul (MSP) home base.

Due to their popularity and the growing number of people with access, Amex made a change to Centurion Lounge guest access earlier this year – making the Amex Platinum Card a less appealing option for families and couples that frequently travel together. Still, there are some ways around this – and none easier than adding your loved one as an authorized user to your card.

With the Platinum Card, you’ll also get a Priority Pass membership, which gets you into more than 1,300 lounges worldwide and includes some outstanding Plaza Premium lounges.

Last but certainly not least, Delta loyalists can rejoice knowing their Amex Platinum Card is also their ticket to getting into Delta Sky Clubs® – up to 10 visits per year (Feb. 1 – Jan. 31). In order to access Delta Sky Clubs with your Platinum Card, you'll need to be flying with Delta and unfortunately, bringing in a guest will cost you an additional $50 – unless you've added them as an authorized user to your card. However, that now costs $195 per card, per year.

If the Amex Platinum can get you into all of those lounges, how does the Chase Sapphire Reserve stack up?

For starters, the Sapphire Reserve card comes with the absolute best type of Priority Pass membership. What makes this Priority Pass so special is that it still allows you to access Priority Pass Restaurants and get dining credits at a growing number of airport locations. Unfortunately, American Express eliminated that benefit in 2019.

On the branded lounge front, Chase is playing catch-up to Amex. So far, they've opened two Sapphire Lounges, but only one is in the U.S. – the Chase Sapphire Lounge in Boston. In addition to the Sapphire Lounges, Chase recently opened a ‘Sapphire Terrace' in Austin (AUS), giving Sapphire Reserve cardholders access to a small indoor seating area and an extensive outdoor deck.

Outside of these two U.S. locations, there are plans to open at least eight more Chase Sapphire Lounges, including at Dallas (DFW), Las Vegas (LAS), New York (LGA), Philadelphia (PHL), Phoenix (PHX), San Diego (SAN), and Washington, D.C. (IAD). And there's also the bank's first lounge location in Hong Kong (HKG) for international travelers.

Winner: Which Card is Best for Lounge Access?

Even after recent changes to the Platinum Card's Centurion Lounge guest access, it's still the single best card for lounge access. Chase is working to catch up and as more Sapphire Lounges get opened this category will certainly be up for debate.

Learn more about *amex platinum*.

Amex Platinum vs. Chase Sapphire Reserve: Statement Credits and Travel Perks

In order to justify annual fees of more than $500, both cards include statement credits for travel (and non-travel) related purchases. These types of credits can go a long way to offsetting either card's high out-of-pocket costs – but just what you get will vary depending on which card you choose.

TSA PreCheck® or Global Entry Credit

Getting through airport security and clearing immigration is a breeze with either card.

Both the Chase Sapphire Reserve and American Express Platinum will cover the cost of either a TSA PreCheck® or Global Entry membership – however, the Sapphire Reserve takes things a step further by paying for NEXUS as well. Considering Global Entry includes a TSA PreCheck membership, that should make it an easy choice for most. Read up on how to apply for Global Entry – and how to speed up the process if you're struggling to get approved or find an interview.

This is becoming a common feature on many cards. And seeing as both of these top-tier cards offer an identical benefit, this one isn’t decisive.

Annual Travel Credits

Both cards offer some serious travel credits that can immediately reduce the upfront costs of big annual fees.

With the Chase Sapphire Reserve, you get a $300 annual travel credit … and it couldn't be any easier to use. Any purchase coded as travel – airfare, airline fees, hotels, taxis, Uber, and more – will get covered. That’s so easy to take advantage of that you can essentially consider your annual fee of $250, right off the bat. You'll also get up to $120 in annual Lyft credits through Sept. 30, 2027 (split into monthly installments of up to $10).

American Express structures its own travel credits differently … and there are a lot of them.

You'll get up to $200 that goes toward fees on a domestic airline of your choice each year. Maximizing these Amex airline credits has become a challenge in recent years: They're meant mainly for incidental fees like seat assignment, baggage, award taxes and fees, and more.

Another up to $200 gets split up into $15 monthly credits for Uber rides (with a total of $35 for December). Next, you get up to $100 in statement credits to Saks Fifth Avenue each year – $50 for January through June and another $50 for July through December.

And back in 2021, Amex added even more benefits. You'll get up to a $200 hotel credit for Amex Fine Hotels + Resorts® and the Hotel Collection (minimum two-night stay for the Hotel Collection) bookings made through American Express Travel®, an up to $240 digital entertainment credit, a $209 credit for CLEAR® Plus, and up to $155 annually in credit for Walmart+ ($12.95 per month plus taxes).

To us, the ease of using an all-encompassing $300 travel credit edges out the bigger sum of credits split between Uber rides, airline fees, and more. It's likely you won't be able to take advantage of each and every credit.

But that doesn't mean you can't come out farther ahead with the Amex Platinum card with some extra work.

Instant Elite Status

Only one card will get you status with hotel chains: The American Express Platinum.

You can easily enroll for Gold status with both Marriott as well as Hilton Honors. Just beware that you have to manually sign up with each hotel chain to make it happen.

And the benefits are worth it. With Hilton, you get extra points on paid stays, free breakfast (except in the U.S.) and your fifth night free when booking with points. Marriott Gold status gets you room upgrades when available, extra points when paying for your stay and more.

What's more, the Platinum card will also get you perks with Hertz, National, and Avis car rentals. National Executive Status is our favorite by far, as you can skip the check-in desk when you rent any midsize car and head straight to the Emerald Aisle, picking any car that's available!

Winner: Which Card Offers the Best Travel Perks and Credits?

When it comes to statement credits and travel perks, you'll get the most bang for your buck with the Amex Platinum Card. But maximizing the Amex Platinum's benefits will certainly require some work on your end – and we couldn't fault you for preferring the straightforward approach of the Sapphire Reserve's annual travel credit.

Learn more about *amex platinum*.

Amex Platinum vs Chase Sapphire Reserve: Travel Insurance

This one's a doozy.

Between coverage for lost and delayed baggage, medical insurance, and getting reimbursed if your flight gets delayed, there's a lot to unpack. We've devoted a whole post to breaking down the best credit cards for these different policies. But if we have to declare an outright winner, it's got to be the Chase Sapphire Reserve.

It starts with offering up to $100 a day if your baggage is delayed by six hours or more. Its trip delay and cancellation coverage are second-to-none, reimbursing you for associated expenses of any delay of six hours or more – so long as you pay for your flight with the card. The Chase Sapphire Reserve also has some great car rental coverage. And it offers some hefty coverage for some injuries during a trip that was paid at least in part with the card – including medical evacuation.

American Express upped the ante in 2020 with the Platinum Card and other top cards by adding some trip delay and interruption coverage – long a weak spot for the card. Unfortunately, it requires round-trip bookings to be put on the card for this coverage to kick in – a quirk you won't find with the Sapphire Reserve.

The Platinum card's car rental coverage isn't quite as good, nor is its baggage policy. And Amex also removed an unbeatable travel accident and medical evacuation policy.

So while the addition of some travel insurance to the Platinum card makes it a great option for booking flights, there's still a clear winner for which card offers the best trip insurance overall.

Winner: Which Card Provides the Best Travel Insurance?

If it wasn't clear from the outset, the Chase Sapphire Reserve offers unbeatable travel insurance. Even with some enhancements to the coverage offered by the Amex Platinum, it just can't compete with all the insurance offered by Chase.

Learn more about the *csr*.

Bottom Line

By the numbers, the Chase Sapphire Reserve wins four of these categories, while the Platinum Card takes the other three. But the scoreboard doesn't tell the whole story.

Every traveler should give different weight to each of these categories. So you need to decide what matters most to you in a premium credit card before choosing one over the other.

For example, there's no denying that the travel perks that come with the American Express Platinum are among the best on the market. If getting into more lounges and upping your hotel and car rental game with instant status is what you're after, it's the obvious winner here. If you're concerned mostly with earning more points when booking flights, there's no better card than the Amex Platinum – period.

But the Chase Sapphire Reserve really shines in other aspects. While American Express travel has closed the gap with recent changes, Chase still has unbeatable travel insurance coverage. It offers the best bonus when booking cash fares with points through Chase Travel℠ – something Amex can't touch. And the ease of using the $300 annual travel credit is unparalleled, immediately offsetting the annual fee.

This just goes to show that determining which card is best isn't a cookie-cutter answer. Every traveler should weigh the pros and cons of both these cards before deciding which to open. Hopefully, this breakdown helps you decide between the Chase Sapphire Reserve and The Platinum Card from American Express.

Can you be more specific about the $300 travel credit with The Chase Sapphire Reserve? Do you charge the travel, etc to that card and then apply the credit toward the charges? Thank you.

Any travel expense charged to your Chase Sapphire Reserve card will automatically trigger the credit. Read more here: https://thriftytraveler.com/guides/credit-card/chase-sapphire-reserve-travel-credit/

If you have both cards, which card would you put your flights on? One gives you better points per flight and one gives you better insurance.

Hi Linda, I would personally use the Platinum card for flights. You’ll earn 5x points per dollar and you will still get very good insurance coverage.