Ever since its launch in 2016, the *chase sapphire reserve* has been a contender for one of the best travel rewards credit cards.

While the Reserve comes with a hefty price tag with an annual fee of $795, the points, perks, and credits you get from this card can easily offset that fee, and then some. And no benefit goes further in helping you justify the annual fee than the $300 Chase Sapphire Reserve travel credit.

This annual travel credit is one of the most lucrative benefits on any travel credit card … and it's also one of the easiest to use. With that $300 travel credit, you can essentially think of the Sapphire Reserve's annual fee as being $495 a year as long as you plan to spend at least $300 on travel each and every year. It's one of the biggest reasons why we urge readers not to rule out cards with big annual fees.

But how does this travel credit really work? What purchases qualify to use it, and which don't? When will you get it? Let's break it down.

Read our full review of the Chase Sapphire Reserve card!

Learn more about the *chase sapphire reserve*.

When Do You Earn the $300 Credit?

It depends.

The $300 Chase Sapphire Reserve travel credit is applied to your account each year right after you open your card – or renew it – and pay your annual fee. The annual fee is charged after your first statement with the Chase Sapphire Reserve closes. This means that you will have the travel credit available to use about one month after opening the card. Yes, you even get this travel credit in your first year with the card.

From there, you'll get this credit every year at the same time, right after you pay your annual fee. That's drastically different than other cards with similar credits like *amex platinum*, which restart like clockwork each calendar year on Jan. 1. With the Chase Sapphire Reserve, it's based on when you were approved for the card.

For example, my annual fee is due each year in January. My new $300 travel credit loads to my account as soon as my December statement closes.

What Purchases Trigger the Chase Sapphire Reserve Travel Credit?

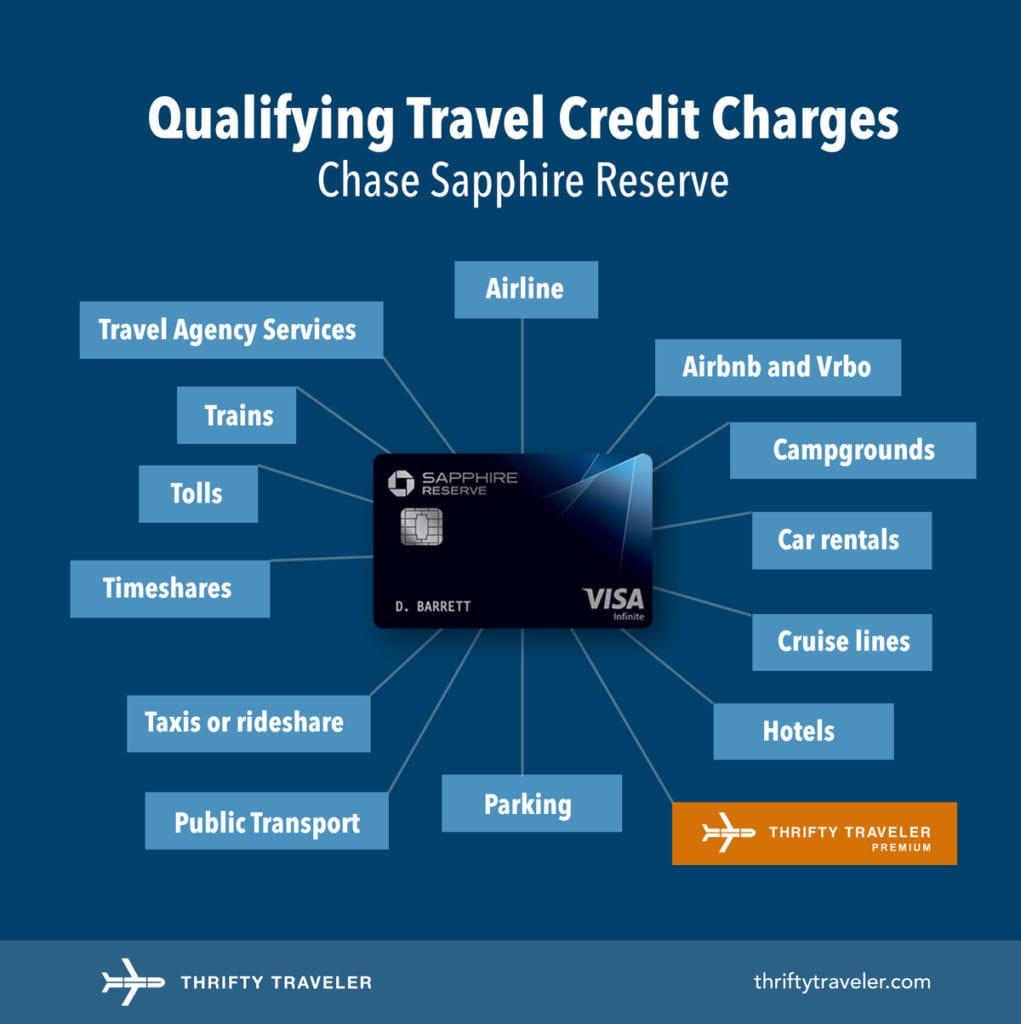

Any purchase that Chase considers travel will qualify for the $300 annual travel credit on the Chase Sapphire Reserve. And that covers a lot of ground, including many expenses you might not normally consider “travel.”

While this isn't exhaustive, here's a list of some charges that will trigger the Chase Sapphire Reserve travel credit:

- Airline (airfare, baggage fees, seat selection, etc.)

- Airbnb, VRBO, or other home-sharing platforms

- Campgrounds

- Car rentals

- Cruise lines

- Hotels

- Parking (ramps, lots, meters)

- Public transport

- Taxis or rideshare (Uber & Lyft)

- Timeshares

- Tolls

- Trains

- Travel Agency services

Thrifty Tip: Are you a Thrifty Traveler Premium member? Since our flight deal alert service codes as travel, it will trigger your Chase Sapphire Reserve travel credit! Get the cheapest domestic and international flight deals sent straight to and the $300 Chase Sapphire Reserve travel credit will cover your membership fee.

For a full list of purchases that Chase will code as travel, visit the FAQs on Chase's credit cards rewards page.

What Doesn't Qualify for the Travel Credit?

Any purchase that doesn't code as travel will not qualify for your $300 credit. That includes money orders, foreign currency exchanges, travelers' checks, or any other similar cash charges.

Do You Get to Choose What You Use the Credit On?

No.

The Chase Sapphire Reserve travel credit is automatically applied to any charges that code as travel. You don't get to pick and choose which transactions you apply the credit for – it happens automatically until you meet the $300 threshold each year.

While that may be a pain if you want to strategically use your travel credits each year, this provides a ton of flexibility. It's infinitely easier to use than the airline credits offered by American Express, or even the $300 travel credit on the *venture x*, and most cardholders should have no issue using it up each and every year.

No matter how you slice it, it's $300 off your purchases – and essentially $300 off your annual fee as long as you plan to spend at least $300 on travel purchases each year. And if you're not, the Sapphire Reserve probably isn't the best fit for you.

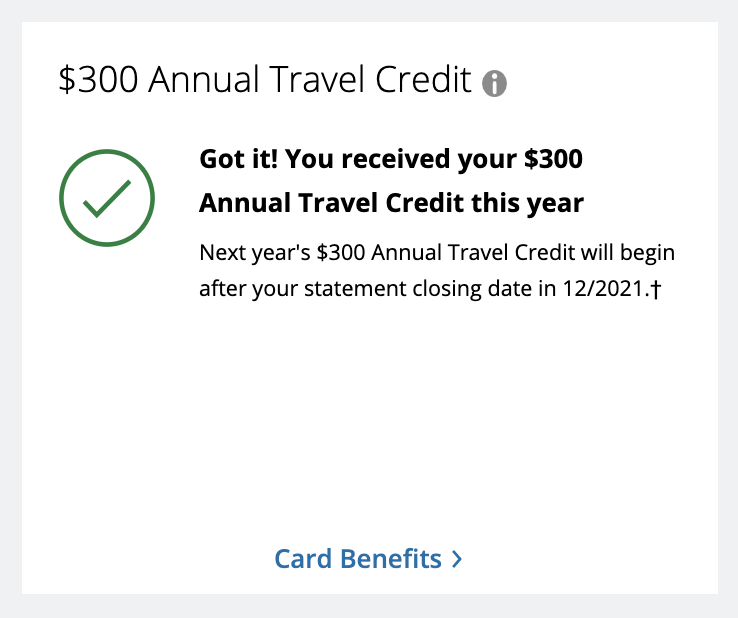

How to Check Your Remaining Travel Credit Balance

To check the remaining balance of your $300 travel credit (or to see when you will get a new $300 to spend, simply log in to your online Chase account and head to the Chase Ultimate Rewards home page.

Once you are here, look for the box on the right-hand side of the page indicating your travel credit balance. Since I have already used mine this year, it shows mine I've already received it. But if you have any unused amount, you'll see it here.

Bottom Line

The Chase Sapphire Reserve travel credit of $300 is incredibly easy to use.

Using up this travel credit each and every year helps justify the high annual fee and makes it far more reasonable for many. Benefits like these are a big part of the reason we always encourage readers to do the math before ruling out cards with big annual fees.

With this credit alone, it's safe to treat the Reserve Card's $795 annual fee more like it's $495 a year.

I think it’s important to remember that the $300 credit actually just represents a $300 pre-payment (or loan) of the cardholder’s own money (paid yearly to Chase as part of the annual fee), which is then given back to the cardholder IF he/she makes travel purchases in the year. (It also doesn’t earn any points for that $300 spent on travel.)

Unfortunately not a gift from Chase, or a magic pot o’ gold. 😉

Hi Erica,

Great article! Thank you. Question: how can we see an itemized listing of how the $300 was applied? And do you know if it’s by percentage of transaction until the $300 is reached? Or is it flat rate until gone? (I’ve had my card 3 months, and just now digging into this benefit and haven’t seen where they applied it. But the comment box in upper right corner appears that I’ve used it all already(?))

Hi Jeff. I don’t believe there is a place to see an itemized list. You would just need to look at your past card statements. The credit is just a flat rate until it is gone.