American Express is making some substantial changes to *amex platinum card*, making it harder to earn a big welcome bonus and more expensive to share perks like lounge access or instant hotel status with loved ones.

The bank quietly tweaked the terms and conditions for its flagship travel card overnight. The changes on deck – many of which are already in effect – range from fairly trivial to major.

Get more travel news to your inbox – sign up for our free daily newsletter

- For years, new Platinum cardholders have earned a welcome bonus – be it 80,000 points or a whopping 150,000-point bonus – after spending $6,000 within the first six months. It’ll now require spending $8,000 within that span.

- Amex has added language that could crack down on earning multiple welcome bonuses on different co-branded versions of the Platinum Card, including those from Charles Schwab and Morgan Stanley … though it may still be possible depending on which order you apply for each card

- Adding authorized users to your Platinum Card is getting drastically more expensive. Instead of adding up to three users for a total of $175, they’ll now cost $195 each.

- It’s long been free for Platinum Cardholders to add another member to their account with a Gold Card instead, with fewer perks. Amex has rebranded that free option as a “Companion Platinum Card” – a name change with apparently no other implications.

- The audiobook and podcast platform Audible will drop off the list of eligible services to use up to $20 in monthly entertainment credits as of Oct. 2, though Amex is adding the Wall Street Journal as an option immediately.

Altogether, it's a sizable change to Amex's pricey Platinum Card likely to rile many current cardholders – especially those who have been sharing travel perks with family or friends. It already comes with a hefty $695 annual fee (see rates & fees), but these changes will make that far more expensive.

The cost of adding new authorized users and many of these other changes are in effect, but Amex has yet to notify current cardholders. Company representatives did not immediately respond to a request for comment.

*amex platinum card* seems more popular than ever as flyers go all-in on the trappings of “premium travel”: Unbeatable lounge access, hotel status, hotel credits, and more. Buoyed by rich benefits and eye-popping welcome bonuses, American Express has said their top-tier card is drawing in record numbers of new customers quarter after quarter.

American Express last hiked the annual fee on the Platinum Card back in the summer of 2021, adding a slew of new money-saving credits to offset it. But beyond that big move, Amex is constantly tweaking its cards, watering down some benefits or making them harder to use.

This is another clear example. And travelers who have added authorized users will be the hardest hit.

A Loss for Authorized Users = A Win for Lounges?

It's been an underrated aspect of the Platinum Card for many years.

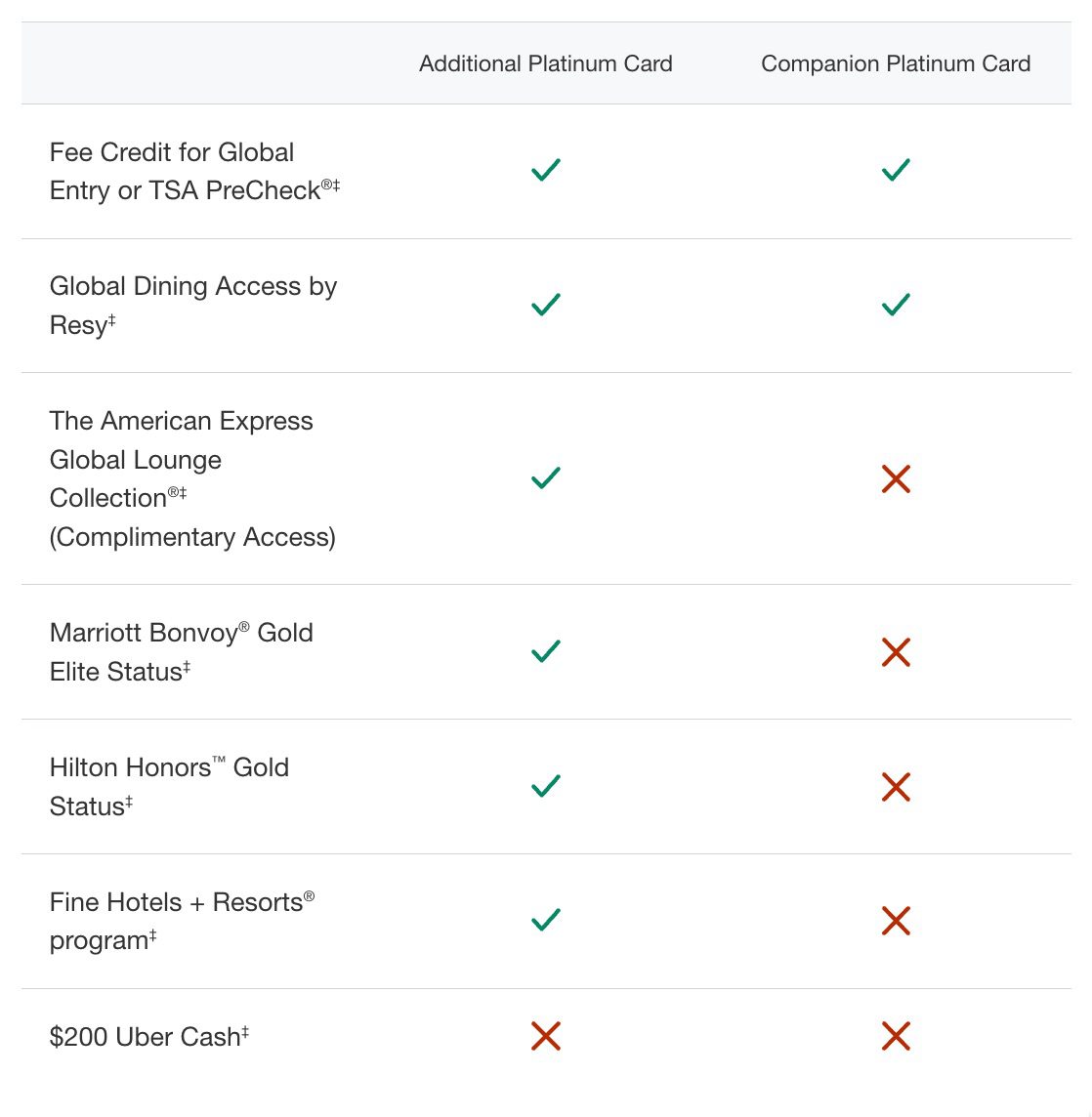

While an additional $175 to add additional card members seems pricey, that fee has covered up to three additional users each year. That's three friends or family members who can get into a Delta Sky Club, Amex Centurion Lounge, or Plaza Premium Lounge on their own. In fact, they get many of the Amex Platinum benefits as the primary cardholder: Lounge access, instant status with Marriott and Hilton, status with several rental car agencies, and more.

But now Amex is charging $195 per person. That means those same three family members will cost you an extra $585 each year, nearly doubling the card's annual fee. After adding three additional users, you can add more for $175 apiece. American Express has claimed it will notify current cardholders of the higher price tag and when it will get charged.

That's steep compared to the competition. Consider this: On the *chase sapphire reserve*, authorized users cost another $75 apiece. With the *venture x*, cardholders can add four authorized users for free.

It's a painful change for the Platinum Card with an undeniable upside: It should mean fewer travelers are lining up outside airport lounges with a Platinum Card in hand.

Overcrowded airport lounges have become a major issue in the last year – none moreso than Delta Sky Clubs and Amex Centurion Lounges. The Platinum Card gets cardholders complimentary access to both. And while Delta and Amex have gone through several rounds of policy changes meant to limit crowding, it hasn't moved the needle much.

American Express likely has all the data it needs to prove that hiking the annual cost of authorized fees would put a dent in the lounge lines. It's a high price to pay for travelers who have extended lounge access to friends and family, but a win for solo travelers.

Amex Platinum Companion Cards?

On paper, there's a brand new kind of card you can extend to friends and family. In practice, nothing has changed.

Rather than pay more in annual fees to give authorized users a full-fledged Platinum Card, there's long been an option to issue them a Gold Card for free instead. American Express is rebranding that option as a Companion Platinum Card® from American Express, fresh with a new look.

As before, you don't get many benefits with the Companion Platinum Card … but one ultra-valuable and underrated perk sticks: Even Companion Platinum cardholders will still get a credit to cover the cost of their own TSA PreCheck or Global Entry membership!

Read more: How to Get TSA PreCheck for the Whole Family With One Credit Card

Bottom Line

This one will leave a mark.

With no warning, American Express is making some substantial changes to its ultra-premium travel credit card. Diehard credit card aficionados will be sad to see they can no longer stack bonuses on different co-branded versions of the Platinum Card – and earning any bonus on the Platinum Card now requires even more spending.

Meanwhile, even occasional travelers will pay hundreds more in fees to share the perks of the Platinum Card with friends and family.

Does anyone here have the chase sapphire card? Which do you like more?

I have the CSReserve. I actually use it for spend, unlike the platinum which has terrible bonuses. I like the centurion lounges with the platinum, but most the other pre-paid “perks” I can do without. The ONLY reason I keep the card is because I can cash in points at 1.1 cent a piece with the schwab card. I have a business gold card that receives a ton of spend that more than pays for the annual fees on the platinum card.

I just dumped the Platinum after having it for 23 years. Too many people get it driving up the popularity and price. Some actually believe it is an upgrade from Gold, but that’s not the case at all.

It’s just a different card. When I canceled, they asked me if I was interested in “downgrading” to the gold card. Amex is selling that and people are buying that BS. The Platinum is for people who travel extensively, maybe a lot on business.

The mid tier hotel branded cards that come with Priority Pass, annual fees less than $100 (with great sign on points bonuses) and points multipliers on dining, restaurants, gas, and other offer so much better value. The card is probably best for those who travel often (probably work related), but obviously membership now is so widespread to so many others who shouldn’t have the card based on its limitations.

As a solo business traveler that spends as much time in a plane traveling as I do at home, I welcome the implied reduction of headcount inside these lounges, especially the Delta Skyclub. I fly out of ATL and it’s unbelievable the amount of people inside any lounge in that airport at almost any given time. Most are there as part of some promotion/bonus etc and aren’t full time travelers. Hopefully this change will make traveling seem a little more bearable again.

I have had Amex since 2000 when you could get into Continental Airlines, US Airways, Northwest, and American lounges then they all got their own co-branded credit cards and airlines merged, and each lounge started to leave one at a time. The card used to have free roadside assistance, two one first first-class international tickets, Event ticket protection, primary car rental protection, and a Concierge that could get you into sold-out events and escorted to the front of the line. Most of these perks are gone and now lots of riff-raff and even 17 years I see at the gym have the card through their parents. The fee used to be $395. All of the sexy perks are gone. All of the platinum reps were US-based and my Delta gold was in India, now they are mostly offshore now. Amex and Delta just dropped the unlimited lounge for Delta to 6 visits a year. I couldn’t stop laughing. I’m excited to see what this does or the Zoo that Delta Lounges become. The poor loophole travelers I’m sure will cancel as they were just using the card for this. I also think they should get rid of letting people break bigger charges in monthly payments this will also help level out the card along with raising the card back to a credit score of 720 or 740. I know Amex needs to keep expanding this base of card members to keep money coming in.

In Canada, the Business Platinum card fee is going up 60% with little to show for it! Not worth it and I’ve already advised American Express that I’m leaving the ship!

i am livid at this news so i called CS to complain.

In a few years, the changes have chipped away at my benefits:

–Increasing the membership fee from $550 to $695

–Limiting guests unless an account hits the $75k annual spend limit

–Reducing the Scwab redemption from $125 to $110

–Upping the charges for AUs

They build such tiny Amex lounges and are using overcrowding as the main reason to make significant changes… if they want to get rid of over-crowding use the extra money that they steal from long-time members and have larger spaces.

I just looked it up. These overnight changes go into effect on September 26. Great journalism.

That may be when it takes effect for you, personally. The date for higher authorized user fees would depend on when an individual cardholder added authorized users and/or opened their card. But the change itself was made effective overnight.

Amex gave me a preset spend after all of these years. I just got my Venture X card and with a new Capitol One Lounge opening in 2 weeks at Den, my most used airport, the X already seems like a much better overall card than my Platinum. You can have 4AU cards for free. Amex is getting the squeeze put on them by a better value premium card.

When I originally got the Platinum Amex about 5 years ago my account manager told me to put all my business expenses through it. I had a limit of $200k that I spend each month and have never missed a payment. Last week I got some bizarre marketing email saying they were making global changes to the credit limits. Overnight my limit was cut to $100k without warning. All the monthly charges for the business were instantly declined. If a bank did that with your overdraft you would sue them. Somehow Amex can get away with it. It is an absolute disgrace.

I fully concur with the observations about the diminishing prestige of the AE Platinum card. Its aura and impact have noticeably diminished over time. It’s possible that AE is adopting a more cautious approach in response to the current interest rate environment, which has led them to curtail the extent of credit they offer to customers.

Interestingly, I’ve encountered situations where my AE Platinum card has been flagged twice in a single month due to higher balances, prompting requests for early payments prior to the actual due date. Curiously, my spending patterns have remained consistent at around $11–13,000 each month, and I’ve diligently settled my balance since 2003 without any complications.

Given these circumstances, I’m beginning to contemplate whether the AE Platinum card will continue to have a place in my wallet beyond this year. The changing dynamics and experiences have prompted me to reconsider its value and role in my financial portfolio.

Simple. For biz travelers waits at lounges to gain access are awful. For those whining about the fee, then you must not use the perk enough to make it worthwhile. Between the meals at my home (other) airports, the Clear/TSA credit and the $400 per year in Dell credits I am getting more from AMEX than my annual fee requires from me.

I don’t understand the attraction to the Platinum? I used to have the card when it sort of meant something. Closed the account and back after 14 years as I needed a new card to open a business checking account. After comparing, the Green made most sense as it filled in gaps from the BBP and compliments my CitiAdvantage Executive at a cost of $595 for essentially similar perks. I live near the MIA hub and recently made AA Gold as a result of spend and occasional travel. I think there are better options out there if you shop around.

Amex is not only cutting benefits, they are even imposing credit limits now on cards that previously did not have “pre-set spending limits”, like the Platinum. It happened to an acquaintance of mine recently, and just about three weeks ago, it happened to me. AMEX has also gone down way downhill with their customer service. All and all, I think that after this year, it might be time to trash my Platinum – and possibly every other account I have with AMEX.

The card is called American Express and Everytime i call CS they’re beber American 🤣🤣🤣🤣

I agree, this card does not feel prestigious anymore. More like a 7 eleven card, they have ruined it. And why does “American Express” customer service send me to India 🤦♂️.

Agree their customer service has been awful for a long time. Won’t even help me try to get a refund from a merchant that clearly kept charging me after I cancelled. Why ask for proof if you’re just going to do nothing?

I contacted AMEX this am to find out what was going on, and decide if i should continue with all the cards. Apparently, as my card renews in 2 days and i was not notified of this 60 days in advance, my account will only be charged the $175. I’ll definitely have to figure out what i am going to do next year. I currently have both my husband and daughter on the account. I was also concerned about changes to my Corporate Card, but was assured there were no changes to it.

My decision to buy low, sell high and get out when I could seems even more prescient now. I got the Platinum in Nov 2020 when the 100k bonus + 10x groceries/gas first started to flow, and rode it to the top at $550/yr, getting off the train in January 2023 to avoid that new $695 fee. The card was profitable, since I got the first Clear credit, and $800 in airline/hotel credits before even accounting for the rest of the coupons. Lounge access was meh living in Central Florida traveling 3-4x a year (Centurion & Cent. Studio all the way down @ MIA & FLL, more than 2 hours’ drive), PP access is available on other cards, and SkyClubs were always SkyCrowded, and useless when traveling with > 2 children.

The Platinum ̶i̶s̶ was a great entry point to Amex membership for the SUB, but long-term the card doesn’t live up to the constant hype. Too much squeeze for so little juice for all but metro New Yorkers, especially now. I retained the Amex Platinum benefits which actually matter with just the EveryDay Preferred (MR earning, Amex Offers), Chase Sapphire Preferred, Hilton Surpass (PP access, Gold status), Delta Platinum (airfare/perks), and Bilt Mastercard (rental car elite status/concierge) for a lot less.

Amex turned out to be to worst bank in the world. Cancellations for no reasons without a proper notice, decreasing credit limit after almost 30 yrs of being a member and fees after fees with ridiculous outrageous in unjustified fees. Stay away if I were you and if you have a card, call and close it if everybody will do that then they will have to make changes the benefits us not them.

Everything went downhill when they chose to accept members with 670 credit scores. I remember when pulling out my platty in public turned heads. Now you see them everywhere.

Chase is way better. Canceled my amex this morning.

👌🏼

AMEX has been quietly cutting MANY benefits from their credit cards. It’s frustrating and nearly impossible to keep up with all the cuts!

I have the regular Amex platinum and planned on applying for the Schwab Amex Platinum, as well. Will the Schwab SUB be permitted? I wasn’t sure what the cobranded “multiple SUB” change meant in the article?

We’re still trying to work this out ourselves. The Amex Platinum terms are clear that you can’t earn the sign-up bonus if you’ve already opened and earned a cobranded bonus. But there’s no such restriction in the terms of the Schwab or Morgan Stanley Platinum … at least not yet.

Could you explain the changes with regard to the co-branded versions? I think a change in AUs and lounge access was inevitable. Overall the changes are clearly not consumer friendly, but maybe not quite as ugly as the headline suggests.

We’re still trying to work this out ourselves. The Amex Platinum terms are clear that you can’t earn the sign-up bonus if you’ve already opened and earned a cobranded bonus. But there’s no such restriction in the terms of the Schwab or Morgan Stanley Platinum … at least not yet.

So my 3 AU $175 charge just posted this week. Was going to cancel that card and go for a new one for SUB and add the 3 same AU to new card. Sounds like that won’t work now? Are the rules in effect now? Maybe I have to keep my Amex plat another year to have my 3 AU’s grandfathered? What say you?

Still waiting to hear for sure but we believe anyone who has already paid for their AUs for the year should have that price honored until they renew.

Existing members will be notified of change in terms as well

This is a really frustrating change. Not good for families.

But great for those who seek quiet time in a lounge without kids running around.

Yes, thank you! A lot of us are in the lounges for business travel and need a quiet environment. I’m all for it! This change needs to happen!

Agreed. We have traveled multiple times over the last year and the lines to get into the lounges were impossible.

Agree

The Platinum card is being promoted to active military AND their additional card holders for free so expect crowding to be worse.

With all due respect to the men and women who serve our country, I wouldn’t suspect there will be droves of active military signing up for this card. Most of those are on a tighter incomes and don’t have additional funds to spend on items like this platinum card. However, at the end of the day, I’d much prefer to sit beside someone who’s fighting for our country than some Millennial sitting there taking selfies of themselves in the lounge and posting on IG like some amateur.

The cards are free to active duty military, so they do sign up. They just need the credit score to qualify.

The Platinum Card has no AF for active duty military. It is quite a deal. Like you though I wouldn’t mind active duty in the lounges.

Thank you for saying this truth! Most military families cannot afford these luxuries that would make their life of travel so much easier as they serve. I remember once arriving back in the US after three years living abroad in Germany at 3 am in the morning. It was a 14 hour flight and my kiddos were so tired they lay right there on the airport floor exhausted trying to beat the jet lag. They were 6 years old at the time. My heart hurts when I hear people speak of military families like pests. Nice that sone can enjoy their freedom in the comfy lounge and not think of the sacrifice others are making for them, some like 6 year olds who’d much rather be in their beds at 3:00 am and not the airport floor.

Active duty belongs in any lounge before I do. Glad for it!

The new trend toward businesses, especially restaurants, charging “convenience fees” for using credit cards, as detailed the other day by the NYTimes, makes one wonder if this whole reward culture is becoming unsustainable.

Probably….I mean, it’s one thing to lure people in with promises of, and then, actual rewards. But if too many people start using them (according to the Credit Card companies) then, you are going to see changes. A few years ago, one of the higher-ups at Delta (around the time they shifted to revenue-based FF miles) was something to the effect of “the practice of over-rewarding frequent flyers has become unsustainable.” Of course, not stated is that those reward programs account for (at least, at this point) more revenue to those places than actual flying.

I’m all for it, good!

This card as been way to generous, particularly as it relates to additional card holders with lounge access.

Clear out the lounges!

Well up until earlier this year you could bring 2 guests for free into the Centurion lounge. Then add 3 people to your account for $175 and THEY got to also bring in 2 guests each. Up to 9 guests into the Centurion lounge for $175 a year. Centurion lounges have become such a zoo I don’t even go to them anymore. Did anyone not see this coming?

That’s why I only book flights early in the morning. Those things are a zoo in the afternoon.

That is absolutely true I stopped going about a year ago because it is packed in there and the food was sub-par. I opted to go to the terminal bar and pay than do that. I am hoping this brings meaningful changes to the lounges.

At least this Amex card’s lounge benefit worked at all. I’ve had a Priority Pass from an Amex business card for over 3 years and not once has it gotten me into a lounge. They always have some excuse. This lounge benefit from Amex has never been a benefit at all and a waste of a promised benefit from Amex. It’s always frustrated me and made me feel like Amex was just blowing hot air.

I thought I was the only one that felt that way also but what you were saying is very true.

Priority Pass works just fine in Southeast Asia!