Another year, another tough blow for loyal Delta flyers – this time in the form of higher annual fees on their Delta SkyMiles credit cards.

In the coming months, travelers with the *delta skymiles gold card* will pay an extra $51 a year while annual fees on the *delta skymiles platinum card* and top-tier *delta reserve card* jump to $350 (see rates & fees) and $650 (see rates & fees), respectively – a $100 increase for both. It's not all bad news for Delta cardholders: The airline and Amex also added a laundry list of new money-saving perks, though some are undeniably better (and easier to use) than others.

But after last year's botched overhaul of earning Medallion Status and restricting Delta Sky Club® lounge access, it's the second time in just the last few months that even once-diehard Delta flyers are wondering if those cards are worth the money anymore. Is this the last straw? Is it time to cancel?

There's no one-size-fits-all answer to that question. As with all things in the world of travel credit cards, you have to do the math for yourself to determine whether benefits like free checked bags, more valuable Delta companion certificates, and new credits for hotel stays or rideshare companies outweigh the higher annual fee.

Your kneejerk reaction might be to cancel in protest of this recent hike. But that may be the wrong move: Maybe you're better off downgrading your card to a cheaper Delta alternative. Or perhaps there is, in fact, a much better travel credit card you should consider … as you finally take your loyalty elsewhere.

Read on to see what questions you should be asking yourself as you reconsider your Delta Amex credit card and chart the best path forward.

Read more: Delta Embraces ‘Extreme Couponing' with New Benefits on Amex Cards

Higher Fees & New Perks: Breaking Down What's Changing

The fee hikes on Delta's Amex cards range from an extra $51 a year to another $100 annually – or no increase at all on the no-annual fee *delta blue* (see rates & fees). And fortunately, the *delta skymiles gold card* will retain a $0 introductory annual fee for the first year (see rates & fees).

| Card Name | Old Annual Fee | New Annual Fee |

|---|---|---|

| Delta SkyMiles Blue Card | $0 | $0 |

| Delta SkyMiles Gold Card | $0 for the first year, then $99 | $0 for the first year, then $150 |

| Delta SkyMiles Platinum Card | $250 | $350 |

| Delta SkyMiles Reserve Card | $550 | $650 |

Delta's line of small business Amex credit cards will see identical annual fee increases.

No matter which card you get, new applicants are on the hook for these higher fees right off the bat. Existing cardholders won't pay these higher fees until their next renewal – and not until May 1 and onwards.

Is your Delta card set to renew before May? You're in the sweetest spot of all: You'll get another full year at the lower rate and more than a year to put these new benefits to use.

Here's a closer, card-by-card look at what's changing with your Delta SkyMiles credit cards – and what's not.

Delta SkyMiles Gold Card

Beyond a higher annual fee in year two and beyond, there's not much changing on the airline's most popular *delta skymiles gold card*

But a few new or improved perks could outweigh that annual cost. And some of the most important benefits of this card aren't going anywhere.

What's New?

- $0 introductory annual fee for the first year, then pay $150 a year (see rates & fees). Existing cardholders will pay that higher fee upon their next renewal starting May 1 and onward.

- $100 Delta Stays Credit: Earn up to $100 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform. These credits reset each calendar year, so you've got until Dec. 31 to put it to use.

- Earn a $200 Delta eCredit: You'll now get a $200 credit to use toward Delta flight purchases when you spend $10,000 or more in a calendar year. Previously, Delta Gold cardholders would only earn a $100 Delta eCredit for that same spending threshold.

What's Not Changing?

- Get a free checked bag for yourself and up to eight others on the same reservation – and there's no need to use your Delta card to book your flight for that free bag.

- Get Priority Boarding (in Delta's Main Cabin 1 zone)

- Get a 15% discount when redeeming SkyMiles on all Delta-operated flights with the TakeOff 15 benefit

- You still earn SkyMiles the same as always: 2x SkyMiles per dollar spent on all eligible Delta purchases, 2x per dollar at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets, and 1x SkyMiles per dollar on all other eligible purchases.

- Get 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees (see rates & fees).

Learn more about the *delta skymiles gold card*.

Delta SkyMiles Platinum Card

The *delta skymiles platinum card* is a frequent choice for frequent Delta flyers. Its annual fee is going from $250 a year to $350. Ouch.

But that increase also comes with some upside: Use up all the new benefits added to the card, and there's an extra $390 a year in value now on the table. Oh, and the card's single-best benefit is getting even better.

What's New

- $350 annual fee, up from the previous $250 a year (see rates & fees). Existing cardholders will pay that higher fee upon their next renewal starting May 1 and onward.

- $150 Delta Stays Credit: Earn up to $150 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform. These credits reset each calendar year, so you've got until Dec. 31 to put it to use. Business owners with the *Delta SkyMiles Platinum Biz* get $200 a year.

- $120 Rideshare Credit: Get up to $120 in statement credits (doled out in $10 monthly installments) a year when you use your card to pay for a ride with Uber, Lyft, Curb, Revel, or Alto.

- $120 Resy Credit: Get up to $120 in statement credits each year (doled out in $10 chunks each month) when you use your card to pay for eligible purchases via Resy, Amex's restaurant reservation platform. This is also a use-it-or-lose-it benefit: Any unused balance won't roll over to the following month.

- New Annual Delta Companion Certificates can now be used for Main Cabin roundtrip travel to destinations throughout the U.S. (including Hawaii, Alaska, the U.S. Virgin Islands and Puerto Rico) as well as many destinations in Mexico, the Caribbean, and Central America. Previously, you could only use companion certificates on flights within the mainland U.S.

- Any current companion certificates you've got won't benefit from this expansion, sadly: A Delta spokesperson confirmed that only companion certificates issued after Feb. 1, 2024, can be used on flights outside of the mainland U.S.

- Join the complimentary upgrade queue: Even if you don't have Delta Medallion status, your Platinum Card now makes you eligible for complimentary upgrades to Delta One (within the U.S.), first class, and Delta Comfort Plus on tickets purchased on or after Feb. 1, 2024. But based on how Delta determines its upgrade order, any upgrades will be a long shot – and unavailable if you bought a Delta basic economy ticket.

- Hertz Five Star Status: Get complimentary Hertz Five Star elite status upon enrollment.

What's Not Changing

- Get a free checked bag for yourself and up to eight others on the same reservation – and there's no need to use your Delta card to book your flight for that free bag.

- Get Priority Boarding (in Delta's Main Cabin 1 zone)

- MQD Headstart: Get a head start on earning Medallion status with an automatic 2,500 Medallion Qualifying Dollars (MQDs) each year starting this year

- Earn 1 MQD for every $20 you spend on your card, helping spend your way to Delta Medallion Status

- Get a 15% discount when redeeming SkyMiles on all Delta-operated flights with the TakeOff 15 benefit

- Get up to a $120 credit to cover the cost for Global Entry or TSA PreCheck once every 4 1/2 years for the application fee for TSA PreCheck and every four years for Global Entry

- You still earn SkyMiles the same as always: 3x SkyMiles per dollar spent on all eligible Delta purchases, 3x on hotels, 2x per dollar at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets, and 1x SkyMiles per dollar on all other eligible purchases.

- Get 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees (see rates & fees)

Learn more about the *delta skymiles platinum card*

Delta SkyMiles Reserve Card

Delta's priciest, premium travel card is getting even pricier.

The annual fee on the *delta reserve card* is jumping from $550 up to $650 – a higher price point than any other top-tier airline credit card. With that hike comes even more valuable money-saving credits than what you get on the Delta Platinum Card, a stronger annual Delta companion certificate, and better Sky Club access when traveling with friends and family … at least for now.

Plus, Delta is completely offsetting that increase this year with a one-time gift of a $100 flight credit, which should hit cardholders' SkyMiles accounts on April 2.

What's New

- $650 annual fee, up from the previous $550 a year (see rates & fees). Existing cardholders will pay that higher fee upon their next renewal starting May 1 and onward.

- $200 Delta Stays Credit: Earn up to $100 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform. These credits reset each calendar year, so you've got until Dec. 31 to put it to use. Business owners with the *delta reserve business* get $250 a year.

- $120 Rideshare Credit: Get up to $120 in statement credits (doled out in $10 monthly installments) a year when you use your card to pay for a ride with Uber, Lyft, Curb, Revel, or Alto.

- $240 Resy Credit: Get up to $240 in statement credits each year (doled out in $20 chunks each month) when you use your card to pay for eligible purchases via Resy, Amex's restaurant reservation platform. This is also a use-it-or-lose-it benefit: Any unused balance won't roll over to the following month.

- Annual Delta Companion Certificates can now be used for economy, Delta Comfort Plus, and first class roundtrip flights to destinations throughout the U.S. (including Hawaii, Alaska, the U.S. Virgin Islands and Puerto Rico) as well as many destinations in Mexico, the Caribbean, and Central America. Previously, you could only use companion certificates on flights within the mainland U.S.

- Any current companion certificates you've got won't benefit from this expansion, sadly: A Delta spokesperson confirmed that only companion certificates issued after Feb. 1, 2024, can be used on flights outside of the mainland U.S.

- Sky Club Guest Passes: Cardholders get four one-time guest passes to bring a friend or family member into the Sky Club each year – up from the two-a-year passes previously.

- Hertz President's Circle Status: Receive complimentary top-tier Hertz President's Circle elite status upon enrollment.

What's Not Changing

- Get a free checked bag for yourself and up to eight others on the same reservation – and there's no need to use your Delta card to book your flight for that free bag.

- Get Priority Boarding (in Delta's Main Cabin 1 zone) on every flight

- MQD Headstart: Get a head start on earning Medallion status with an automatic 2,500 Medallion Qualifying Dollars (MQDs) each year starting this year

- In 2024, Delta Reserve cardholders will get an extra 1,000 MQD boost for a total of 3,500 MQDs

- Earn 1 MQD for every $10 you spend on your card, helping spend your way to Delta Medallion Status

- Get a 15% discount when redeeming SkyMiles on all Delta-operated flights with the TakeOff 15 benefit

- Unlimited Sky Club access … but only until Feb. 1, 2025, when Delta Reserve cardholders will be capped at visiting Sky Clubs just 15 days per year.

- Get up to a $120 credit to cover the cost for Global Entry or TSA PreCheck once every 4 1/2 years for the application fee for TSA PreCheck and every four years for Global Entry

- Complimentary space-available upgrades, even for non-Medallion members. Don't count on a free upgrade if you don't have status, but this is a great way to improve your upgrade chances.

- You still earn SkyMiles the same as always: 3x SkyMiles per dollar spent on all eligible Delta purchases and 1x SkyMiles per dollar on all other eligible purchases.

- Get 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees (see rates & fees)

Learn more about the *delta reserve card*.

Why Did You Get a Delta Card in the First Place?

Answering this question might be easier said than done. But as you evaluate whether that Delta card is worth keeping in your wallet anymore, it's important to consider why you got it to begin with.

Like many travelers based in Delta hubs, I've had Delta credit cards over the years. The answer to why I was initially drawn to them is simple: A bonus of 70,000 SkyMiles to 100,000 SkyMiles. That doesn't mean that I didn't value (and use) other benefits of the cards, but a big welcome bonus initially lured me in.

If your primary reason for having a Delta American Express card was a big welcome offer, it's high time to re-evaluate whether it's worth keeping. Even if you're dead set on earning them to book those cheap Delta SkyMiles flash sales, there are actually better ways to earn Delta SkyMiles.

If you're a casual Delta flyer with the *delta skymiles gold card* who makes good use of the card's ongoing perks like free checked baggage (for you and up to eight others on your itinerary), priority boarding, and the TakeOff15 discount for an automatic 15% off Delta flights booked with SkyMiles, then keeping one of this card for the longer term might still make sense. But that depends on how often you'll be flying with Delta in 2024 and beyond.

If you're a Delta loyalist who has been spending big bucks each year on either the *delta skymiles platinum card* or the *delta reserve card* to earn elite status, then you're overdue to reconsider that Delta card. The airline's hefty increases to spending requirements to earn status coupled with the elimination of the Medallion Qualifying Dollar (MWD) Waiver – a nifty workaround to bypass those annual spending requirements by charging $25,000 a year to your Delta card – could make these cards far less valuable.

Then again, was your primary motivation for getting the Delta companion certificate – an annual buy-one, get-one fare? If you use it each year, that perk alone can easily outweigh even the higher annual fees on these cards.

Deciding which benefits of your Delta card you can't live without will help you determine a path forward. And that path just might include doing exactly what Delta and American Express want you to do: spending a ton on your card to keep things status quo.

Do the Math on These Annual Fee Increases

We get it: No one likes paying annual fees on credit cards. And no one wants to pay even more of them.

But while it might be tempting to grab your scissors now and chop up your Delta credit card, it's time to do some math. Is it worth paying $150, $350, or even $650 a year for your Delta Amex Card? Maybe not … but it might still be.

It's up to you to do some serious mental inventory about the value you'd get from your card's benefits in exchange for paying another year in fees. Does paying that $150 or more annual fee help you save $150 or more on checked bag fees, an annual trip with a companion, Delta Sky Club access, and other expenses? Even before you factor in those new credits for hotel stays, rideshare trips, and restaurants, you might find that you'll still come out ahead.

But before you do all that: Check your American Express account (or start a chat online) to determine when your card is up for renewal.

Are you set to renew anytime before these higher fees take effect for existing cardholders on May 1? Then the math is simple: You'll pay the same, older fee you've had for years – and be able to use new benefits in the meantime, too. Unless your travel plans or financial situation has changed, why not keep it open for another year?

Delta SkyMiles Gold Card

Free baggage.

That's the real value of the *delta skymiles gold card* – and it's why we encourage nearly all Delta flyers to skip the no-annual-fee *delta blue*, which doesn't offer such a benefit.

Whether you fly domestically or all the way to Australia, you'll get your first checked bag free on every Delta-operated flight – and not just your own bag, but for up to eight other passengers booked on your reservation, too. That's $30 or more in savings each way, every flight. And you don't even need to pay for your flight with your Delta Gold Card to get this perk – so long as your SkyMiles number is attached to your reservation, you're set.

Let's do some math together to see how quickly this can outweigh the annual fee, shall we?

- If you're regularly flying solo for work or vacation and checking a bag, the breakeven point is six one-way domestic Delta flights or three roundtrip reservations. If you expect to fly Delta that much or more in the next year – or fly somewhere like South America or Europe where checking a bag can cost even more – you'd wind up coming out ahead.

- Traveling with a pal or spouse? Three one-way flights together would cost you at least $180 in bag fees if you each checked your luggage. If you've got the Gold Card and book for both of you, you're already breaking even and then some.

- Family of four? If you each check a bag, you'd save $240 in checked bag fees on just one domestic roundtrip, dwarfing the card's higher $150 annual fee in one fell swoop.

Other perks on the Delta Gold Card can add up, too.

If you were to ditch your Delta Gold Card, you'd lose the automatic 15% discount when redeeming SkyMiles – the no-annual-fee Delta Blue Card doesn't offer that perk either. Saving 15,000 when you redeem 100,000 SkyMiles may not be monumental, but it can add up over the years.

And now, there's a new, $100 annual credit for prepaid hotel and vacation rental reservations booked via Delta Stays, the airline's Expedia-powered online travel agency. While I wouldn't consider this a full $100 in savings – you'll probably wind up paying more than booking direct or through another site, plus you'll lose out on the option to earn hotel points or get status benefits – it could be enough to push someone on the fence over the edge.

Delta SkyMiles Platinum Card

If the Delta Gold Card is all about baggage, the annual fee killer on the *delta skymiles platinum card* is its once-a-year companion certificate. And that perk is getting even better – though not quite yet.

The most exciting item in Delta's big overhaul by far was a major expansion of where you can use Delta companion certificates, which have long been restricted to just flights within the mainland U.S. Going forward, you can book buy-one, get-one flights throughout the entire U.S. and its territories, Mexico, and much of the Caribbean and Central America.

But don't try to book your trip to Mexico, Honduras, or Hawaii just yet. A Delta spokesperson confirmed that any existing certificates won't benefit from this expansion – only new certificates issued Feb. 1 and onward can be used for one of these bigger trips for two. So if you've got a certificate from re-upping your card last year, you're stuck using it within the lower 48 states.

Have you struggled to use your companion certificates in the past? Well, this may not change much for you – these certificates are still restricted to certain classes of main cabin economy fares, and those can be tricky to find. That's why many Platinum cardholders swear these certificates have become worthless because every search for a buy-one, get-one fare comes up empty.

Delta has made it a bit easier to find flights that work by introducing a new price calendar feature when searching for flights using your Delta companion certificate. We've also cobbled together some of the best tips to put Delta companion certificates to use – including a next-level tool you can use to zero in on the flights that will actually work, this year or next.

So take it from me: It can be done! I just redeemed a companion certificate for flights from Minneapolis-St. Paul (MSP) to Louisville (SDF) to catch a concert with a friend this spring. Instead of paying more than $800, we paid just $432 total for two tickets. And I'm confident I can use it wisely again next year and going forward.

If you're not (or it's just not worth the trouble), this fee hike might be the push you need to ditch the Platinum Card. After all, you can still get free bags and other Delta perks with a far cheaper alternative.

Really, using this companion certificate is the linchpin for whether this card is a keeper or not – and that hasn't changed. Sure, Delta loaded up the card with hundreds of dollars in new credits, including:

- $120 a year toward rideshare rides with Uber, Lyft, and other companies, though they're doled out in $10 monthly installments

- Another $120 a year toward charges at restaurants that are a part of the reservation platform Resy, again split into $10 monthly chunks

- $150 each year for prepaid hotel and vacation rental reservations booked via Delta Stays, the airline's Expedia-powered online travel portal

But unless you're riding Uber or Lyft monthly like clockwork, I'm not sure these benefits move the needle compared to the companion certificate.

One last thing to consider: If you're hot on the chase for Delta Medallion Status, the Platinum Card can give you a serious leg up thanks to the MQD Headstart bonus: an automatic 2,500 MQDs each and every year. That's half of what it now takes to earn Silver Medallion Status and enough to vault many frequent Delta flyers to an even higher tier.

How much is that worth? That depends on how much you'll spend with Delta in the next year to enjoy the perks of status and climb up to Gold status, Platinum status, or even higher.

But be warned: If you decide to cancel or downgrade your Platinum Card, Delta has warned you might forfeit those bonus MQDs.

Delta SkyMiles Reserve Card

While paying $650 a year for a travel credit card might sound absurd, the top-tier *delta reserve card* was the biggest winner in these otherwise difficult-to-swallow changes. At least for the next year.

Yes, the Reserve Card will also eventually benefit from the expansion of companion certificate, just like the Delta Platinum Card. And sure, it's getting even more in money-saving credits for hotel stays and restaurants than the Platinum Card.

But Delta went out of its way to satisfy current Reserve Cardholders with a few one-time perks, too. Anyone who had the Reserve Card open before Feb. 1, 2024, will also get:

- A one-time $100 Delta flight credit to offset the annual fee hike. That's supposed to be available April 2.

- While Reserve cardholders also get a 2,500 MQD Headstart bonus each year to begin the chase for Medallion Status, Reserve cardholders are getting another 1,000 MQDs this year as a bonus. Reserve cardholders should see that reflected in their SkyMiles accounts now.

If you were ready to re-up your Reserve Card before this annual fee increase, these two perks alone should be enough to make it an easy choice to do so again – at least if you ask me. Unless you don't care about Delta Medallion Status, of course … but if that's the case, having the Reserve Card was likely the wrong choice for you in the first place.

But the math might seriously change next year when Delta's most brutal Sky Club entry restrictions kick in. Come Feb. 1, 2025, Reserve cardholders who currently get unlimited lounge access will be capped at visiting Sky Clubs just 15 days per year.

That's right: You'll be paying $650 a year for Delta's top credit card, yet the airline will still limit how often you can use its lounges. And the only way around that restriction is by spending a whopping $75,000 a year on your Reserve Card.

You've got a year before you need to worry about that, though. Until then, the math should work out in your favor.

Should You Downgrade or Cancel Your Delta Card?

If you've determined that your current Delta card isn't worth the price tag as these changes take hold, you have two options: Downgrade your card to a cheaper (or free) version … or cancel it altogether.

Deciding which route to take depends on your future travels. If you still plan to fly with Delta frequently but don't spend enough to earn status with the airline or can't be bothered with trying to use a companion certificate, then downgrading to a cheaper Delta card might be the best move.

Holding the Delta SkyMiles Gold Card will still get you free checked baggage, priority boarding, and a discount on award tickets. If you fly Delta just a few times a year, that can make this card more than worth its higher annual fee.

Additionally, if you downgrade your card to a cheaper version, there's always the chance that American Express will try to rope you into a more premium version of the card again down the road. While it's no guarantee, Amex is notorious for handing out upgrade offers on its different travel cards – and even though you can't earn a bonus more than once, this is a sneaky way to get a second welcome offer bonus of sorts.

If you're ready to move on from your co-branded Delta card altogether, canceling will help you avoid paying an annual fee and let the airline (and bank) know what you think of their recent changes.

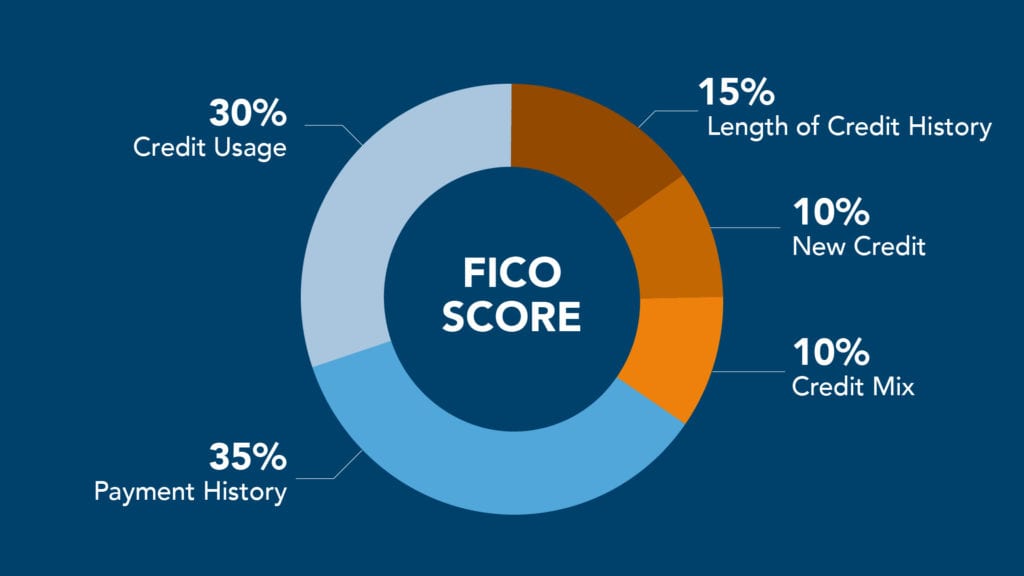

Before you cancel, there's one big thing you should consider: How will doing so impact your credit score?

If you've had your Delta card for years, canceling it outright could hurt your score as it will impact your credit usage (by decreasing the total amount of credit you have available), decreasing your average age of accounts, and shrinking your length of credit history. So the better path for many longtime Delta credit cardholders might be to downgrade to the no-annual fee *delta blue* instead to keep that line of credit alive.

As for any SkyMiles you've earned on the card, there's no need to worry about those. Once they're earned and in your SkyMiles account, you won't lose them should you decide to cancel.

Thrifty Tip: Before canceling or downgrading a credit card, always check to see if there is a retention offer available first. These retention offers can take the sting out of paying another year of annual fees and make keeping the card a no-brainer.

What Travel Card to Get Instead

If your mind is made up and you're done with your SkyMiles credit card, I've got good news for you: There are lots of great options to replace it with.

Rather than focusing on which airline you're most likely to give your business to, consider opening a credit card that earns transferable points that can be moved to a variety of different airline and hotel partners, including potentially your favorite airline.

This way, you're not locked into one specific program and can use your points or miles to book flights with whichever airline has the best deal. American Express, Chase, Capital One, and Citi all offer travel rewards cards that earn transferrable points and come with a range of benefits, opportunities to earn bonus points and miles, and annual fees.

Best Replacement for the Delta SkyMiles Gold Card

The *chase sapphire preferred* is a mainstay travel rewards card that's perfect for almost anyone – from those who are just getting started redeeming points for travel to the points and miles pros. The card's annual fee is annual_fees, quite a bit less than the Gold Card's new $150 annual fee.

This card earns 3x Chase Ultimate Rewards points on dining purchases, 2x on travel purchases, and 1x everywhere else. Chase Ultimate Rewards points are extremely valuable and can be used to book flights on any airline (including Delta) through Chase Travel℠. If you want to take things to the next level, you can transfer those points to Chase transfer partners – including handy workarounds to book Delta flights for fewer miles than what Delta itself charges.

The Sapphire Preferred also comes with an annual $50 statement credit for hotels booked through Chase Travel℠ and some of the best travel insurance of any card on the market.

It also comes with a sweet welcome bonus offer: bonus_miles_full

Learn more about the *csp*.

The *capital one venture card* is another solid option for anyone looking to ditch their Delta Gold card.

For an identical annual fee of $95 per year, you'll get an easy-to-use travel rewards card that earns unlimited 2x Capital One Miles on every purchase, everywhere. The miles that this card earns can be used to offset any travel purchase – yes, even a bucket-list golf trip to Oregon – or transferred to one of Capital One's many transfer partners. The card also comes with travel benefits like a statement credit for either Global Entry or TSA PreCheck.

Welcome Bonus Offer: bonus_miles_full.

Learn more about the *capital one venture card*

Best Replacement for the Delta SkyMiles Platinum Card

The best card for replacing the Delta Platinum card should feel very comfortable to any Delta loyalist. That's because even though it isn't Delta branded, it actually earns points that can be transferred directly to Delta SkyMiles – and 20 other travel partners.

I'm talking about the *amex gold card*. This card isn't just the best card for replacing the Delta Platinum, it's one of the best all-around credit cards, period.

You'll also get up to $120 in dining credits each year to spend at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys, $84 Dunkin' Credit, $100 Resy Credit, and up to $120 annually in Uber cash to use at both Uber and Uber Eats. These statement credits are given out in $10 monthly increments and any amount you don't use at the end of the month will be forfeited. Just add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S.

Cardholders earn an unlimited 4x Membership Rewards points per dollar spent at restaurants worldwide (including takeout and delivery in the U.S. up to $50,000 annually then 1x). The Amex Gold Card also earns 4x points per dollar spent at U.S. supermarkets on up to $25,000 each year (1x points thereafter), making this card a go-to for buying groceries at home, too.

The Membership Rewards points that this card earns can be used to book travel directly through the Amex Travel portal or transferred to any of their 20+ travel partners – including Delta! To pad your points stash, the Amex Gold comes with a big welcome offer bonus. bonus_miles_full

Learn more about the *amex gold*

Best Replacement for the Delta Reserve Card

If you currently hold the Delta Reserve Card, you're accustomed to paying a high annual fee in exchange for outsized travel perks and benefits. There are several similarly priced travel rewards cards on the market right now and most of them come with even more perks than the Delta Reserve.

The easy choice would be to go with *amex platinum card*. This card will still get you into the Delta Sky Clubs (although you'll be limited to just 10 visits per year starting Feb. 1, 2025) and you'll earn Membership Rewards points that can be transferred directly to Delta SkyMiles. On top of Sky Club access, it's also a great card for lounge access in general, as it comes with a complimentary Priority Pass™ membership, and gets you into Amex Centurion® Lounges and Escape Lounges.

The card also comes with a slew of statement credits that offer over $3,500 in annual value. While some of those credits can be difficult to use, there should be plenty there to offset the card's (admittedly steeper) annual_fees annual fee (see rates & fees).

If you've never held the card before, you can currently get a welcome offer as high as 175,000 Membership Rewards points when opening the card and spending $12,000 on purchases in the first six months of card membership. Exactly what offer you qualify for (if any) will vary. Amex will let you know your exact offer details before accepting the card (if approved) and having your credit pulled.

Learn more about *amex platinum*.

Another really good option – and what gets our vote for replacing the Delta Reserve card – is the *venture x*. This card provides some tremendous value, and with an annual fee of $395, it's a fraction of the cost of the Reserve Card. But with that middle-of-the-road annual fee, you get travel benefits typically reserved for credit cards that cost far more.

How so?

The card comes with an annual $300 travel credit (essentially a $300 discount on bookings in the Capital One Travel portal), an anniversary bonus of 10,000 Capital One Miles, and some of the best lounge access and travel insurance of any card on the market. The annual travel credit and anniversary miles alone make it seem like Capital One is paying you to have the card, never mind everything else that it offers.

The card makes earning and redeeming miles simple by rewarding unlimited 2x Capital One Miles for every dollar spent on every purchase.

Learn more about the *venture x*.

Of course, none of these cards will provide you with a free checked bag when flying on Delta. And if you're still set on earning Delta Medallion status this year and beyond, neither of these cards will help you there either, Just remember: airline and hotel loyalty is expensive – and Delta's latest changes reinforce that fact.

Bottom Line

It's the question on thousands of Delta flyers' minds: Are these credit cards even worth the cost anymore?

Regardless of these annual fee increases and annoying new benefits, you're wise to ask yourself that question each and every year. But only you can answer it for yourself, doing the math to determine whether the benefits, new and old, justify paying a higher annual fee this year and next.

Lucky you, there are plenty of options for canceling or downgrading your Delta Sky Miles credit card in favor of something cheaper or more rewarding – and maybe even both.

Thanks for the information. I will be cancelling my Delta Reserve before the renewal date this fall. Up yours Delta

Just dropped my Delta Amex Platinum in December after 20+ years. Delta seems to be feeling full of themselves because they are an above average carrier. They can eliminate a lot of perks and still get the same market share as before. If American or United were able to ever create a viable alternative, Delta would have to rethink their strategy. As I predicted, I have already started to get mailings for the gold card – $0 for the first year and 70,000 miles.

That article was, by any estimation, the best and most well articulated analysis of the Delta credit cards (and the recent AF increases) this long time Delta flyer has ever read.

Many thanks for your research and supporting financial calculations.

I signed up for the AMEX gold card last May and qualified for the bonus points which are now in my Delta skymiles account. I called to cancel the AMEX and was informed that any bonus miles in the skymiles account would be revoked. I called on two different days and was told the same thing.

I believe this is incorrect.

Can we use the rideshare credit on ubereats?

Unfortunately you can not.

There is no “down grading” an American Express card per see. You can cancel a card and open a new one which has credit score implications. But there is no “down grading”.

Yes, you can downgrade (the banks refer to it as “product changing”) an Amex Card, including Delta.

Source: I’ve done it many times myself, as have many other Thrifty Traveler staffers and readers.

Both my husband and I have gold Delta cards. With the huge increase in fees coming up, we decided to cancel mine. I called the number on the back of the Amex card and read a disclosure by the rep, stating I understood I would lose my miles if I cancelled. I’m keeping it for now.

Based on the yearly fee for Reserve card, Delta is same for same competing with cost of entry to lounges for American and United. Given their premium ticket price over both of those carriers and close rates of delays and cancellations, it’s clear that loyalty is not value to them, so it shouldn’t be for (former) customers either. An Amex that gets you into Priority/Centurian/Escape is much better deal if frequency of travel justifies. Chase United comes with greater travel benefits. Switch to Platinum and let Delta flounder for a few years til they come back begging, then demand more premium.

Wondering what a reasonable fee for the Delta Reserve card is with the downgraded benefits. I’m thinking $150 for the companion pass given limited availability of seats eligible with cert and $70 for Skyclub access (based on $550 fee – $150 companion pass) / 26 club visits I make today) * 6 visits based on new visit limit. So, I’m willing to renew my Delta Reserve in 2024 for $220 otherwise it’s time to switch to non Delta card.

You get 10 visits on Delta Reserve (plus 2 Sky Club guest passes). You get 6 visits on Amex Platinum (0 Sky Club guest passes).

Delta Airlines… the new BudLight.