Let's face it. Airlines and hotel brands are making millions of dollars from customer loyalty.

They shell out tons of money marketing their planes, rooms, and programs, hoping to woo you into flying or staying only with them and ignoring the price tag. Everyone loves the idea of building status and getting free flight upgrades, but loyalty is expensive.

Take it from us; hotel and airline loyalty will cost you more money in the long run. And while we all have our favorite airlines, it simply doesn't make sense for the average traveler to stick with one airline – to keep booking the more expensive flight on Delta Airlines, even when American or Southwest or United are selling the same flight for cheaper.

It's one of the biggest mistakes most travelers are making.

Be A Loyalty Free Agent

Of course, everybody has a preference for their favorite airline and hotel brands. Living in Minneapolis-St. Paul (MSP), a massive Delta airlines hub airport, I prefer flying Delta simply because I think they offer the best onboard experience, the most nonstop flight options and the most convenient flight times.

But does that mean it's always worth the premium they often times try to charge? Sometimes yes, but often it's not. Especially when you consider that even Delta Medallion status is rarely worth it unless you're a top-tier elite flyer. And the same is true of status with other airlines.

In April, I fulfilled a bucket-list travel experience and attended the 2019 Masters Golf Tournament. Being loyal to Delta on this trip would have cost us a ton of money or SkyMiles I wasn't willing to part with for a flight into Atlanta (ATL) or Charlotte (CLT). Instead, we ended up using American Airlines miles to fly nonstop into Charlotte which saved us a ton of money.

It's reasons like this that I always suggest people be travel loyalty free agents, and have no airline or hotel loyalty. You will simply save yourself money in the long run and make better decisions with your points, miles, and money.

Follow the Cheap Cash Fare

We often tell readers and Thrifty Traveler Premium subscribers to follow the cheap cash fare. It will keep your options wide open when it comes to meeting your travel goals as you won't be handcuffed by finding a cheap fare on only one airline.

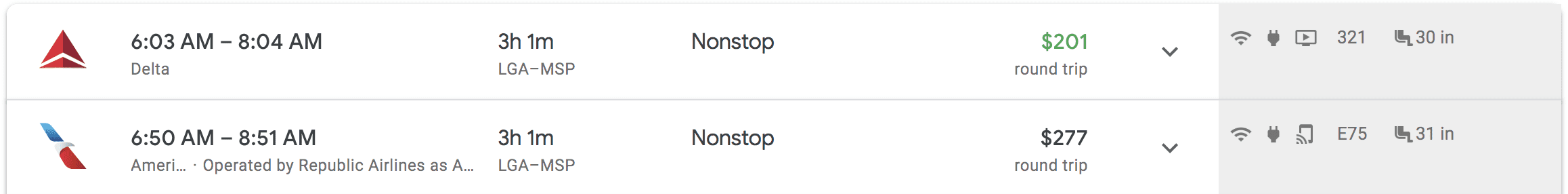

Let's take for example a flight from New York City-LaGuardia (LGA) to Minneapolis-St. Paul (MSP) this summer. This is a route that both American and Delta fly nonstop. And let's say you typically book American Airlines to keep earning AAdvantage miles and try to build status.

But by sticking with American Airlines, you'd be paying $76 more than a similar flight on Delta. Are the miles and status on your favorite airline worth it? For all but frequent business travelers, probably not.

This is a perfect example of where having airline loyalty might force you to spend more.

Now there are certainly other things worth considering, like the fact that Delta offers inflight entertainment screens at every seat where American doesn't or the fact that Delta will eventually be rolling out free WiFi at every seat. There is no denying that some airlines are better than others and might be worth the premium.

Just don't let blind loyalty be one of them.

Earn All the Points & Miles

Much like stocks and bonds, having a diversified portfolio of points and miles is always a wise decision. Putting all your points eggs in one basket will just make it harder to see more of the world. And almost every hotel and airline has at least one co-branded credit card that allows you to earn points within that specific program.

At Thrifty Traveler, we believe that earning a broad array of points and miles over time is one of the best strategies to fund your travels for pennies on the dollar. Of course, that requires a bit of organization and a lot of financial responsibility, which may not be for everybody. That's why it's important to take things slow as you get started.

Points diversification is also why we always recommend getting started with flexible points programs like Chase Ultimate Rewards or American Express Membership Rewards. Because these points can be transferred into a number of different hotel and airline programs, they stay more valuable as individual airlines make their miles worth less over time.

Case in point: If you are only using a co-branded airline card, you will be locked into earning and using miles with that specific airline. You're a prisoner to whatever that airline wants to charge for a flight. It's another way that airlines and hotels force your hand into staying loyal, to a fault.

With the 60,000 Chase Ultimate Rewards points you can earn from the *chase sapphire preferred*, meanwhile, you could book two round-trip tickets to Hawaii. Or two tickets to Europe and back. Or turn them into Virgin Atlantic miles to book a Delta One Suite or a first class seat on ANA.

Or you can even transfer them to Hyatt to book some of our favorite all-inclusive hotel properties.

Here's the point: When you free yourself from blind loyalty, your travel gets cheaper. And you will open up travel opportunities you might have never thought possible.

Bottom Line

Airlines and hotels want you to be loyal. With loyalty, you're likely to pay more when a cheaper alternative exists. And that's how airlines and hotels win.

There is nothing wrong with preferring one airline or hotel brand over the other, but don't let it cloud your decision making when it comes to planning your next trip. For the average traveler, free agency is the best loyalty status you will find anywhere.