More than 24 hours later, it's still hard to believe it: Even after starting an uproar last year, Delta is still hiking annual fees on the most popular Amex SkyMiles cards. And while Delta and Amex have tried to soften the blow with a bevy of new perks, longtime Delta cardholders are still justifiably wondering, for the second time in just a few months, whether it's worth the trouble to keep their card .. or if it's time to cancel.

Delta borrowed a page straight out of the playbook Amex has been using for years with its own flagship card, *amex platinum*: Add a laundry list of new benefits to justify raising annual fees. Now, Delta can tout that it's adding nearly $400 in credits to use on your *delta skymiles platinum card* and more on the upper end. But the onus is on you to actually put them all to use. And it won't be easy.

From the *delta skymiles gold card* to the top *delta reserve card*, there's $100 to $200 a year you can use toward hotels through the airline's Expedia-powered booking portal. Delta's top two cards get much more like $120 a year to put toward rides with Uber or Lyft and up to $240 at restaurants – but they're split into $10 or $20 monthly installments. And Delta companion certificates on those cards are getting much more powerful … eventually, anyway.

It'll take some serious legwork and organization but if you're really diligent, you can still come out ahead. Maybe. Most importantly, you can put almost all of these new benefits to use starting today – even if you're dead set on canceling or downgrading your Delta credit card when it's time to renew at the new, higher price.

Let's take a closer look at each of the new benefits Delta added to its suite of SkyMiles cards and how you can put them to use.

Read more: Really? Delta is Raising Annual Fees on SkyMiles Cards, Adding Perks

- Your Annual Fees are Going Up (But Maybe Not Yet…)

- New Credits for Hotel Stays on All Delta Cards

- $10 a Month for Rideshares on Platinum & Reserve Cards

- Platinum & Reserve Cards Get Dining Credits, Too

- Delta Companion Certificates Get Even Better … But Not Yet

- Automatic Hertz Status, Too

- Upgrades Just With a Platinum Card? Don't Count on It

- More Goodies for the Delta Reserve

Your Annual Fees are Going Up (But Maybe Not Yet…)

Death, taxes, and higher annual fees.

Those are three certainties in the life of travel and airlines, who have built their businesses around their relationships with banks. American Express, in particular, never met an annual fee increase it didn't like. This is what they do.

The fee hikes on Delta's Amex cards range from an extra $51 a year to another $100 annually – or no increase at all on the no-annual fee *delta blue*. And fortunately, the *delta skymiles gold card* will retain a $0 introductory annual fee for the first year (see rates & fees).

| Card Name | Old Annual Fee | New Annual Fee |

|---|---|---|

| Delta SkyMiles Blue Card | $0 | $0 |

| Delta SkyMiles Gold Card | $0 for the first year, then $99 | $0 for the first year, then $150 |

| Delta SkyMiles Platinum Card | $250 | $350 |

| Delta SkyMiles Reserve Card | $550 | $650 |

Delta's line of small business Amex credit cards will see identical annual fee increases.

No matter which card you get, new applicants are on the hook for these higher fees right off the bat in exchange for bigger welcome bonuses. Existing cardholders won't pay these higher fees until their next renewal – and not until May 1 and onwards.

Is your Delta card set to renew before May? You're in the sweetest spot of all: You'll get another full year at the lower rate and more than a year to put these new benefits to use.

No matter when your card is up, there's plenty new on the table. Let's dive in.

New Credits for Hotel Stays on All Delta Cards

From the Delta Gold Card to the top-tier Delta Reserve, all of them are getting $100 or more a year to put toward prepaid hotel and vacation rentals. But not just anywhere: You have to book via Delta Stays, part of the airline's dedicated booking portal for hotels, rental cars, and more.

- *delta skymiles gold card* cardholders get a $100 annual credit.

- That increases to $150 a year on the *delta skymiles platinum card*.

- And top-tier *delta reserve card* cardholders get $200 annually.

Business versions of each card get an extra $50 apiece. So you'll get $150 on the *delta gold business card*, $200 a year with the *Delta SkyMiles Platinum Biz*, and $250 annually on the *delta reserve business*.

These credits reset each calendar year, so you've got until Dec. 31 to put them to use. Just head to Delta.com/stays, book a prepaid hotel stay or vacation rental, charge it to your Delta card, and a statement credit of up to $200 should kick in automatically. Delta warns these credits can take up to 90 days.

Just keep in mind: This is Delta's take on an online travel agency – it's powered by Expedia, in fact. That means you won't earn hotel points, elite credits, or even benefit from your status with hotel chains like Hyatt, Hilton, Marriott, and others when using these Delta hotel credits. And Delta can afford to dole out these extra credits because it takes a cut on each and every booking.

There's another tradeoff to keep in mind: Anecdotally, it seems like you'll often wind up paying more per night by booking through Delta Stays than you would by booking directly with a hotel. That won't always be the case, but it's worth comparing to make sure you're not getting ripped off with a higher rate just to put this credit to use. The credit also won't cover cancellation fees, property fees, or resort fees – including, we're assuming, any meals or services you charge to the room.

But these new hotel credits are already available to use today, even to cardholders who haven't yet paid the higher annual fee. They reset on a calendar year basis, so you've got until Dec. 31 to put your first one to use. And unlike other new perks outlined in this post, there's no need to register or enroll to use this credit.

Word to the wise: Since this credit only works for prepaid hotel stays, use it for a trip that's set in stone. You might find some prepaid rates that are still refundable – but if you don't and plans change, you might be stuck and wind up wasting these credits.

Whether you've got the *delta skymiles platinum card* or the *delta reserve card*, you've now got $120 a year to cover rides with Uber, Lyft, and other rideshare companies including Curb, Revel, and Alto. Sorry to flyers with the *delta skymiles gold card*: None for you.

But it's not $120 you can use up throughout the year until it's gone. These credits are doled out in $10 monthly installments. Don't use it in February? It won't roll over to March: This is a use-it-or-lose-it monthly benefit.

And that's by design. Amex and Delta are hoping you'll forget to use it each month – and if you don't, they're counting on scraping up another $10 of your money on a $20 Uber or Lyft ride, conditioning you to keep swiping your SkyMiles credit card on every rideshare you take to ensure you don't waste these credits. That's the point.

There's a term for this in the world of accounting and finance: breakage. From the perspective of the banks, breakage basically means: “How can we make it harder to use these perks … so that fewer people actually use them?” And much to travelers' chagrin, Amex has turned maximizing breakage into an annoying art form.

Can you put this to use and easily save $10 a month on rides with Uber, Lyft, and other companies? You sure can – and it's available to Platinum and Reserve cardholders right now. Sadly, Uber Eats orders won't cut it – the terms and conditions spell that out clearly. Neither will scooter rentals or buying gift cards, among other charges to rideshare companies.

Another warning: You can't just go out and charge your next Uber or Lyft ride to your eligible Delta SkyMiles card. You have to register for this benefit first.

Just log into your Amex account, head to “Benefits & Rewards” and click the option to enroll in the New $120 Rideshare Credit. Amex says it can take up to 24 hours, so you might as well do it now.

On the plus side, this will pair well with travelers who already get $10 or $15 in monthly Uber Cash perks from *amex platinum* or *amex gold*. You can use that balance up, then charge the remainder of a ride to your Delta Platinum or Reserve Card to use up that $10 monthly credit, too. It'll kick in after the fact as a statement credit.

Platinum & Reserve Cards Get Dining Credits, Too

The new perks continue for Delta's top two cards with some monthly dining credits with Resy, Amex's restaurant reservation platform.

- You get $120 a year on the *delta skymiles platinum card*.

- With the *delta reserve card*, that doubles to $240 a year.

Just like new rideshare credits, you don't get this in one lump sum to cover a night out once a year. It's split up into $10 or $20 monthly installments, which you'll lose if you don't use each and every month. Amex strikes again!

Is $10 or $20 a month enough to make a dent in a nice night out? No. Is $10 or $20 a month better than nothing? Yes. Is that annoying? Also yes.

It's obvious: Delta and Amex are hoping you'll throw your Platinum or Reserve Card down for a $150 dinner just to save that extra $10 or $20.

And it gets worse. Again, just like the rideshare benefit, you have to register in advance to put this to use. You'll find that option after logging into your Amex account and heading to the “Benefits & Rewards” section. Just do yourself a favor and do it now, whether you plan to head out for dinner sometime soon or not.

Finally, there's the process of actually using these credits when you're out to eat. Fortunately, the terms and conditions make it clear you don't necessarily need to reserve and pay through Resy to use this credit: So long as the restaurant is bookable through Resy or its app when you pay with your Delta card, the $10 or $20 statement credit should kick in automatically.

But you'll need to find a Resy-participating restaurant first. And while Resy has a big (and growing) presence in cities across the country – as of last year according to Eater, there were more than 16,000 restaurants spread across more than 200 cities globally on Resy – it still skews toward upscale restaurants in big cities like New York City, Chicago, and Los Angeles and some midsize locations like Austin, Minneapolis, and Portland.

So this new benefit may seem useless to Delta cardholders who live elsewhere. And only U.S. restaurants will qualify for these new credits, so don't count on putting them to use on your international travels, either.

Delta Companion Certificates Get Even Better … But Not Yet

One of the best perks on both the *delta skymiles platinum card* and the *delta reserve card* is an annual companion certificate. That once-a-year BOGO flight benefit alone can offset the annual fees on either card, and Delta's recent changes will make them even better.

The most exciting item in Delta's big overhaul was a major expansion of where you can use Delta companion certificates, which have long been restricted to just flights within the mainland U.S. Going forward, you can book buy-one, get-one flights throughout the entire U.S. and its territories, Mexico, and much of the Caribbean and Central America. Here's the full list of eligible destinations:

- The United States, including Alaska, Hawaii, Puerto Rico, and the U.S. Virgin Islands

- Mexico

- Antigua

- Aruba

- Bermuda

- Bonaire

- Grand Cayman

- Cuba

- Jamaica

- Bahamas

- Turks and Caicos

- Dominican Republic

- Saint Kitts

- St. Maarten

- St. Lucia

- Costa Rica

- Belize

- Guatemala

- Panama

- Honduras

- El Salvador

But don't try to book your trip to Mexico, Honduras, or Hawaii just yet. A Delta spokesperson confirmed that any existing certificates won't benefit from this expansion – only certificates issued from Feb. 1 and onward can be used for one of these bigger trips for two. So if you've got a certificate from re-upping your card last year, you're stuck using it within the lower 48 states.

Platinum and Reserve cardholders get a companion certificate shortly after renewing their card starting in the second year, so that means most travelers will have to wait until their next renewal at a higher fee to get a more valuable certificate. A few lucky travelers who renew between now and May 1, when higher annual fees kick in, will benefit at a lower price, but that's it.

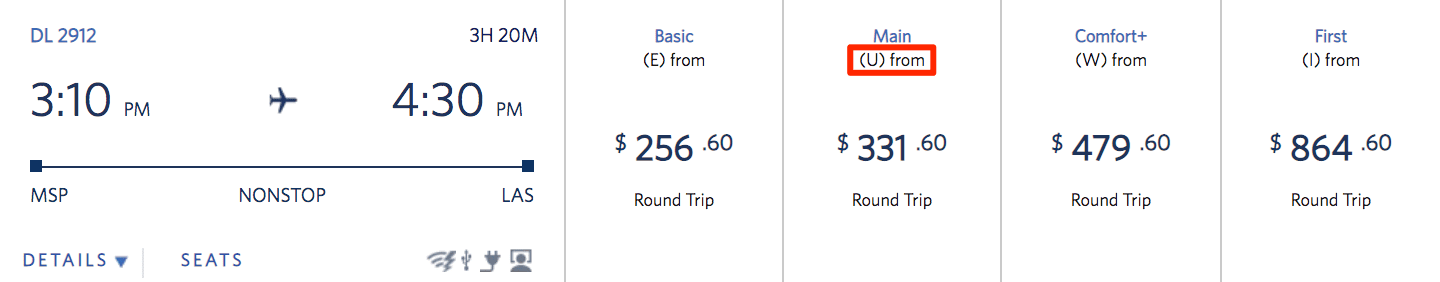

Of course, those changes do nothing to address travelers' main gripe: Finding flights that are eligible to redeem these certificates can be a serious chore. Many searches may come up empty because while Delta says Platinum Cardholders can use them for a roundtrip in main cabin economy and Reserve Cardholders can book first class and Delta Comfort Plus, only a select few of Delta's two dozen fare classes are actually bookable:

- With the Delta Platinum Card, you can only book fare classes L, U, T, X, and V in the main cabin.

- On the Delta Reserve Card, you can book all those fares plus fare classes I, Z, and W – first class and Comfort Plus tickets.

Delta has made it a bit easier by introducing a new price calendar feature when searching for flights using your Delta companion certificate. We've also cobbled together some of the best tips to put Delta companion certificates to use – including a next-level tool you can use to zero in on the flights that will actually work, this year or next.

Automatic Hertz Status, Too

Rental car benefits when you book with Hertz? Sure, why not.

- Platinum cardholders get Hertz Five Star Status, which comes with benefits like the occasional vehicle upgrade, earning more points on each rental, and adding an additional driver to your rental for free

- Got the Reserve Card? You get Hertz's top President's Circle status for guaranteed upgrades, even more points, and the option to pick any car you want from

Either way, you'll need to enroll at delta.com/hertz to get started.

Several other travel credit cards also come with top Hertz status like the *amex platinum* and the *venture x*. And anyone with Delta Medallion Status already gets it free, too. So this benefit feels like more of a wash.

Upgrades Just With a Platinum Card? Don't Count on It

On paper, it might be the most exciting addition on this entire list: A shot at complimentary upgrades to Comfort Plus or even first class just because you've got the Delta Platinum Card in your wallet? Yes, please!

In practice, that's likely to be worthless.

Yes, the Platinum Card now automatically puts you in the queue for complimentary upgrades to Delta One (within the U.S.), first class, and Delta Comfort Plus on tickets purchased on or after Feb. 1, 2024. But based on how Delta determines the upgrade list, you're still at the bottom of the pecking order – below even Delta Reserve cardholders, who have had an even more potent upgrade priority for a few years.

Considering most travelers who have these cards live in big Delta hubs – like Atlanta (ATL), Minneapolis-St. Paul (MSP), Detroit (DTW), and others – where countless flyers have racked up status, Platinum cardholders are likely to be left at the bottom of Delta's increasingly long upgrade lists. So don't bank on an upgrade unless you're flying outside of one of Delta's big airports … and even then, it's probably a long shot.

Take it from me: I took about 20 Delta flights in and out of Minneapolis last year, armed with both a more powerful Reserve Card and Silver Medallion status, too. I didn't get a single upgrade all year.

More Goodies for the Delta Reserve

The *delta reserve card* is Delta's top-of-the-line card with more perks than any other – and at a new price tag of $650 a year (see rates & fees), it isn't cheap. So go figure Delta went even further to satisfy its top-paying customers.

Reserve cardholders are getting a couple of additional benefits, from some one-time perks in 2024 to some other ongoing benefits:

- They now get four one-time passes to bring guests into Sky Clubs for free each year – up from the two they previously received. It's unclear when these additional guest passes will hit cardholders' accounts.

- According to an email sent to Reserve cardholders Thursday, they're also getting a one-time $100 Delta flight credit to offset the annual fee hike. That's supposed to be available April 2.

- While both Platinum and Reserve cardholders get a 2,500 MQD Headstart bonus each year to begin the chase for Medallion Status, Reserve cardholders are getting another 1,000 MQDs this year as a bonus. Reserve cardholders should see that reflected in their SkyMiles accounts now.

The $100 flight credit and extra 1,000 MQDs are a nice touch. That should be enough to satisfy current Reserve cardholders for at least another year if you ask me.

But while getting two more passes a year to bring guests into Sky Clubs for free certainly helps, I highly doubt that's enough to offset Delta's hammer-swinging on Sky Club access a year from now. Come Feb. 1, 2025, the Delta Reserve Card will lose its unlimited Delta Sky Club access: Instead, you'll be capped at visiting Sky Clubs just 15 days per year.

At least that's better than the treatment Delta Platinum cardholders got. As of Jan. 1 of this year, even cardholders paying $250 (and soon $350) a year can no longer even buy their way into the Delta Sky Club. And even while increasing annual fees on that card, Delta did nothing this week to throw Platinum cardholders a bone when it comes to lounge access.

Bottom Line

An American Express representative defended these changes to the Star Tribune, quipping: “We try to create rewards that are meaningful and don't require cardholders to change behavior.”

Cue the laugh track.

This entire overhaul is nothing if not an exercise in changing behavior. Delta and Amex want cardholders to pay more in annual fees, justified by new benefits that practically require a spreadsheet and calendar alerts for you to have a chance at coming out ahead. And above all, they want to condition you to keep swiping your Delta card more, more, more, and more. Delta's most important relationship isn't with you and I – it's with American Express. And this is how the airline makes that $7-billion-a-year relationship even more valuable.

Some travelers will surely see the upside with these new perks. If you're ready to give up, I can't blame you.

But before you grab the scissors, wait until your Delta card comes up for renewal at a higher price point – and use up any of these new benefits you can in the meantime.

As always, YMMV. I’ve had the Delta Platinum for two years, and renewed in January. I recently flew from EWR to TPA a couple of days ago, and was surprised that I’d been upgraded to C+ at check-in (despite this ticket being bought well before 1 Feb). This is the second time I’ve been upgraded in less than a year, and I’ve never had Medallion status, and never will. I don’t travel for work, and don’t have any other criterion except for the Amex card, so it’s a solid plus for me.

It is a game they play and we play and right now, we are on the losing end. Those who were able to benefit on the backs of others are now feeling the burn; the same issue for CC and hotel points vs. people who actually put the work in. It may seem unfair AMEX and Delta are upping their game yet the scales were probably balanced for those who got the most of what was offered.

Delta used to be a very accommodating and generous carrier, especially when they screwed up. That ended long ago. Since many of the benefits of Amex Delta Reserve map to Amex Platinum card, why should anyway even bother with getting both of these cards? As far as the using the 2 for 1 flight coupon, using it is an exercise in futility. We have managed to use it, but your plans have to be super flexible.

We are some of the few that won’t have to pay the increased AF. But after next year, the card is goner.

No, thanks! Simply NOT worth the hassle factor!!

Kyle, a great recap of the latest changes and take-aways. Thank you!

On Delta Stays, they charge about 10% more for the same EXACT room on Hotels.com (Expedia) as a general rule. Also, if you look at Pay with Miles, for example, a $178 stay ($160 on hotels.com) required almost 26,000 miles to book. That is only about .7 cents per mile, even worse than using them for the over-inflated flight miles requirements. Delta and Amex thinks folks are becoming increasingly stupid, in my opinion. Not on this economy!

Also, the hotels I looked at on Stays only allowed you to reserve, not pay upfront, meaning you would not get the credit since you did not pre-pay. Another Amex and Delta ruse, so beware. You think you will get the credit, but will not without prepaying.

I am pretty good at keeping up with all the hassles to get the credits, so I may try it one more year (Have been an AMEX card holder since 1989), but I am at the end of my rope with both Amex and Delta. Looking at some Chase cards per your recommendations. Thanks

Kyle, I have the Delta Reserve and the regular Amex Platinum card (both are now in the $650+ range per year)

Is there a reason to keep the Platinum card anymore?

With nearly identical annual fees, I would personally keep the Amex Platinum over the Delta Reserve Card, if you had to pick one. More benefits that you can use at multiple airlines, better lounge access (at least for now), more flexible, valuable points than the SkyMiles you earn with the Reserve Card. But that’s just me!

Doesn’t matter if you have the Amex cards…a SM will rarely if ever get an upgrade. I’m a DM with reserve card and sometimes don’t get an upgrade. With the changes Delta did, now cabin class is more important than fare class, which makes no sense based on the program being completely a money based earn. For instance, I have to fly 2/5 to PHX. Only flights that worked were a Y fare class…$1800 RT (what a joke). Even with that, I will be behind another DM that bought a C+ seat (for much less). That makes no sense to me at all.