Most travelers dabbling in points and miles wind up facing a choice: Should you pay up for a premium travel card to unlock benefits like airport lounge access and money-saving travel credits? Or stick with something cheaper without all the extra perks?

The *capital one venture x* splits the difference. Four years after launching to great fanfare, Capital One's premium travel card remains one of our favorite cards on the market – if not the top option, period.

It starts with a big welcome offer of 75,000 Capital One miles after spending $4,000 in the first three months – miles you can easily use to cover the cost of cheap flights (and countless other travel expenses) or send on to an excellent array of Capital One transfer partners to get even more value. But then Capital One ups the ante with top-notch travel perks like lounge access, a $300 Capital One Travel credit, a 10,000-mile anniversary bonus (beginning in year two), unbeatable travel insurance coverage, and more.

Similar premium travel cards with these kinds of perks carry annual fees of nearly $800 (or more). But the Capital One Venture X credit card costs travelers just $395 a year, with an easier path to recoup that cost (and then some) than you'll find on any other top-dollar credit card. Along with all the other premium benefits, we believe that makes the Venture X a strong contender for many travelers looking to elevate their experience in 2025 and beyond.

Read on for our review of the Capital One Venture X Rewards Credit Card and a full breakdown of all the card's benefits.

Read More: Sick of Annual Fees & ‘Coupons’? Get the Capital One Venture X

Learn more about the *capital one venture x*

Full Card Benefits Overview

Venture X Card Welcome Offer Bonus

You can earn 75,000 Capital One miles after spending just $4,000 in the first three months.

Considering you earn at least 2x miles on every dollar you spend, you'll actually earn at least 83,000 miles once all is said and done. Since Capital One miles are worth at least 1 cent apiece toward travel – and potentially much more when using transfer partners – that bonus alone is worth at least $830 towards travel.

Need some ideas? Read our list of the best ways to use your Capital One miles.

An Annual $300 Travel Credit

Each year of card membership, Venture X cardholders get up to a $300 Capital One Travel credit to use to book flights, hotels, vacation rentals, or rental cars through the Capital One Travel portal. Simply book your travel through Capital One, and you'll automatically get up to $300 in credit toward your purchase.

Think of it this way: Do you plan to spend $300 or more on travel each year? Then this card's annual fee isn't $395 – it's more like $95. That automatically makes this card a brilliant alternative to the popular *capital one venture*.

Not to mention, you'll also earn 10x Capital One miles on hotels and rental cars and 5x miles on flights and vacation rentals booked via Capital One Travel … but only once you've exhausted that $300 credit.

Read more: Everything You Need to Know About Capital One Venture X $300 Travel Credit

Capital One Lounge & Priority Pass Lounge Access

This is a big one.

Capital One Venture X cardholders get complimentary access to the new Capital One Lounges, the first of which officially opened its doors in Dallas-Fort Worth (DFW) back in 2021. It took a few years, but you can now visit Capital One lounges in Denver (DEN), Washington, D.C.-Dulles (IAD), Las Vegas (LAS), and New York City (JFK), too.

Plus, Capital One also offers cardholders access to its hybrid airport lounge-restaurant concept called Capital One Landings. The one in Washington, D.C.-Reagan (DCA) is already open, with another at New York City-LaGuardia (LGA) on the way.

Each lounge is a bit different, but they've all got a great design, fun amenities, and absolutely outstanding food and drinks – easily among the best airport lounges in the U.S., period. Capital One puts a big emphasis on offering excellent food and drinks, with a local flair – and once you're in the door, it's all free.

Finally, the Capital One Venture X will also come with a complimentary Priority Pass Select membership, giving you access to even more participating airport lounges across the world. Again, the quality and offerings in Priority Pass lounges can vary quite a bit. But even the worst Priority Pass lounge is still better than sitting at the gate in the terminal.

Venture X cardholders get unlimited complimentary access for themselves and two guests at all these lounges until Feb. 1, 2026. At that time, guests will incur an extra cost … unless you spend $75,000 per year on your card.

Read more: A Complete Guide to Capital One Lounges & Landings

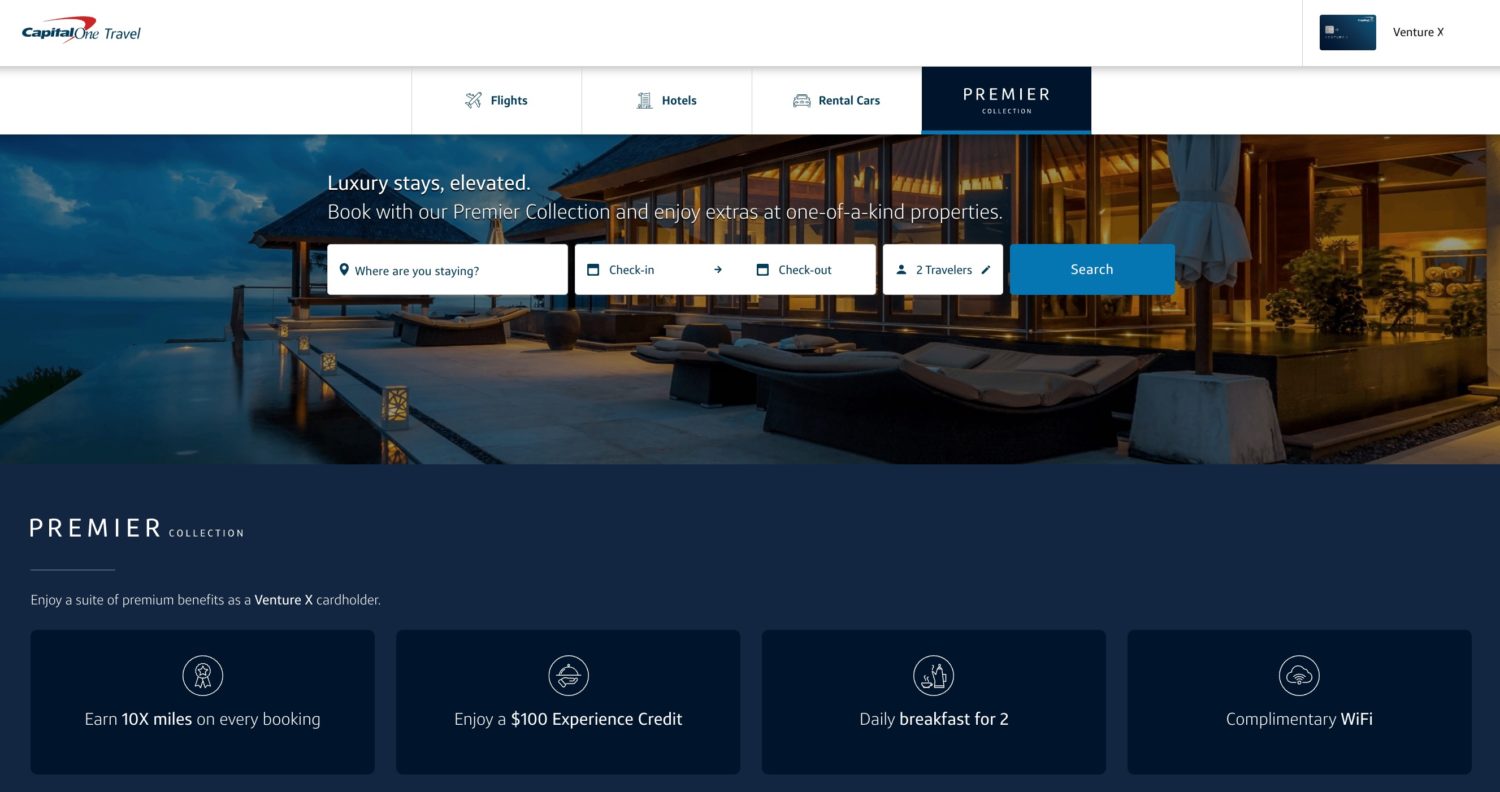

The Premier & Lifestyle Collection of Hotels

In early 2023, Capital One launched The Premier Collection – a portfolio of luxury hotels and resorts, bookable with exclusive benefits for Venture X cardholders, similar to American Express Fine Hotels + Resorts®.

Just log into your account and head for the Capital One Travel portal, where you'll see the option to search for Premier Collection properties in addition to flights, stays, packages, rental cars, and activities.

It's not just glamorous hotels and resorts that Capital One hopes will draw travelers in, either. Every Premier Collection booking unlocks a handful of additional perks that match (or exceed) the top levels of hotel status, including:

- Free breakfast for two every morning

- A $100 experience credit for dining, the spa, or other services at the property

- Free Wi-Fi during your stay

- Room upgrades, early check-in, and late check-out when available

- Earn 10x miles per dollar on every booking

- You can use your Venture X Card's $300 Capital One Travel credit for these hotel bookings

Additionally, Capital One has introduced the Lifestyle Hotel Collection, including brand names like Virgin, The Standard Design, and The LINE, as well as a number of boutique hotels around the world. While the Premier Collection is available exclusively to Venture X cardholders, the Lifestyle Collection will be available to other Capital One cardholders – including those with a *capital one venture*.

Cardholders will get perks usually reserved for those with hotel status or who hold a premium travel rewards credit card, such as earning more miles on stays, room upgrades, early check-in, and late checkout, as well as a $50 experience credit to use at bars, hotel restaurants, room service, or other activities.

Venture X $120 Credit for Global Entry or PreCheck

Add the Capital One Venture X to the growing list of credit cards offering up to a $120 credit for either TSA PreCheck® or Global Entry. Membership in either program is good for five years, and Venture X cardholders will get this credit every four years.

If you plan for any sort of international travel, spring for Global Entry, as it includes a TSA PreCheck membership. At just $120, the statement credit provided by the Venture X credit card will completely cover your membership cost for as long as you keep the card open.

Taking advantage of this credit is simple. Just use the card when you pay for your application, and voilà: Your credit will kick in to cover the entire cost.

Read more: Global Entry vs. TSA PreCheck: Which is Better for You?

10,000-Mile Anniversary Bonus

Each and every year on your account anniversary, you'll receive 10,000 bonus miles after paying your card's annual fee.

These miles are worth a minimum of $100 towards travel – and potentially much more by utilizing Capital One's list of transfer partners. You won't get this right when you open the card: This benefit starts in your second year and each year after that.

In our experience, Capital One deposits this 10,000-mile bonus about a month or two after paying your annual fee on the card, starting in your second year.

Read More: Wondering Whether to Renew Your Venture X Card? Make Sure You Read This

Earn Unlimited 2x Miles on Every Purchase

Like the regular Capital One Venture Rewards Credit Card, Capital One Venture X cardholders will earn 2x miles on every dollar spent on the card.

That's incredibly lucrative and could easily make the Venture X card a go-to option in your wallet for many expenses.

Earn Bonus Miles on Capital One Travel Purchases

In addition to the flat 2x miles that you'll earn on everyday purchases, Venture X cardholders earn a bigger bonus on travel purchases made through the Capital One Travel portal.

You'll earn 10x miles per dollar on hotels and rental cars, and 5x miles per dollar on flights and vacation rentals booked through Capital One Travel.

Complimentary Hertz President's Circle Status

Venture X cardholders get complimentary Hertz President’s Circle status.

As the highest level of elite status in their Gold Plus Rewards program, President's Circle elite members who book an intermediate car or higher get guaranteed upgrades to the next available car class or the ability to choose a car from the President's Circle Ultimate Choice aisle.

Members can also skip the counter when renting a car, have access to a dedicated Hertz Rewards customer service line, and can add an additional driver at no extra cost.

Read our full story on why we love Hertz President's Circle status!

Travel Insurance & Rental Car Coverage

Premium travel credit cards typically come with some excellent travel protection policies, and the Venture X is no different.

This Capital One card is technically a Visa Infinite card, which is a distinction that doesn't matter much … until it comes to these benefits. Charge your rental car, flights, or any trip to your Venture X card, and you'll get added protections.

Primary Rental Car Coverage

Some of the strongest rental car insurance you can get, nearly identical to what's available through the Chase Sapphire cards. Decline the rental car agency's policy and you'll have a strong insurance policy that will cover most damages or even the theft of the vehicle. It applies to rentals in the U.S. for up to 15 days and in most foreign countries for up to 31 days.

Check out the fine print of this policy.

Lost Luggage Reimbursement

Did an airline lose your luggage – or worse yet, did it get stolen? If you paid with your Venture X Card, you can get up to $3,000 to replace the bag and its contents (or $2,000 per bag for New York residents). The main cardholder and all immediate family members are covered when you use your card to pay for your flights.

Trip Delay Coverage

Get reimbursed for up to $500 in additional expenses like overnight hotel stays or new plane tickets if your travel is delayed by six hours (or more), or forces an overnight stay.

Cancellation and Interruption Coverage

If something goes seriously wrong on your trip, like an accident, illness, or death that forces you to cancel or cut it short, you're covered for up to $2,000 per person in expenses – and you, a spouse, and any dependent children are eligible.

That's on par with some of the best travel insurance policies from credit cards that we've ever seen. Just pay for your trip with your Venture X Card and you're set.

Venture X Annual Fee

The Venture X card has an annual fee of $395 each year. Compared to other premium travel credit cards, that's a bargain – so much so that it has us questioning how long it will last.

Ask yourself this: Are you the kind of person who plans to spend $400 a year or more on travel? If so, do the math, and you'll see that between the annual Capital One Travel credit and anniversary bonus, it's almost like you're getting paid to have this card.

If you're not the kind of person who spends $400-plus a year on travel, a premium travel card like this probably isn't the right fit for you.

Read more: Why The Capital One Venture X Annual Fee Shouldn't Scare You Off

No Foreign Transaction Fees

Because it's a Visa Infinite card, you won't pay foreign transaction fees when using your Capital One Venture X abroad.

Related reading: A Few Underrated Features Make the Capital One Venture X Best for International Travel

Redeeming Capital One Miles

Capital One flipped the travel world on its head by transforming Capital One miles into an indispensable travel rewards program for travelers who want to do more for less.

No other points or miles give you more flexibility and versatility to redeem them towards travel – any travel – than Capital One. Whether you’re just getting started with earning and redeeming miles and want a simple option, or consider yourself an advanced traveler who knows how to stretch your miles to the fullest, there’s a path for you with Capital One miles.

Here are a few of the best ways to redeem the miles earned with a Venture X card.

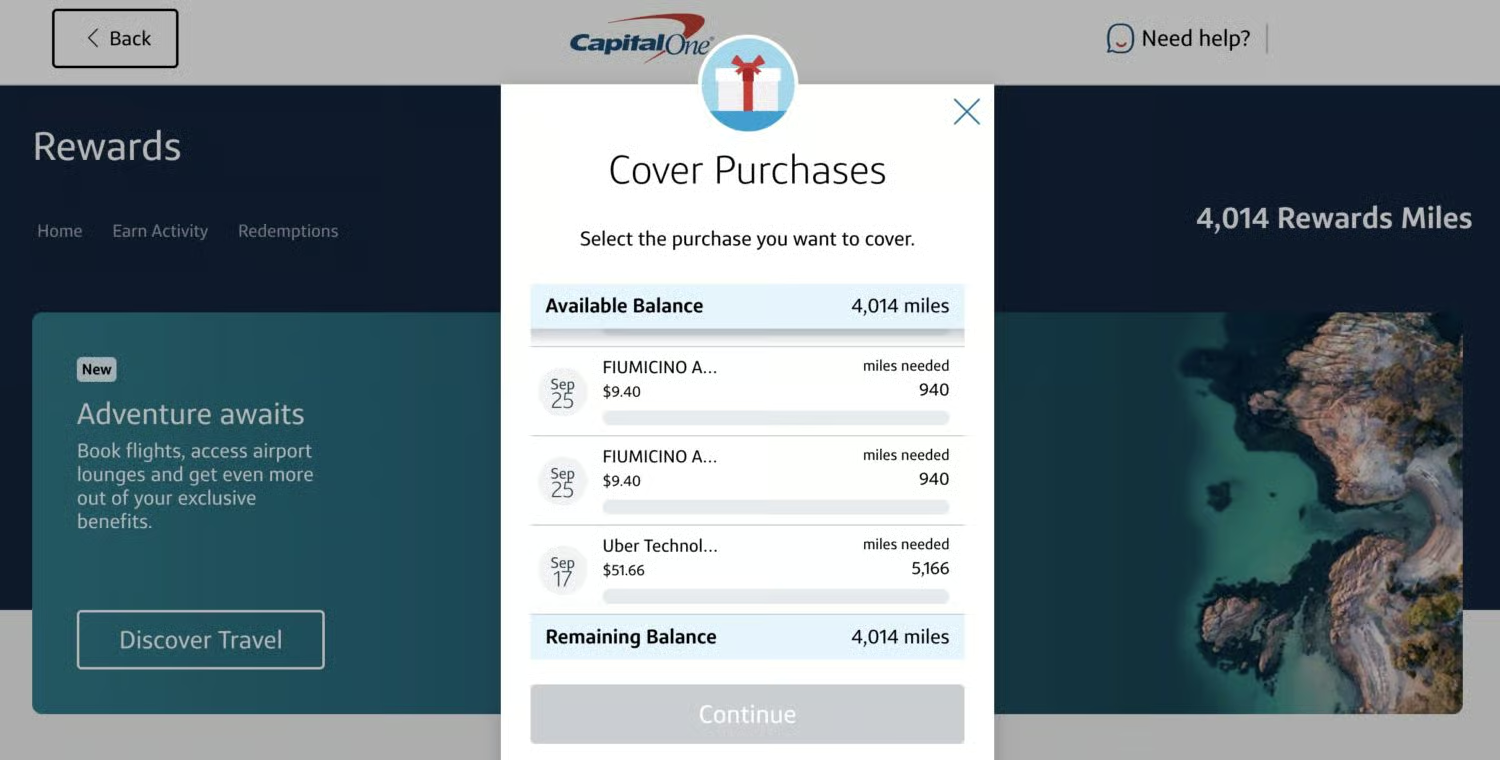

Cover Travel Purchases

Let’s start with the easiest route. This is what Capital One is really known for.

Just charge your flight, hotel, Airbnb, bucket-list golf trip, or almost any other travel expense to your Capital One card. A few days later, you can log in and remove that charge from your statement using miles.

Read our step-by-step guide to covering travel purchases with Capital One miles!

Using Capital One miles this way, every one is worth 1 cent. That means you can book a $500 flight using 50,000 Capital One miles. That may not be earth-shattering value, but it’s easy as can be – and pairing it with a cheap flight deal can take you quite far, literally.

Book Through the Capital One Portal

Capital One has its own travel portal where you can search directly for flights, hotels, car rentals, and more, then book using miles.

Since the Capital One Venture X card earns bonus miles on flights, hotels, and rental cars booked through the portal, you really shouldn't be redeeming miles like this at all. Instead, you'd be better off using your card to pay for flights and other travel booked through the portal and then using your miles to cover the purchase later on.

All that being said, there are a few other advantages to booking through the travel portal:

- Capital One will automatically refund you if the price of your flight drops after booking. Those Price Drop Protection refunds are only available on flights where Capital One predicts that prices won’t fall, and they’re capped at up to $50 – or 5,000 Capital One miles – in refunds total. Still, that’s a nice feature.

- You can freeze a fare through the portal for a small fee, then come back to buy it later at that price (within 14 days).

- Much like Google Flights, Capital One allows you to set price alerts for the flights you want to book. That means you’ll get an email if the flights you’re looking at drop or increase in price.

- Capital One offers an add-on “cancel for any reason” travel insurance policy, which is quite reasonably priced.

Unfortunately, the travel portal took a hit a couple of years ago when Capital One capped price drop refunds at $50 – and now, the portal's “Price Match Guarantee” gets paid out in travel credits instead of a refund to your card.

Level Up Using Capital One Transfer Partners

If you want the most value from your Capital One miles, you’ll want to look into Capital One transfer partners.

Capital One added the ability to transfer miles straight to airline programs back in late 2018. After steadily adding more and more partners, it’s now a bona fide option with some killer value. With few exceptions, every 1,000 Capital One miles you transfer gets you 1,000 airline miles or hotel points.

Here’s the full list.

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific AsiaMiles | Airline | 1:1 | 1-5 Days (sometimes instant) |

| Emirates | Airline | 2:1.5 | Instant |

| Etihad | Airline | 1:1 | Instant (sometimes 12-24 hours) |

| EVA Air | Airline | 2:1.5 | 24-48 Hours |

| Finnair | Airline | 1:1 | Instant |

| Japan Airlines | Airline | 2:1.5 | Instant |

| JetBlue | Airline | 2:1.2 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | TBD |

| Singapore | Airline | 1:1 | Up to 24 Hours |

| TAP Air Portugal | Airline | 1:1 | Same day |

| Turkish Airlines | Airline | 1:1 | Same day |

| Virgin Red | Other | 1:1 | Same day |

| Accor | Hotel | 2:1 | 1 Hour (Same Day) |

| Choice Hotels | Hotel | 1:1 | Same day |

| Preferred Hotels & Resorts | Hotel | 1:2 | TBD |

| Wyndham | Hotel | 1:1 | Same day |

Read more: Save Points When Booking Flights: Transfer Them to an Airline Partner

Bottom Line

You can currently earn 75,000 miles after spending $4,000 in the first three months with the Venture X. Since you earn 2x miles on every dollar you spend, you'll end up with 83,000 miles worth a minimum of $830 towards travel.

Add in the card's easy-to-use $300 Capital One Travel credit and 10,000-mile anniversary bonus, and it's quite easy to come out ahead of the $395 annual fee. Other perks, such as lounge access, top-notch travel protections, and rental car elite status, sweeten the deal even further.

If you're looking for a premium travel card without all the hassle and high fees, this is the one for you.

Learn more about the *capital one venture x*

I love the Venture X card and have had it since it first came out. The way I figure it, with the $300 annual travel credit plus the 10,000 mile annual bonus, Capital One is paying me $5 a year to have the card. Not a bad deal at all. I used it extensively for club access when I travel and haven’t had any problems.

Got to love SEO boosting. Dated a few days ago, comments from 2021.

How about an in-depth usage review? For example, did you know they don’t support international mobile pay? (For a premium travel card!) Did you know all fraud disputes have to be done over fax or physical mail? (Because CapOne Utah still lives in telemarketing 1998.)

There’s a lot more to a card than the earning rates and official benefits. Overall customer service and experience is a C- on this thing. Even Citi performs better, and that’s saying something.

IT’s NO AMEX! Yes, the card has many advantages, but the customer service is unrefined and lacking. When trying to pay online near the 8pm cutoff, the site was overwhelmed. By the time I got thru on the phone, it was after 8. I was then chastised by the rep for waiting until the last minute. Took several calls to get the late fee removed.

Hi Nick,

If I cross the $10K minimum spend threshold, but have to cancel and refund and fall under $10 afterwards, do I still get to keep 100K miles? Do you happen to know the policy on this with Capital One? Thank-you!

Hello. I don’t know specifically how Capital One handles this, but it is always a good idea to try and replace that spending with new charges if you can.

Are the travel benefits (lounge, $300 credit) available immediately or after minimum spend is met?

Hi Mark. Yes, they are. The only thing not available right away is the 100k points you will earn after spending $10k in 6 months.

What’s the process for obtaining some of these benefits, e.g., Hertz Pres Circle status and Priority Pass membership? Sorry if I missed it above or in other articles. A link or explainer would be great. Nothing about it came in the cardmember mailing.

Hey Jake. Once you get your online account activated, you can do this from the benefits tab. Generally just a few clicks and you’ll be set.

Will do, thanks!

Do you know if the Airbnb/VRBO credit is still part of the introductory offer? It isn’t identified in the account opening disclosures somebody I know received today, unlike the precheck/global entry credit.

Hey Jake, yes it is. Being it is a limited-time offer it’s likely they just excluded it from these disclosures as it will eventually go away. All current Venture X offers include it.

To sign up Authorized Users for Premier Pass is it the same process — enter their credit card number in the link from the Capital One site? It worked for me, but not for the second user.

Hi Alan. I am not entirely sure why it wouldn’t work the same way for your authorized user. I would call Capital One to see if they can assist.

I did. It took a couple of calls to get it straightened out, but they did.

During a delay(or two), trying to leave Las Vegas, my wife and I extensively used the lounge access benefit. I was very happy to have the card at that point. For me, lounge access alone is worth the annual fee.

Hi Nick,

So I bit the bullet and applied (and was approved) for the Venture X. I also have two other Capital One cards (so now 3 total) . One I have had for a long time, and although it is useless as far as perks, I still keep it open and just use it time to time. My other one one is a Capital One Venture Card with decent benefits. I have a few other cards, that are good as far as perks. Do you think it would be wise to cancel the long time, no benefits Cap 1 card?

Great to hear you were approved! Does that Capital One card you have had have an annual fee? If it doesn’t, there really isn’t a reason to close it as it is helping your credit score. More things to consider before closing a card in this article:

https://thriftytraveler.com/guides/credit-card/cancel-a-credit-card/

Thank yo Nick. There is an annual fee. It’s $60 a year. I really only kept it around because my child was an authorized user while she was in College. But for the past year, that hasn’t been any usage, so I’m wasting $60. I will read the article and make a decision. Thanks again!

Happy to help!

Hello Nick,

Did you ever have success with your reconsideration for the Capital One Venture X card?

I received my letter explaining why I got denied for the Venture X; “too many revolving accounts” with a credit score of 773. I called the number for Capital One you have on your site. The first rep stated their was nothing she could do so I asked for a manager. The manager was very dismissive saying there was no way the application could reviewed any further. Every question that I asked her, she said she could not answer because she could not give credit advice even though I was not asking for advice. Very frustrating to say the least. I am not sure what the best plan is going forward to get approved. Should I email their executive office, close out a couple of older accounts that I no longer use, reduce the amounts on some of my cards that I no longer use, and/or just wait a few months and reapply?

Thank you,

Gregg

Hi Gregg,

I did not have any success. I got my letter in the mail and I also had “too many revolving accounts” listed as my denial reason with a very similar credit score. The reconsideration line was not helpful at all and they were not able to give me any more information on what that even means. I know many others with more open accounts than me who were approved with similar credit score metrics.

I wish I had a better answer but I am not entirely sure what the best approach is.

I have a few questions as we have used the delta platinum card for years but this looks so good and I’m not as familiar w/”premium travel cards.” Here are my questions & a link that answers them is fine if there is one. 1) Do these VentureX miles expire? 2) Flights can be booked with any airline and the portal will tell you how many miles, right? 3) This may mean losing platinum status on Delta w/out purchase rewards every $10,000, yes (in other words, status could only be retained by flying a lot of miles on Delta)? and 4) There is no foreign transaction fee but do you know the fee if the card can be used to withdraw $ from an ATM overseas? Thank you! It feels big to switch and drop our Delta platinum but we might do it (deep breath!)

Hi Vicki.

1) Venture Miles do not expire as long as you have the card open. If you close the card, you will lose any unused miles unless they are moved to one of the Capital One transfer partners.

2) That is correct. Miles are always worth one cent each when used in the portal so a $400 flight could be booked with 40,000 Venture Miles.

3) If Delta status is important to you, it may be a good idea to also keep the Platinum card for the MQD waiver (and MQM bonus at certain spending levels).

4) I don’t know the specific fee on this, but that should be available in your account assuming you apply and are approved.

In regards to the $200 airbnb/vrbo credit, is it listed anywhere on the account page? I’ve looked under benefits and rewards, but don’t see it listed. Just looking to confirm it is included on my card. Thanks!

It is absolutely included. All you have to do is spend at Airbnb or VRBO and the credit will kick in. This is a limited-time intro offer which is why you may not see it listed on the benefits pages.

Thanks. Do you know if it is a 1 time credit up to the $200 (if stay is less than $200, you lose the remaining), or will it cover multiple stays/charges up to the full $200 amount?

Hey Dan. You will be covered up to $200. That can be used across multiple transactions.

Thanks for all the info!!

Should I switch from the previously recommended Sapphire Preferred to this one?

Hi Jill. That will depend on a number of factors, but at a minimum, if you can make the spending requirement work, this card might be a great companion card to your Sapphire Preferred.

It appears that only one card holder gets the PreCheck or Global Entry reimbursement. Is that how you read it?

Hi Alan, that’s correct. Only one tsa precheck/global entry credit per account.

Thanks. I see I missed that Sean had already asked that question.

I don’t know if this relates to many of you, but I was able to transfer my Capital One Venture card miles over to my new Venture X card. Customer service said it was not possible, but once online it clearly let move the miles to the new X card.

Authorized users get their own lounge access and Hertz President status. But do they also get the Global Entry credit, or is that just the primary cardholder?

Hey Sean. They do not. Only the primary cardholder

Nick, it mentions that with Hertz you get the Presidents Circle status on bookings. If you book through their portal to get the 10x points, you don’t get the status which is the same as with other portals, correct? Or am I misunderstanding the portal bookings (Amex, Chase, etc)?

Hey Nate. I would assume that to be the case but I don’t know for sure.

If I apply for new X card and also keep my Venture card will I get the 100,000 bonus miles? Thought I read current customers don’t receive bonus?

Hi Paula. Yes, you will. The only way you won’t receive the bonus is if you upgrade your existing Venture account (instead of applying for a new account). Assuming you are approved, you could then combine your points into one account.

Very interesting option! We have and use the Venture Double Rewards card from largely for the Purchase Eraser as it covers travel most other cards don’t. Will this new card still offer that feature? If so, I’d be hard pressed not to switch! Thanks 🙂

Hi Kate. The Venture X will absolutely have the purchase eraser option.

I’m wondering if I should double dip and ADD this to my top tier cards (my other premier card, Chase Reserve). Does it ever make sense to have 2 cards?

It depends on a lot of factors, but I would say these two cards specially have a lot of overlap. You might be better with venture x and the lower annual fee Sapphire Preferred instead

Can you use this new card as a “regular” credit card too? I have & use one card for all my needs. I am interested in this new card but need to be able to use it for everything else not just on travel.

Yes. It’s a regular credit card and can be used for expenses other than travel.

do you know if it has primary rental car insurance?

Hi Nick, we are wondering if we have a venture card in my husbands name (I have a card with my name on it but the bill comes in my husbands name) could I now apply for the venture X card and get the benefits of being a new card holder?

Hi Terri. You sure can

Hi Mark. It sure does. The card is a Visa Infinite card which means it should make all of the same travel protections that the Sapphire Reserve card currently offers.

Hi Nick,

In the article you mention being able to upgrade from the current Venture card. I know with most cards an upgrade isn’t the best option since you don’t get all the benefits of a ‘new’ card holder but it sounds like you can upgrade to the X and still get all the benefits?

Hey John. You will be able to upgrade, but what you wouldn’t get by upgrading is the big 100k bonus. I am sure we will know more about what the upgrade offers look like next week.

Hi Nick – wondering if Capital One allows combining of points between spouses?

Hi Paul. You sure can. More info on this in the link below:

https://thriftytraveler.com/guides/points/points-principles-transfer-credit-card-points/

This is really interesting. Thanks, Nick. You told me something interesting was coming in an email and this probably a really good fit for me. I ended up keeping my Reserve card as I have a couple of flights coming up that I will probably book through the Chase portal because my Delta points are expensive at MSP. I will most likely switch to this card next year, unless Chase Reserve makes some changes to match.

Nick,

Great article. This is really compelling for me. I was already considering closing or downgrading my AMEX Platinum when the next annual fee hits, and looking for alternatives. This seems like a very solid card and a heck of a deal compared to the AMEX Platinum, although the lounge benefits are not at the same level as far as Delta Sky Lounger and Centurion etc….

Thanks, Chris. I agree. It is a very compelling option and I am excited for it to launch on Tuesday.

I wish there were a feedback section on the site for the cardholders to submit suggestions. Priority Pass got a huge blow not too long ago when Plaza Premium Lounges are no longer in their network. Those are predominant lounges in Canadian airports. For those of us who have family members in Canada or frequently travel there, the only option in the US market would be Amex Platinum.

If Capital One can strike an agreement with either Plaza Premium Lounges directly, or some other lounge network that has them (such as Dragon Pass, where Canadian issuers of premium cards went for Plaza Premium access for their cardholders), it would be a big boost in their lounge access department and gets them well ahead of the pack, closer to Amex Platinum.