Delta flyers love Delta, touting their Delta Medallion Status like a badge of honor, and proudly swipe their SkyMiles credit cards. And two of the most popular options are the *delta platinum* and the *delta reserve*.

The SkyMiles Platinum and Reserve cards are Delta's top offerings, charging higher annual fees in exchange for valuable perks like free checked bags, priority boarding, an annual Delta companion certificate, and Delta Sky Club access. While there are better options to rack up points and miles than a Delta card, those benefits and more can easily make it worth keeping one of these cards in your wallet. Big welcome bonus offers on both cards make that case stronger.

Delta has made some big changes to these cards lately, increasing how much spending it takes to climb the tiers of Medallion status while also restricting how Platinum and Reserve cardholders can access Delta Sky Clubs. And in a tried-and-true move, the airline also added a handful of new benefits to these cards earlier this year…while also raising the annual fee it charges to hold them.

That got us thinking: Which card is better, the Delta Platinum Amex or the Delta Reserve Amex? From annual fees to welcome offers to lounge access and more, there are plenty of differences (and similarities) to dissect between Delta's top travel cards.

Keep reading for a full breakdown of the Delta Platinum and Delta Reserve cards from American Express.

Similarities & Differences

No matter which version of Delta SkyMiles American Express Card you choose, the real draw with these cards is the ongoing perks and benefits you get for being a cardholder. A big batch of SkyMiles is just a bonus.

Both cards come with valuable perks like a free checked bag, priority boarding, discounted award tickets, rideshare credits, Resy credits, a Delta Stays hotel credit, and an annual companion pass. But one card takes things a step further by providing access to Delta Sky Clubs and even Amex Centurion Lounges.

These two cards have quite a bit in common. However, a few key differences could be enough to make one of them a better fit than the other, depending on what benefits you value most.

Welcome Offer Bonus

Looking for a big welcome offer bonus? Here's what's available on both cards.

Delta SkyMiles Platinum Card

bonus_miles_full

Delta SkyMiles Reserve Card

bonus_miles_full

Winner: Which Card Has the Better Welcome Offer?

You'll currently earn more points with the Delta Reserve, but you'll have to spend $2,000 more to do so. That said, you have a full six months to meet the spending requirement on either card.

Learn more about the *delta reserve*

Earning Points

When it comes to earning SkyMiles, one of these cards will help you rack them up much faster than the other.

Delta SkyMiles Platinum Card

The American Express Delta Platinum Card earns 3x SkyMiles on all Delta purchases, 3x SkyMiles on purchases made directly with hotels, 2x SkyMiles at restaurants and U.S. supermarkets, and 1x SkyMiles per dollar on other purchases.

You can earn far more SkyMiles by spending on other Amex Cards. But if you're dead set on using your SkyMiles card for routine purchases, the Platinum card is definitely the best of the two.

Delta SkyMiles Reserve Card

With the American Express Delta Reserve Card, you'll earn 3x SkyMiles on all Delta purchases and 1x SkyMiles per dollar on other purchases.

There are no other bonus categories outside of Delta, making it a poor choice for regular spending.

Winner: Which Card Earns More Points?

The Delta Platinum Card is the clear winner in this category. It offers the same 3x miles on Delta purchases you get with the Delta Reserve but adds several additional bonus categories for things like hotels, restaurants, and supermarkets.

Learn more about the *delta platinum*

Comparing Annual Fees

Paying an annual fee is never fun. Many travelers fear annual fees so much that they avoid cards with annual fees altogether.

But flyers need to do the math before ruling out cards with annual fees as the benefits and bonuses can more than offset even a high annual fee. Both the Delta Platinum and Delta Reserve cards are a perfect example of how things can shake out.

Delta SkyMiles Platinum Card

After a recent fee increase, the Delta Platinum Card carries a middle-of-the-road $350 annual fee (see rates & fees).

While that $350 annual fee might seem steep to some, it comes in well below the Delta Reserve. Meanwhile, it clocks in at a higher price than the *delta gold*. And unlike that entry-level Delta card, the Delta Platinum Card's $350 annual fee is charged in your first year.

But what makes the annual fee reasonable is what the card offers in return: an annual companion pass starting in your second year with the card after you renew, a first checked bag free for you and up to eight others on your reservation, up to $120 in statement credits for TSA PreCheck or Global Entry enrollment and a few other credits that were added earlier this year.

Those are just a few benefits you should consider when determining whether the card is worth its annual fee.

Delta SkyMiles Reserve Card

The Delta Reserve Card now comes with a $650 annual fee (see rates & fees). But yet again, that doesn't tell the full story.

For $650 per year, you'll get most of the same benefits as Delta Platinum cardholders. But most importantly, you get complimentary access to Delta Sky Clubs and American Express Centurion Lounges, among others, when flying Delta that day. If you're a frequent Delta flyer, this complimentary lounge access could easily offset the card's annual fee and then some.

Winner: Which Card Wins on Fees?

From a pure cost perspective, the Delta SkyMiles Platinum Card is the winner in terms of annual fees. But for some, paying more for the Delta Reserve will be worth it for the additional benefits alone.

Learn more about the *delta platinum*

Companion Certificate

What's a companion certificate? Think of it as a once-a-year BOGO ticket for flights within the U.S. ….and beyond.

After your first full year with the Platinum or the Reserve card, you'll get a companion ticket good for roundtrip airfare to destinations throughout the U.S. (including Hawaii, Alaska, the U.S. Virgin Islands, and Puerto Rico) as well as many destinations in Mexico, the Caribbean, and Central America. Previously, you could only use companion certificates on flights within the mainland U.S.

All you'll need to pay for are the taxes and fees on the ticket. It's as simple as that! The value of the companion pass from either card can be huge, easily offsetting the card's annual fees.

Read our full guide on how to maximize Delta companion certificates!

Delta SkyMiles Platinum Card

The Delta SkyMiles Platinum Card comes with an annual companion certificate you can use on economy fares. After a recent change, that companion pass is good on destinations not only throughout the continental U.S., but also Hawaii, Alaska, the U.S. Virgin Islands, and Puerto Rico as well as many destinations in Mexico, the Caribbean, and Central America.

Delta SkyMiles Reserve Card

The Delta SkyMiles Reserve Card comes with a companion certificate similar to the Delta Platinum but that also works for Delta Comfort Plus and first class tickets to the same destinations.

Winner: Which Card Has the Better Companion Pass?

The value of these companion passes is close. But since the companion pass you get with the Delta Reserve Card can also be used for Comfort Plus or first class tickets – not just economy – the edge goes to the Reserve Card.

Learn more about the *delta reserve*

Lounge Access

Having access to an airport lounge can be a game changer for travelers.

While the quality of food and drinks can vary greatly depending on which lounge you're in, you can generally count on a solid experience at Delta Sky Clubs – especially newer lounges like in Los Angeles (LAX), Chicago-O'Hare (ORD), Minneapolis-St. Paul (MSP), and New York City-LaGuardia (LGA). At the very least, it's an oasis from the rest of a crowded airport.

Read our full review of the new Delta Sky Club at Minneapolis – St. Paul (MSP)!

There are several ways to access airport lounges. But these days, the easiest way to get in is by simply holding the right credit card – and with the Delta Reserve Card, you can do just that.

The Delta Reserve Card comes with complimentary access to Delta Sky Clubs, Amex Centurion Lounges, and Escape Lounges when flying on a same-day Delta flight. Currently, you'll get unlimited access to Delta Sky Clubs with your reserve card. But after Feb. 1, 2025, you'll be limited to 15 visits to the Sky Club each year unless you also spend $75,000 on your card.

You don't need to use your Reserve card to pay for your ticket to get into Sky Clubs, although you do need to pay for your airfare with an American Express card to get into Centurion and Escape Lounges.

Thrifty Tip: Add your Reserve Card to your Delta wallet so you can simply scan your boarding pass and waltz into the Sky Club!

In addition to your own free pass into the Sky Club, cardholders receive four free guest passes to the Delta Sky Club each year. That means four times a year, you can bring a guest into the Sky Club with you at no additional cost. You'll be limited to bringing up to two guests on each visit.

After that, you'd simply pay $50 per guest – with the ability to bring up to two guests into the Sky Club at a time. Reserve cardholders will continue to get annual guest passes after the new access policies go into effect after Feb. 1, 2025, and they won't count against your 15-visit allotment.

On the other hand, the Delta SkyMiles Platinum card no longer offers any access to the Sky Club. Previously, cardholders could buy a one-time Sky Club day pass for $50 per entry.

Unlike other airlines, there are no day passes to Delta airport lounges available for everyday flyers. That means the Delta Reserve is one of your only options for getting in. Delta even killed off annual memberships for travelers without Delta Medallion status in its ongoing efforts to combat lounge overcrowding.

Winner: Which Card Offers Better Lounge Access?

The Delta Platinum card no longer offers a path into the Delta Sky Club, so this is an easy choice.

With the Reserve card, you'll get access to Delta Sky Clubs, American Express Centurion Lounges, and Escape Lounges, too. That makes it the clear winner when it comes to lounge access.

Remember: Starting in February 2025, with the Reserve card, you'll be limited to 15 Sky Club visits a year.

Learn more about the *delta reserve*

Statement Credits

To help offset the new, higher annual fees, Delta and American Express added a handful of potentially money-saving new statement credits to both the Platinum and Reserve cards.

Here's what's now available.

A Hotel Booking Credit Through Delta Stays

Every calendar year, Delta Platinum and Reserve cardholders will receive a credit to use for a prepaid hotel or vacation rental booking through the Delta Stays platform, the airline's hotel booking platform powered by Expedia.

If you hold the Delta Platinum card, you'll get up to $150 back in statement credits on a Delta Stays booking. If you hold the Delta Reserve card, you'll get up to $200.

These credits reset each calendar year, so you've got until Dec. 31 to put it to use. Any unused amount won't roll over to the following year, so like most statement credits on Amex cards, it's a use-it-or-lose-it benefit.

Learn more about how to use the Delta Stays credit card benefit!

A Monthly Credit to Use at Resy Restaurants

Resy is a restaurant reservation platform that is available online and through a mobile app. American Express acquired Resy way back in 2019, and the bank has slowly been integrating the platform into its product offerings, including its co-branded Delta credit cards.

If you hold the Delta Platinum card, you now have up to $120 in statement credits, doled out in $10 monthly increments, for purchases at restaurants available through Resy. With the Delta Reserve card, you'll get up to $240 in statement credits, doled out in $20 monthly increments, at Resy restaurants.

Restaurants partner with Resy to power their reservations system and other parts of their operation, so critically, not all restaurants will be available through the platform. And perhaps more importantly, Resy is generally only available in larger metropolitan areas.

Resy does have partner restaurants in smaller cities, but the options are much more limited. If that's you, using this new Delta card benefit will be much more difficult.

Critically, you don't have to make a purchase through Resy to use the new benefit. Simply enroll for the benefit in your American Express account, then find a restaurant that partners with Resy and use your Delta Platinum or Reserve card to make a purchase directly with that restaurant. You should see the $10 credit on your statement a few days or weeks later.

Like the other credits on these Delta cards, the Resy credit is a use-it-or-lose-it benefit. Any unused amount each month will be forfeited.

Read More: How to Use the New Resy Credit on Your American Express Card

A Monthly Rideshare Credit

Like the monthly Uber Cash you get with *amex platinum* and *amex gold*, the *delta skymiles platinum card* and the *delta reserve card* now come with an annual rideshare credit.

With each of Delta's top two cards, you get up to $120 in statement credits (doled out in $10 monthly installments) a year when you use your card to pay for a ride with Uber, Lyft, Curb, Revel, or Alto.

Unused rideshare credits don't roll over to the next month either, so it's important to ensure you use up these credits in full each month.

Learn more about how to use the rideshare credit on the Delta Platinum and Reserve cards!

Winner: Which Card Offers Better Statement Credits?

While the Delta Reserve card costs $300 more each year in annual fees, the rideshare credit on both cards is exactly the same. You'll get up to $120 each year doled out in $10 monthly increments.

Travel Perks

Stop me if you've heard this before: Your primary reason for getting either the Delta Platinum or Reserve Card shouldn't be to earn SkyMiles.

The real value of these cards is in the perks and travel benefits that can make your trip better. And both of these cards bring a lot of additional perks to the table.

First Checked Bag Free

One of the biggest travel perks of both the Delta Platinum and Reserve card is getting a free checked bag on all Delta flights – a savings of at least $70 on each roundtrip.

By simply attaching your SkyMiles number to your itinerary, you'll automatically receive this benefit for yourself … and up to eight other passengers booked on the same reservation. There's no need to even pay for your flight with your Delta card!

Getting a free checked bag on every Delta flight can go a long way to offsetting either card’s annual fee, especially as airlines like Delta keep upping baggage fees. The math works out even better if you’re flying with family or friends, as it allows you to get a free bag for up to nine passengers, including yourself.

Both cards offer the exact same free baggage benefit.

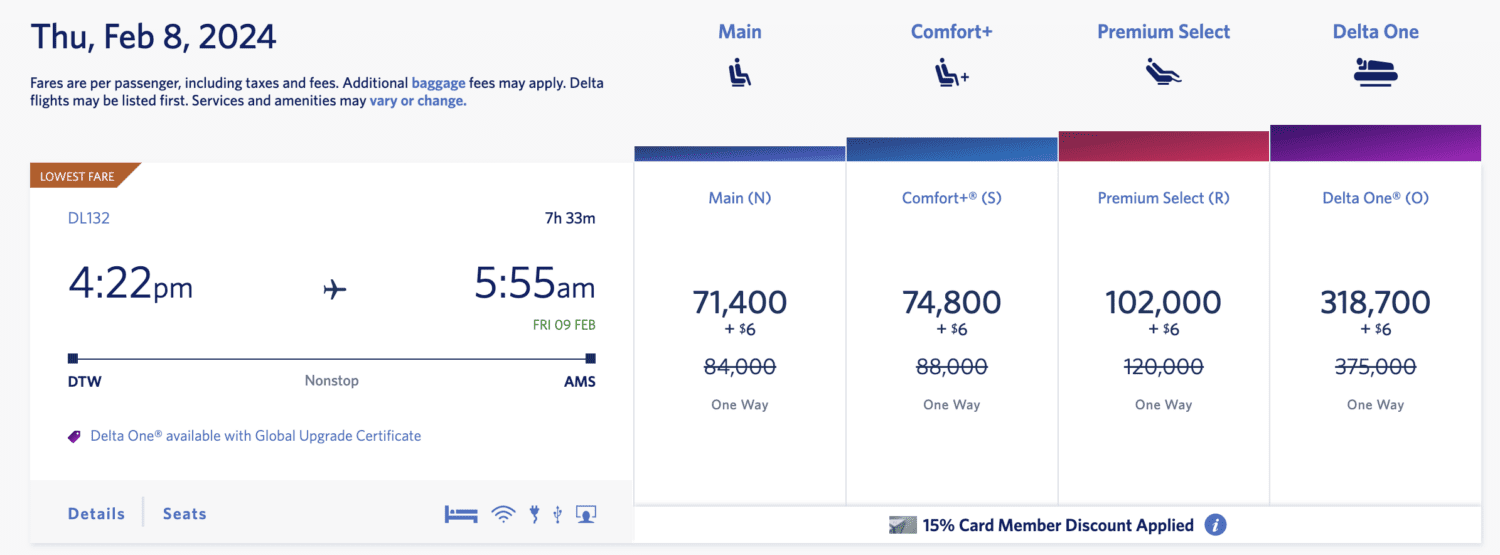

TakeOff 15

TakeOff 15 is a new benefit for Delta SkyMiles American Express cardholders that provides a 15% discount on award tickets when redeeming SkyMiles for Delta-operated award flights.

You'll get the same 15% discount regardless of whether you have the Delta Platinum or Delta Reserve American Express Card. You'll even get this benefit with the cheaper *delta gold*. Only the no-annual fee (see rates & fees) *delta blue* misses the cut.

This benefit couldn't be any simpler: You'll see the discounted price automatically applied whenever you're logged into your SkyMiles account and searching for award flights. The discount even applies to additional passengers in your travel party, so the savings can add up fast when booking flights for a group with your SkyMiles.

Unfortunately, this discount is only available to the primary cardholder – authorized users on your Delta card won't get a 15% discount booking flights on their own.

20% Back on In-Flight Purchases

Whether you need a light bite to eat or something to help take the edge off, it'll cost you on most Delta flights. But thankfully, there's a way to save on these purchases with both the Delta Platinum and Reserve Cards.

If you hold either card, you'll get 20% back on in-flight purchases as a statement credit for any food or beverage purchase. This 20% credit does not apply to anything else purchased onboard like inflight Wi-Fi … though the days of paying for internet are numbered as Delta continues rolling out free onboard Wi-Fi.

TSA PreCheck or Global Entry Credit

Both cards give you up to a $120 credit to cover the cost of Global Entry or TSA PreCheck every four and a half years. And that's enough to cover the entire cost of either program.

This benefit might seem redundant, as many travel cards offer a credit for Global Entry or TSA PreCheck nowadays. But even if you're already enrolled in one of these trusted traveler programs, it could still be useful for paying for a renewal. Or you could pay the application fee for a friend or family member and make their next airport experience a bit less stressful.

Here's how it works: Just pay the application fee with your card, and poof – you'll get a credit back on your statement to cover the cost. Once enrolled, membership lasts for five years – that means you’re set to keep your enrollment up to date with either program.

Can’t decide which to go with? Global Entry is the best of both worlds as it comes with TSA PreCheck benefits and gets you into a designated customs and immigration line when returning to the U.S. from abroad.

Earning Elite Status

Delta kicked off 2024 with big changes to how Medallion elite status is earned.

The biggest change? Delta flyers now earn only Medallion Qualifying Dollars (MQDs), and will no longer earn Medallion Qualifying Miles (MQMs) or Medallion Qualifying Segments (MQSs).

Here is how you can earn them.

How to Earn Delta MQDs Starting in 2024

- You'll earn 1 MQD per $1 spent on the ticket price for a Delta-marketed flight operated by Delta or a Delta partner airline.

- If you hold the *delta reserve card* or the *delta reserve business*, you'll earn 1 MQD for every $10 you spend.

- If you hold the *delta platinum* or the *delta platinum business*, you'll earn 1 MQD for every $20 you spend.

- You'll earn 1 MQD per $1 spent on completed car rentals booked through Delta.

- You'll earn 1 MQD per $1 spent on completed hotel stays booked through Delta.

- You'll earn 1 MQD per $1 spent on Delta Vacations package bookings.

- There will no longer be an MQD waiver for meeting a spending threshold on the Delta Platinum and Reserve credit cards.

- There will be no path to earning MQDs for spending on the *delta skymiles gold card*.

While the Delta Reserve card will make all of your spending worth twice as much in terms of earning MQDs as the Delta Platinum card will, both cards will give you an annual $2,500 MQD headstart just for holding them. If you have both cards, you can earn the MQD headstart bonus on each – for a total of $5,000 MQDs.

Those $2,500 MQDs are halfway to the $5,000 MQDs needed to qualify for Delta Silver Medallion status.

Read more: Is Delta Medallion Status Worth It?

Adding an authorized user to your credit card means that a person will get their own physical card, which they can use to make purchases on your behalf.

Doing so can be a great way to work toward the minimum spending requirement with either of these welcome offers. It's also a good option for spouses and families – especially if you want to help a minor get off on the right foot by building their credit early.

Both cards allow you to add an authorized user to the main account, but what benefits you get with that additional card range from “not much” to “well worth it.”

Delta SkyMiles Platinum Card Authorized Users

Authorized users can be added to the Delta Platinum Card at no additional cost. Outside of using the card for purchases – earning additional SkyMiles – there aren't really any other benefits for the main cardholder or authorized users to take advantage of.

They won't get free checked bags unless they're traveling on the same reservation as the primary cardholder.

Read More: What Benefits Do Delta SkyMiles Authorized User Cards Get?

Delta SkyMiles Reserve Card Authorized Users

With the Delta Reserve Card, you can add authorized users for an additional fee of $175 per year. The main benefit of adding an authorized user to your Delta Reserve Card is that they'll get complimentary access to Delta Sky Clubs, American Express Centurion Lounges, and Escape Lounges when flying Delta.

With the changes to Sky Club access coming in 2025, Delta Reserve authorized users will get their own allowance of 15 Sky Club visits each year, separate from the main cardholder.

Compared to the cost of purchasing a Sky Club Membership outright (if you can), this is far and away the better alternative.

Like the Platinum card, authorized won't get free checked bags unless they are traveling on the same reservation as the primary cardholder.

Winner: Which Card Has the Best Authorized User Benefits?

Although adding an authorized user to a Delta Reserve card will cost an additional $175 a year, getting Sky Club and other lounge access can be well worth it for families that travel together. The Delta Reserve is the clear winner in terms of authorized user benefits.

Learn more about the *delta reserve*

Bottom Line

By the numbers, the Delta Reserve card is the clear winner. But that doesn't tell the full story, as it comes with a much bigger annual fee.

If you're after top-tier credit card perks like lounge access or an even faster path toward building Delta Medallion Status, the Delta Reserve is the clear winner. Meanwhile, the Delta Platinum is a far cheaper alternative that still offers many of the same great benefits.

Ultimately, deciding which card is best is a personal decision: You have to look at all the cards' features and benefits and decide which one fits your travel plans – and your budget for annual fees. If you're a frequent Delta flyer looking for additional perks to make your travel life a little easier, you really can't go wrong with either card.