Points and miles are a lot like currencies around the world. Just as $100,000 U.S. dollars aren't equal to 100,000 Japanese yen, 100,000 Delta SkyMiles are not equal to 100,000 Hilton Honors points.

But let's take the analogy a bit further. Diversifying your investments is critical: It’s not wise to put your entire life savings into one stock. You’ll need a basic understanding of stock portfolio diversification before you put your hard-earned money into an investment vehicle. If that company went belly up or didn't perform particularly well, your finances will suffer. It's why index funds exist.

The same mentality is true with points and miles. If you focus on earning points with just one airline or hotel program, you're locked in. That's fine … until a great deal pops up with an airline where you don't have miles. Or when you need to fly a different airline. Or stay somewhere where your favorite hotel chain doesn't have a location. Or when that airline decides to suddenly start charging a boatload more miles for the flights you want.

When that happens, all the Delta SkyMiles or Hilton Honors points in the world can't help you. That's why it's so critical to branch out and start earning different points and miles – sooner rather than later. We'll walk through the top three reasons to underscore why you need to diversify in 2024.

Points and Miles Get Less Valuable

Death, taxes, and reward program devaluations.

These are simply certainties in life. With airline and hotel programs, it happens over and over again: Airlines raise award rates – how many points or miles you need to book a flight – often without much notice. Just last year, we were reminded of that on several occasions.

In December, Virgin Atlantic hiked award rates by as much as nearly 60% on all its Delta routes, effectively killing off one of our favorite sweet spots for flying Delta on the cheap. A week later, British Airways followed suit by raising the price to fly Oneworld airline alliance partners, American and Alaska Airlines.

The move from Virgin was all too familiar as it's just the latest of several painful changes the U.K.-based program has made over the years. Back in early 2021, the airline destroyed a similar sweet spot to get to Asia in Delta One for just 60,000 miles. And earlier in 2023, it also raised award rates to book ANA First Class. Thankfully, Delta flights to Europe escaped unscathed … for now.

But don't let those two take all the credit for sudden devaluations: United also raised award rates last year. It started with a 33% increase on fares to Europe and quickly spread to nearly every corner of the globe. Whether you're flying United itself or using their MileagePlus miles to book with a partner airline it'll now cost you more than it did last year at this time – and in some cases, it's a lot more.

You see, United axed its award charts – the cheat sheets that determine how many miles you need to fly from point A to point B – years ago, but pricing had remained fairly stable. If you could find the lowest-priced “saver” award rates, you could book a seat in United economy to Europe for 30,000 miles each way or 60,000 miles in United Polaris business class.

Now, you'll see something that looks like this.

While 40,000 miles each way in economy is no steal, that's the best you can hope for at the new “saver” level. Business class awards didn't fair any better: One-way flights that once cost 60,000 miles now price out at 80,000 for the exact same seat and route.

Southwest Airlines also got in on the fun by devaluing its points at the tail end of the year – and this came only two years after a similarly unannounced devaluation where the airline jacked up award redemptions by about 6% across the board.

In the hotel world, Hyatt made some brutal changes to its award chart last year – significantly raising the price of many of our favorite all-inclusive and high-end properties around the world.

Those are just a few of the hundreds of examples over the years. If all your eggs are in one basket, these devaluations can be crushing. It's why we constantly urge travelers to stop waiting and use their points and miles.

But if you can build up points in several different programs, these devaluations are far less painful. You can use your points more judiciously when it makes the most sense to maximize their value.

Prioritize Earning Flexible Points

Co-branded airline credit cards like the *delta skymiles gold card*, the *united explorer*, or the Citi / AAdvantage® Platinum Select® World Elite Mastercard can offer a ton of value for travelers.

They typically come with free checked luggage, priority boarding … and from time to time, big welcome offer bonuses. Having one of these cards in your wallet for your preferred airline is worth it for anyone who travels more than a couple of times each year.

But here’s the thing: The average traveler shouldn’t be using a co-branded credit card for their everyday spending, or focusing on only one airline program. While it may seem smart to keep adding to your balance of Delta SkyMiles, United MileagePlus miles, or American Airlines AAdvantage miles, you can do much better.

Read more: Why You Shouldn't Be Putting Everything on Your Airline Card

More often than not, you’ll be better served by leaning more heavily on a flexible points credit card like the *chase sapphire preferred*, *venture x*, or the *amex gold*.

All three of these cards earn the most valuable points around.

By using a card that earns flexible points, you keep your options open. Not only can you use your points to fly Delta or United, for example, but you can also use them to fly on almost any other airline – or even use them for hotel stays.

It’s one of the main reasons we love Chase Ultimate Rewards points. You can use them to book flights on almost any airline through the Chase Travel Portal. But you can also transfer them to one of the bank's many airline and hotel transfer partners for an award booking.

A sum of 60,000 Delta SkyMiles is stuck with Delta. But a sum of 60,000 Chase Ultimate Rewards points from the Chase Sapphire Preferred is worth at least $750 towards travel with almost any airline, hotel, or even a cruise company. These points give you an unparalleled level of versatility.

Read More: The Best Credit Card Points to Earn This Year to Fuel Your Travels

Use the Best Part of Each Program

More and more, airline and hotel programs are using dynamic award pricing.

While some airlines still use an award chart to set mileage rates for a given flight, it's all over the map with dynamic award pricing. Rates can swing wildly from day to day based on the cash price, demand, seasonality, and more.

Read more on How Much Are Delta SkyMiles Really Worth?

But by diversifying your points and miles, you can get around these hurdles and cherry-pick the best way to book whatever trip you're taking – often for far fewer miles. One of our favorite examples of this is using Virgin Atlantic points to book Delta flights.

Delta is infamous for charging an arm and a leg for award flights in Delta One business class. Seeing 300,000 SkyMiles or more for a one-way flight to Europe is not out of the norm. For reference, most airlines charge 70,000 to 80,000 miles one-way for business class flights, if not substantially less.

Delta wants 375,000 SkyMiles for a business class seat on the flight from New York (JFK) to Munich (MUC). No, thank you.

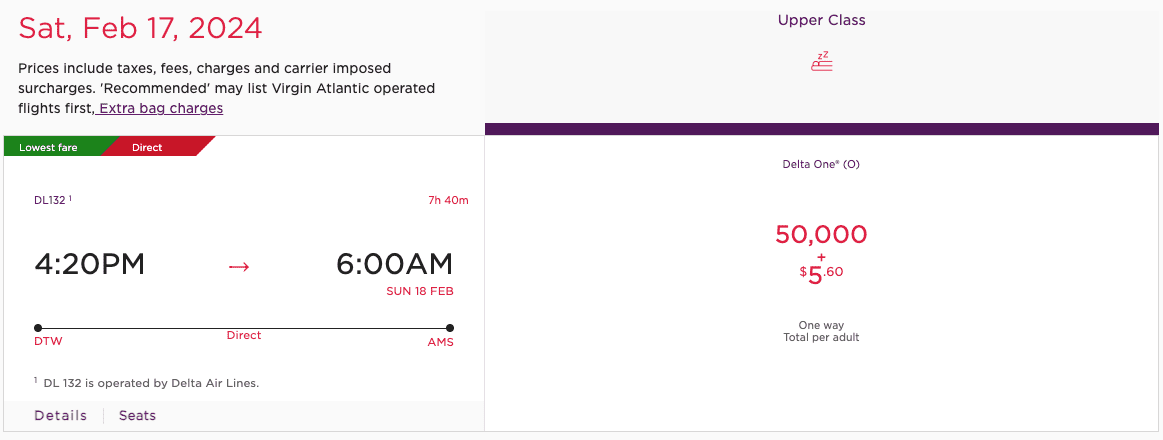

You can do much, much better by booking through Virgin Atlantic. That exact same flight can be booked for just 50,000 miles each way. You may need to be flexible, as finding availability through Virgin Atlantic can be a challenge – especially lately.

Want award alerts for opportunities to book flights like this? Get them delivered straight to your inbox with Thrifty Traveler Premium, along with cheap domestic and international fares!

But when you can make it work, it's a steal. The exact same flight – same date, same plane, same Delta One seat – for 325,000 fewer miles? That's the definition of a no-brainer move.

When you find what you're looking for, you can transfer credit card points to a Virgin Atlantic account from Chase, American Express, Capital One, Citi, and Bilt Rewards. You can even transfer a stash of Marriott Bonvoy points to become Virgin Atlantic miles.

Read more: How to Book Delta One Business Class to Europe for Just 50K Points

Bottom Line

Having points in flexible programs is the best way to protect yourself against the inevitable devaluations of airline and hotel loyalty programs – and score the best deals.

Not only should you diversify your points into the flexible points programs, but it's a great idea to also start building up miles with the three major U.S. airlines: Delta, United, and American.

Diversifying your points and miles keeps your award travel options open. And that's the key to jumping on the best deals and redemptions while avoiding the bad ones.

Gregory, you may be looking out a bit too far for those Delta flights to be bookable through Air France/KLM. Finding these flights can require some flexibility, but we promise it can work. No difference between using AF/KLM sites.

Here’s the full step-by-step guide on how to book: https://thriftytraveler.com/book-hawaii-flights-air-france-klm-flyingblue/