Business owners (and trust us, that might be you) would be hard-pressed to find better welcome bonus offers outside of what American Express and Capital One are offering with their top-of-the-line business credit cards.

Right now, you can earn a welcome bonus of at least 150,000 points (or miles) on *biz platinum* and *venture x business* after hitting each card's (admittedly massive) minimum spending requirement – but you'll need to look beyond the eye-popping pile of points to decide which card is right for your business. And the two cards' list of valuable travel credits and perks could certainly make choosing which card to get that much more difficult.

While the key differences in the benefits you get with each card are important factors, any travelers deciding between Business Platinum and Venture X Business cards should also consider which welcome bonus is the most valuable. Read on for a full breakdown.

Related reading: The Best Business Credit Card Offers Right Now

A Brief Overview of Both Cards

The Business Platinum Card® from American Express

- bonus_miles_full

- Earn 5x Membership Rewards points on flights and prepaid hotels booked through American Express Travel®.

- Earn 2x Membership Rewards points on all eligible purchases of $5,000 or more. Business Platinum Cardholders will also earn 2x Membership Rewards Points per dollar spent on up to $2 million spent each calendar year on electronic goods retailers, software and cloud service providers, U.S. construction materials, hardware supplies, and shipping providers.

- Earn 1x Membership Rewards points on all other qualifying purchases

- Up to $200 Airline Fee Credit: Get up to $200 per calendar year for airline incidental fees at one airline.

- Up to $600 Hotel Credit: Get up to $300 in statement credits semi-annually (up to $600 per year) for prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel. The Hotel Collection bookings require a two-night minimum stay.

- Lounge Access: Get access to American Express Centurion® Lounges, Delta Sky Clubs® (10 visits per year, Feb. 1 – Jan. 31), Escape Lounges, and membership in the Priority Pass™ Select program.

- Global Entry or TSA PreCheck® Credit: You are eligible to receive up to $120 in statement credit every 4 1/2 years for the application fee for TSA PreCheck® and every 4 years for Global Entry. Membership in both programs is good for five years.

- Up to $120 Wireless Credit: Get up to $120 per year (up to $10 monthly) in statement credits for wireless telephone service purchases made directly with a wireless provider in the U.S. on the Business Platinum Card.

- Up to $1,150 Dell Technologies Credit: Enroll and get up to $150 in statement credits on U.S purchases directly with Dell Technologies on the Business Platinum Card, and an additional $1,000 statement credit after you spend $5,000 or more on that same card per calendar year.

- Up to $360 in Annual Statement Credits at Indeed: Cardholders will get up to $90 each quarter on all Indeed hiring and recruiting products. Enrollment is required.

- $250 in Annual Statement Credits on Adobe Products: Get a $250 statement credit per calendar year after you spend $600 or more on U.S. purchases directly with Adobe in a calendar year.

- One AP® Statement Credit: Unlock up to $2,400 in statement credits for use in the next calendar year on American Express One AP® monthly fees after you spend $250,000 on eligible purchases on the Business Platinum Card in a calendar year.

- $1,200 Flight Credit: Unlock up to $1,200 in statement credits on flights booked on AmexTravel.com with the Business Platinum Card, for use in the next calendar year, after spending $250,000 in eligible purchases.

- Up to $209 in Annual Statement Credits for CLEAR+: Get up to a $209 statement credit for CLEAR+ each year.

- Up to $200 Hilton credit: You'll get up to $50 in statement credits to use at Hilton properties once every three months (up to $200 per year).

- Hotel Elite Status: Get Marriott Bonvoy® Gold and Hilton Honors™ Gold status just for being a card member. Enrollment is required.

- Annual Fee: annual_fees (see rates & fees).

Learn more about *biz platinum*

Capital One Venture X Business

- *Venture X Biz Offer*

- Earn Unlimited 2x miles on all business purchases

- Earn 10x miles on hotels and rental cars

- Earn 5x miles on flights and vacation rentals

- $300 Capital One Travel Credit: Every year, you get a $300 travel credit to use on flights, hotels, rental cars, and more booked through the Capital One Business Travel portal.

- Lounge Access: Complimentary access to participating lounges in the Priority Pass network and Capital One lounges.

- Global Entry or TSA PreCheck: Up to $120 in statement credits to sign up for either TSA PreCheck® or Global Entry. This credit is good once every four years, and membership in both programs lasts five years.

- 10,000-mile Anniversary Bonus: Starting in year two, you'll get 10,000 bonus miles (annually) after renewing your Venture X Business Card.

- Annual Fee: $395

Learn more about the *venture x business*.

Minimum Spending Requirement

Both the Business Platinum and Venture X Business come with massive bonus offers – but the two cards require vastly different spending to score those big bonuses.

Although you'll have a similar timeframe to hit the minimum spending requirement, no matter which card you choose, there's a difference of $10,000 between the two. With the Business Platinum, you'll need to spend $20,000 within three months.

While that number is already quite high, it's even worse with the Venture X Business as that card requires spending $30,000 in three months.

You'll have to spend more and work harder to earn the welcome bonus on the Venture X Business. But since the card earns 2x Capital One miles on every purchase, you'd end up with a total of 210,000 Capital One miles when all is said and done.

With the Business Platinum's base 1x point earning rate, you'd earn a minimum of 220,000 points after meeting the card's spending requirement. Even if you can maximize the select business categories or spend over $5,000 on a single purchase to earn 2x points, you'll still end up with just 240,000 points.

While it's clear that you can earn more points with the Venture X Business, as you work on meeting the minimum spend requirement, you're spending more money along the way. Depending on the scale of your business and your typical monthly expenses, these spending requirements could be a sticking point … or it might not matter at all.

Which Points Are More Valuable?

The Business Platinum and Venture X Business are both great cards, but are the points equivalent in value?

At first glance, Amex Membership Rewards points might appear superior to Capital One miles based on the presence of more domestic redemption options like Delta, Marriott, and Hilton. With Capital One, you can transfer your miles to 20-plus airline and hotel programs, while Amex has 17 airline partners and three hotel chains from which to choose. But quantity isn't always greater than quality.

American Express Transfer Partners

Here's the full list of choices:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| Choice | Hotel | 1:1 | Instant |

| Hilton Honors | Hotel | 1:2 | Instant |

| Marriott Bonvoy | Hotel | 1:1 | Instant |

Capital One Transfer Partners

Here's the full list of options:

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific AsiaMiles | Airline | 1:1 | 1-5 Days (sometimes instant) |

| Emirates | Airline | 2:1.5 | Instant |

| Etihad | Airline | 1:1 | Instant (sometimes 12-24 hours) |

| EVA Air | Airline | 2:1.5 | 24-48 Hours |

| Finnair | Airline | 1:1 | Instant |

| Japan Airlines | Airline | 2:1.5 | Instant |

| JetBlue | Airline | 2:1.2 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | TBD |

| Singapore | Airline | 1:1 | Up to 24 Hours |

| TAP Air Portugal | Airline | 1:1 | Same day |

| Turkish Airlines | Airline | 1:1 | Same day |

| Virgin Red | Other | 1:1 | Same day |

| Accor | Hotel | 2:1 | 1 Hour (Same Day) |

| Choice Hotels | Hotel | 1:1 | Same day |

| Preferred Hotels & Resorts | Hotel | 1:2 | TBD |

| Wyndham | Hotel | 1:1 | Same day |

How Do They Compare?

Let's break it down a bit further. Amex and Capital One share a handful of transfer partners, including valuable airline partners like Air Canada, Air France/KLM Flying Blue, British Airways, Emirates, Singapore Airlines, and Virgin Atlantic. But as you dive in further, one of these programs could prove better for you and your travels than the other.

When it comes to airlines, Amex has some unique partners like ANA, Delta, El Al, and Iberia. But Capital One has some real standouts of its own like Finnair, Turkish, EVA Air, and Japan Airlines.

If you prefer to fly with SkyTeam airlines, American Express has you covered with Delta, Air France/KLM, and Virgin. That means you can cash in on one of Delta's amazing SkyMiles flash sales even if you're short on SkyMiles. And as the only bank currency that can transfer points to Delta, that's a win for Amex in our book.

Get amazing Delta SkyMiles deals sent to your inbox with Thrifty Traveler Premium+!

Capital One, meanwhile, has Air France/KLM and Virgin at its disposal … but again, no Delta. It's not the end of the world – but having more choices is always a good thing!

If you're looking to book a Star Alliance airline, both banks transfer to Air Canada's Aeroplan program. And even after a major overhaul in late 2020, there are some great sweet spots to book Star Alliance award travel with Aeroplan miles. You can even book flights on Etihad (including the Apartments) with Aeroplan miles now, too.

But a real winner for Amex is Japan's ANA – especially considering transferring points from Amex is your only real source for getting these miles. Even after a recent devaluation, you can still book roundtrip flights to Japan in business class for what most airlines charge for economy. Getting to Japan and back in a lie-flat seat for 100,000 miles is a steal, and ANA makes it possible.

Within the Oneworld Alliance, Capital One is the clear winner with the recent addition of Japan Airlines (JAL) Mileage Bank – one of our absolute favorite programs for booking cheap business class seats on partners like Iberia, British Airways, and American Airlines.

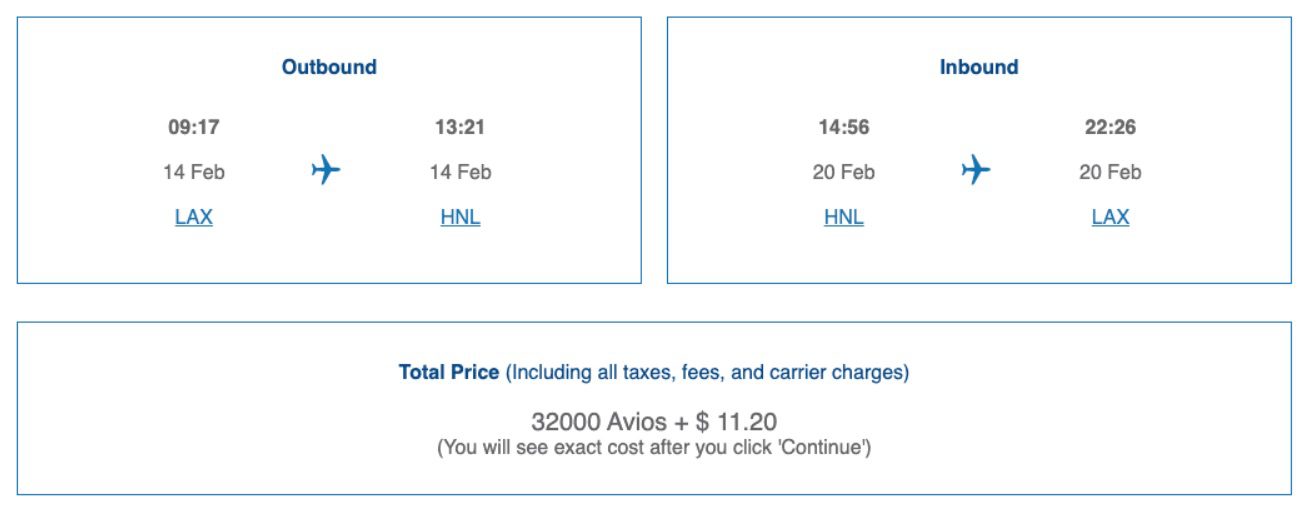

Beyond JAL, British Airways should be on your radar if you want to get to Hawaii for cheap. Using British Airways Avios, you can fly from several West Coast cities to all four major Hawaiian airports for 32,000 miles roundtrip. That's a win, seeing as American typically charges 45,000 AAdvantage miles (or more) for the exact same flights.

On the hotel side, Amex partners with Choice Privileges, Hilton Honors, and Marriott Bonvoy. Capital One meanwhile offers travelers the ability to move points to Choice, Wyndham, Accor, and I Prefer. While it's nice to have the option to move points to one of these hotel partners, none of these should be your first choice. In fact, we often caution against transferring points to hotels altogether just because there are many more valuable uses for them – but in the right situation, any of these hotel partners could make sense.

In terms of which points are more valuable, Amex takes the cake (ever so slightly) here over Capital One due to the quality of transfer partners. Regardless, both banks offer a long list of transfer partners that are incredibly valuable for travelers.

Best Ways to Redeem Amex Points

With 20 transfer partners, there are tons of options to redeem Amex points. These are just a few of our favorites.

- Fly business class to Tokyo and back in ANA business class starting at just 100,000 miles roundtrip by transferring your Membership Rewards to ANA. Read how to use ANA Mileage Club!

- Or book a trip all the way around the world in business class for around 125,000 miles using the ANA Around the World redemption!

- Save some points to transfer to Delta and book a SkyMiles flash sale, like a domestic trip for 8,000 SkyMiles or flights to Mexico for 12,000 roundtrip!

- Snag flights to Europe for just 34,000 roundtrip in economy by transferring points to Iberia – or 68,000 roundtrip to do it in business class!

- Got the *biz platinum*? It unlocks the option to use Membership Rewards® to book an eligible flight through American Express Travel® (with your selected airline) and get 35% of those points back, up to 1,000,000 points back per calendar year.

Check out our full list of the best ways to redeem Amex points!

Best Ways to Redeem Capital One Miles

Capital One's 20-plus transfer partners provide travelers with plenty of options when it comes time to redeem miles. Here are a few of our favorites.

- Book roundtrip business class flights to Europe for just 113,400 Capital One miles by transferring to Japan Airlines

- Book flights (or hotels and other travel experiences) directly through the Capital One Business Travel portal and save even more with features like price matching and freezing, price alerts, and automatic refunds if the price of your ticket price drops.

- Transfer your points to Air Canada Aeroplan and book an EVA Air business class flight from the U.S. to Asia for just 75,000 points each way.

- Remove travel purchases such as flights, hotels, Airbnbs, Ubers, or even a bucket list golf trip from your statement with your Capital One Miles after the fact.

Read our full guide to earning & burning Capital One miles!

Bottom Line

With *biz platinum* and *venture x business*, you can earn at least 150,000 points after meeting either card's lofty minimum spending requirement. When it comes to evaluating which bonus is best, the Business Platinum's bonus is easier to earn, but there's no denying the Venture X Business offers the biggest possible bonus.

No matter which card you choose, you won't run out of ways to put all those points or miles to use with several great transfer partners with both banks.