The *chase sapphire reserve* has long been considered one of the best travel rewards cards on the market, thanks to its long list of travel perks and benefits … and after the card's recent “refresh,” that list is even longer.

Sure, the card's big bonus offer – currently 100,000 points + a $500 Chase Travel℠ promo credit after spending $5,000 in the first three months – is a big reason to get the card. But it's worth keeping year after year because of the suite of travel perks and benefits that come with it

It starts with things like an easy-to-use $300 travel credit, access to Chase Sapphire Lounges, and a credit for Global Entry, TSA PreCheck®, or NEXUS and extends to the card's new credits for “The Edit” hotel bookings, StubHub purchases, dining, Lyft rides, and more. Make use of all (or even some) of these perks and credits, and you can easily take some of the sting out of the card's whopping $795 annual fee.

But to do that, you'll need to maximize all the card has to offer. So here's a rundown of the best Chase Sapphire Reserve benefits and how to put them to use.

Learn more about the *chase sapphire reserve*.

Airport Lounge Access

Perhaps one of the Sapphire Reserve card's biggest selling points is that it's your ticket into the growing list of Chase Sapphire-branded lounges. Over the last couple of years, Chase has been playing catch-up with American Express and lapping Capital One with its network of lounges.

These aren't your average, run-of-the-mill airport lounges, either. Chase has upped the ante with each new lounge it debuts: The designs are all chic and spacious, the complimentary food and drinks are a big step above your typical airport club, and many feature upscale amenities like showers and wellness areas.

As of publication, Chase has 10 lounge locations already open or in the works:

- Boston (BOS) between Terminals B and C: Now open

- Dallas-Fort Worth (DFW) in Terminal D by gate 35

- Hong Kong (HKG) in Terminal 1: Now open

- Las Vegas (LAS) in the C Concourse

- Los Angeles (LAX) in the Tom Bradley International Terminal

- New York City-LaGuardia (LGA) in Terminal B: Now open

- New York City (JFK) in Terminal 4: Now open

- Philadelphia (PHL) in Terminal D/E connector Now open

- Phoenix (PHX) in Terminal 4: Now open

- San Diego (SAN) in Terminal 2: Now open

While it's not officially dubbed a Sapphire Lounge, Chase also shares a space with Etihad at Washington, D.C.-Dulles (IAD).

Chase Sapphire Reserve cardholders get complimentary access for themselves and two guests at all these lounges.

The card also comes with a complimentary Priority Pass Select membership, which gives you free access to an additional 1,300-plus airport lounges around the world. You can also bring up to two guests into these lounges for free.

Priority Pass lounges can be a bit of a mixed bag: Some are great, while others are fairly lackluster. But no matter what, it's a better place to relax before your flight than the terminal, grabbing a quick snack or a drink for free.

Unfortunately, you can no longer access airport restaurants and dine for free with a Priority Pass membership through Chase.

Statement Credits

The new-look Sapphire Reserve touts up to $2,700 in value with its laundry list of statement credits and travel benefits, but getting anywhere close to that amount of value out of the card will require some work.

Here's a look at all the statement credits the card offers.

$300 Annual Travel Credit

The Reserve Card carries an incredibly lucrative benefit that easily cuts down some of the annual fee.

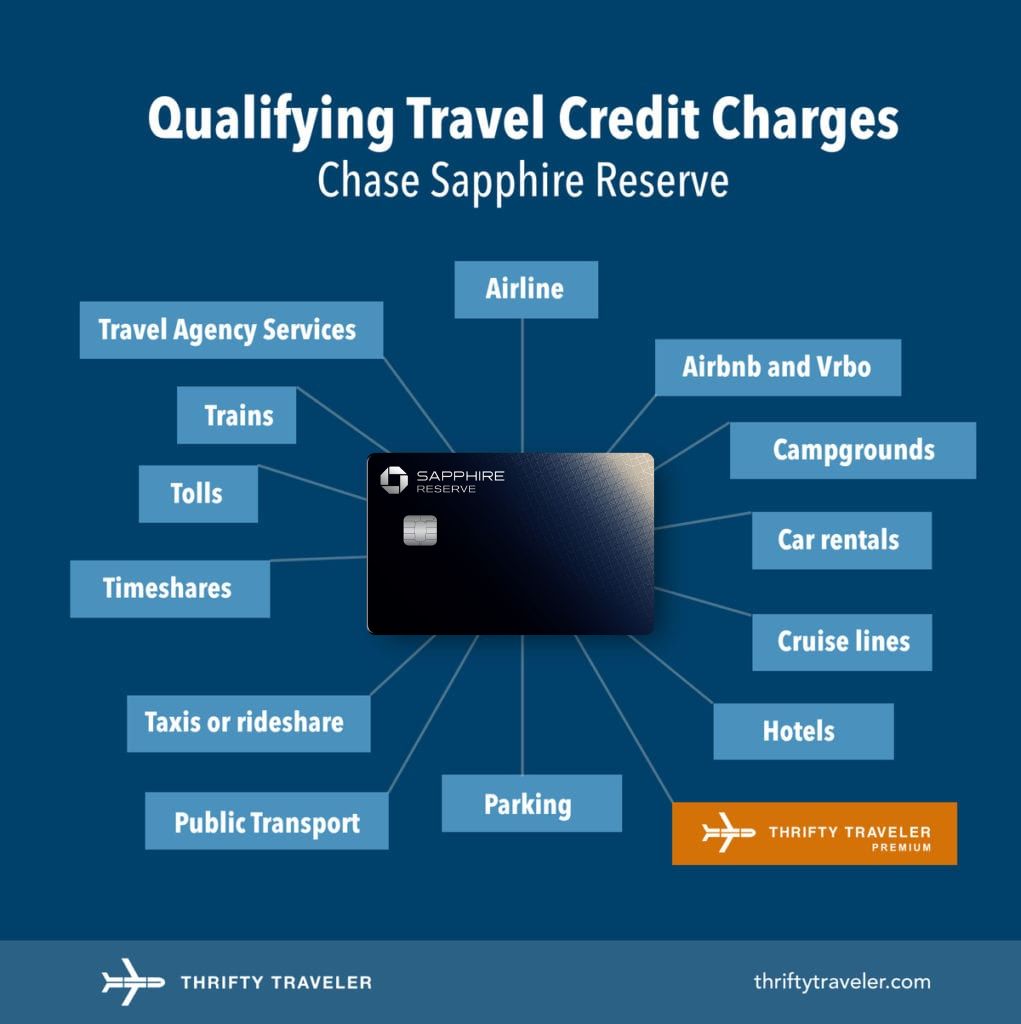

Each year, Chase automatically reimburses you for up to $300 in purchases that code as travel. Whether that is a taxi, Uber, hotel, plane ticket, cruise, or any other travel expense, $300 is right back in your pocket, effectively reducing the annual fee to $495.

Any purchase that Chase considers travel will qualify for and that covers a lot of ground … including many expenses you might not normally consider “travel” like parking fees, tolls, and campgrounds.

You don't have to book through Chase Travel℠ or jump through any hoops like other cards. Just spend on travel, pay with your Sapphire Reserve, and the $300 credit kicks in automatically.

Read More: All About the $300 Chase Sapphire Reserve Travel Credit

$500 “The Edit” Hotel Credit

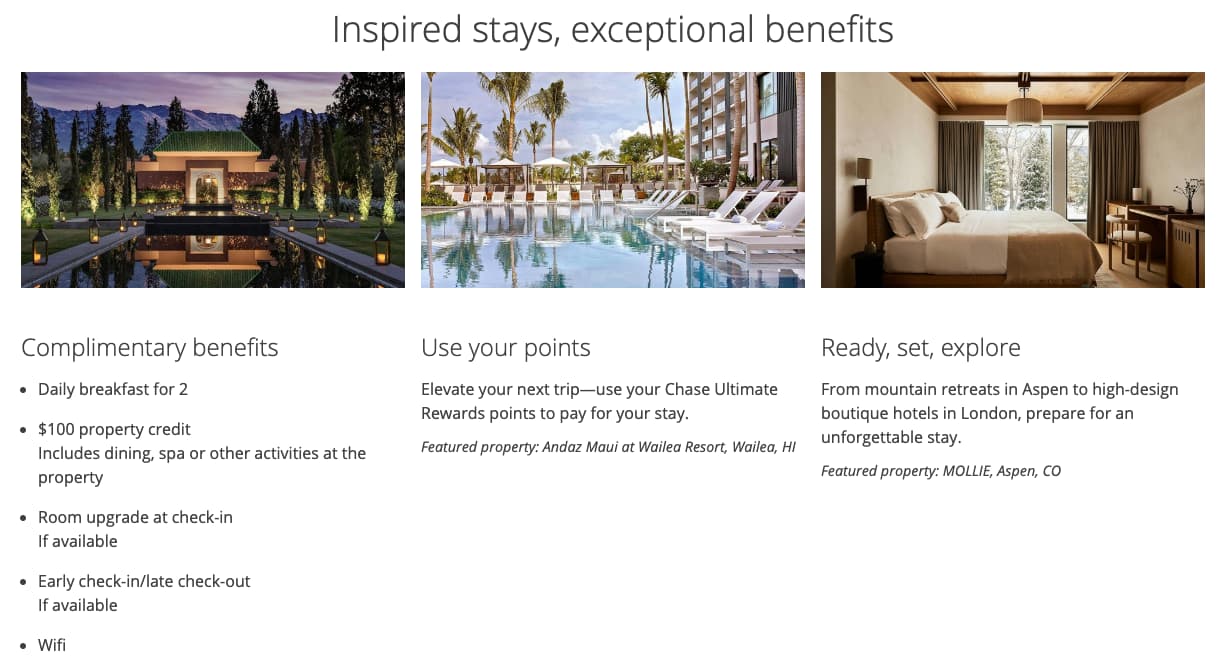

Sapphire Reserve cardholders get up to $250 in statement credits for prepaid, “The Edit” hotel bookings to use from January to June, and again from July to December, up to $500 per year.

This new hotel collection from Chase offers a curated set of upscale properties, similar to Amex's Fine Hotels + Resorts®. In addition to the card's semi-annual credit, you'll also get added benefits like complimentary breakfast, a $100 property credit, possible upgrades, and more. However, you must book at least a two-night stay for the credits to kick in.

Just keep in mind: This credit is only for the primary cardholder, requires a two-night minimum stay, and the credited amount won't earn any points. Still, it's a nice benefit with some really valuable perks. Being able to save up to $250, twice per year, at one of these properties will go a long way toward justifying the card's annual fee.

$300 Dining Credit

With the Sapphire Reserve, you'll get up to $150 in statement credits from January through June and again from July through December, for a maximum of $300 annually, for dining at restaurants that are part of our “Sapphire Reserve Exclusive Tables.”

You'll mostly find eligible restaurants in major cities like New York City, Chicago, and Los Angeles, but even some mid-sized cities like Charleston, Minneapolis, Nashville, Denver, and more have a handful of restaurants where you can use this credit. Since these restaurants skew higher end, you should have no trouble using your semi-annual $150 credit up in one fell swoop … or over multiple visits.

$300 DoorDash Credit & Complimentary DashPass

Sapphire Reserve cardholders get a $5 per month discount on DoorDash restaurant orders and two monthly coupons of up to $10 off on grocery, convenience, and other non-restaurant orders through Dec. 31, 2027.

These promos must be applied at checkout when placing an order on DoorDash using the Sapphire Reserve card enrolled in DashPass. Unfortunately, if you don't get around to using one of your promos, it won't carry over to the next month.

You'll also get a complimentary DoorDash DashPass membership, providing free delivery access and lower platform fees. Just be sure to activate this benefit by Dec. 31, 2027, and it'll be good for a minimum of one year.

$300 StubHub Credit

You now get up to $150 in statement credits from January through June and again from July through December for a maximum of $300 annually for StubHub and viagogo purchases through Dec. 31, 2027.

If you regularly attend live events like concerts, sports, or even theater and comedy shows, this credit should be pretty easy to use and help you get some value back out of your card's high annual fee.

$120 Global Entry, TSA PreCheck®, or NEXUS Credit

With the Sapphire Reserve, you can receive up to $120 in credit once every four years to cover the cost of Global Entry, TSA PreCheck, or NEXUS.

Membership in these programs lasts for five years, so you're set with this credit. And since Global Entry includes TSA PreCheck, it's the obvious choice if you're planning any international travel.

Read our guide to enrolling in Global Entry!

$120 Lyft Credit

Sapphire Reserve cardholders get access to up to $10 in monthly Lyft credits (up to $120 per year) to use on rides – plus earn 5x total points on your purchase – through Sept. 30, 2027. Unfortunately, these credits are use-them-or-lose-them, so if you don't use rideshare services on a regular basis, you won't be able to stack the credits for a pricier ride later.

Complimentary Apple TV+ & Apple Music Subscription

You'll now get a complimentary Apple TV+ and Apple Music subscription for holding the Sapphire Reserve card (through June 22, 2027). If you're already paying for one (or both) of these services, that's an annual value of $250.

With tons of original content and access to music across all your devices, this will no doubt prove to be a valuable benefit for many.

One thing to note about this credit is that it's not valid for Apple One subscriptions or even family subscriptions of Apple Music or Apple TV+.

$120 Peloton Credit

Get $10 in statement credits per month on eligible Peloton memberships through Dec. 31, 2027, for a maximum of $120 per year (activation required). Plus, you'll earn 10x total points on eligible Peloton equipment and accessory purchases over $150 through Dec. 31, 2027.

This is likely the least useful credit of all the new perks you get with the Sapphire Reserve, but if you're already paying for a Peloton membership, saving $10 per month isn't nothing.

Travel Protections

Primary Car Rental Insurance

This primary coverage from Chase Sapphire cards replaces the typical “collision damage waivers” – or loss damage waivers – that car rental companies are required to offer. This policy will provide reimbursement for damage due to collision or theft on a rental car. So if you get into an accident, it will cover the costs of any damage up to the cash value of the vehicle.

To use this benefit you must charge your rental car to your Sapphire Reserve and decline the rental company’s collision damage waiver. If you don't decline the car rental company's collision damage waiver, your Chase coverage will be voided.

Read more: All About the Chase Sapphire Rental Car Insurance Benefit

Roadside Assistance

Receive 24-hour towing assistance (up to $50), 24-hour lockout assistance (up to $50), up to two gallons of fuel delivery, and flat tire changing service, all included with your card membership.

Related reading: Car Broke Down? Your Travel Credit Card Might Have Roadside Assistance

Lost Luggage Reimbursement

If you check your bags and they’re delayed more than six hours, the card will reimburse you up to $100 per day for up to five days. This coverage is meant to provide reimbursement for essential items like toiletries, clothing, and cell phone charging cables, for example.

Trip Delay & Cancellation Coverage

The card will reimburse you for any delay lasting six or more hours. Cardholders will be covered along with their spouse or domestic partner and any dependent children under the age of 22 for up to $500 for each purchased ticket.

Read more: A Firsthand Experience With Chase's Trip Delay Insurance

Medical Evacuation & Travel Accident Coverage

The card provides coverage up to $1,000,000 for accidental death or dismemberment, or a combined loss of speech, sight, or hearing, experienced on a covered trip. Benefits are available when some portion of a trip has been purchased with the card or with Ultimate Rewards points earned on the card.

The card will also provide coverage for a medical evacuation. If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Doing the Math

While the card does have a $795 annual fee, it offers an easy-to-use $300 travel credit that should help most travelers recoup a big chunk of that. In that case, viewing this as a $495 annual fee travel card is more appropriate. If you wouldn't ordinarily spend $300 per year on travel, this card simply isn't for you.

For $495 each year, you'll get up to $500 “The Edit” hotel credit, $300 Chase Dining credit, Chase Sapphire and Priority Pass lounge access, a credit for TSA PreCheck, Global Entry, or NEXUS, and much more. You also get some of the best travel protections of any card on the market.

While carrying the card has a real cost, these benefits will far outweigh it for many travelers. Once you consider the card's big bonus offer, it becomes a no-brainer … at least for the first year.

Read more: Is the Sapphire Reserve Still Worth the Annual Fee?

Bottom Line

Despite a hefty $795 annual fee, the *chase sapphire reserve* offers up to $2,700 in potential value through a $300 annual travel credit, lounge access, a slew of statement credits for dining, hotels, rideshares, and more, plus premium travel protections. If you can take advantage of even a handful of these benefits, the value can easily outweigh the fee – especially when you factor in the current bonus offer.

Learn more about the *chase sapphire reserve*.