Getting travel credit cards comes with all kinds of considerations. You'll want to protect your credit score, obviously … though that topic alone is with misunderstandings and misinformation. You'll want to master the points and miles you'll be earning. And above all, you'll want to make sure you're being financially responsible – credit cards are serious business, after all.

But before you apply, you probably also want to make sure you can … you know, actually get approved for that new credit card. And that's often the hardest part: the rules and restrictions change constantly and vary from bank to bank. Even with a perfect credit score, that could mean you get outright denied.

Whether you're considering a card from Chase, Citi, American Express, Capital One, or even a credit card issuer like Wells Fargo or U.S. Bank, we'll walk through all the credit card application rules in place that you'll want to know before hitting that apply button.

- American Express Credit Card Application Rules

- Chase Bank Credit Card Application Rules

- Capital One Credit Card Application Rules

- Citi Credit Card Application Rules

- Bank of America Credit Card Application Rules

- Barclays Credit Card Application Rules

- U.S. Bank Credit Card Application Rules

- Wells Fargo Credit Card Application Rules

- Discover Credit Card Application Rules

American Express Credit Card Application Rules

If you have a high credit score, American Express is one of the easiest of the big banks to get approved for a credit card.

That said, there are a few rules specific to American Express that you'll want to be aware of before submitting an application. And in the last year or two, American Express has become noticeably more strict with applicants who have opened several Amex cards.

One Welcome Bonus Per Lifetime Rule

If you're looking at a new travel credit card, odds are you're hoping to earn a big bonus. With American Express cards, you can earn these welcome offer bonuses once per “lifetime.” But that may not mean what you think.

For starters, it means you can get just about every American Express credit card once. But once you've had it, you won't be able to earn the welcome bonus on it again.

That rule applies even if you've had the card in the past, but never earned the welcome bonus on it. So if you previously held the *amex gold card* but then upgraded to *amex platinum card*, you would be ineligible to earn the welcome bonus on the Platinum Card.

But this rule comes with a big caveat: American Express' definition of “lifetime” isn't anywhere close to an actual lifetime. Many data points suggest that seven years after you've canceled an Amex card, you're once again eligible to open that card and earn the welcome bonus.

And finally, make sure to keep an eye out for targeted welcome offer bonuses that are not publicly available. Oftentimes, the fine print on these offers does not include the “once per lifetime” language.

A Limit of Five Credit Cards

On top of the “once per lifetime” rule, American Express also limits consumers to having no more than five American Express cards open at any given time. So if you already have five open cards, you would automatically be declined if you were to apply for another one. This includes both personal and small business Amex cards.

One important note: This five-card total doesn't include hybrid cards that don't have fixed spending limits – formerly known as charge cards. That means the following cards don't count towards that five-card limit:

- *amex platinum card*

- *biz platinum*

- *amex gold card*

- *biz gold*

- American Express® Green Card

- The American Express® Business Green Card

Only Two Credit Cards Every 90 Days

Regardless of which cards you are applying for, you won't be approved for more than two American Express cards in a 90-day period. However, this restriction excludes hybrid cards without a fixed spending limit like *amex platinum card* and others mentioned above.

There shouldn't be any issues applying for two cards on the same day, though you may not get instant approval on the second one.

Membership Rewards Credit Card Rules

Since Amex traditionally limits cardholders to earning one “lifetime” welcome bonus offer per card, and they offer three separate Membership Rewards-earning credit cards, you used to be able to pick up all three at any points – in any order – to earn a big pool of Amex points on each one.

No more.

But as of October 2023, that's no longer the case. Amex has begun adding terms that limit welcome offer eligibility based on which other Amex point-earning cards you've previously had. As of publication, every card within the family has been affected.

You can now only work your way up, not down. So while it's fine to get the Amex Green Card and then get a bonus on the Amex Gold Card, the reverse won't work. And if you start with the Platinum Card, you've made yourself ineligible to get welcome bonuses on the other two cards.

Amex went even further to limit welcome bonus eligibility for different flavors of *amex platinum*. If you've had that standard version or one the co-branded cards from banks like Morgan Stanley and Charles Schwab, you won't be able to earn the bonus on one of the other two anymore.

It's still possible to earn a bonus on multiple Membership Reward-earning credit cards, but you'll have to start at the bottom and work your way up in order to do it.

Read More: New Gold Card Restriction Makes it Even Harder to Earn Amex Bonuses

Delta Co-Branded Credit Card Family Rules

Since Amex has traditionally limited cardholders to earning a welcome offer bonus once per card, and they offer four separate Delta co-branded credit cards, you could pick up all four – in any order – and earn a big pool of SkyMiles in the process. It's the reason we have always cautioned travelers to not upgrade their Delta credit card, as you could apply for a different version outright and still earn the big welcome offer bonus.

But as of September 2023, that's no longer the case as Amex has also added terms that limit welcome offer eligibility based on which other Delta SkyMiles cards you've previously had. It's not a blanket one-size-fits-all restriction, though. And as of publication, the Delta American Express business credit cards don't appear to be impacted.

It's still possible to earn a bonus on multiple Delta credit cards, but you'll have to start at the bottom and work your way up in order to do it.

Under the new requirements, Amex is only allowing travelers to earn a welcome offer on a more expensive Delta card than the one they currently have, or have had.

Read More: Amex Makes It Harder to Earn to Earn Welcome Offers on Delta SkyMiles Credit Cards

Cashback Credit Card Family Rules

Amex cashback cards are not immune to the family rules as of September 2023. You are now ineligible for the Blue Cash Everyday(R) Card from American Express if you've had the Cash Magnet® Card, card_name or the Morgan Stanley Blue Cash Preferred.

As for the card_name, you are ineligible for the welcome bonus offer if you've had the Morgan Stanley Blue Cash Preferred.

The Cash Magnet® Card and the Morgan Stanley Blue Cash Preferred are currently unaffected by any family language at the time of publication.

It's still possible to earn a multiple bonuses on Amex cashback credit cards, but you'll have to start at the bottom and work your way up in order to do it. In other words, you'll want to start with the Blue Cash Everyday(R) Card from American Express first.

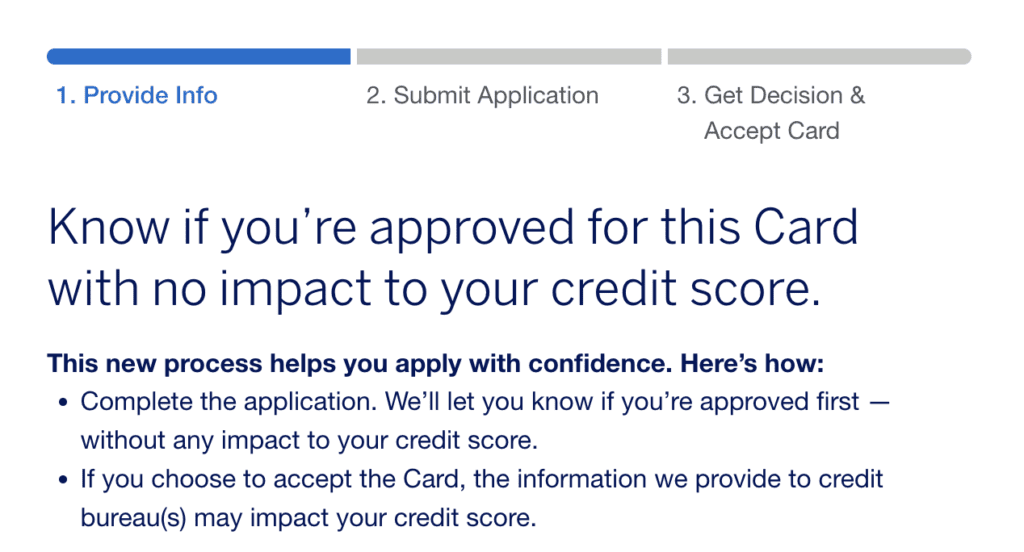

Amex's ‘Apply with Confidence' Feature

In November 2022, Amex officially rolled out its new feature dubbed the “Apply with Confidence” tool. Whether you're concerned your credit score isn't up to snuff or can't remember whether you've had a certain card before, this new tool can help reassure you before that fateful moment when you hit “submit.”

During the application process, select applicants can use the Apply with Confidence tool to find out if they are approved for a card without impacting their credit score. If you get the green light, apply, and get approved for the card, then your credit score may be affected.

At launch, this new application experience is currently available for individuals applying for a U.S. personal card via Thrifty Traveler, at AmericanExpress.com/us/credit-cards, or by calling American Express and is not available if you apply for a card after you log in to an existing card member account. That means if you're applying for an American Express business card, this tool won't be available.

The new American Express “Apply with Confidence” tool allows you to see if you'll be approved for a card before you actually submit your application for an Amex card. That allows consumers to fill out the card application as they normally would and then agree to the terms of the application.

Without a doubt, this new feature makes applying for American Express cards easier and provides more transparency than any other bank out there.

Read More: Amex Rolls Out Great New ‘Apply with Confidence' Feature For Card Applications

Use the Amex Welcome Offer Eligibility Pop-Up

One nice thing about Amex is that they have an easy-to-use tool to confirm you're actually eligible to earn a big bonus on any card before you officially hit submit on any credit card applications.

This tool processes your information before American Express actually pulls your credit. It can help stop you from applying for a credit card if you're not eligible for the bonus, saving you the trouble of a pointless hard credit pull.

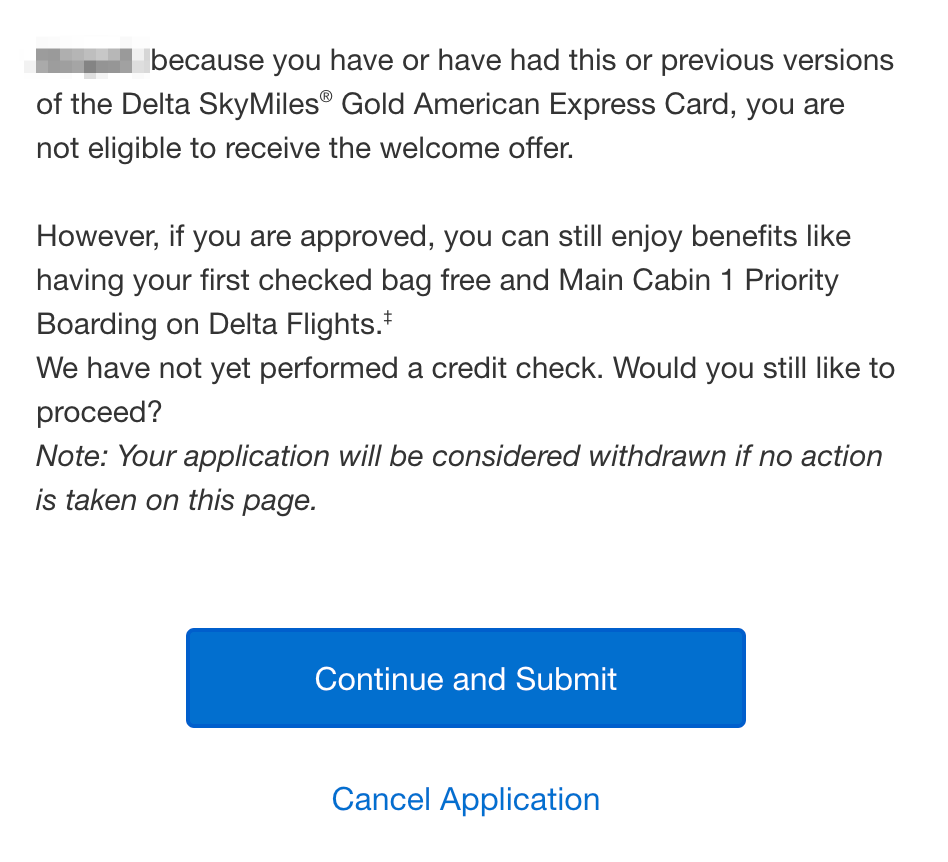

You’ll only get a pop-up if American Express deems you are not eligible to earn the welcome offer on the subject card. That means you can assume you're eligible to earn a welcome bonus if the application goes straight through to a final decision without a warning like the one below.

Read More: Why Am I Not Eligible For an Amex Welcome Offer Bonus?

But more and more travelers are getting warnings just like this one recently. After years of approving anyone, it sure seems like Amex is cracking down on applicants who already have several of their credit cards, preventing them from earning yet another bonus.

Chase Bank Credit Card Application Rules

Chase has some of the most restrictive policies of all the credit card issuing banks when it comes to getting approved for their credit cards.

That's a big part of the reason why we urge travelers just getting started with travel cards to start with Chase. Once you get rolling, Chase credit cards simply get more difficult to open thanks to something called the Chase 5/24 rule.

Here's everything you need to know before you apply for a Chase credit card.

The Chase 5/24 Rule

The Chase 5/24 rule is a black-and-white restriction rolled out years ago in order to limit card applicants from opening credit cards for the sole purpose of earning the bonus rewards.

Here's what it boils down to:

- If you have opened five or more credit cards in the past 24 months from any bank (not just Chase cards), you will not be approved for most Chase credit cards – regardless of your credit score or history with Chase bank.

- The rule does not count credit inquiries, but rather card products that you have applied and been approved for.

So if you have opened five or more new credit cards from any bank in the past 24 months, you won't be approved for Chase credit cards that are subject to the 5/24 rule. Nearly all of Chase's personal credit cards fall under this rule.

Again, Chase isn't just looking at your history with Chase cards to make this determination: Personal credit cards from any bank will add to your 5/24 count.

The rule is not officially published through any of Chase's platforms. Case in point: If you ask about it in a Chase branch, employees are likely not familiar with it. But trust us, it's real.

Are Business Credit Cards Impacted by the Chase 5/24 Rule?

Business credit cards also fall under the Chase 5/24 rule … kind of.

When it comes to Chase business credit cards specifically, you'll need to be underneath the 5/24 rule to get approved … but that approval will not add to your 5/24 count.

For example, let's say you want to apply for the *chase ink preferred*. If you've opened five or more credit cards in the last 24 months, you'd almost certainly get denied. But let's say you've opened four credit cards over the last two years. You could get approved … and you'd remain at 4/24 under this rule.

Most business card approvals do not count towards your 5/24 total – regardless of the card issuing bank. That includes business cards from American Express, Chase, Citi, Bank of America, and more. The reason? Business credit card accounts typically don't show on your personal credit report.

No More Than Two Chase Cards Every 30 Days

Chase allows you to be approved for a maximum of two personal cards in a 30-day window. You'll only be able to get approved for one Chase business credit card in a 30-day period.

Marriott Card Rules

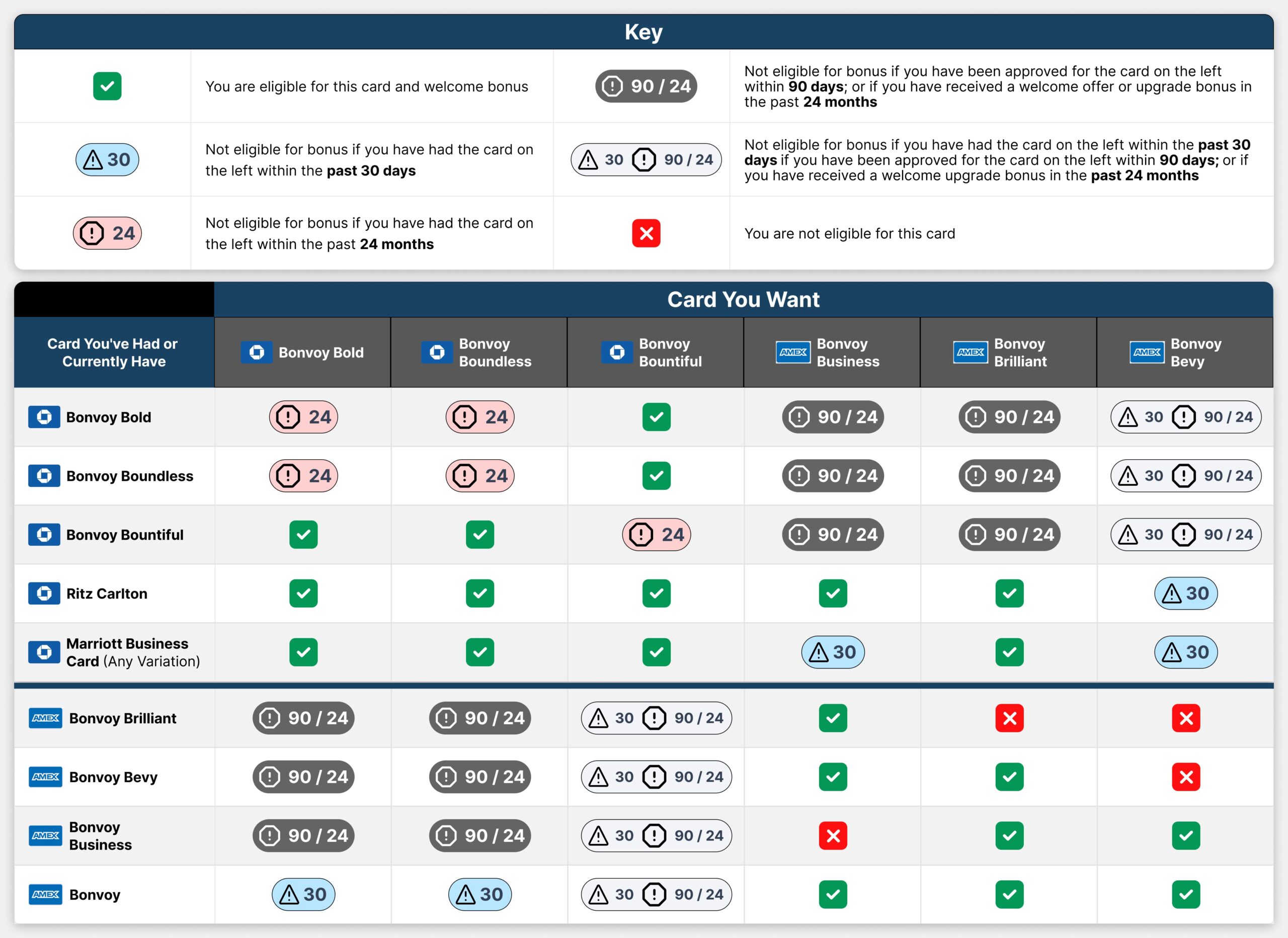

Besides the Chase 5/24 rule, if you've never had a Marriott or Starwood Preferred Guest Credit Card, you're good to go. Don't bother yourself with trying to decipher the rest of these rules.

For those that previously had (or currently have) a Marriott co-branded credit card, you'll want to ensure you're eligible before applying for one of these increased offers. Since Marriott and their bank partners have made it a challenge to know exactly which card you're eligible for, we created a handy card eligibility matrix to help make sense of it all.

Below, you'll find the specific terms and limitations for each of the cards with increased offers.

- *bonvoy brilliant*: You are not eligible for this welcome offer if you have or have had the Ritz-Cartlon card in the last 30 days. You're also ineligible for the welcome offer if you've opened the Marriott Bonvoy Bountiful, Boundless, or Bold from Chase in the past 90 days. Finally, it needs to be more than 24 months since you received a welcome or upgrade bonus on the Marriott Bonvoy Bountiful, Boundless, or Bold from Chase.

- Marriott Bonvoy Bevy: You are not eligible for this welcome offer if you have or have had the Marriott Bonvoy Brilliant Card or any Marriott credit card from Chase in the last 30 days. Additionally, you're ineligible if you received a welcome or upgrade bonus on the Marriott Bonvoy Bountiful, Boundless, or Bold cards from Chase in the past 24 months.

- Marriott Bonvoy Boundless® Credit Card: You are not eligible for this welcome offer if you have or have had the Marriott Bonvoy® American Express® Card (no longer open to new applicants) in the last 30 days. Additionally, you're ineligible if you opened any of the following cards within the past 90 days, or if you received a new cardmember or upgrade bonus in the past 24 months on any of the American Express Marriott Bonvoy Cards – *Bonvoy Business*, Brilliant, or Bevy.

- Marriott Bonvoy Bold: You are not eligible for this welcome offer if you have or have had the Marriott Bonvoy® American Express® Card (no longer open to new applicants) in the last 30 days. Additionally, you're ineligible if you opened any of the following cards within the past 90 days, or if you received a new cardmember or upgrade bonus in the past 24 months on any of the American Express Marriott Bonvoy Cards – Marriott Bonvoy Business, Brilliant, or Bevy.

Related reading: Which Marriott Credit Card Am I Eligible For?

Capital One Credit Card Application Rules

A few years back, Capital One made a huge splash by officially launching the *venture x*.

With a big welcome bonus and great travel perks for an affordable annual fee, it's without a doubt the most exciting travel rewards credit card we've seen in a number of years. And with Capital One making some major improvements to its Venture Miles rewards program, the bank is officially on the radar of points and miles enthusiasts.

That's where the good news ends, as Capital One has some of the most mysterious credit card application rules and standards. The bank doesn't officially publish any rules, period … but enough data points and trends have emerged over the years to give us a bit of information that can help get you approved for a Capital One credit card. And some recent experiences with the new Venture X suggest it may be easier than many travelers expected.

Still, Capital One's credit card application rules seem inconsistent at best.

Have You Recently Been Approved for Another Capital One Card?

If you have applied and been approved for any other Capital One credit card within the past six months, it's likely that any new credit card application will not be approved. This includes both personal and business credit cards.

There are, of course, exceptions to this rule. But generally speaking, keeping your Capital One application and approval history clean for at least six months will give you the best chances of getting approved.

Capital One's sensitivity has also gone beyond just Capital One's credit card applications. Historically, recent credit inquiries seem to be a factor when deciding your approval fate. That includes inquiries from other banks.

Generally, that means it's best to limit any and all credit inquiries from all banks (not just Capital One) for at least a few months before you want to apply for a Capital One credit card.

Only Two Personal Credit Cards at a Time

Data points suggest that Capital One will only allow you to hold two personal credit cards at any given time.

That said, there are several data points of people having more than two Capital One personal credit cards. So this rule – like many – seems to be applied inconsistently.

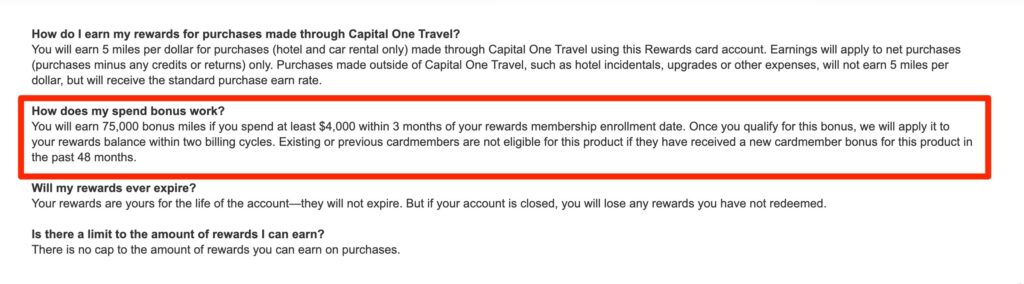

You Can't Earn A Bonus on the Same Card Within 48 Months

Unlike other banks, Capital One previously had no written rules on welcome bonus eligibility, allowing both existing and previous cardmembers to apply for the same credit card again. That opened a little-known avenue to earn the bonus on the exact same card twice.

But a new disclosure on the application pages for personal Capital One credit cards that first appeared in August 2023 puts a stop to that practice.

“Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months,” it reads.

Let's say you earned a big bonus on the *capital one venture card* within the last four years – whether you still have that card open or not. Some savvy travelers have been getting approved and earning yet another welcome bonus on that same credit card – even if they still have their previous Venture Card open. That's exactly what Capital One is attempting to crack down on with this new policy.

Critically, this new policy wouldn't stop you from earning a welcome bonus on the *venture x*, the *venture x business*, or the no annual fee *capital one ventureone*.

By the way it's written, Capital One handles this restriction on a card-by-card basis. But until four full years have passed since you last earned the bonus on the Venture Card, that specific card is off-limits.

Read More: Capital One Tightens Up Welcome Bonus Eligibility on its Credit Cards

Does Capital One Have a 5/24-Like Rule for Approvals?

Many data points over the years have also suggested that Capital One had a Chase 5/24-like rule of their own – though the exact number of cards remains somewhat of a mystery.

Here's what we can say: Being under Chase's 5/24 rule was generally a good idea if you were looking to get approved for a Capital One credit card. But again, it's not a sure thing.

Through the first years of Venture X applications, something like the 5/24 rule doesn't seem to be nearly as much of a factor as it had been before. We've heard from readers both below and well above the Chase 5/24 rule who received instant approval for the Venture X card.

It appears that so long as you meet the other requirements laid out above, Chase's 5/24 doesn't appear to be impacting Venture X approvals. That said, too many recent credit inquiries could harm your chances of approval.

Does Capital One Limit You Within Card a Card Family?

Already got a *capital one venture card*? Don't worry. Capital One said in an interview with Thrifty Traveler that current Venture cardholders will be eligible to apply outright for the new Venture X Card, and vice versa. There's no restriction on holding both cards at the same time, though you may not want to keep them both long-term, as there is a lot of overlap.

Credit Pulls From All Three Credit Bureaus

One unique thing about applying for a Capital One credit card is that the bank will pull your credit from all three of the major credit bureaus: Equifax, TransUnion, and Experian. Most other banks pull from only one or two bureaus at most.

This isn't necessarily a good or bad thing, and it shouldn't have much of an impact on your approval odds if you have a high credit score. Still, it's something to be aware of. If you have your credit report frozen at any or all of the credit bureaus, you'll need to remove the freeze from all three before applying.

Do Capital One Business Cards Count Towards Chase 5/24?

Most business cards won't add to your Chase 5/24 status. That means if you are at 3/24 and apply for a business card from Chase and Amex for example, you'll remain at 3/24.

The reason? Business credit card accounts typically don't show on your personal credit report. But that's not the case for most Capital One business credit cards: These do show up on your personal credit report.

That means if you are at 3/24 and apply for and get approved for a card like the *CapOne Spark Miles*, you'll then be at 4/24 as it relates to your Chase 5/24 status.

A couple of exceptions to this rule are the *venture x business* and the Capital One Spark Cash Plus card which, for whatever reason, are not reported to credit bureaus.

Citi Credit Card Application Rules

While Citi has a number of credit card application rules to be aware of, they are far more straightforward than its competitors.

Here's what you need to know.

The Citi 8/65 Application Rule

You can only be approved for one Citi credit card in an eight-day period – and at most, two credit cards in a 65-day period.

Citi's 48-Month Rule

For the longest time, Citi operated under two different sets of rules for earning a welcome bonus – and it all depended on which type of card you were applying for. In April 2023, Citi changed the wording in their terms to create consistency across all of their cards with a new account bonus.

For better or worse, the new rule states that you must wait 48 months between earning a welcome bonus and applying for the card again. Previously, this 48-month rule only applied to the Citi AAdvantage cards, but now it's applicable to the Citi ThankYou Points family of cards as well.

That means if you had the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® within the past 48 months, you wouldn't be eligible to apply and earn another bonus. But that shouldn't impact your ability to apply for the *citi aa exec card*, or even the American Airlines AAdvantage MileUp℠ Card.

And since American Airlines also has a co-branded credit card issued from Barclays called the AAdvantage® Aviator® Red World Elite Mastercard®, it wouldn't impact your ability to get that card, either. Since the card isn't issued from Citi, none of these Citi credit card application rules would apply.

Related Reading: How to Quickly Earn American Airlines Miles (And Why You Should)

Bank of America Credit Card Application Rules

When it comes to credit card application rules from Bank of America, there are three rules you will want to know. So if you are looking to grab the *alaska visa card* or any other Bank of America credit card, here's what you need to keep in mind.

The Bank of America 2/3/4 Rule

The Bank of America 2/3/4 rule states that you can only be approved for two Bank of America credit cards in a rolling two-month period. You can be approved for three Bank of America cards in a rolling 12-month period, and four cards in a rolling 24-month period.

This rule is specific to Bank of America credit cards (both business and personal), and applications from other banks will not be factored into this rule.

The Bank of America 3/12 & 7/12 Rule

Similar to Chase's 5/24 rule, Bank of America has something called the 3/12 & 7/12 rule. It works like this:

- If you have a bank account with Bank of America and have opened seven new cards (from any bank) in the past 12 months, your application for a new Bank of America card will not be approved.

- If you don't have a bank account with Bank of America and have opened three new cards (from any bank) in the past 12 months, your application for a Bank of America card will not be approved.

That said, these rules aren't firm. There are plenty of reports of non-Bank of America members getting approved for one of its credit cards despite having opened far more than three credit cards in the last 12 months.

The Bank of America 24-Month Rule

Like both Chase and Citi, Bank of America allows you to earn the welcome offer bonus on the same card multiple times. They will, however, restrict how often you can earn it.

You are not eligible to open a Bank of America Card and earn a welcome bonus if you've earned the bonus on that card in the past 24 months. You also can't have the card currently open if you want to get approved.

Barclays Credit Card Application Rules

Barclays has a few application rules you'll want to be aware of before applying for their credit cards. But as is the case with Capital One, these rules seem to be inconsistent in practice.

Something unique about Barclays' credit card application rules is that data points suggest the bank may consider your spending on other Barclays cards – if you have them open – when they are deciding your approval fate. Not spending a lot on your existing Barclays card? That may impact your ability to get another one.

Here's what you need to know.

The Barclays 6/24 Rule

Similar to Chase's 5/24 rule, Barclays also has a rule in place to limit approvals from people who have recently been approved for a lot of new credit cards.

The bank's 6/24 rule applies if you have more than six new credit card accounts on your credit report in the last 24 months. In the past, that rule was believed to have been as high as eight new accounts.

But in practice? Data points suggest that you can still get approved for Barclays cards if you are above that 6/24 rule. At best, the rule seems inconsistent. It seems likely that Barclays may consider your existing banking relationship when applying this rule.

The Barclays 24-Month Rule

Like other card issuers on this list, Barclays allows you to earn a welcome bonus multiple times … you'll just need to wait 24 months to do so.

Critically, the 24-month rule with Barclays states that you need to wait 24 months from when you last closed the card to be eligible to earn a welcome bonus again. It isn't enough to simply wait 24 months to earn a bonus again: You must have closed that card at least 24 months prior.

And make sure you read the terms and conditions of the specific card product you are applying for. Some Barclays cards state that you won't be eligible to earn a welcome offer bonus if you have or previously had an account in that program.

Again, inconsistency is the theme with Barclays.

U.S. Bank Credit Card Application Rules

U.S. Bank has some of the most simple and straightforward credit card application rules you'll find. Here's what you need to know.

U.S. Bank Welcome Offer Bonus Eligibility

U.S. bank has no hard limits or required waiting periods on their credit cards. That means, in theory, you can receive a welcome bonus on a U.S. Bank credit card multiple times – though you can't have the specific card product open at the time of application.

U.S. Bank Application Rules for Altitude Reserve

The U.S. Bank Altitude® Reserve Visa Infinite® Card is the only U.S. Bank credit card with an application rule on paper.

In order to get approved for the Altitude Reserve Card, you'll need to have an existing banking relationship with U.S. Bank. That can be an existing bank account, credit card, mortgage, or any other banking product.

No such restrictions apply to the U.S. Bank Altitude® Connect Visa Signature® Card, the U.S. Bank Altitude® Go Visa Signature® Card, or any other U.S. Bank credit card.

Wells Fargo Credit Card Application Rules

Wells Fargo doesn't limit the number of credit cards you can hold with them at any given time. Rather, they limit how much credit, in dollar figures, they will extend to you based on your individual credit profile. That amount will be different for every person and may shift as you add more cards. For example, if you have an existing account with a $10,000 credit limit and then apply for another card, they may move some of that available credit over to your new account.

The Wells Fargo 48-Month Rule

Wells Fargo will let you earn a bonus offer on the same card multiple times … so long as you wait 48 months in between. This new rule was added in August of 2024 and is in addition to the longstanding 6-month rule (more on that below).

Thankfully, the 48-month clock starts ticking the day you open your Wells Fargo card – not when the bonus is earned – so in some ways, it's a little more generous than other banks. So long as it's been more than 4 years since you last opened the card, you'll be eligible to earn a bonus again.

You can't, however, have two of the same card at once – you'll need to close or downgrade your old card before applying again.

Only One New Card Every 6 Months

Wells Fargo's 48-month rule only applies to the same type of card. This means that during that timeframe you can earn additional bonuses on other Wells Fargo cards. However, application terms state that you must wait 6 months between receiving a welcome offer bonus on any two Wells Fargo-branded credit cards.

Data points suggest that this isn't a concrete rule: Rather, the bank will consider your relationship with the bank to determine whether or not to approve you for a new card. That means having an existing Wells Fargo account could help you bypass this rule. And personal and business credit cards are treated separately so even when the rule is applied, it's still possible to get approved for one of each in a 6-month window.

Discover Credit Card Application Rules

Last but not least is Discover, which has a few rules you'll need to be aware of before applying for their credit cards.

First and foremost, Discover only allows you to have a maximum of two credit cards issued by Discover at one time. Further, your first account needs to be open for at least one year before a second credit card account can be opened.

With Capital One announcing plans to acquire Discover, it's anyone's guess which bank's application rules will survive or if the brands (and rules) will remain separate.

Bottom Line

Clearly, there is a lot to be aware of if you are applying for a credit card with any of the card-issuing banks. But understanding which banks have what rules can be the single most important factor in whether you get approved or shot down.

Any information about FNBO cards?