I’m a loyal Delta flyer, avoiding American Airlines as much as possible. Yet I’m always looking for new ways to earn American Airlines AAdvantage miles. Yes, you read that correctly.

Between its middling on-time record and increasingly cramped planes without seatback screens, flying with AA isn't every traveler's first choice. But that doesn't mean you shouldn't care about American AAdvantage miles – far from it.

Compared to the likes of Delta and United, American and its AAdvantage frequent flyer program have some serious upside that make these miles far too valuable to ignore. That's especially true because they're not just good for booking flights on American Airlines, but global partners like Qatar Airways and Japan Airlines, too.

With some of the best airline partners in the world, bookable at rates lower than you'll find with virtually any other carrier, AAdvantage miles are arguably some of the most valuable of all. Here's why you should be earning AAdvantage miles, too.

Don't want to fly American? No problem.

One of the best parts about AAdvantage miles – and all airline miles, really – is that they're good for more than just booking flights on American Airlines itself. Airline alliances and partnerships open up the world of using your miles, making them far more valuable and versatile. And if you ask us, American has some of the best partners out there.

Whether you want to fly Cathay Pacific to Asia, Qantas to Australia, Finnair to Scandinavia, or even Etihad to the Middle East, AAdvantage miles can take you there. But a few of AA's partners stand out more than the others…

From spacious seats in economy in the far back of the plane to incomparable service in first class at the front, Japan Airlines is one of the best ways to fly from the U.S. to Asia. You can book these flights from 35,000 AAdvantage miles each way in economy, 60,000 in business class, and 80,000 for first class. Depending on the route you're flying, you might even get lucky and wind up in an extra-large suite like this.

And if you want to fly the best airline in the world, your best bet is … you guessed it, AAdvantage miles. Booking flights on Qatar Airways is one of our favorite ways to use AA miles – especially if you're booking Qatar's Qsuites business class.

The problem? As Qsuites have gotten more popular and easier to book, finding availability from U.S. cities is a bit like finding a needle in a haystack. But if you do, American's prices are tough to beat.

On paper, you can book Qsuites between the U.S. and the Middle East for just 70,000 miles each way. Want to connect on to bucket list destinations like the Maldives (MLE) or even all the way down to South Africa? It's just 5,000 miles more: 75,000 AAdvantage miles to get to Cape Town (CPT), Johannesburg (JNB), or practically anywhere in Africa.

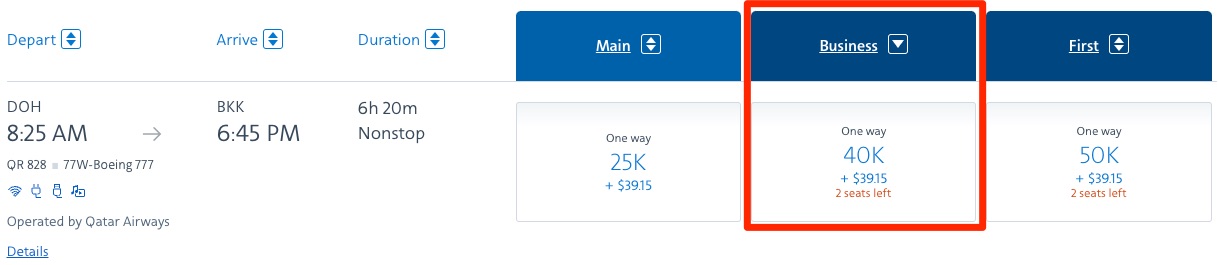

But just because it's gotten harder (or nearly impossible) to book Qatar's business class to and from the U.S. doesn't mean you can't still fly Qsuites with AAdvantage miles. If you're making your way around the world, 40,000 miles are all you'll need for a business class flight from Qatar's hub in Doha (DOH) all the way to Hong Kong, Thailand, or anywhere else in Southeast Asia.

Building a flight like this into a bigger trip is a great way to check out one of the world's best business class seats on the cheap.

Read our full Qatar Qsuites review from Dallas-Fort Worth (DFW) to Doha (DOH)!

Great Award Chart

Great partner airlines don't mean much if they cost an arm and a leg to book. Luckily, that's not the case with American.

Even as American-operated flights have moved to a dynamic pricing model, where more expensive flights generally cost more AAdvantage miles, you'll still find a standard award chart for booking partners. Think of this award chart as a cheat sheet for how many miles it costs to get from point A to point B. Rates depend on where your origin and destination fall on the map – not on the cash price of a flight or how many miles you're flying … and that opens the door to a goldmine of deals flying those five-star partner airlines.

Overall, American's award rates are on par or better than what you'll find using other airline mileage programs. Here's what that award chart looks like for one-way flights on one of American's partner airlines departing from the U.S.

Follow the award chart, and you'll see that an economy flight on Oneworld partner airlines from the U.S. to the South Pacific costs 40,000 each way. Meanwhile, a business class flight from the U.S. to Europe will run you 57,500 AAdvantage miles on British Airways, Finnair, Iberia, and other partner airlines.

Here are some of our favorite sweet spots in AA's partner award chart:

- Flying from the U.S. to Japan (Asia Region 1) in business class for just 60,000 AAdvantage miles is a steal.

- The cost to fly from the U.S. to Africa in Qatar Airways economy is 40,000 miles each way – the exact same amount as the nonstop flight to the Middle East.

- Or do it in business class for 75,000 miles – just another 5,000 miles over the nonstop rate to the Middle East.

- If you're making your way around the world, 40,000 miles are all you'll need for a business class flight from the the Middle East to China, Hong Kong, or Southeast Asia.

- Or do it in first class with Etihad's Apartments for just 50,000 miles!

And keep in mind that this award chart doesn't just apply to nonstop flights.

Free Connecting Flights (Maybe)

While you might be accustomed to forking over big bucks for a flight that starts from smaller airports, that's not the case with AAdvantage miles. All that matters is that your origin is part of the same region. Even with several connections, it won't change the price in miles.

This means that in the eyes of American, flying business class from tiny Peoria (PIA) to Chicago-O'Hare (ORD) to Hong Kong (HKG) is the same as the nonstop flight to Southeast Asia – both cost 70,000 AAdvantage miles. Even with a longer flight – say, starting from Duluth (DLH), Minnesota to Chicago, or even San Francisco (SFO) to Chicago – it will price out the same.

The same principle holds true for your final destination. So long as the regions remain the same, the price doesn't change. So you could fly from Chicago to Hong Kong and onward to Hanoi (HAN) for the same 70,000-mile rate because your award is still from the U.S. to Asia Region 2 – even with a connection.

Thrifty Tip: With more complicated itineraries like these, search for each segment of your trip individually at AA.com to confirm each flight is bookable with miles. Once you've done that, search for the entire itinerary, with your initial starting point in “From” and final destination in “To.”

That's true whether you're using AA miles to fly American itself, one of its partner airlines, or a mix of the two. They're AAdvantage miles, so American sets the rules for how many you need.

So, while the nonstop flight in Japan Airlines business class from Dallas-Fort Worth (DFW) to Tokyo-Haneda (HND) will cost you 60,000 miles each way…

… you can often start your search from your home airport and fly through Dallas en route to Tokyo, and it still costs just 60,000 AAdvantage miles total.

That ability to book from airports big and small nationwide is a serious differentiator for redeeming American miles. It's rarely, if ever, possible when booking through Delta or United.

Thrifty Tip: If you're booking a mixed-carrier ticket (with one segment on American and another on a partner airline), you may need to put your reservation on hold and then call in to get it ticketed.

A Powerful Website

Some airlines make it difficult to find the flights to use your miles, with clunky search engines that only show one day at a time – but that's not the case with American.

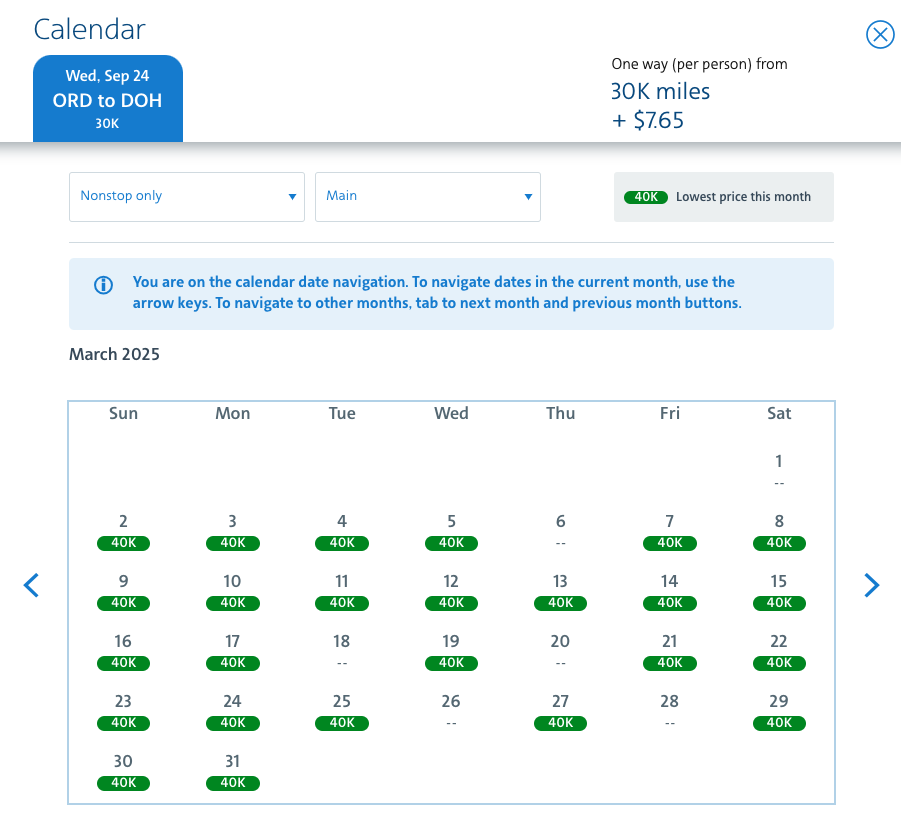

Whether you're looking to use American Airlines miles or trying to book one of its partner carriers through another airline program, American has one of the best sites for finding award availability, period. By allowing you to filter for nonstops and specific cabins and get a monthlong view of award availability, it's fairly easy to zero in on the flights you can actually book with your miles.

Read more: How to Find & Book the Best American AAdvantage Miles Deals

Deals on Domestic (and Some International) Flights

American has an easy way to score cheap domestic flights using your miles. Over the last few years, we've seen American slash award pricing for its own flights.

Unfortunately, AA doesn't publish a list of which routes are eligible for this lower pricing – much like Delta SkyMiles flash sales, they're unpredictable. Lucky for you, these discounted fares are becoming more and more widespread.

But it's not just domestic flights. Over the last year or two, we've seen these discounted awards spread to international flights with dirt-cheap pricing to Europe, Australia, South America, and beyond. One of the best award alerts we've sent our Thrifty Traveler Premium members was one of these deals: Roundtrip flights to New Zealand for just 10,000 AAdvantage miles!

There are even some cheaper fares for first and business class cabins on American, like these 64,000-mile one-way fares to London-Heathrow (LHR) in American Airlines first class.

Put Your Award on Hold

Not sure you can get the time off work but worried about award space disappearing while you ask? Need to check things over with a spouse or travel pal before forking over a small mountain of miles? American has you covered.

American is one of the few airlines in the world that allows you to put award tickets on hold for up to five days. It's actually a bit longer: In our experience, your hold will end five calendar days later at 11:59 p.m. local time.

Better yet, you can easily do so online with any award ticket, whether it's an AA flight or flying with a partner airline. And best of all, it's completely free.

Just log into your account, search for the flights you want, click through to checkout, and select the option to place the reservation on hold. You'll get an email confirming your flights have been put on hold with the deadline to book or lose your ticket.

Here's the crazy part: You don't even need all the miles in your account to put a reservation on hold.

Whether you need to cancel an existing reservation to get the miles you need, wait for a big bonus to finally hit your account, or simply decide to buy a bunch of AAdvantage miles, this hold option is invaluable.

Free Award Cancellation

For years, American had one of the best policies for award tickets, giving you unlimited date, time, and routing changes for free. That meant you could push up (or push back) your flights. Or lock in flights with one airline, then swap to another when award space opened up. You could even change which cities you connect through, so long as your origin and destination remained the same.

While those days are long gone, American has replaced it with something even better: Every ticket booked with American AAdvantage miles can now be canceled for free.

In November 2020, American ditched its usual $150 fee to cancel an award ticket and get your miles back. Prior to the pandemic, that perk was reserved only for American's top-tier elites. Now, anyone can cancel an award ticket and get a refund for free. Canceling online is simple, whether you've booked a flight with American or on a partner carrier.

Cheap Mexico and Caribbean Getaways

If you want to escape to Mexico or the Caribbean, AAdvantage miles can be invaluable.

No U.S. airline has a better network throughout Central America and the Caribbean islands than American. With more than 170 daily flights to 37 destinations in the Caribbean alone, we're not just talking about the usual hotspots like Cancún (CUN) or the Bahamas (NAS). American even has flights to smaller cities in Mexico like Oaxaca (OAX) or Huatulco (HUX), and smaller Caribbean destinations like St. Martin (SXM), St. Lucia (UVF), and Antigua and Barbuda (ANU), too.

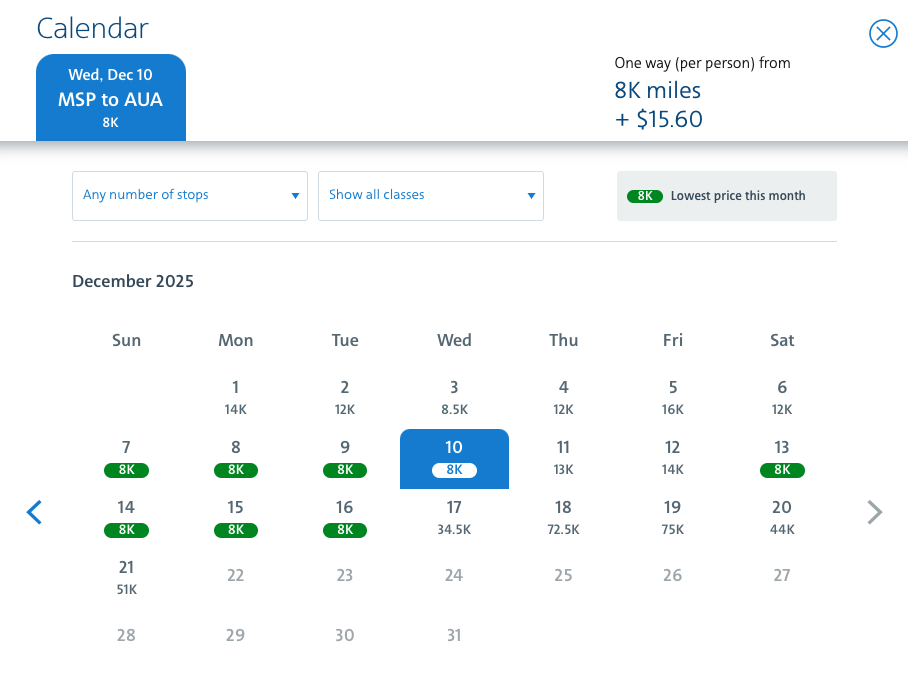

And if you time it right, you can get there for as low as 8,000 AAdvantage miles each way. That's yet another upside of American's transition to dynamic award pricing, with rates even lower than the previous norm of 12,500 miles each way.

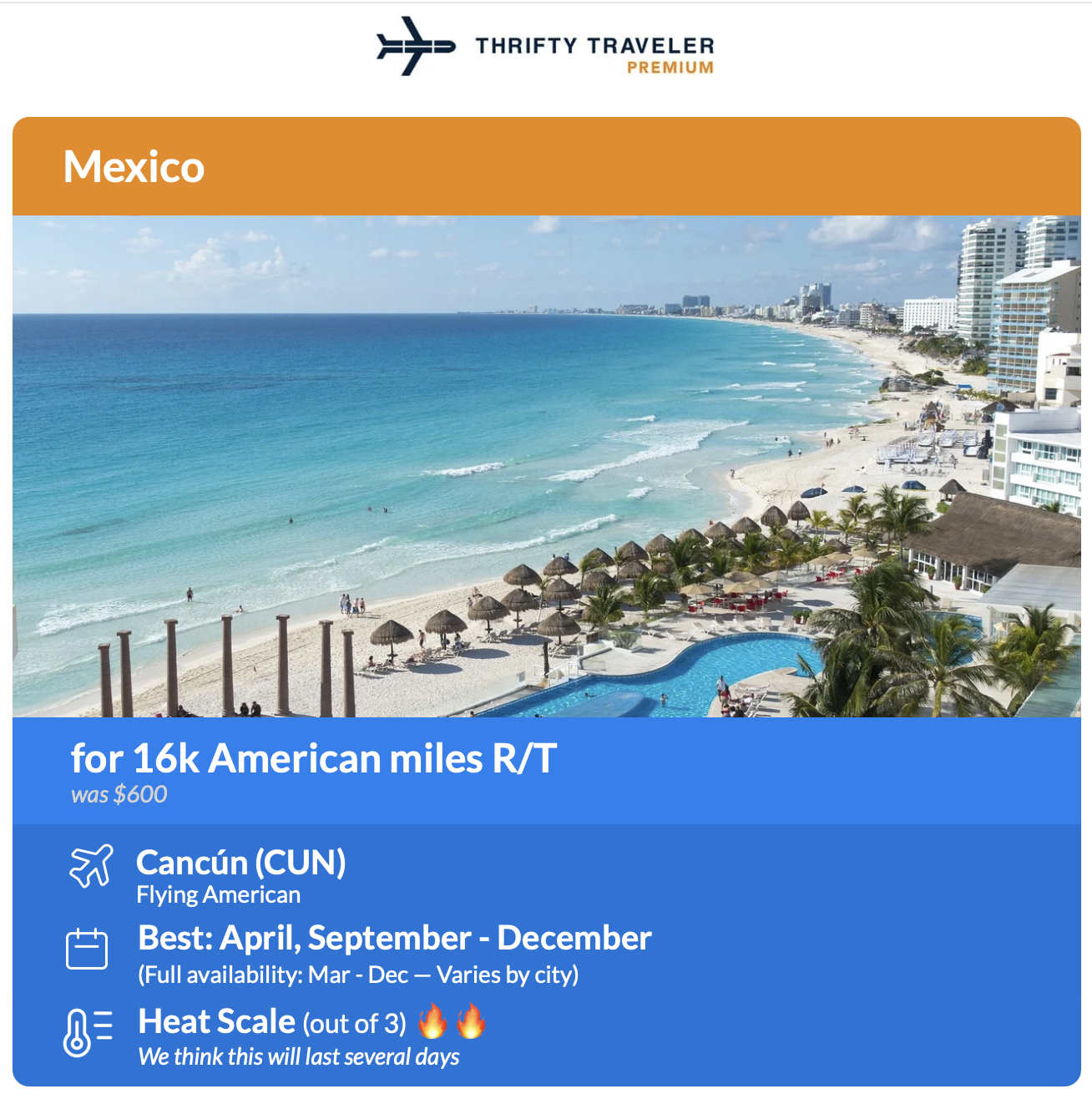

We've seen AAdvantage award sales to Mexico as low as 16,000 miles roundtrip … from airports nationwide!

Get deals like this in your inbox with Thrifty Traveler Premium!

No matter how you approach it, AA miles can be one of the cheapest ways to get to the Caribbean, Mexico, or elsewhere in Central America.

Bottom Line

American Airlines AAdvantage miles have some serious advantages, pun intended.

Between amazing partner award sweet spots, extra flexibility with free cancellations, free award holds, and more, collecting AAdvantage miles is well worth your time – even if you don't consider yourself an AA flyer.

The ability to hold a flight for 3-5 days, even if you don’t have enough free miles, is the greatest benefit. Holding and waiting for the ability to quickly grab better flights is so great. I would never start this process on Delta because they don’t even allow me to see the final price if i don’t have enough miles available and logged in, let alone the chance i could ever find a reasonably priced redemption on Delta to switch to…

AA also is pretty random on their points for flights. Many say it is like a slot machine for flight costs, just keep pulling the lever and see what it costs the next time you look. Just the other day i snagged a few seats from Tokyo in business that had shown 300-400k forever, but that day was going for 143k. I’ll hold those seats until a possible partner flight for 60k pops up.

I haven’t booked a ward travel in a while on American but just went to see if I can fly my wife and some to join me on a business trip to europe. I was STAGGERED by what it would cost. I’ve been very loyal to AA on my business travel. Exec platinum every year, about 1.4M miles saved up (I rarely use them). They wanted 475K miles PLUS almost $900 per ticket for business seats! That’s NUTS!!!! I searched every possible way and they’re all just crazy overpriced. Even to go in coach is between 70K and +- $100 per ticket. What the heck happened to being able to use your miles? And it seems like American is definitely the culprit. When I looked at the difference in the cash portion on the cost for the same exact flights, the “OTHER TAXES & CARRIER-IMPOSED FEE” went from $200 for coach to $1400 for Business. I feel like the airline I have been foolishly loyal to has devalued all my benefits and has no loyalty to me as a long time customer. Maybe time to switch.

Literally can’t use my aa miles for anything I need. They want 105k miles per person to get my wife and daughter half way to Singapore or Thailand (from NC) in economy. Business class was 400k miles each one way. Literally no amount of miles would get them all the way there and we tried many dates. I’m considering switching over to united. Executive platinum on American but doesn’t do my family any good

Your article is null and void now that AA has eliminated their award’s chart. They are slowly dissolving their loyalty to frequent travelers. You are fortunate to have Delta as a choice. Be loyal to them.

Although Delta is my hometown airline, for the past 20 years we have been utilizing AA miles for overseas trips. We have always tried to fly off peak times Sep/May. Gaining most of my miles through shopping portal and credit card. We just scored r/t air to Amsterdam for July, for 70k pp. I thought that was a steal considering Delta wants over 300k miles for both of us. Is it nonstop? no, but I don’t mind the extra 2 hr flight and access to Centurion club in PHL while we wait.

I just booked a flight to Portugal using AA miles. Business class cost me 270,000 miles per seat, even though the reservation screen showed 192,000 miles. I had to purchase the transfer of 31,000 miles from my wife’s account for $499.00, even though she is flying with me. AA doesn’t allow the sharing of miles even if we can share the credit card!

I’m dumping AA – miles no longer work for us.

Wow !. Are you paid by American Airlines? I fly often to Brazil. Now, the miles are crazy. I end up just buying a ticket on United. I refuse to “bend over” for American

I just searched LAX to ATH in July (7/12-26) and it came back with 700,000 miles EACH for business, so for the two of us 1,400,000 miles. That seems a bit hefty by any standard.

BS. AA blacks out everywhere so it’s almost impossible to use the miles. I have 27000 and I can’t get rid of them , about the only thing you can do is donate them or buy a newspaper with the.

I used to save Skymiles, but since AA comes in and offered some crazy deals to compete here at MSP, we have gone full AA. After flying to Barbados twice for $217 rt each time and Saint Thomas for $227 a few times, we could help but switch over our loyalty to AA. Before they introduced dynamic pricing it was almost guaranteed we could get to most Caribbean islands for 25,000 miles any time of the year. While those award tickets still do exist, it’s mostly for off peak, which were okay with. Taking an annual beach trip at the end of August has become a family tradition at this point. I also use Bask Bank which gives me AA Mike’s just for saving money. We earn that 25k in a year of saving and not spending. With me also having a business, I was able to get all three AA credit cards and their bonuses. My husband has two. If you love the Caribbean and Mexico AA awards are for you.. especially if you live in Seattle or far away since the award redemption is going to run the same whether you’re departing from Miami or the northwest.

I also am a delta fan and perennial platinum. Yet my wife has gone on home on biz class to Japan for five years on miles, impossible with skymiles. With politeness and patience the excellent AA international desk always finds us a route since we are flexible

The old award search on American airline webpage changed to new look

You article on Award Milage was very informative and interesting , however , I recently tried to book A flight from LAX to Hamburg Germany in business class when I was informed that the tax alone would be around $1,300. A friend of mine used different Airline miles, same itinerary , also business class and only paid roughly $150 taxes. Why is American Airlines tax system so high as well as so different from other airlines? Thank you for your response

Elke, I’d guess that your ticket involved flights on British Airways, which is notorious for passing on a lot of taxes and fees when booking with American miles (among other airline miles). The amount of taxes can vary by the airline you fly, the airline whose miles you use, and the airports you fly in and out of. In general, booking flights with AA miles results in low to mild cash fees. British Airways flights are an outlier.

Here’s where the value of ‘complaining’ comes into play. Every time I get delayed (for whatever reason) I send a complaint to AA. I detail the flight number and, to the best of my knowledge, the reason why. Even on award flights! Plus I add that I was severely inconvenienced (missed connection perhaps) and was late for a meeting or something similar. My ‘success rate’ is probably 75%. AA doesn’t want an upset customer, especially if you have some ‘status’ and the CS people don’t want the ‘hassle’. 5000 free miles seems to be the norm.

so much BS for 5000 miles, new low unlocked

I clicked on this article thinking I must be the only one who has horrible flight experiences EVERY TIME with American Airlines. Every flight is delayed (missing my connections) or just plain canceled (while I’m sitting in the airport). I have their credit card, and understand the value of points but AA does NOT value me in the least!

Clearly you are not flying economy. Haven’t been able to book a 12.5k one way award flight in years. Finding those tickets is like ‘pulling teeth’. Also, as a Gold member, I haven’t been able to secure an upgrade, again, in years even though I request one on every flight. The article is representative for what AA used to be before the merger. Only thing keeping me with AA is that I don’t have status elsewhere.

Agree. AA showing “potential ” redeemability is one thing, but it’s more of a fraud and scam and actually redeeming is often impossible. Despicable airline.