There are plenty of credit cards out there to help you earn points and accelerate (or even improve) your travels. But if you're looking for a premium card with premium perks, you don't need to look much further than either the *venture x* or the *chase sapphire reserve*.

These aren’t introductory cards for the average Joe or Jane, but rather powerful weapons for the more frequent traveler. And while the hefty annual fees (especially on the new-look Sapphire Reserve) may scare some off, they come with top-of-the-line perks that could easily justify the higher out-of-pocket cost.

With banks going all-in on premium travelers, it's time to examine these two heavyweights of travel rewards to determine which one reigns supreme. Which card comes out on top, the Capital One Venture X or the Chase Sapphire Reserve? Whose premium perks win out?

We'll break it down, category by category – whether you're looking for your first premium travel card or a seasoned veteran with a wallet full of them – to help decide which card suits you best.

Learn more about the *venture x*.

Learn more about the *chase sapphire reserve*.

Benefits Overview

No matter which card you choose, you can't go wrong with either the Capital One Venture X or Chase Sapphire Reserve – they're both excellent options.

Here's a breakdown of what you get with each card:

| Capital One Venture X | Chase Sapphire Reserve | |

|---|---|---|

| Welcome Offer | bonus_miles_full | bonus_miles_full |

| Annual Fee | annual_fees | annual_fees |

| Authorized User Fees | Add up to four authorized users for no additional fee | $195 for each authorized user |

| Annual Credits | Annual $300 travel credit and a 10,000-mile anniversary bonus | Annual $300 travel credit, $500 "The Edit" hotel credit, $300 dining credit, $300 StubHub credit, $120 in Lyft credits, and more |

| Earning Points | Earn 10x on hotels & rental cars and 5x on flights booked through Capital One Travel. Earn 2x on all other purchases. | Earn 8x on travel booked through Chase Travel℠, 3x on dining, and 1x on all other purchases. |

| TSA PreCheck or Global Entry Reimbursement | Yes, available once every four years. | Yes, available once every four years for the primary cardholder - and includes NEXUS. |

| Lounge Access | Complimentary access to Capital One Lounges and participating Priority Pass Lounges | Complimentary access to Sapphire Lounges and Priority Pass Lounges |

| Primary Car Rental Coverage | Yes | Yes |

| Foreign Transaction Fees | None | None |

| Trip Delay Reimbursement | $500 per person for delays lasting six hours or more | $500 per person for delays lasting six hours or more |

| Lost Luggage Insurance | $3,000 per person per trip | $3,000 per person per trip |

As you can see, these two cards have a few things in common … and a whole lot of differences. Depending on your personal situation, one of them could be a more obvious fit than the other.

Welcome Offer

To start, opening a new travel rewards card is all about the welcome offer … and both of these cards come with big bonuses.

Capital One Venture X Rewards Credit Card

bonus_miles_full

Chase Sapphire Reserve®

bonus_miles_full

Winner: Chase Sapphire Reserve®

While both of these offers are good, the Sapphire Reserve's current offer is clearly best for anyone looking to earn a whole bunch of points in a hurry. Add in the up to $500 Chase Travel℠ credit for ‘The Edit' properties, and it's a no-brainer… at least for the first year.

Earning Points

When it comes to earning points and miles, it's important to maximize every dollar you spend.

The Chase Sapphire Reserve offers boosted earnings in a few spending categories, but you'll get a run-of-the-mill 1x points everywhere else. On the flip side, the Venture X offers a solid 2x earning on all purchases.

Let's take a closer look.

Capital One Venture X Rewards Credit Card

With the Capital One Venture X, you'll earn an unlimited 2x Venture Miles on every dollar you spend. That makes this a go-to card for many travelers to use on their everyday spending.

Beyond that, you'll also get a whopping 10x miles per dollar spent on hotels and rental cars booked through the Capital One Travel portal. Booking flights and vacation rentals with Capital One Travel will also earn you 5x miles.

Chase Sapphire Reserve®

With the Sapphire Reserve Card, you will earn 3x points per dollar spent on dining (including eligible delivery services) and 4x points per dollar spent on flights and hotels booked directly with airlines and hotels. You'll also earn 8x bonus points when you purchase travel through Chase Travel℠ (including The Edit℠).

Through Sept.30, 2027, Sapphire Reserve cardholders can also earn 5x points per dollar on Lyft rides, including scooters and bike rentals.

Outside of those bonus categories, the Sapphire Reserve earns 1x Ultimate Rewards on all other purchases.

Winner: Capital One Venture X Rewards Credit Card

This one is close. But if you ask us, earning unlimited 2x miles on all purchases makes the Venture X more rewarding for most travelers. It's the perfect “set-it-and-forget-it” card.

Learn more about the *venture x*.

Annual Fee

Any time you're considering a premium travel rewards credit card, you should expect a premium price tag. Yet one of these cards bucks that trend and offers top-tier benefits at a mid-tier price point.

Capital One Venture X Rewards Credit Card

The annual fee on the Capital One Venture X is $395.

That might immediately make it a non-starter for some … but it's actually quite a bit cheaper than the other premium travel rewards cards, and that includes the Sapphire Reserve. And when you consider all the travel perks and benefits the Venture X comes with, that price tag can be a real bargain.

For starters, you get a $300 annual credit to use in the Capital One Travel portal each year, automatically making the annual fee more like $95 a year. Plus, you'll get a 10,000-mile anniversary bonus each year you renew your card.

If you use both the anniversary miles and travel credit to full value, it's almost as if Capital One is paying you to have this card. In fact, it seems like such a good deal that it recently got us thinking about whether or not an annual fee increase might be on the horizon. But for now, $395 seems like a steal for this travel rewards credit card.

Chase Sapphire Reserve®

The Sapphire Reserve has an annual fee of $795 each year.

While that might sound steep (and it is), there are plenty of extra perks and benefits on the Sapphire Reserve card that offset that cost. And it starts with a $300 annual travel credit.

Just for holding the card and paying the annual fee, you'll receive a $300 credit each year that will automatically cover any travel expense and it's even easier to use than the credit on the Venture X card. Considering how easy it is to use that credit, you can think of the Chase Sapphire Reserve's annual fee as more like $495 – as long as you plan to spend at least $300 on travel each and every year, anyway.

Following the card's recent “refresh,” you'll now get even more “money-saving” credits to help you recoup the full annual fee … and then some. If you can make use of even a few of these, it won't be hard to come out money ahead with the Sapphire Reserve.

Winner: Capital One Venture X Rewards Credit Card

The Capital One Venture X Card is the clear winner for annual fees, as it comes with the lowest out-of-pocket cost of any premium card on the market.

Learn more about the *venture x*.

Statement Credits

This is a big one.

Using the perks and annual travel credits that come with a credit card is essential to justify paying an annual fee. Both cards include credits for travel-related purchases … but one packs just a bit more punch than the other.

Capital One Venture X Rewards Credit Card

$300 Travel Credit

If you hold the Capital One Venture X Card, you'll get a $300 travel credit each and every year you hold the card redeemable towards flights, hotels, and rental cars booked through the Capital One Travel portal.

Simply head to the Capital One Travel portal in your online Capital One account and book your travel. Generally speaking, pricing should match what you find on Google Flights or directly with hotels and rental car agencies – but not always.

Once you make a selection and go through the booking process, you'll have the option to apply your $300 travel credit at checkout as a discount on the purchase price. That's a change – and not a great one: It means you won't earn bonus miles when putting that $300 to use each year.

Still, this benefit alone can make the Venture X card worth its annual fee. So long as you can use it, it effectively brings your annual fee down to $95 ($395 annual fee minus the $300 travel credit) – right on par with what the regular Venture card charges.

$120 Global Entry or TSA PreCheck® Credit

Add the Capital One Venture X to the growing list of credit cards offering up to a $120 credit for either TSA PreCheck or Global Entry. Membership in either program is good for five years, and Venture X cardholders will get this credit every four years.

If you plan for any sort of international travel, spring for Global Entry, as it includes a TSA PreCheck membership. At just $120, the statement credit provided by the Venture X credit card will completely cover your membership cost for as long as you keep the card open.

Taking advantage of this credit is simple. Just use the card when you pay for your application, and voilà: Your credit will kick in to cover the entire cost.

Read more: Global Entry vs. TSA PreCheck: Which is Better for You?

10,000-Mile Anniversary Bonus

Each and every year on your account anniversary, you'll receive 10,000 bonus miles after paying your card's annual fee.

These miles are worth a minimum of $100 towards travel – and potentially much more by utilizing Capital One's list of transfer partners. You won't get this right when you open the card: This benefit starts in your second year and each year after that.

In our experience, Capital One deposits this 10,000-mile bonus about a month or two after paying your annual fee on the card, starting in your second year.

Read More: Wondering Whether to Renew Your Venture X Card? Make Sure You Read This

Chase Sapphire Reserve®

$300 Travel Credit

It all starts with a $300 annual travel credit. Just for holding the card and paying the annual fee, you'll receive a $300 credit each year that will automatically cover any travel expense: flights, hotels, Airbnb, Uber, Lyft, cruises, parking, a Thrifty Traveler Premium subscription, and so on.

As long as you plan to spend at least $300 on travel each year, you can think of the Chase Sapphire Reserve's annual fee as more like $495, after accounting for this easy-to-use credit.

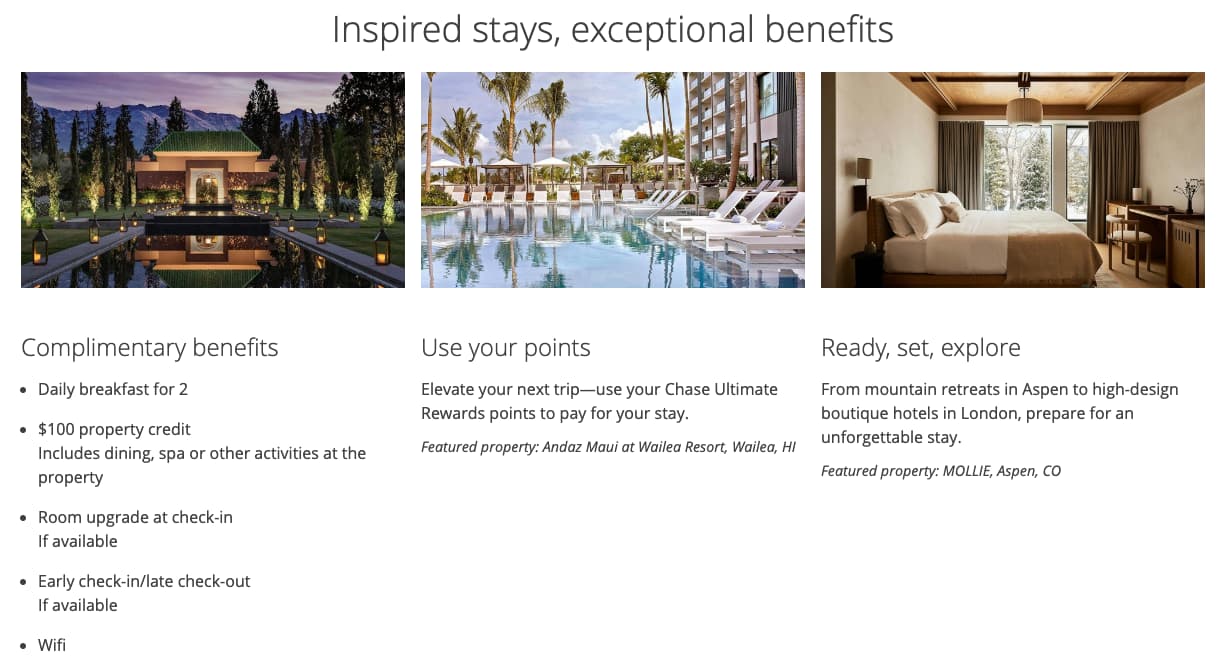

$500 “The Edit” Hotel Credit

Sapphire Reserve cardholders get up to $250 in statement credits for prepaid, “The Edit” hotel bookings to use from January to June, and again from July to December, up to $500 per year.

This new hotel collection from Chase offers a curated set of upscale properties, similar to Amex's Fine Hotels + Resorts®. In addition to the card's semi-annual credit, you'll also get added benefits like complimentary breakfast, a $100 property credit, possible upgrades, and more. You must book at least a two-night stay.

Just keep in mind: This credit is only for the primary cardholder, requires a two-night minimum stay, and the credited amount won't earn any points. Still, it's a nice benefit with some really valuable perks. Being able to save up to $250, twice per year, at one of these properties will go a long way toward justifying the card's annual fee.

$300 Dining Credit

With the Sapphire Reserve, you'll get up to $150 in statement credits from January through June and again from July through December for a maximum of $300 annually for dining at restaurants that are part of our “Sapphire Reserve Exclusive Tables.”

You'll mostly find eligible restaurants in major cities like New York City, Chicago, and Los Angeles, but even some mid-sized cities like Charleston, Minneapolis, Nashville, Denver, and more have a handful of restaurants where you can use this credit. Since these restaurants skew higher end, you should have no trouble using your semi-annual $150 credit up in one fell swoop … or over multiple visits.

$300 DoorDash Credit & Complimentary DashPass

Sapphire Reserve cardholders get a $5 per month discount on DoorDash restaurant orders and two monthly coupons of up to $10 off on grocery, convenience, and other non-restaurant orders through Dec. 31, 2027.

These promos must be applied at checkout when placing an order on DoorDash using the Sapphire Reserve card enrolled in DashPass. Unfortunately, if you don't get around to using one of your promos, it won't carry over to the next month.

You'll also get a complimentary DoorDash DashPass membership, which provides access to free deliveries and lower platform fees. Just be sure to activate this benefit by Dec. 31, 2027, and it'll be good for a minimum of one year.

$300 StubHub Credit

You now get up to $150 in statement credits from January through June and again from July through December for a maximum of $300 annually for StubHub and viagogo purchases through Dec. 31, 2027.

If you regularly attend live events like concerts, sports, or even theater and comedy shows, this credit should be pretty easy to use and help you get some value back out of your card's high annual fee.

$120 Global Entry, TSA PreCheck®, or NEXUS Credit

Like the Venture X, you can receive up to $120 in credit once every four years to cover the cost of Global Entry – or $85 for TSA PreCheck. The Sapphire Reserve also offers an application credit for NEXUS.

Membership in these programs lasts for five years, so you're set with this credit. And since Global Entry includes TSA PreCheck, it's the obvious choice if you're planning any international travel.

$120 Lyft Credit

Sapphire Reserve cardholders get access to up to $10 in monthly Lyft credits (up to $120 per year) to use on rides – plus earn 5x total points on your purchase – through Sept. 30, 2027. Unfortunately, these credits are use-them-or-lose-them, so if you don't use rideshare services on a regular basis, you won't be able to stack the credits for a pricier ride later.

Complimentary Apple TV+ & Apple Music Subscription

You'll now get a complimentary Apple TV+ and Apple Music subscription, just for holding the Sapphire Reserve card (through June 22, 2027). If you're already paying for one (or both) of these services, that's an annual value of $250.

With tons of original content and access to music across all your devices, this will no doubt prove to be a useful benefit for many.

One thing to note about this credit is that it's not valid for Apple One subscriptions or even family subscriptions of Apple Music or Apple TV+.

$120 Peloton Credit

Get $10 in statement credits per month on eligible Peloton memberships through Dec. 31, 2027, for a maximum of $120 per year (activation required). Plus, you'll earn 10x total points on eligible Peloton equipment and accessory purchases over $150 through Dec. 31, 2027.

This is likely the least useful credit of all the new perks you get with the Sapphire Reserve, but if you're already paying for a Peloton membership, saving $10 per month isn't nothing.

Winner: Chase Sapphire Reserve®

This one isn't even close. The Sapphire Reserve comes with a much higher out-of-pocket cost up front, but there is tons of value to be had with all the credits the card offers. Even if you only make use of the annual $300 travel credit and a few of these other perks, it'll be quite easy to come out ahead with this card.

Learn more about the *chase sapphire reserve*.

Airport Lounge Access

If it's lounge access you want, both cards are up to the task.

Capital One and Chase have both been building out their own lounges across the U.S., though just a few are open to date. Plus, both cards come with a Priority Pass™ membership for access to 1,300-plus participating lounges across the globe.

Let's take a closer look at what kind of lounge access you get with these two cards.

Capital One Venture X

With the Capital One Venture X Card, you'll get access to the new Capital One Lounges in Dallas-Fort Worth (DFW), Denver (DEN), Las Vegas (LAS), New York City (JFK), and Washington, D.C.-Dulles (IAD). These are truly incredible spaces – easily among the best airport lounges in the U.S., period. Each lounge is a bit different, but they've all got a great design, fun amenities, and absolutely outstanding food and drinks.

Venture X cardholders currently get unlimited complimentary access for themselves and two guests – but that's changing next year. Come Feb. 1, 2026, Venture X cardholders will have to pay an additional $45 to bring a guest into Capital One Lounges – or a discounted rate of $25 for children 17 and under. Kids under 2 years old will remain free.

If you're a big spender, you can retain complimentary guest access by charging a whopping $75,000 to their card in a calendar year – a carbon copy of the policy American Express adopted at Centurion Lounges a few years ago.

Take a look inside the Capital One DFW Lounge!

Capital One is also rolling out a hybrid lounge-restaurant concept, called Capital One Landings, the first of which opened at Washington, D.C.'s Reagan National Airport (DCA) late last year. The D.C. location features both a sit-down dining space and grab-and-go options. The food and beverage program is spearheaded by award-winning celebrity chef José Andrés, with made-to-order Spanish-style tapas and drinks delivered directly to your seat.

So far, only one other Capital One Landing has been announced for New York City-LaGuardia (LGA), though an exact opening date is still unknown. Venture X Cardholders get unlimited complimentary access to Capital One Landings for themselves and two guests. Reservations can even be made through the Capital One app up to to six months in advance.

In addition to Capital One Landings and Lounges, Venture X cardholders also get a Priority Pass Select membership, opening the door to 1,300-plus participating airport lounges in cities big and small across the globe. But Venture X cardholders' Priority Pass lounge access is taking a hit next year, too. Cardholders will soon have to pay an additional $35 per guest – and even if you do manage to spend $75,000 on your card each year, that won't get you free guest access at these lounges.

Related reading: Capital One Slashes Free Guests at Lounges

Chase Sapphire Reserve

The Sapphire Reserve

comes with a complimentary Priority Pass Lounge membership. This opens the door for you (and up to two guests) to hang out in 1,300-plus airport lounges all over the world.

Additionally, Sapphire Reserve cardholders will also get access to Chase's new Sapphire Airport Lounges. Chase currently has seven open in Boston (BOS), Hong Kong (HKG), New York City-LaGuardia (LGA), New York City (JFK), Phoenix (PHX), San Diego (SAN), and Philadelphia (PHL) … and more are on the way. These lounges are a big step above your typical Priority Pass space.

Sapphire Reserve cardholders get unlimited complimentary access to Sapphire Lounges. They can also bring up to two guests free of charge. Authorized users on the Reserve get their own access and guests, too.

One small hitch: It's not the Reserve that gets you in, but the Priority Pass membership you get from your Reserve card that gets you access. Just be sure to activate that account, and you should be set.

Read more: Chase is Winning The Airport Lounge Wars … & It’s Not Close

Winner: Chase Sapphire Reserve®

If lounge access is a priority, this one should be an easy choice. Not only does Chase have more of its own lounges than Capital One, the Sapphire Reserve includes complimentary access for up to two guests at both Sapphire and Priority Pass Lounges – something Capital One is cutting next February.

Learn more about the *chase sapphire reserve*.

Travel Protections

The best travel credit cards protect you when things go wrong and help you avoid paying more for add-on coverage.

Pay for your trips with either of these cards, and you'll get nearly identical protection for many travel-related mishaps. Here's what you can expect if your trip goes awry.

Trip Delay Coverage

While you'll be on the hook to cover the expenses upfront, you may be eligible for reimbursement when your trip gets held up due to a covered event like weather or airline maintenance.

- As long as your airfare was booked at least in part with your Venture X or Sapphire Reserve card, you are eligible for up to $500 if your travel is delayed by six or more hours – or forces an overnight stay.

- You, your spouse, and your dependent children under 22 years of age are automatically covered if they are traveling with you.

- You must also be traveling outside of your home city to be eligible.

Read more: A Firsthand Experience Using Chase's Trip Delay Insurance

Trip Cancellation and Interruption Coverage

If you've got the Venture X and something goes seriously wrong on your trip like an accident, illness, or death that forces you to cancel or cut it short, you’re covered for up to $2,000 per person in expenses – and you, a spouse, and any dependent children are all eligible.

The following situations qualify:

- The death, accidental bodily injury, disease, or physical illness of you or an immediate family member of the cardholder. The death, accidental injury, disease, or physical illness must be verified by a physician and must prevent you from traveling on the trip.

- Default of the common carrier due to financial insolvency.

Meanwhile, the Chase Sapphire Reserve ups the coverage even further by reimbursing up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses.

This includes passenger airfare, tours, and hotels booked with your Sapphire Reserve Card. There is a maximum benefit amount of $40,000 for a twelve-month period.

Chase lists the following examples as situations that would be covered, but notes that it isn't an exhaustive list:

- Accidental bodily injury, loss of life, or sickness experienced by the cardholder, a traveling companion, an immediate family member of the cardholder, or a traveling companion.

- Severe weather that prevents the start or continuation of a covered trip.

- Terrorist action or hijacking.

- Jury duty or a court subpoena that cannot be postponed or waived.

Again, the kicker here is that the trip must have been paid for with your Venture X or Sapphire Reserve card.

Lost Luggage Coverage

Lost luggage reimbursement is something you typically don't think about until you need it. Did an airline lose or damage your luggage – or did it get stolen?

- As long as you paid for your airfare with one of these cards, you can get up to $3,000 to replace or repair the bag and its contents (or $2,000 per bag for New York residents).

- The cardholders and all immediate family members are covered.

While it's definitely a pain to replace all your personal items, knowing that you've got some extra protection with the Venture X Card should help provide travelers with some additional peace of mind.

Read next: The 4 Best Credit Cards with Travel Insurance

Rental Car Coverage

Here's how it works: Charge your rental car to your Venture X or Sapphire Reserve card and you get some of the strongest rental car insurance of any travel rewards credit card. When picking up your rental, simply decline the rental car agency’s policy and either card's primary car rental insurance policy will kick in to cover most damages or even the theft of your rental vehicle. It applies to rentals in the U.S. for as long as 15 days and in most foreign countries for up to 31 days.

Read more about the Capital One Venture X rental car insurance benefits!

In addition to primary car rental insurance, Venture X cardholders also get complimentary Hertz President’s Circle status.

As the highest level of elite status in their Gold Plus Rewards program, President’s Circle elite members who book an intermediate car or higher get guaranteed upgrades to the next available car class or the ability to choose a car from the President’s Circle Ultimate Choice aisle. Members can also skip the counter when renting a car, have access to a dedicated Hertz Rewards customer service line, and add another driver at no additional cost.

Travel Accident and Medical Coverage

You always hope you never need Medical Evacuation & Travel Accident coverage. But if you ever need it, it’s invaluable.

Both cards will provide coverage for accidental death or dismemberment, or a combined loss of speech, sight, or hearing, experienced on a covered trip. Benefits are available when a covered trip has been purchased with either card – or with the points earned on either card.

One key difference in the accident coverage provided by these two cards: The Sapphire Reserve card is the only one that will provide coverage for a medical evacuation. If you or a member of your immediate family are injured or become sick during a trip away from home that results in an emergency evacuation, you'll be covered for medical services and transportation for up to $100,000.

Finally, Chase Sapphire Reserve cardholders and eligible family members can also receive up to $2,500 (with a $50 deductible) for emergency dental or medical treatment should anything happen when traveling 100 miles or more from home.

Winner: Chase Sapphire Reserve®

This one is close. Both cards come with primary rental car coverage, reimbursement for lost luggage, and identical trip delay insurance.

However, the Sapphire Reserve takes things a step further by reimbursing more money for a trip cancellation or interruption – and includes additional coverage for a medical evacuation. And that makes it the better option overall.

Learn more about the *chase sapphire reserve*.

There are many reasons why adding an authorized user to your account makes good sense.

Perhaps you and a spouse share expenses equally and paying all your bills with one account is easiest for your bookkeeping. Or maybe you're trying to earn a big welcome offer and having someone else put their every day expenses on your account is the extra push you need.

One of the biggest, and best, reasons for adding authorized users to your account is to extend the many great travel benefits and perks that come with these cards to a friend or family member.

Capital One Venture X

In a world where adding authorized users to a premium travel rewards card usually means forking over even more money on top of an already steep annual fee, Capital One broke the mold.

Shockingly, you can still add up to four authorized users to your Venture X Card at no additional cost. Better yet, those authorized users will get their own lounge memberships (for now) to be used regardless of whether or not they're traveling with the main cardholder. That's simply unheard of in the world of premium travel credit cards.

Sadly, you'll need to pay an additional $125 per year if your authorized user to have lounge access come next year. Along with the guest access changes, Capital One is ending the authorized user free for all on Feb. 1, 2026.

To be perfectly clear: You can still add four authorized users for free after that date, but they won't get lounge access unless you pay up.

Related reading: After Cutbacks, The Capital One Venture X is No Longer Best for Family Lounge Access

Chase Sapphire Reserve

Adding an authorized user to the Sapphire Reserve will cost $195 each year for every cardholder you add. If your authorized user often travels without you, that fee can easily be worth it.

While Sapphire Reserve authorized users won't get as much as Venture X card authorized users, they will get a few worthwhile perks including:

- Their own Priority Pass lounge membership with the ability to bring two of their own guests at no additional cost

- 12 months of their own DoorDash DashPass membership for free food delivery on orders starting at $12

- All the travel insurance protections provided by the card, regardless of whether they are traveling with the primary cardholder

Winner: Which Card is Best for Authorized Users?

Being able to add up to four additional card members for free (for now) makes the Venture X the clear winner in this category. Early next year, Capital One authorized users won't get perks like lounge access unless you're willing to pay an additional $125 per year. Even still, that's a much cheaper price tag that what it costs with the Sapphire Reserve.

Learn more about the *venture x*.

Bottom Line

By the numbers, the *chase sapphire reserve* takes four categories, while the *venture x* takes three.

So does that make the Sapphire Reserve the clear-cut winner? Hardly!

If you're looking for premium travel perks at a modest price point, the Venture X is the clear winner. Meanwhile, the Sapphire Reserve's laundry list of statement credits and perks could make it worth the added cost for others. Every traveler can – and should – weigh each of these categories differently.

This article is a well written comparison article. As Lu pointed out, the cell phone insurance with the Capital One card is also a large value add, especially with four expensive phones on a family plan, if you were going to buy cell phone insurance anyway. I have both of these cards, and they both provide incredible value. To me the biggest value is the avaliability of services at the primary departure airport, and airports that you layover in. I fly out of DFW at least once per month, so access the the Capital One lounge makes the Venture X card my top. In addition, if I book one airline ticket (which counts as a cash purchase for earning EQMs) using my $300 travel credit through the portal annually, the card pays pays me $5 annually. That is after I use my 10,000 points for travel reimbursement. The Hertz Presidents Circle is a huge perk if you rent Hertz exclusively (I do). Plus normal Priority Pass. Plus 2% back an ALL purchases. This card is a no brainer. Anyone who travels at all, and books over $400 worth of travel, pays for the card. Also, if you fly out of Dulles, Denver, or Dallas-Ft. Worth even once per year, the Capital One lounge access makes it worth it. It’s nice to grab a salad, sandwich, and water to take with me on the plane FOR FREE if I’m going to be in the Main Cabin.

I also layover in Seattle about 20 times per year. The Sapphire Reserve card gives access to THREE restaurants with $28 at each one with the Chase Priority Pass. If you layover at any of the airports with restaurants often, this is a great value. I rarely use Lyft and never use food delivery services, so these perks do not add value for me. I do use the Sapphire card for all restaurant, Uber, and misc. travel purchases. I book all airfare and hotels direct with their own branded card. I use the Sapphire card to book all rentals for the rental car insurance.

I’ve searched the web for a while trying to find a breakdown of the differences between the rental car insurance provided by the Venture X card and the Sapphire Reserve card. I was hoping Jackson may know if the coverage is the same with both cards through Visa Infinite, or if they are separate insurance policies?

I like the detail from the article and there are a few things I didn’t know but it probably needs to be updated as others suggested. Also, the article forgot to mention the phone protection program only from Capital One Venture X. It covers all phones listed under the same bill.

It is a bummer that Chase upped the price to 550. Still believe it is the best in business if you can leverage it correctly.

Travel protection is unparallel in the industry. They give dashpass and $60 credit, so the effective price is $190.

We travel internationally every year with tickets anywhere from 6k-10k

If you have such an expense that is an additional 10k points for you (min $100) since chase is 3X vs Venture 2X.

So the effective cost is $90 or less.

Well there are many ways to compare this is just one 🙂

I was forced to close CSR because of non travel for 2 years and switched to venture x but will probably switch if someone can get me the old 100k link 🙂

The $300 back for travel through the Capital One portal isn’t the greatest. With the Chase Sapphire Reserve, I do prefer that they just reimburse any travel expense for the $300. I tried booking a hotel through Capital One Travel portal and the hotel I was looking at didn’t have all the rooms in the listing. Even though if you went to the direct hotel’s website the room is available. I just started with the Capital One Venture X, it remains to be seen how well I can book travel through the portal.

The 1.5x multiplier using the Chase portal will make me keep it around for a few years. That being said, I also have a Venture X in my wallet.

This article read a lot like paid promotion rather than an objective comparison with real world examples.

What about the comparison do you think isn’t objective?

I disagree the travel protections are a wash. For Cap One Venture, the trip cancellation/interruption coverage is limited to $2k and it also only covers the common carrier fare. So there is no coverage for lost hotel charges. For CSR, it’s up to $10k and covers fare as well as hotel and other travel related purchases. That’s a significant difference in my mind

Have you ever tried to use CSR insurance coverage? They only cover if your plane is delayed by weather, not mechanical. It is not as good as you may think it is.

We have used our CSR trip interruption due to illness and can confirm it covered everything from airline fare to hotels booked and even tours and local car rentals.

What CSR gives in terms of travel protection is unmatched and not a wash.

Imagine your tickets are $2000 for a one-month Hawaii trip, but you have concert reservations, hotel reservations, tours etc easily running up to $10k. Venture X will not cover that.

This article has to be updated to reflect that.

I had CSR for over 5 years and closed it for VentureX this year. But was disappointed by this travel insurance caveat.

I have other chase cards (freedom, flex, prime) and am hoping they give this benefit when booking travel

Both cards are Visa Infinite cards which is where the travel protections come from. Generally speaking, they should offer the same coverage.

Unfortunately, they don’t.

Also a lot of Visa Infinite cards work differently, some use to give airline credits like the Ritz Carlton and others not.

https://usa.visa.com/pay-with-visa/cards/visa-credit-cards/visa-infinite-credit-cards.html

Some give airline incidentals credit but none of the reserve and venture x do that.

So they share some benefits but not all.

Sapphire covers the whole trip including side trips booked using other cards inside your travel dates. I have myself got it reimbursed when during a trip a booked using chase I had another reservation using Amex and chase happily reimbursed it as the trip was affected.

Venture X only covers the actual flights and nothing in between.

The travel insurance is definitely not a WASH Nick. For most parts as the article is correct, I would recommend you update that section on the travel insurance side to give the right picture. As Sapphire Reserve is a hands-down winner there, there is none in the market with that kind of insurance.