With travel demand roaring back and many flight prices through the roof, travelers are once again focusing on earning airline miles to fuel their future travels. There's just one problem: Your airline miles may be far less valuable than they were pre-pandemic.

The hits just keep coming. Whether you want to go to Europe, Asia, or South America, United has raised award rates – how many miles they're charging for a flight – by 30% or more. Aside from some recent sales, Delta SkyMiles don't go nearly as far as they once did. American's AAdvantage program is moving in the wrong direction, too. And even international airline programs like Emirates and Virgin Atlantic have suddenly raised award rates or hiked cash surcharges when redeeming miles – or both.

As travel demand continues its rebound, the writing is on the wall: More of these negative changes are coming for your airline miles.

Luckily, there's an easy way to shield yourself from these painful changes: Rather than continually swiping your favorite airline credit card, you should focus on earning flexible points from banks like Chase and American Express. Points from credit cards like the *chase sapphire preferred* or the *amex gold* are more valuable and versatile. And that's never been clearer.

What Are Airlines Up To?

Airlines have a problem: There are just too many miles out there.

According to a previous CNBC story, Delta Air Lines, American Airlines, United Airlines, Southwest Airlines, and JetBlue saw their balances of unused miles spike by nearly 12% at the start of the pandemic. And as those balances continue growing, it gives airlines all the more reason to charge more for mileage redemptions than they have in the past.

Take United, for example. By the end of 2020, there was nearly $6 billion worth of United MileagePlus miles out there. Even as travelers have redeemed far more of their miles as travel rebounded, that sum grew to more than $6.6 billion by the end of 2022, according to regulatory reports.

Raising award rates is like inflation for airline miles. With too many miles out in circulation, airlines eventually decide to increase award rates to offset that imbalance.

The same pattern plays out across every major airline. And since American, Delta, and United have all eliminated their award charts – the cheat sheets that spell out exactly how many miles you need to book a flight from point A to point B – increasing redemption rates is simple: They can charge whatever they want.

To make matters worse, banks and airlines have opened the floodgates with huge credit card bonuses. Again and again, we've seen record-setting welcome bonuses over the last few years, from eye-popping 80,000- to even 100,000-point bonuses on the *chase sapphire preferred* (which are long gone) to the biggest bonuses we've ever seen on Delta's SkyMiles American Express cards (which is also over).

A huge mileage bonus is great … until an airline makes a change that suddenly makes those miles worth less than they were previously. These kinds of devaluations are inevitable in the travel world, pandemic or not. But the last few years have just given airlines even more rationale to degrade their miles.

That means more of these negative changes are on the horizon. To solve the imbalance, airlines will continue tweaking, eliminating sweet spots, and charging more to fly using miles.

It's why we've urged readers and travelers to use their miles to book future trips now. Airline miles are not an investment: They only get less valuable over time.

But it also reinforces just how much more valuable it is to keep your options open with flexible credit card points.

The Versatility of Credit Card Points

A big stash of Delta SkyMiles or American AAdvantage miles is great … until you want to fly on a different airline. Or until that airline decides to make those miles less valuable.

And that's where flexible credit card points from banks like Chase, American Express, and Capital One shine: You're not tied to just one airline. When the right opportunity comes, you can turn those points into miles with a dozen or more airlines (or hotel chains) using transfer partners.

For example, 100,000 Chase points can become 100,000 Virgin Atlantic points. Or 100,000 United miles. Or 100,000 Avios with British Airways or Iberia. The list goes on. Here's the full list of Chase transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

Read up on the best ways to use Chase transfer partners – and how to redeem Chase points.

Let's say you want to fly Delta out to Hawaii next winter, so you're focused on earning SkyMiles. Thanks to Delta's unpredictable award pricing, the airline often charges 70,000 SkyMiles or more for roundtrip flights to Hawaii. And that may only go up from here.

But by earning Chase points, you can also book those exact same Delta flights to Hawaii for as low as just 30,000 points each by transferring them to Virgin Atlantic. Or fly from the West Coast to Hawaii and back on American Airlines by transferring 26,000 points to British Airways. Or use them for a completely different trip when the time comes.

Let's spell it out with a concrete example. Let's say you've been saving up United miles – maybe even opened one of their Chase co-branded credit cards – in hopes of booking an ANA business class flight to Tokyo. After United's recent painful hikes, a seat that once cost 88,000 United miles each way will now cost you 110,000 miles.

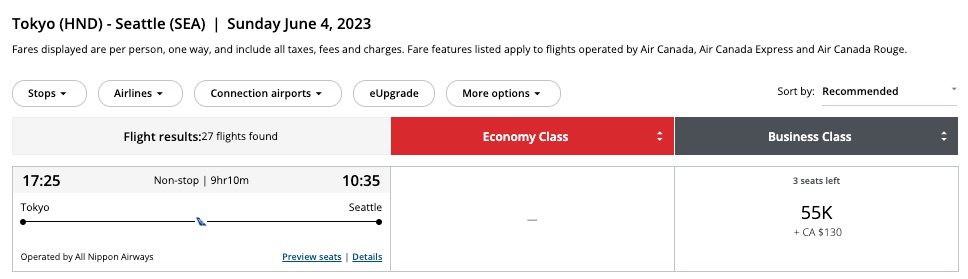

If United miles are all you've got, you're stuck paying that rate. But if you've focused on earning Chase Ultimate Rewards, you could also transfer those points to United … or better yet, send just 45,000 to 47,500 points to Virgin Atlantic and book that same flight. With business class flights between the U.S. and Tokyo as low as 55,000 miles each way, transferring to Air Canada Aeroplan is another strong option.

This level of flexibility to transfer points where they'll go furthest takes the sting out of an airline suddenly nuking their mileage program.

American Express points have even more options at their disposal than Chase, with a list of more than 20 different airline and hotel transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Read our guide on Amex transfer partners!

You've simply got countless more options to use credit card points than airline miles. And that makes a single airline's decision to devalue their miles less painful.

But the value of these credit card points goes beyond transferring them to airline miles.

Book Direct with Your Points, Too

Sometimes, simplicity is best. Booking through a travel portal could be the way to go.

Let's back up. When you've got a stash of Chase points or Amex points, you can transfer them to a dozen-plus different airlines or hotels. But you've also got another option: Use those points to buy your airfare direct.

Chase has the Chase travel portal. American Express has AmexTravel. Either way, you can book flights. And unlike the ever-changing world of airline award charts and pricing, it's simple: The higher the cost of your flight, the more points you need. The cheaper the flight, you can use fewer points.

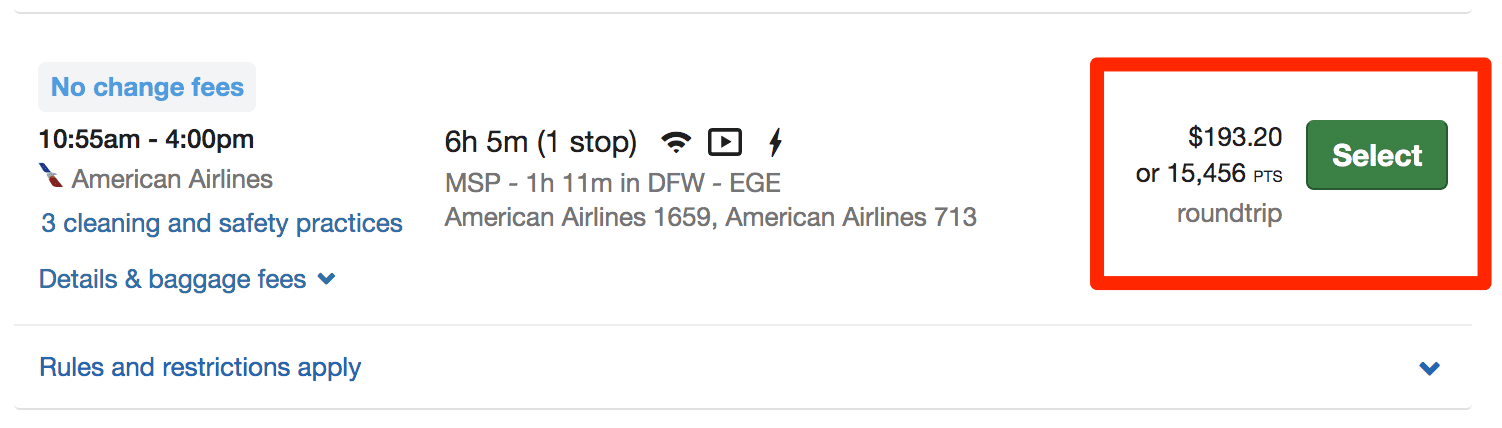

It's even better with Chase, as you'll get a bonus when using your points to book travel through the Chase Ultimate Rewards travel portal. If you hold the Chase Sapphire Preferred, every point is worth 1.25 cents. That means you can book this $193 flight to Vail (EGE) for just 15,456.

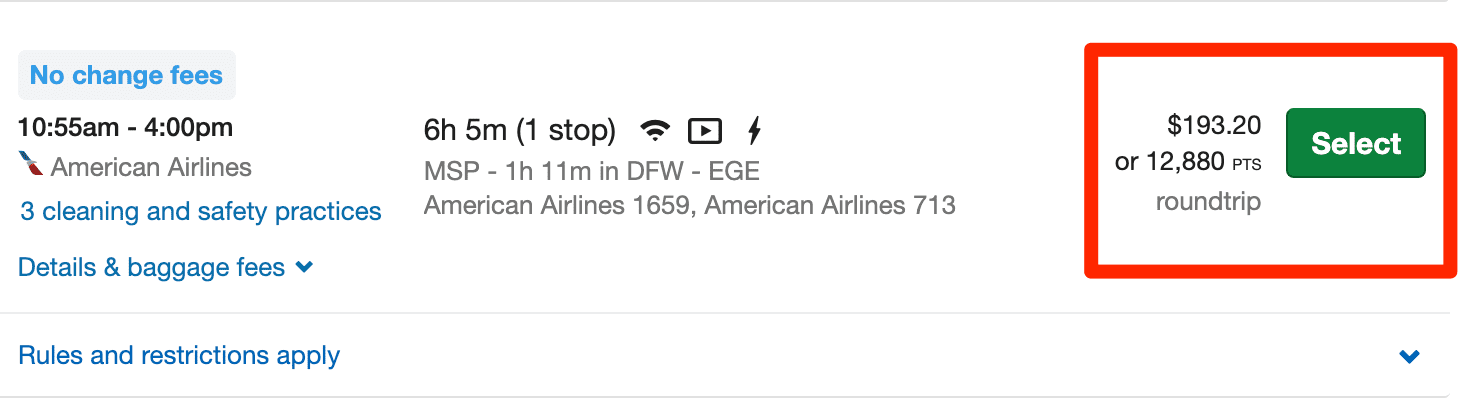

You get even more value booking direct with your points from the *chase sapphire reserve*, as every point is worth 1.5 cents toward travel. That means you can book that same $193 flight using less than 13,000 points.

To top it all off, you'll also earn miles (and build towards elite status) with the airline you fly booking this way. That's generally not the case with a traditional airline award booked using miles. Plus, you won't have to pay additional taxes – it's completely free.

American Express points aren't as strong in this regard unless you have *biz platinum*. That gets you a 35% rebate when you use points to book on your designated airline – and on any premium cabin tickets.

Will it always make sense to book through a travel portal? No, especially if you're looking to fly first or business class, where booking with airline miles will almost always be significantly cheaper. There are risks with booking through the third-party agencies that run these travel portals, especially if things go wrong with your flight. And if you're trying to fly Southwest, it's not an option – the airline doesn't have fares available in these portals (or any online travel agency).

But especially when it comes to cheaper fares, credit card points are emerging as a more tempting option to book flights. You'll have to do the math. But as airlines look to carve out more value from their miles, that case only gets stronger.

Bottom Line

The writing is on the wall: Your airline miles are getting less valuable.

Use your airline miles now to book that future trip. But more importantly, focus on flexible credit card points that will give you more options. It's the best way to hedge against the airlines' games.

Maybe the airlines should price award travel at a decent rate then. Delta charges a boatload just to fly D1. AA is the same, but if I fly on JAL metal (booked through AA) in J class, amount is at least 1/3rd cheaper. Just my thoughts.

And don’t forget to put your United cards away to apply pressure to moerate thei 30% award price hike. If no pain to them other airlines will follow!

Thank you for reiterating this. I’ve been stubborn for years, swiping my Delta card for all purchases since we fly out of MSP and trust Delta to get us to our destinations. However, after booking the MSP-OGG deal for 45,000 Virgin points (instead of paying cash), I’ve seen firsthand how swiping my Chase Sapphire is going to pay off in the long run – and we can still fly Delta if and when the deals keep coming. Now, to train my husband to keep that Chase card out front and center! 🙂