The *Ink Unlimited* and the *Ink Cash* are two of the best no-annual-fee business credit cards on the market, and you can currently earn $750 cash back after spending $6,000 in the first three months with either card.

While $750 is certainly nothing to scoff at, it gets even better if you've got a Chase Sapphire or Ink Business Preferred® Credit Card in your wallet. With any one of those cards, you can turn that big bonus into 75,000 ultra-valuable Chase Ultimate Rewards points – and potentially much greater value by kicking them over to one of Chase's transfer partners like Hyatt, United, Air Canada Aeroplan, and many more.

If you're a small business owner (and trust us, you just might be), these cards and their massive bonuses warrant a good, hard look. So long as you can responsibly meet either card's $6,000 spending requirement, you won't find a better or cheaper way to earn a big bonus.

But remember: Whether it's a personal card or for a small business, credit cards are serious business. You should never apply for a credit card unless you can afford to pay off every dime you charge.

Read on for everything you need to know about the Ink Unlimited and Ink Cash cards.

Learn more about the *chase ink unlimited*.

Learn more about the *chase ink cash*.

Who Can Apply for Business Credit Cards?

Before we get into the nitty-gritty of what makes these cards perfect for small business owners, it's important to set a foundation for who is actually eligible to open business cards.

To open a business credit card, you don’t need a full-time business with employees or six-figure revenues.

Do you have any income from freelance work, or plans to start freelance work? You have a business. Have you ever sold an item on eBay, Facebook Marketplace, Etsy, or other platforms, or have plans to do so in the future? You have a business.

At the end of the day, if you are selling any goods or services, or contracting with a company to do so in an attempt to make a profit, you have a small business and thus are typically eligible to apply for a small business credit card. That makes it possible for just about anybody to apply for a business credit card.

Just keep in mind: You should never lie or attempt to mislead a bank when applying for a business credit card. It's important to have a legitimate business, even if that business is a small one.

Read more: You Might Be Eligible for Business Credit Cards & Not Know It

Chase Ink Business Unlimited® Credit Card

Racking up points in a hurry is easy with the Ink Unlimited, as you'll earn 1.5% cash back (or 1.5x Ultimate Rewards points) on every dollar you spend.

When you factor in the ability to earn 1.5% cash back on the $6,000 you'll need to spend to earn the $750 bonus, you'll end up with $840 (or better yet, 84,000 points) when all is said and done. That's as big of a bonus as you'll find on a card that doesn't charge an annual fee.

Even though this card is marketed as a cashback card rather than a points-earning card, the cashback is actually earned in the form of Chase Ultimate Rewards points. If you also hold a personal or business credit card that earns Ultimate Rewards points, like the *chase sapphire preferred* or even the new *Sapphire Reserve for Business*, you can move the “points” over from your Ink Business Unlimited for even more redemption options.

Full Benefits of the Chase Ink Business Unlimited Credit Card

- Welcome Offer: *Ink Unlimited Bonus*

- Earn unlimited 1.5% cashback (1.5x points) on all business purchases

- Earn 5% cashback (5x points) on Lyft rides through September 2027

- Primary rental car collision and damage waiver coverage

- Lost luggage insurance of up to $3,000 per person per trip

- Add employee cards at no additional cost

- Foreign Transaction Fee: foreign_transaction_fee

- Annual Fee: annual_fees

Learn more about the *chase ink unlimited*.

Chase Ink Business Cash® Credit Card

With the Ink Business Cash, you'll earn a whopping 5% cashback (5x points) on office supply purchases; internet, phone and cable service charges (up to $25,000 in combined spending each account anniversary year). You'll also earn 2% cashback (2x points) at restaurants and gas stations (up to $25,000 in combined spending each account anniversary year) and all other eligible purchases earn unlimited 1% cashback (1x points).

Much like the Ink Unlimited card, the Chase Ink Business Cash doesn’t earn points outright. But so long as you’ve already got another Chase card that earns Ultimate Rewards in your wallet, you can turn that cashback into points to use for booking travel.

That means you can turn the $750 cashback into 75,000 Chase Ultimate Rewards points, and send them over to Chase transfer partners to book flights and hotels … or book travel directly through the Chase Travel℠ portal.

Full Benefits of the Chase Ink Business Cash Credit Card

- Welcome Offer: *ink cash bonus*

- Earn 5% cashback (5x points) on office supply purchases; internet, phone, and cable service charges (up to $25,000 in combined spending each account anniversary year).

- Earn 2% cashback (2x points) at restaurants and gas stations (up to $25,000 in combined spending each account anniversary year).

- Earn 1% cashback (1x points) on all other eligible spending

- Primary rental car collision and damage waiver coverage

- Lost luggage insurance of up to $3,000 per person per trip

- Add employee cards at no additional cost

- Foreign Transaction Fee: foreign_transaction_fee

- Annual Fee: annual_fees

Learn more about the *Ink Cash*.

How to Redeem Chase Ultimate Rewards Points

While this bonus is obviously worth $750 in cold hard cash … the real magic happens when you convert it to Chase Ultimate Rewards and redeem those points for travel. So, what can 75,000 points get you? In two words: A lot.

The beauty of Chase points is just how valuable – and flexible – they are.

By leveraging Chase transfer partners and sending these points to airlines like Air Canada Aeroplan, United, Iberia, British Airways, or even hotel chains like Hyatt, you can easily redeem them for flights and hotels that would have otherwise cost you thousands of dollars.

Here's a quick list of some of the best ways you could redeem this big 75,000-point bonus.

This list is just the start! Read our full guide on the best ways to redeem Chase points!

3 (or More!) Roundtrip Tickets to Hawaii

You can book three or more round-trip tickets to Hawaii with a big Chase points bonus. So much for Hawaii being an expensive place to get to, right?

This is where turning to Chase transfer partners really shines, as you have several options to book round-trip flights to the Hawaiian islands for about 30,000 points each – or much less.

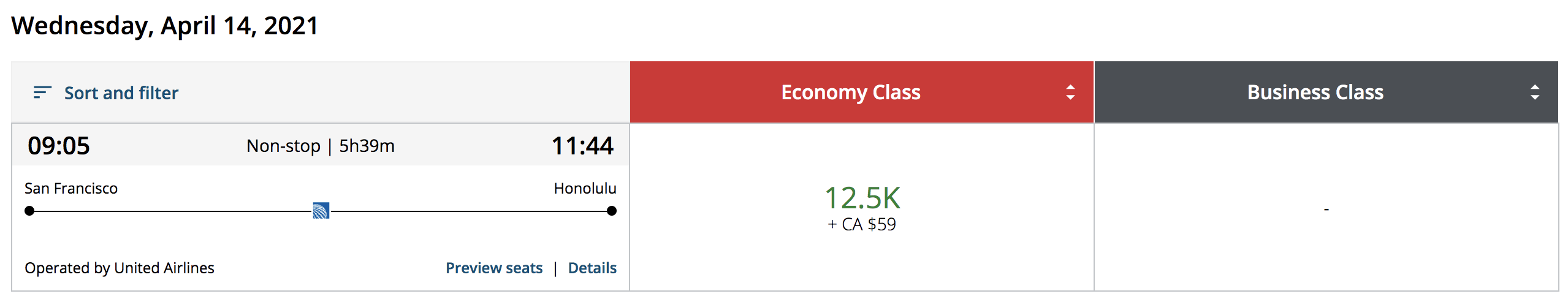

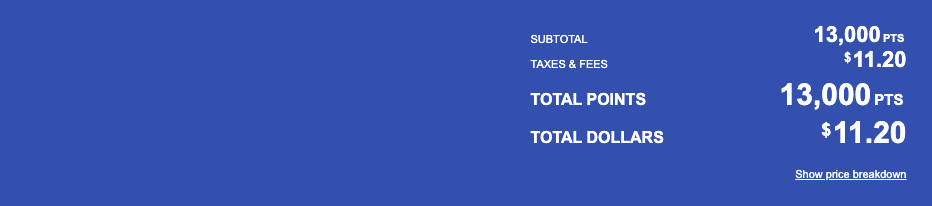

If you time it right, you can even get to Hawaii for just 13,000 Southwest Rapid Rewards points, as with this round-trip flight from Los Angeles (LAX) to Honolulu (HNL). And because Chase points transfer to Southwest on a 1:1 basis, 13,000 Chase points is all you need.

Another option is transferring your points to Air Canada Aeroplan, which you can use to book flights to Hawaii on United Airlines. Here's why: Flying from the West Coast, you can book roundtrip flights to Hawaii for just 30,000 Aeroplan points … even when United is charging 45,000 miles or more for the exact same flights.

Chase points also transfer to Air Canada on a 1:1 basis, so just 30,000 Chase points is all you need per ticket.

Read more on our favorite ways to get to Hawaii using points!

A Trip for 3 to Europe – Or 1 in Business Class

This 75,000-point bonus is nearly enough to get three people to Europe and back in economy … or fly solo in style.

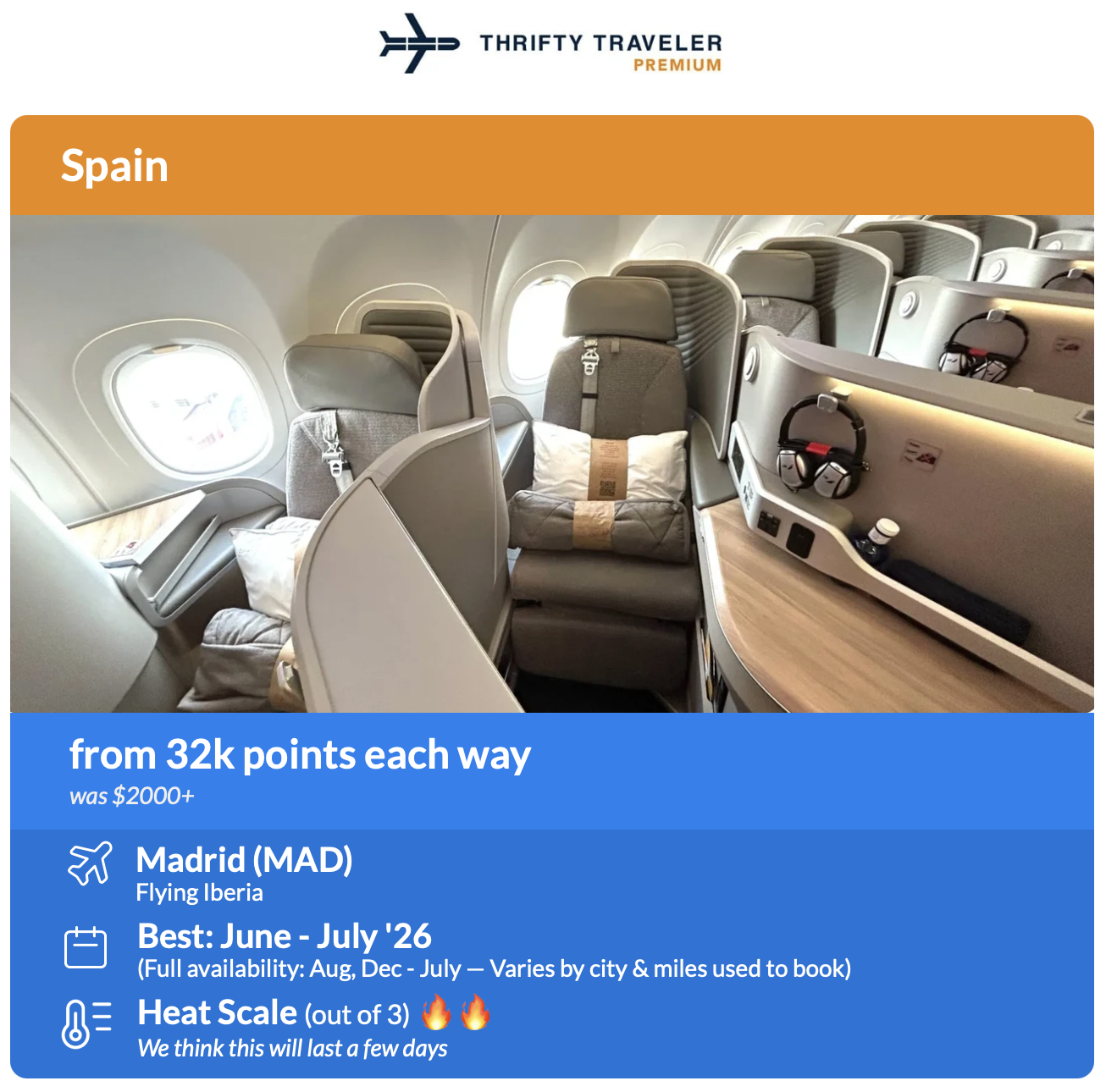

The trick is turning to Iberia, a Spanish airline and yet another Chase transfer partner. Using Iberia, you can fly from Boston (BOS), New York City-JFK (JFK), or Chicago-O'Hare to Madrid (Madrid) in economy for as low as 32,000 miles roundtrip.

After completing the $6,000 minimum spending requirement on either card, you'd have a minimum of 81,000 points to work with – almost enough for three of these roundtrips.

Or you could splurge for this:

Read our step-by-step guide on how to book Iberia business class!

That's right: 75,000 Chase points is almost enough for a roundtrip to Europe in Iberia business class. Even after a recent price increase, you can still book these lie-flat seats for just 40,500 miles each way or 81,000 miles roundtrip! That's a fraction of what most other airlines charge to fly business class to Europe.

Considering these business class tickets cost $4,000 or more a ticket when paying cash, it's a phenomenal way to use those Chase points. And with a Thrifty Traveler Premium alert like this one, it's fairly easy to book.

Book Free Hotel Nights with Hyatt

It's not just flights: You can book hotels using this 75,000-point bonus, too. And with Chase points, you've got an ace in the hole with Hyatt.

With free nights starting as low as just 3,500 points per night, World of Hyatt is easily the most valuable hotel loyalty program … and it's not even close. Chase points also transfer to Hyatt 1:1

With 75,000 points in hand, you could:

- Cover 21 nights at the cheapest Hyatt properties!

- Book a few nights at one of the 100-plus excellent all-inclusive resorts like the Hyatt Ziva Puerto Vallarta or the Hyatt Ziva Riviera Cancún

- Book a few nights at a posh Park Hyatt property close to home or abroad – some like the Park Hyatt Siem Reap in Cambodia are bookable for just 15,000 points per night!

- Get two nights with your own villa in Bali (complete with a private pool!) at the Alila Villas Uluwatu

Score a Business Class Suite to Tokyo

This isn't just business class. It's ANA's The Room business class … and you can book a trip to Japan flying in this seat with a Chase Ink bonus.

Thanks to a (relatively) strong U.S. dollar, Japan continues to rank high on nearly every travelers bucket list – and this is one of the best ways to get there … if you can find the availability.

All Nippon Airways (ANA) might not be a Chase transfer partner, but Virgin Atlantic is. And Virgin Atlantic prices these flights more like an economy seat: You can fly from the western U.S. to Tokyo and back for just 105,000 Virgin Atlantic points, or 120,000 points from Chicago-O’Hare (ORD) or East Coast cities. One-ways are half the price.

Read more: How to Book ANA flights with Virgin Atlantic Flying Club points

Which Chase Ink Card is Best?

That’s a tough one. There's no one-size-fits-all answer: It really depends on your small business's spending patterns.

If you’re paying serious dollars every month for telecommunications or office supplies for your business, the Chase Ink Business Cash card's 5% cashback (5x points) on internet, cable, and phone service, and at office supply stores is second to none.

Meanwhile, the Chase Ink Business Unlimited is about as good of an all-around spending card as you’ll find – especially for having no annual fee. If none of the spending categories above stick out, but you’ll still be racking up some serious business expenses, earning 1.5% cashback (1.5x points) on all purchases is a stellar return.

Keep in mind: Chase doesn't restrict you from having both cards, so that's an option.

Read next: Which Chase Ink card offers the best return for your business?

Special Considerations with Chase Ink Business Cards

If you’ve applied for or read about Chase credit cards, you’ve likely come across the bank's dreaded 5/24 rule.

Chase won’t accept applications if you’ve opened five or more cards in the last 24 months from any bank – not just Chase. With business cards, that same rule applies … kind of.

For starters, you will need to be under the 5/24 limit to get approved for a Chase Ink Business card … but that approval won't add to your 5/24 count. So if you've opened three or four credit cards in the last two years, it might be the perfect time to apply for one of these cards. That way, it won’t hinder any applications for other future Chase cards.

And there’s one other detail that makes these cards even more alluring: You can stack welcome bonuses from several of these cards so long as you can get approved.

But Chase can be very stingy with approvals for business credit cards. Be prepared to provide business paperwork and answer a lot of questions – though that won't always be the case.

Read our master guide to credit card applications.

Bottom Line

Chase is out with big, bonus offers of $750 cashback on both the Ink Business Unlimited and Ink Business Cash cards after spending $6,000 in the first three months. With a Chase Sapphire or Ink Business Preferred Card in your wallet, you can turn that cash bonus into 75,000 ultra-valuable Chase Ultimate Rewards and redeem them for some really amazing travel.

If either card makes sense for you – and they likely do – you'll be hard-pressed to find better bonus offers than these.

Learn more about the *chase ink unlimited*.

Learn more about the *chase ink cash*.

I had signed up for the both the Ink Cash and unlimited over a year ago when the welcome offer was 90,000 UR.

I have since closed the ink cash and kept the ink unlimited as it was a better fit and benefits for my business at the time.

I have made a few transitions and would now get more benefits from the ink cash card now.

Is it possible to sign up for the ink cash again under the new welcome offer and receive it even if I received the last welcome offer less than two years ago? I can’t find any language like it used to state, that says you can’t earn a welcome offer again after a specific period of time?

I’d like to apply for both cards. However, I’m waiting on one of my current CC’s to report that its balance has been paid in full. (Full payment was sent on Friday and should post by mid-week. The statement closes on 04/07). This way I can qualify for a higher credit line, which I could use. My current FICO with Experian is 839 but will be closer to 850 after my one remaining balance is brought down to zero. So, my question is how much time do I have left before this deal expires? How much longer can I wait?

What if you don’t spend the $6000 in 3 months?

You won’t earn the bonus.

Does the $6000 spend have to be on business expenses? Does Chase look at or monitor that? I have my own business and should get approved for the card no problem and could easily spend the $6000 to get the bonus but it wouldn’t be on business expenses. I would only use it for business expenses after achieving the bonus, but would need to make non-business purchases to hit the $6000.

Applied last week 3/6/2023, but my account is showing the promotion is 75,000 points instead of 90,000. I escalated to marketing team, anyone having the same issue?

P2 closed their account in October 2022 but got their signup bonus in 2020. Would they still be eligible for this offer?

They should be eligible as the restriction is from when you last earned a bonus. You can’t earn another bonus if you earned the last one within 24 months. You will also need to be underneath the Chase 5/24 rule.

Any idea how long the 90,000 bonus will last?

I wanted to take advantage of the bonus categories on the Freedom Flex this quarter before I opened a new card with a minimum spend – but now I’m not sure I should wait since this is such a good offer.

We don’t know for sure. It’s been around since last summer, but it could end at any time.

Several other sites say “scheduled to end March 21, 2023 at 9am EST.”

How does one turn the cash back into reward points?

You have to have a card that earns Chase Ultimate Rewards points. Assuming you do, this guide walks through how to do it.

https://thriftytraveler.com/guides/points/how-to-transfer-points-between-your-chase-cards/

Still don’t understand. I have Chase Ink and Chase Sapphire already. I want to apply for another Ink. It says $900 cash back. I don’t want cash, I want 90,000 UR points. Exactly how does one go about “transferring cashback value“ into points? Do I need to call Chase? When I get this new Chase ink card, will it show 90,000 points or only $900?

It’s quite simple for me to transfer my current Ink to CSR points but I don’t understand this cash back part.

It’s the same process as your current Ink card.