No, the headline isn't what you think: It's not Visa, Amex, and Mastercard. And it's not about banks and points programs like Chase, Capital One, or Citi, either.

While doing some mental inventory about the travel credit cards I've had over the years, I realized they all fit into one of three different categories based on how often I use them – or don't. I call them wallet, drawer, and “bonus & cancel” cards.

Some cards are the ones I use day in and day out because they help me earn the most points (or cash back). Others are still keepers but don't need to be in my wallet. And then there are the rest: The one-and-done cards that help me earn a big upfront signup bonus … only to meet a pair of scissors soon after.

Whether you've got a dozen credit cards or just two or three, thinking about your credit cards this way can help you.

First, A Word About Credit Cards

If you want to use credit card points and airline miles to travel more for less, you need a solid credit card strategy. And if you want a solid credit card strategy, you need a solid foundation. You need to know how these things really work.

Many Americans are understandably wary of credit cards and guarding their credit score – and they should be. Credit cards are serious business. Credit card debt is a major problem that gets bigger every day. You should never charge more to a credit card than you can afford to pay off immediately, regardless of any points or miles you could earn.

But this world is also filled with myths and misconceptions about how credit cards actually affect your credit score. So while it's right to be cautious and starting slow is key, these misunderstandings are a major hurdle for many travelers who might otherwise be able to responsibly earn points and miles to help them achieve their travel goals.

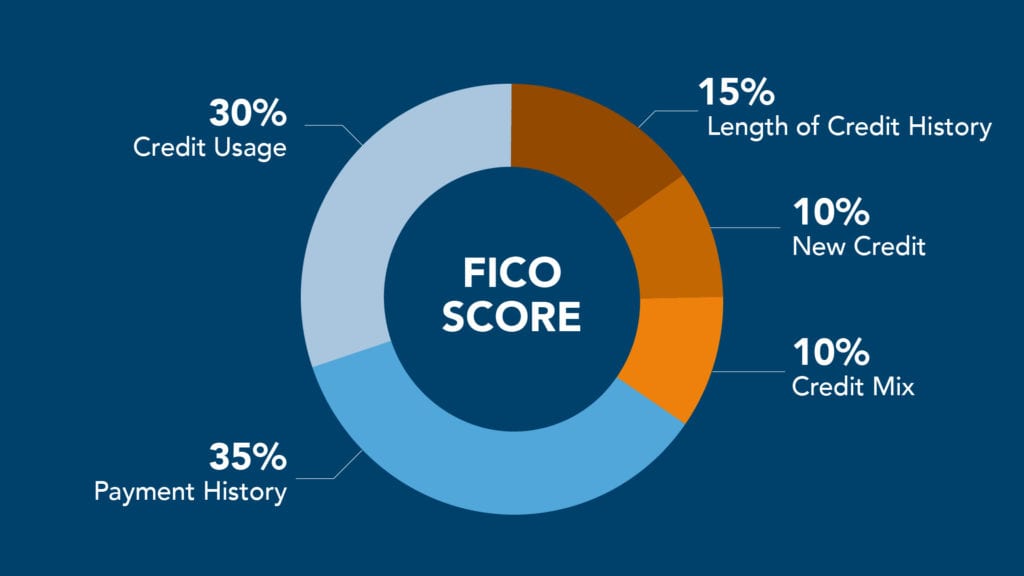

So long as you pay your balance in full and on time, your credit score will improve over time – even as you continually add or subtract credit cards from your wallet. The temporary, five- to 15-point hit your credit score might take when opening a new credit card is practically insignificant compared to paying off your credit on time (payment history) and in full (credit usage).

Read more: From New Cards to Closing Accounts, How Your Credit Score Really Works

Now, that doesn't mean you need to open a half-dozen or more credit cards. But it also means you don't necessarily need to cling to the ones that you've already got.

Here's what's more important to understand: Opening a credit card is not the start of a lifelong relationship. In fact, it probably shouldn't be.

Much like you go through your monthly bills for streaming services and subscriptions you no longer use, you should do the same with credit cards. It's all about doing the math, making sure that the cards you've got are worth the annual fees you're paying for them.

If you're earning enough points or using a card's travel benefits to come out ahead (or close to it), great: Keep it! If not, it's time to get rid of it – or rather than cancel it altogether, downgrade it to a cheaper alternative. Then, move on to the next card that will help you toward your travel goals.

Just getting started with travel credit cards? Read our beginner's guide!

Over time, you'll get a feel for which cards suit your travels best: Which are worth pulling out day in and day out, which are worth keeping around but not using regularly, and which you can simply ditch.

And that's the entire point of this system: Which credit cards belong in your wallet, which cards belong in your drawer, and which simply don't belong.

Wallet Cards

Credit cards need to earn a place in your wallet. If I don't use a credit card regularly, there's no reason to keep it in my pocket day in and day out.

The purpose of “wallet cards” is fairly simple: To earn as many points as possible on your daily spending. These are the cards that help me earn the most points on my everyday spending like at restaurants and on groceries or occasional trips to the gas station, convenience store, and pharmacy. Every card has its strong suit, otherwise it doesn't stay.

To figure out your own wallet cards, do some mental inventory on where you're spending the most money each day, week, month, and year. Then check out our breakdown of the best credit cards to earn points on grocery shopping, dining out at restaurants, or at the gas pump to determine which might deserve a spot in your wallet.

Paying rent? You can't beat the Bilt Rewards Mastercard!

One card that's constantly at the very front of my wallet? The *amex gold*.

There's arguably no better all-around travel card out there to rack up points on your everyday spending – far beyond the 60,000-point welcome bonus (or even 90,000 points!) after spending $6,000 in the first six months. And it's tailor made for where I spend the most week in, week out: restaurants and groceries.

- The American Express Gold card earns an unlimited 4x Membership Rewards points per dollar spent at any and all restaurants

- It also earns 4x points per dollar spent at U.S. supermarkets on up to $25,000 of spending in a calendar year (then 1x)

Those two bonus categories combined make my Gold Card the no-brainer choice anytime I need to put a card down for dinner or at the grocery store. In 2023 alone I've earned more than 44,000 Amex points on my everyday spending. Throw in the points we've earned from my wife's own Amex Gold Card and it's more than 60,000 points this year and counting.

That's 60,000-plus points we can transfer to Iberia for nearly two business class seats to Spain, move over to Delta to hop on the next great SkyMiles flash sale, or send to any of the other great Amex transfer partners. Earning Amex Membership Rewards is a core part of how we fund our travels, and no single card is more important than the Amex Gold Card.

While that might be my go-to, there are several other cards that have earned a long-term spot in my wallet.

- Even after nearly a decade, the *chase sapphire preferred* is still one of my favorites and a mainstay. Its built-in travel insurance means it's a must-have for car rentals and booking many flights – and if we get stuck somewhere, slapping this down for a surprise hotel night means I can get reimbursed later on. And it's a trusty alternative abroad when restaurants and shops don't accept Amex.

- The *venture x* is a good catch-all for “everything else” expenses, since it earns 2x Venture Miles on any and every purchase. When no other card in my wallet makes sense, this is the one I turn to.

- Just to be safe, I've always got my personal debit card (15 years and counting, thanks U.S. Bank!) – though I almost never use it. But I've also got a separate debit card to withdraw cash while traveling abroad: The Charles Schwab debit card, which refunds 100% of any withdrawal or ATM fees. After forgetting it more than once before jetting overseas, it lives in my wallet now.

- There's a temporary spot in my wallet for any credit card that I'm working to meet a minimum spending requirement to earn a big wecome bonus. Right now, that's the *Hilton Surpass* thanks to a record-setting 170,000-point bonus after spending $3,000 in the first six months.

For the most part, my wallet cards are the only ones that I regularly use. I'd love to add the *freedom unlimited* to my wallet – especially with the bank's incredibly lucrative double cash back (or points…) bonus for the first year. Thanks to other cards I've opened over the last two years, Chase won't approve me just yet … but once I drop below the Chase 5/24 rule and I'm eligible for that card, it's the first place I'll look.

And since it earns at least 1.5% cash back on every single purchase, it will likely stay in my wallet for good. Other cards, however, aren't so lucky.

Drawer Cards

I'm a fairly frequent Delta flyer and, despite their many shortcomings, I love my Delta SkyMiles – so much so that I can never seem to keep more than a few thousand in my account.

But I almost never use my *delta skymiles gold card* – and I never carry it in my wallet, period. It's one of several cards with a long-term residence in my desk drawer. And it's not alone.

My drawer cards are the ones I keep and renew each year simply because of travel benefits – or because they're benefitting my credit score. Those perks run the gamut from basics like free baggage and priority boarding with my preferred airline to money-saving credits to airport lounge access, no matter which carrier I'm flying. And in many cases, I get those benefits regardless of whether I actually swipe the cards that carry them.

So long as those benefits outweigh the annual fees I pay each year, I renew them … but keep them in my drawer. Other than an occasional charge here or there to keep the banks happy, I don't use these credit cards day to day. That's what my wallet cards are for.

Here's a quick peek at some of what's in my drawer:

- *delta skymiles gold card* is the ultimate drawer card, as it gets me a free checked bag on every Delta flight … even if I don't pay for my airfare with it! That frees me up to use other cards when booking Delta flights.

- I've had *amex platinum* for years but really only pull it out of the drawer when booking flights, thanks to the 5x it earns on airfare booked directly with the airline. Other than trying to use up the laundry list of statement credits to offset that punishing $695 annual fee (see rates & fees), it's not worth swiping much more. And while it's my path to get into Delta Sky Clubs for free (at least for now…), I don't even need it in my wallet to get in.

- Same goes but for Hilton benefits with the Hilton Honors American Express Aspire Card – just keeping the card open gets me top Hilton Diamond status with perks like fairly regular upgrades, executive lounge access, free breakfast when traveling abroad, and more. That said, I'll throw it in my wallet when heading on a trip with a Hilton stay on the itinerary to earn 14x per dollar – especially if it's somewhere I can use its $250 resort credit, too.

- Before there was the *chase sapphire reserve* or even the *chase sapphire preferred*, there was the Chase Sapphire Card: my very-first travel card. Other, better travel cards might have supplanted it in my wallet but this one has stuck around for more than a decade because 10-plus years of credit history is doing my credit score a solid. And since there's no annual fee, there's absolutely reason to scrap it.

- That's the same reason why the U.S. Bank Visa Platinum Card – my first credit card, period – lived in my drawer forever, too. But I learned a hard lesson: Because I never used it, the bank eventually just canceled it. Even for cards you've got no reason to use, it's wise to schedule a small recurring monthly bill or two – and set up autopay to pay them off automatically, lest you forget and miss a payment.

‘Bonus & Cancel' Cards

OK, so this final category of credit cards also lives in my drawer – or sometimes, my wallet. But it's a short-term lease: Some don't even last for a full 12 months.

These cards serve one purpose, and one purpose only: To earn a big welcome bonus. I do my best to time it right when a card is offering a bigger sign-up bonus, earning even more miles that will help book one of my next big trips. But once that's fulfilled, they're gone.

See our list of the best credit card bonuses available right now!

Again, let me reiterate: Credit cards are serious business. No matter how many points you can earn, you should never open a credit card and rack up a bunch of charges unless you can pay off every dime, in full.

But that's exactly what I do. Maybe I've got a big expense on the horizon like a home improvement project or a big federal tax bill? Or, lucky me, can I simply charge rent to a credit card each month for a nominal fee? Pair that large expense with a big welcome bonus, and I can make the most of it, paying off the charge in full when the statement for that card closes.

And that's it. That new credit card has done its job: Earned me a bunch of extra points for the spending I was going to do anyhow.

So which cards are the one-and-dones? Plenty. Here are a few that come to mind:

- I bought a coffee and paid the $99 annual fee on the AAdvantage® Aviator® Red World Elite Mastercard®, earned 60,000 AAdvantage miles – plus another 15,000 miles after adding an authorized user and having them make one purchase – and used those miles to book a Japan Airlines business class flight home from Singapore … and then got rid of the card. I rarely fly American, so it's not worth keeping around for another $99 each year.

- My wife and I have Australia in our sights next year, and no airline cuts you a better deal for getting to Australia using miles than Alaska Airlines Mileage Plan. So I picked up the Alaska Airlines Visa® Credit Card back when it was offering a record-setting 70,000-mile welcome bonus. But when this card comes up for renewal next year, I'll probably get rid of it.

- I might be a fairly frequent Delta flyer, but I don't care about Medallion Status so I still can't make sense of paying another $550 a year (see rates & fees) for the *delta reserve card*. But it was worth it as a one-timer, earning a 100,000-mile bonus in order to book a flight home from Sydney (SYD) in Delta One Suites – one of the last solid ways to redeem SkyMiles for business class … until Delta chopped that, too. So when that card came up for renewal, I didn't hesitate: I downgraded it to a no-annual-fee *delta blue*.

- I was tempted to keep the *citi premier* after earning its welcome bonus a few years ago as it's one of the best to use at gas stations. But my plug-in hybrid electric vehicle means I rarely need to fill up, so out it went.

Read more: Thinking About Canceling a Credit Card? Ask Yourself These Questions First

With each and every card, I did the math twice. First, I decided opening a new card and paying an annual fee was worth it because all those miles would fuel a future trip I had in mind. A year later (give or take a few weeks), I did the math again and determined that same card wasn't worth paying another annual fee.

Bottom Line

There's no such thing as a one-size-fits-all approach when it comes to travel, credit cards, or finances as a whole. It's deeply personal, based on your travel goals and financial situation. What works for me may not make a lick of sense for what you need.

But I'm fairly confident that this mindset can work for almost anyone. It's just up to you to decide which credit cards have earned a spot in your wallet, which should stay in the drawer, and the ones that you can throw in the dumpster.

Hi,

Great tips, really! BUT you don’t address the fact that getting rid of cards ( cancelling them, correct?) can be detrimental to your credit. I’ve always heard that canceling my card(s) will ding my credit thus I’ve got a drawer full of cards that I even pay the annual for so I don’t ruin my credit score. Any thoughts on this, Kyle? Maybe an article addressing this would be good.