Wouldn't it be great if you could earn points for paying your rent? It seems so sensible, yet none of the major banks or loyalty programs had found a way to tackle the issue without tacking on hefty additional fees … until Bilt Rewards hit the scene, offering a way for renters to earn transferrable points while paying their largest monthly expense.

Depending on who you rent from, you have two different options for how you make your payment and earn points. If you live in one of the 1 million or so apartments that are currently a part of the Bilt Rewards Alliance, you can simply pay your rent through the Bilt app and earn a flat 250 points per month. But if your landlord isn't a part of the Bilt Rewards Alliance – or if you'd like to earn even more points – then you'll really want the Bilt Mastercard® (for full disclosure, this is a personal referral link).

The Bilt Rewards Mastercard allows you to pay your rent through Bilt and earn 1 point per $1, for up to 100,000 points per calendar year – all without paying any additional processing fees. Considering other third-party processors charge around 3% for processing rent payments with a credit card, this can save you a ton while also racking up points. And best of all, the card itself has no annual fee!

While the Bilt Mastercard is marketed towards renters, its appeal stretches far beyond that. With its top-tier transfer partners, an impressive list of travel benefits, useful category bonuses to earn more points, and monthly Rent Day promos, you could easily make the case that the Bilt card is one of the best no-annual-fee travel credit cards, period.

Learn more about the Bilt Mastercard® (for full disclosure, this is a personal referral link).

Let's take a closer look at all the Bilt card has to offer and see if it deserves a place in your wallet – whether you pay rent or not.

Bilt Rewards Mastercard® Overview

The Bilt Rewards Mastercard was initially geared towards renters looking to earn rewards for making their monthly rent payments, without paying additional processing fees. The company is also looking into offering rewards to homeowners paying their mortgage, though there's no timeline or details on that.

But after relaunching the Bilt Card in partnership with Wells Fargo, the card's revamped earning structure now makes it an excellent choice for everyone. No matter your living situation, this card is packed with benefits that help it punch well above almost any other card on the market.

Here's what you get with the Bilt Rewards Mastercard:

- 1x points per dollar spent on rent in the Bilt Rewards app (up to $100,000 per calendar year)

- 1x points per dollar spent on everyday purchases

- 2x points per dollar spent on travel

- 3x points per dollar spent on dining

- Earn double points on Rent Day (the 1st of the month), up to 1,000 bonus points per month

- 6x points per dollar spent on dining

- 4x points per dollar spent on travel

- 2x points per dollar spent on everyday purchases

- 1x points per dollar spent on rent

- Trip cancellation, interruption, and delay protection

- Trip delay reimbursement

- Auto rental collision damage waiver

- Cellular telephone insurance

- No foreign transaction fees

- No annual fee!

In order to earn points for rent and purchases made with your Bilt Card, you need to make a minimum of five purchases each statement period. With this requirement, Bilt is encouraging you to keep its card at the top of your wallet and make it your go-to card for all your purchases. With the ability to earn additional points on dining and travel, that should be reason enough to make it an everyday contender for many folks.

For more information on Bilt Rent Day, check out some of the fun promotions they've run in the past!

Welcome Offer

Let's address the elephant in the room. Unlike other top travel rewards credit cards that lure you in with big welcome bonuses of 60,000 points or more, the Bilt Rewards Mastercard does not come with a flashy welcome offer at all.

That could easily make this card a non-starter for some who rely on those big welcome offers to kick-start their points earning. But what the Bilt card lacks in terms of a welcome offer, it makes up for with new ways to earn more points on your everyday spending through different public and targeted promotions.

While this isn't official, we've heard reports of many new cardholders receiving an email from Bilt on the day their card arrives, offering 5x points per dollar spent everywhere (excluding rent), up to 50,000 points. If you luck out with this kind of offer and time your application around large upcoming purchases, that could make up for the lack of an upfront traditional welcome offer.

Impressive Travel Benefits

Most cards that include built-in travel insurance protection carry annual fees of $100 or more. That's not the case with the Bilt Card.

Sticking true to form, they've found a way to pack benefits typically reserved for premium cards into the no-annual-fee Bilt Mastercard®.

So what kind of benefits are we talking about here?

Trip Cancellation & Interruption Protection

If your trip is canceled or interrupted due to a covered reason, such as death, accidental bodily injury, or physical illness to yourself or a family member, you are eligible for reimbursement of any nonrefundable common carrier (plane, train, bus, cruise, etc.) tickets. In order to be eligible for this benefit, the entire fare must have been purchased with your Bilt Mastercard, though using Bilt points earned from the card would also qualify. Coverage maxes out at $5,000 per covered person

So if you pay for something like airfare or a cruise with your Bilt Card, and you or a family member get sick or hurt before or during your trip, you're eligible for reimbursement of any nonrefundable tickets for you, your spouse, and any dependent children traveling with you.

Trip Delay Reimbursement

If your trip on a common carrier is delayed by six hours or more, you're eligible to receive $200 per day, for up to three days, for necessary expenses like food, temporary lodging, and entertainment. The maximum benefit for all covered travelers is $1,800 per trip. Yet again, you must have used your Bilt Rewards Mastercard to pay the entire fare of your covered trip.

Translation: If your flight gets delayed by six hours or more due to weather, mechanical issues, or any other covered reason, you can get $200 per person to help cover the cost of food, hotels, or even an airline lounge day pass!

Primary Rental Car Insurance

Bilt's auto rental collision damage waiver provides up to $50,000 of coverage in the event of an accident or theft. This is primary coverage, meaning you won't need to run it through your own personal insurance or a separate policy first. And it applies to rentals in both the U.S. and abroad – excluding Israel, Jamaica, The Republic of Ireland, and Northern Ireland.

The one hitch? The length of your rental must be 31 days or less, which certainly shouldn't be an issue for most travelers.

In order to take advantage of this car rental coverage, you must pay for the rental with your Bilt Rewards Mastercard and decline the rental company’s collision loss/damage insurance. It's important to note that this coverage is not all-inclusive, which means it does not cover such things as personal injury, personal liability, or third-party personal property. So it wouldn't cover any damages to other cars or property and it doesn't cover any injuries.

Cellular Telephone Protection

While not travel insurance per se, there's hardly a travel accessory more important than your cellphone. Ensuring it's protected from damage, theft, or loss is a must.

Bilt's cellular telephone insurance will reimburse you, up to $800 per covered loss, in instances where your phone is damaged, stolen, or accidentally parted with (i.e. lost). Reimbursement is limited to the cost of repair or replacement for your original cell phone, minus a $25 deductible.

In order to be eligible for this coverage, you must pay your monthly cell phone bill with the Bilt Mastercard. That coverage applies to all active lines on the plan – not just the primary cardholder's phone.

Read more: The 4 Best Credit Cards Offering Travel Insurance

How to Redeem Bilt Points

Now it's time for the fun part: Reaping the rewards of your spending! There are lots of great ways to use your Bilt points – including some that don't involve travel at all.

Book Travel Through the Bilt Travel Portal

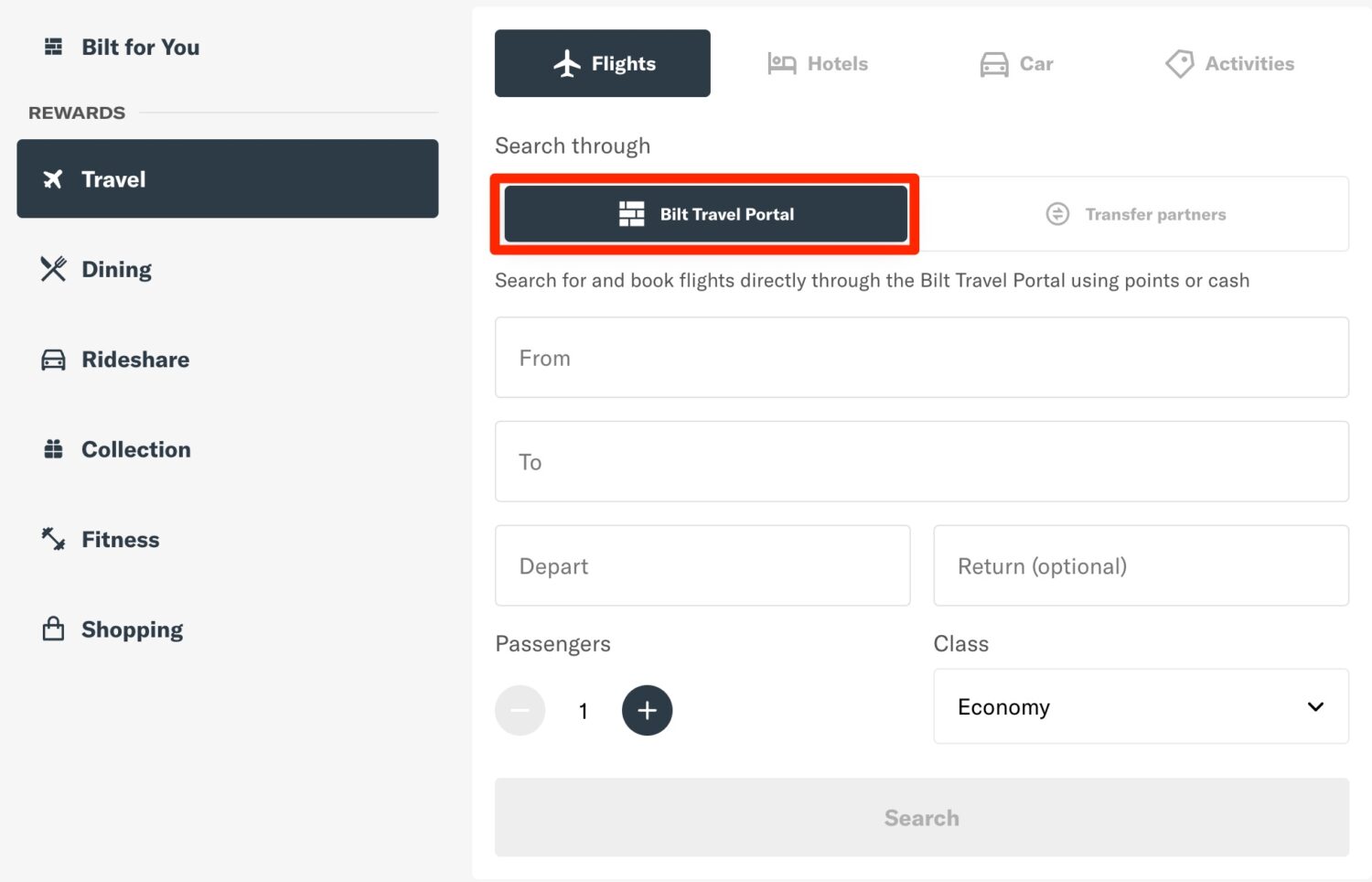

Let's start with the easy one. Bilt partnered with Expedia to build a powerful travel search engine that allows you to search for and book flights, hotels, rental cars, and activities. Your Bilt points are worth 1.25 cents each towards travel when booking through the Bilt Travel Portal.

For the most part, you should see the same pricing that's available directly through the airline's website or what you find via Google Flights. To begin your search, navigate to the “Rewards” section in the Bilt app or on their website and click on “Travel”.

Thrifty Tip: Using your Bilt points like this is a great way to book the flight deals we send out as part of our Thrifty Traveler Premium membership!

If this all sounds and looks familiar, that's because it's also how point bookings work in the Chase travel portal with the *chase sapphire preferred*, albeit without the $95 annual fee.

Read More: Bilt Rewards Launches New Travel Booking Portal Powered by Expedia

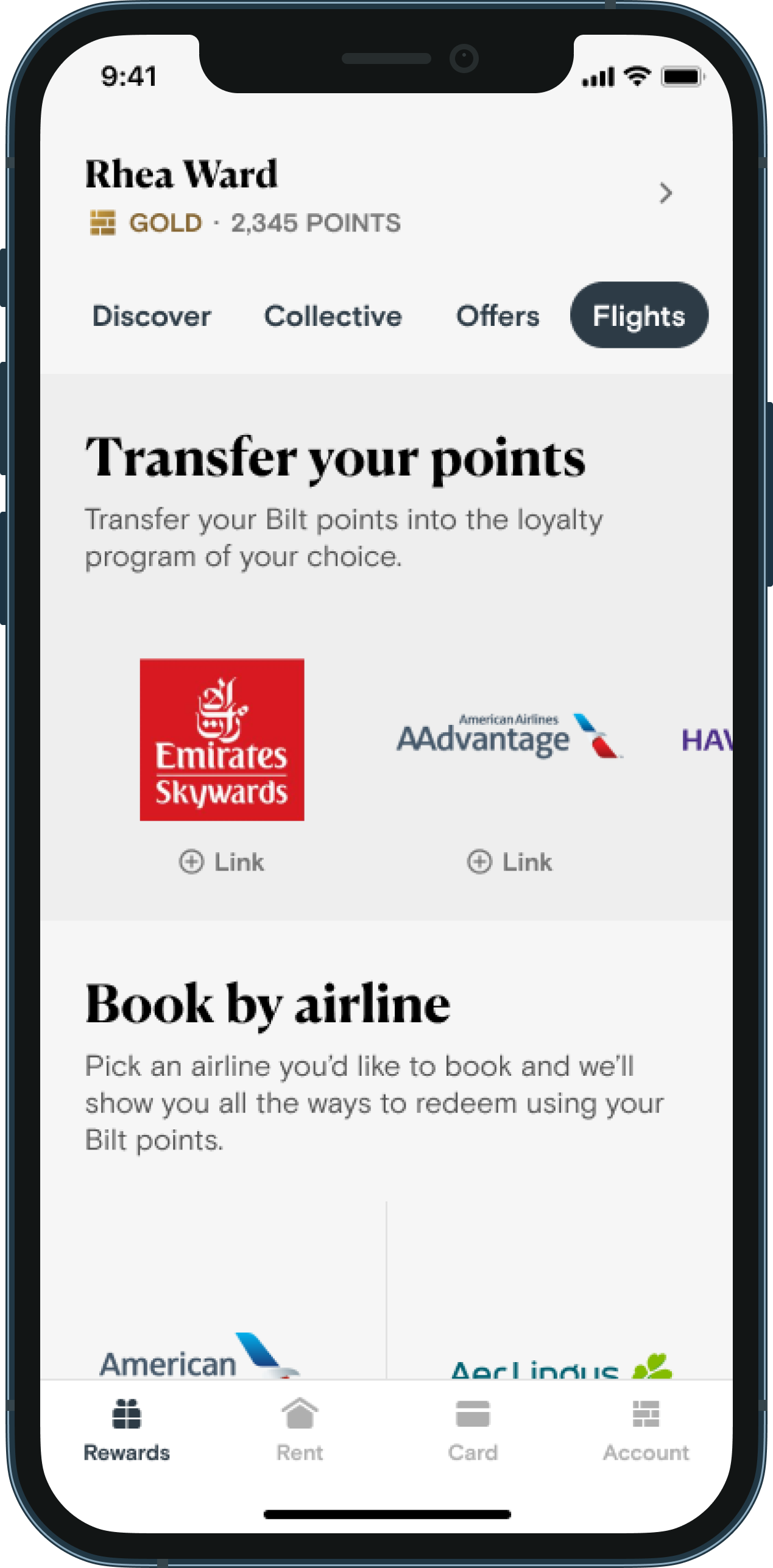

Transfer Points to Partners

The power of Bilt points, though, really lies in Bilt's hotel and airline transfer partners.

Bilt has amassed arguably the best list of transfer partners in the industry. You can transfer your Bilt points at a 1:1 ratio to all of Bilt's transfer partners – or even better, if you time it right with a big transfer bonus – often redeeming them for a much better value than you would get booking through the Bilt travel portal.

Here's a look at all of Bilt's transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus Avios | Airline | 1:1 | Within 10 Minutes |

| Air France/KLM Flying Blue | Airline | 1:1 | Within 10 Minutes |

| Air Canada Aeroplan | Airline | 1:1 | Within 10 Minutes |

| Alaska Airlines Mileage Plan | Airline | 1:1 | Within 10 Minutes |

| Avianca LifeMiles | Airline | 1:1 | Within 10 Minutes |

| British Airways Avios | Airline | 1:1 | Within 10 Minutes |

| Cathay Pacific Asia Miles | Airline | 1:1 | Within 10 Minutes |

| Emirates Skywards | Airline | 1:1 | Within 10 Minutes |

| Iberia Avios | Airline | 1:1 | Within 10 Minutes |

| Japan Airlines (JAL) | Airline | 1:1 | Within 10 Minutes (new accounts may have to wait up to 7 days to redeem) |

| Qatar Airways | Airline | 1:1 | Within 10 Minutes |

| Southwest Rapid Rewards | Airline | 1:1 | Twice per day |

| TAP Air Portugal Miles&Go | Airline | 1:1 | Within 10 Minutes |

| Turkish Miles & Smiles | Airline | 1:1 | Within 10 Minutes |

| United MileagePlus | Airline | 1:1 | Within 10 Minutes |

| Virgin Red | Airline | 1:1 | Within 10 Minutes |

| Accor | Hotel | 3:2 | Within 10 Minutes |

| World of Hyatt | Hotel | 1:1 | Within 10 Minutes |

| IHG Hotels | Hotel | 1:1 | Within 10 Minutes |

| Marriott Bonvoy | Hotel | 1:1 | Within 10 Minutes |

| Hilton Honors | Hotel | 1:1 | Within 10 Minutes |

Transferring points and booking award tickets is a bit more advanced, requiring you to know about things like award charts, routing rules, partner programs – the list goes on and on. But Bilt has taken some of the work out of these complicated redemptions by teaming up with the powerful award search tool, point.me, offering members a way to find flights that are bookable with one of Bilt's airline transfer partners.

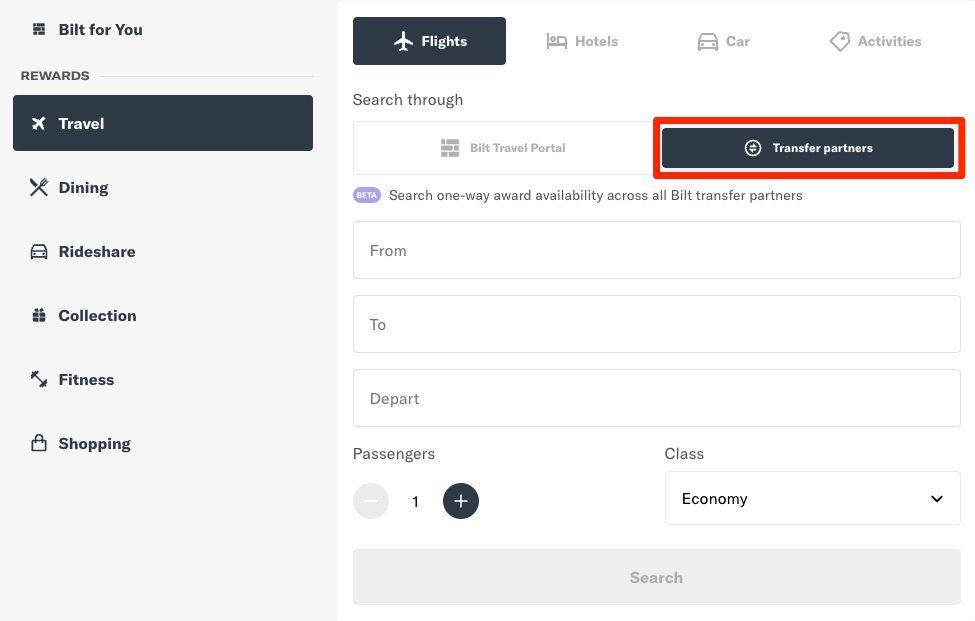

Instead of navigating to the travel portal when you go to redeem rewards through Bilt's website, you'll simply need to change to the “Transfer partners” search option and input your desired search criteria such as date, destination, and departure city.

The site will then search for one-way award availability across all Bilt transfer partners. It will then display all your options for transferring your Bilt points to an airline partner's mileage program and booking that same flight.

Be warned that because the search tool is looking for award availability across multiple travel partners, it takes a little longer to search than you're probably used to. As it starts to find options, they will appear on the screen before the complete list is available. When finished, you can sort the list by “quickest flight” or “lowest price.”

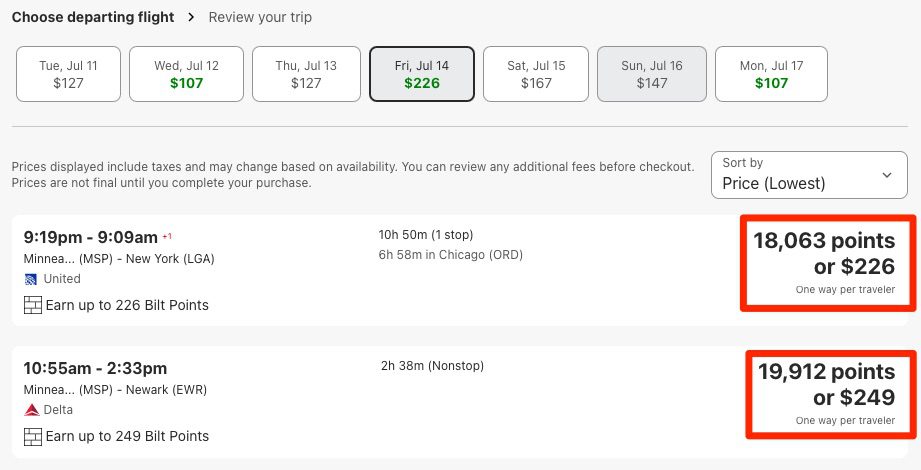

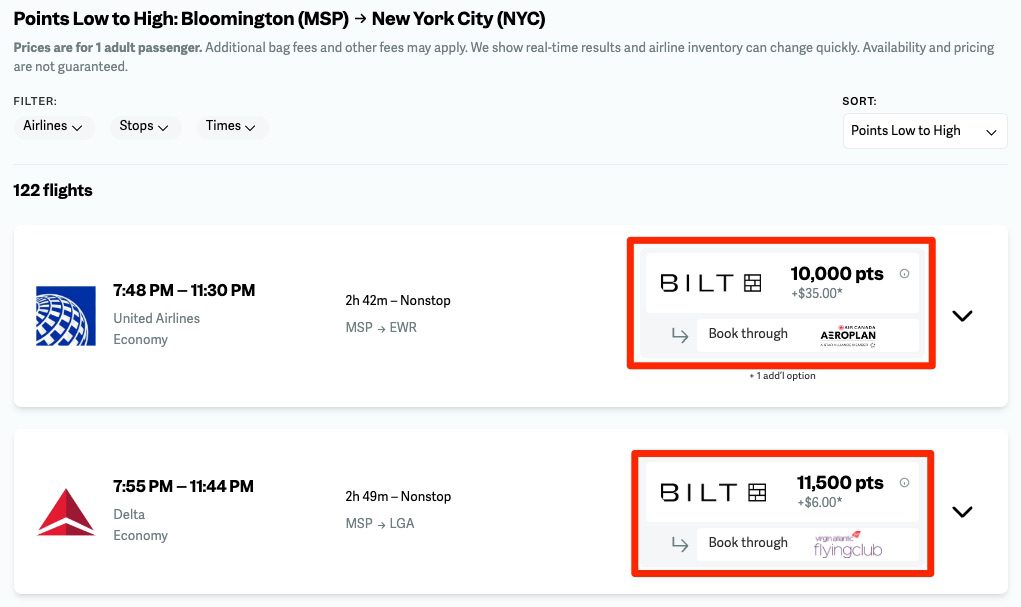

Let's use the same Minneapolis-New York flight that we used above as an example.

Here, you'll see the two cheapest award options for using Bilt points are by booking with Air Canada's Aeroplan or Virgin Atlantic's Flying Club. In both instances, transferring Bilt points to one of these partners would be significant savings over using them to book for the same date through the Bilt travel portal.

If you're looking to transfer your Bilt points to a hotel loyalty program like Hyatt instead, Bilt partnered with Awayz to help members find hotels where they're able to use their points for an award booking. This means Bilt members can use the Bilt website or app to search for real-time award availability at Hyatt, Marriott and IHG properties, Bilt's three hotel transfer partners. The search process is nearly identical to finding a flight, you'll just need to select the “Hotels” tab instead of “Flights.”

Read more: A Complete Guide to Bilt Rewards Transfer Partners

Non-Travel Redemptions

As promised, you can even use your Bilt points for things other than travel – though in most instances, your points won't be worth nearly as much.

Still, it's nice to have the option to use your points for things like merchandise, fitness classes, or even for paying rent!

One of the easiest ways to use your points, for something other than travel, is to use them on Amazon purchases. Simply link your Bilt Mastercard to your Amazon account and choose the “pay with points” option at checkout.

Using your points for Amazon purchases will give you a value of .7 cents per point (100 Bilt points = $0.70). Again, that makes it a much less valuable redemption than either the travel portal or transferring your points to partners.

In addition to Amazon purchases, you can also use your points to cover the cost of everyday items within the “Bilt Collection.” Here you'll find everything from chess sets to ski goggles to artwork.

Given the wide array of items available through the “Bilt Collection”, there should be a little something for everyone, but just like with using your points for Amazon purchases, the value per point isn't terribly good.

One last redemption option is pretty fitting for a credit card that started as a way for renters to earn rewards and build their credit: Using your points towards a down payment on a house. Given the recent rise in home prices and interest rates, home ownership likely seems out of reach for some. But being able to earn rewards on rent, then use them for a down payment (at a rate of 1.5 cents per point) can help a lot.

More Ways to Earn Bilt Points

So what if you're still not earning Bilt points quite as quickly as you'd like? Bilt has come up with some creative ways for both cardholders and everyday members to engage with the program and earn additional points. Some of these we've already covered or alluded to, but others might be brand new, so let's take a look.

Pay Rent

If you're a renter it's an absolute no-brainer to use the Bilt Rewards program – there's simply no better way to earn points on one of your biggest monthly expenses. There are over 1 million apartments in the Bilt Rewards Alliance that have partnered with Bilt, accepting monthly rent payments straight through the Bilt app.

What if your property isn't a part of the Bilt Rewards Alliance? No worries! You can still earn points by putting your monthly rent payment on your Bilt Mastercard. Even if your property only accepts checks, you can pay with the Bilt card and they will send a paper check on your behalf.

Refer a Friend

Bilt incentivizes you to share your love for the Bilt Mastercard® by referring friends. In turn, you'll receive 2,500 Bilt points for every friend you refer with an additional 10,000-point bonus for completing five referrals.

The number of points you can earn through the referral program is capped at 2 million Bilt points. So unless you're really popular, you shouldn't have an issue with too many referrals.

Link Loyalty Programs

Bilt has partnered with some of the biggest names in travel – such as Alaska Airlines, United, Hyatt, and IHG – to offer 1:1 point transfers and allow redemptions within those individual award programs. You can currently earn 100 bonus points for every loyalty program that you link to your Bilt Rewards account.

That means if you link a new or existing account to all 16 of their partners (as of publication), you'll earn 1,600 transferrable points. These are seriously some of the easiest points you'll ever earn!

Bilt and Lyft

Bilt and Lyft have partnered together to allow Bilt Rewards members to earn points on each and every Lyft ride. You'll earn 2x Bilt points for every dollar spent with Lyft – and an additional 3x Bilt points if you pay with a Bilt Mastercard. All you need to do is link your accounts in the Bilt app, then select Bilt as your preferred rewards program.

Knowing how integral rideshares have become in our daily lives, this is a pretty easy way to earn some extra points for simply getting to where you need to go.

Read More: Earn Up to 5x Bilt Points on Every Lyft Ride!

Bilt Dining

Bilt launched an exciting new feature in its app called Bilt Dining, allowing members to earn bonus points at participating restaurants. While the biggest bonus is for members who pay with their Bilt Mastercard®, Bilt also allows members to link non-Bilt cards to the dining program in the app and earn extra points that way as well.

Exactly how many points you earn will vary from restaurant to restaurant but you can generally expect to get 3x Bilt points – and that's on top of what you'd earn from your credit card.

With earning rates nearly identical between Bilt Dining and other airline dining portals, I'd much prefer to earn transferable Bilt points instead of an individual airline's miles. And if you ask me, you should too.

Read More: Earn Bonus Bilt Points at Select Restaurants

Bottom Line

The Bilt Rewards loyalty program has been a disruptor in the industry since day one, so it should come as no surprise that they'd aim to do the same thing with their credit card. While initially targeted toward renters, the Bilt Mastercard® is an extremely well-rounded travel rewards credit card that any traveler would do well to have in their wallet.

Travel benefits like trip delay and cancellation protection, no foreign transaction fees, and access to a full slate of transfer partners, are unheard of for a card with no annual fee. Most of all. it's unprecedented to be able to pay rent and earn valuable points without paying additional transaction fees. Add it all up, and we might just have a challenger to our best card for beginners.

Learn more about the Bilt Mastercard® (for full disclosure, this is a personal referral link).

I recently got the Bilt Credit Card and DO NOTTTT RECOMMEND!!! The customer service is atrocious and your check will bounce!!! They refuse to pay any fees related to their bounced checks… atrocious.