Got a stash of transferable points from banks like American Express, Capital One, or Chase? Take advantage of these current transfer bonuses to get even more out of them.

Think of transfer bonuses as a way to get free miles. The big banks routinely roll out bonuses of 10% to as much as 40% – and sometimes even more! – when transferring points to select airline or hotel partners. With a 25% transfer bonus, for example, you'd only need to transfer 40,000 points to get the 50,000 miles you may need to book an award ticket.

Here are all the current transfer bonuses available as of publication, broken down bank by bank.

| Transfer from | Transfer to | Bonus | Expires | More info |

|---|---|---|---|---|

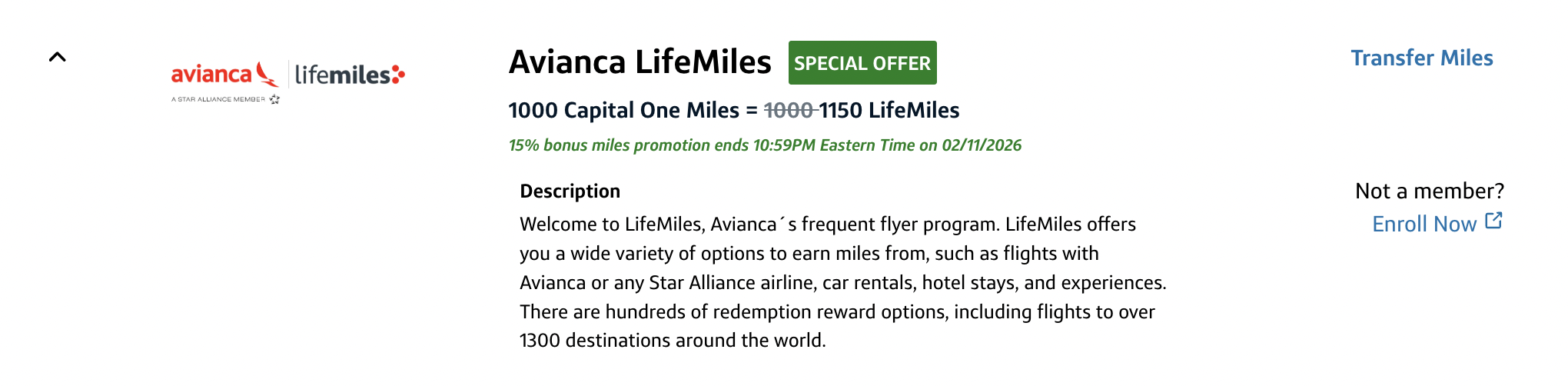

| Capital One | Avianca LifeMiles | 15% | Feb. 11, 2026 | Full details |

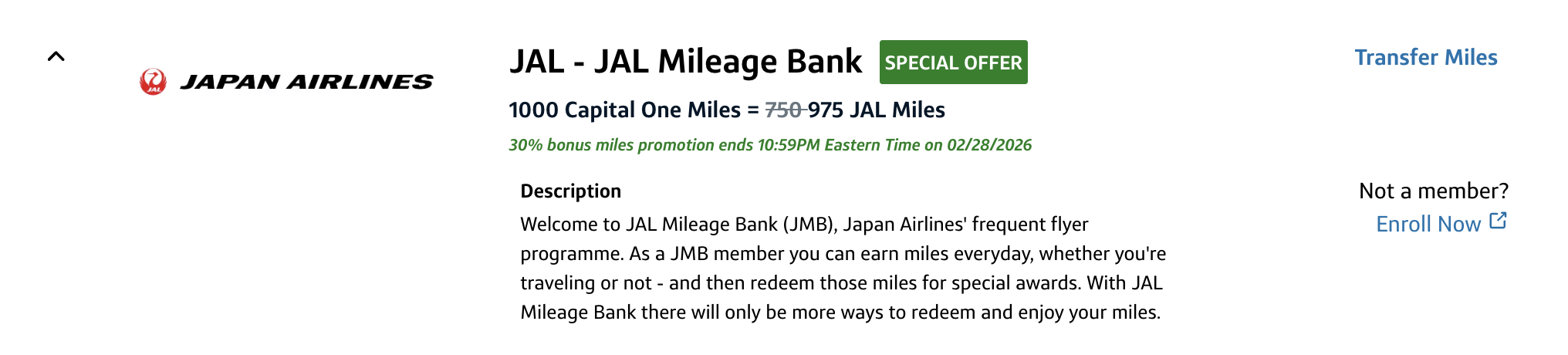

| Capital One | JAL Mileage Bank | 30% | Feb. 28, 2026 | Full details |

| Chase | Marriott Bonvoy | 50% | Feb. 28, 2026 |

Wondering why you should transfer your points? Read up on how it can help you book flights for less!

But before you rush to send your points somewhere with a bonus, remember: These transfers are a one-way street. Once you send the points to an airline partner, you cannot get them back to your Capital One, Chase, or other credit card account. That means you'll generally want to have a redemption in mind (and make sure the flights or hotels you want are actually available to book) before transferring your points.

Let's take a closer look at each of the current transfer bonuses and how you may (or may not) want to use them.

15% Bonus on Capital One Transfers to Avianca LifeMiles

You can currently get a 15% bonus when moving Capital One miles to Avianca LifeMiles – giving cardholders a way to save even more on Star Alliance award flights. This transfer bonus runs through tonight, Feb. 11 at 10:59 p.m. ET.

If you're unfamiliar, LifeMiles is the quirky yet underrated mileage program of South American carrier Avianca. While customer service can be spotty at best and even its website is hit or miss, you put up with it because few airline programs offer cheaper ways to book flights using miles around the globe – with low cash taxes and fees, too.

Sadly, LifeMiles don't go quite as far as they used to after a couple of nasty devaluations over the last year – the program raised many award rates to Europe, Asia, and beyond by as much as 70%! Thankfully, Avianca rolled back some of these devaluations, and there are still deals to be had – including business class to Europe for as low as just 55,000 miles each way.

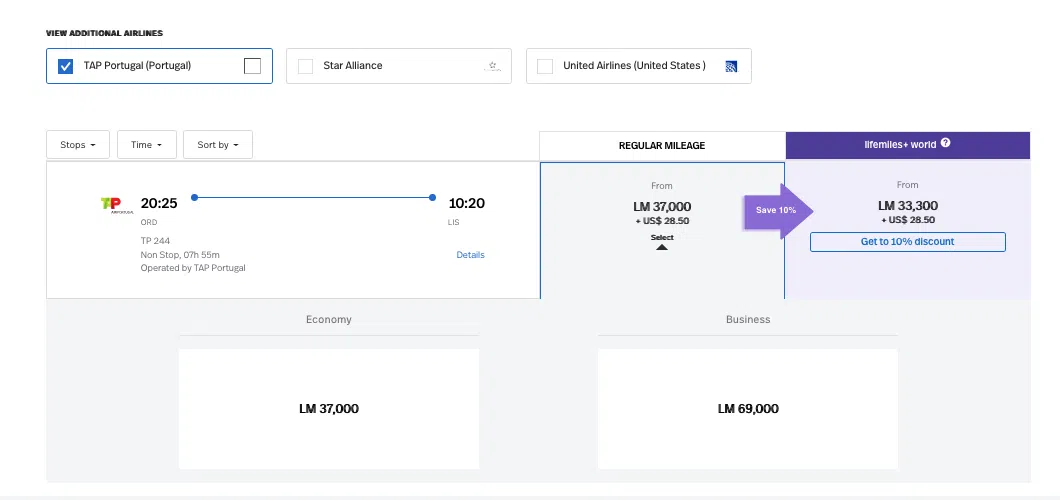

So long as you avoid United, you'll now generally pay 69,000 miles one-way for a business class award to Europe with Avianca LifeMiles. That's true whether you're hopping on a short overseas flight from the East Coast … or making a longer journey, like this TAP Air Portugal business class fight from Chicago-O'Hare (ORD) to Lisbon (LIS).

With a 15% bonus, you'd only need to transfer 60,000 Capital One miles to make it a reality.

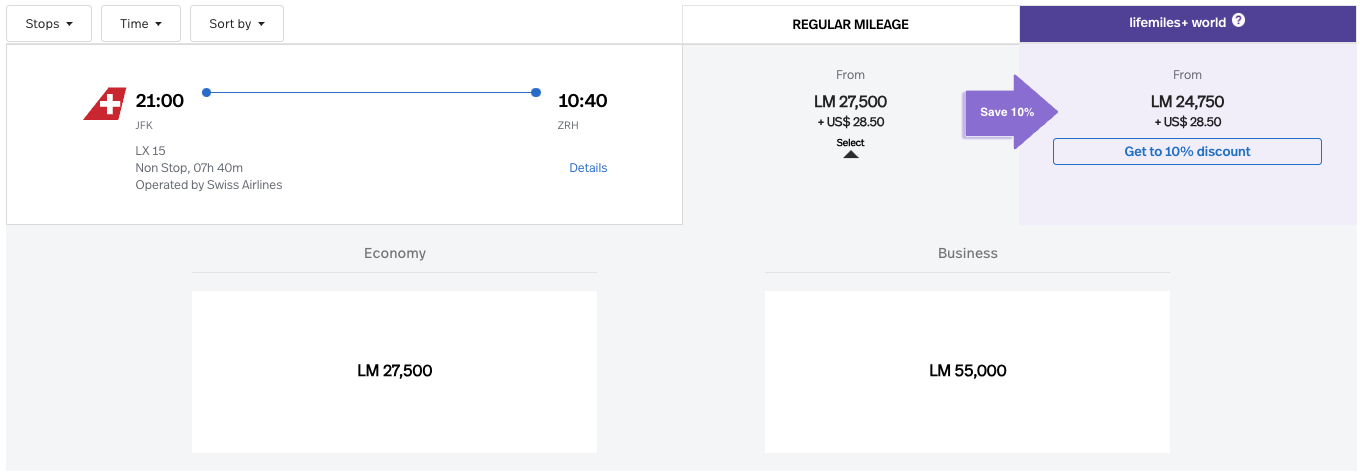

But LifeMiles is full of oddities … in a good way: There are a handful of routes that price out even cheaper. For example, you can head to Switzerland on this SWISS business class route from New York City (JFK) to Zurich (ZRH) for just 55,000 miles. Factor in that transfer bonus, and you need just 48,000 Capital One miles to book!

Check out this story for full details on this transfer bonus!

30% Bonus from Capital One to Japan Airlines

Travelers with cards like the *venture x* and the *capital one venture card* can get a 30% bonus when transferring miles to Japan Airlines (JAL) Mileage Bank.

That brings JAL's ordinarily subpar transfer ratio of 1,000:750 to nearly a 1:1 transfer. For every 1,000 Capital One miles you transfer, you'll get 975 miles. Yes, the math is messy – multiply the miles you need by 1.0256 to determine what you need to transfer – but it's well worth the trouble for what's an incredibly lucrative mileage program … with tons of incredible sweet spots.

This bonus ends on Saturday, Feb. 28, so you've got the rest of the month to take advantage!

These days, everyone wants to go to Japan … and for good reason. It's clean, safe, modern (yet steeped in culture), and don't even get me started on the food.

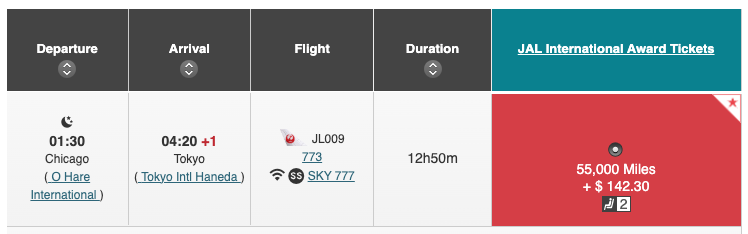

Flying Japan Airlines from one of the carrier's nine North American gateways to Tokyo Haneda (HND) or Narita (NRT) – or even Osaka (KIX) – is a great way to cross the Pacific, no matter if you're flying in economy or business class. Thanks to JAL's reasonable award chart, a one-way ticket to Japan will set you back as few as 27,000 miles in economy, 40,000 miles in premium economy, or 55,000 miles in business class. That's even better than what American AAdvantage charges!

The only problem? It had been practically impossible for U.S. travelers to actually earn JAL miles. But that all changed when Bilt and Capital One added JAL as a transfer partner last year – opening the door to some incredible sweet spots.

Take this flight from Chicago-O'Hare (ORD) to Tokyo-Haneda (HND) for example. You can book a Japan Airlines business class seat on the nearly 13-hour flight to Japan for just 55,000 miles – just 56,500 Capital One miles with the current transfer bonus – and $142 in taxes and fees.

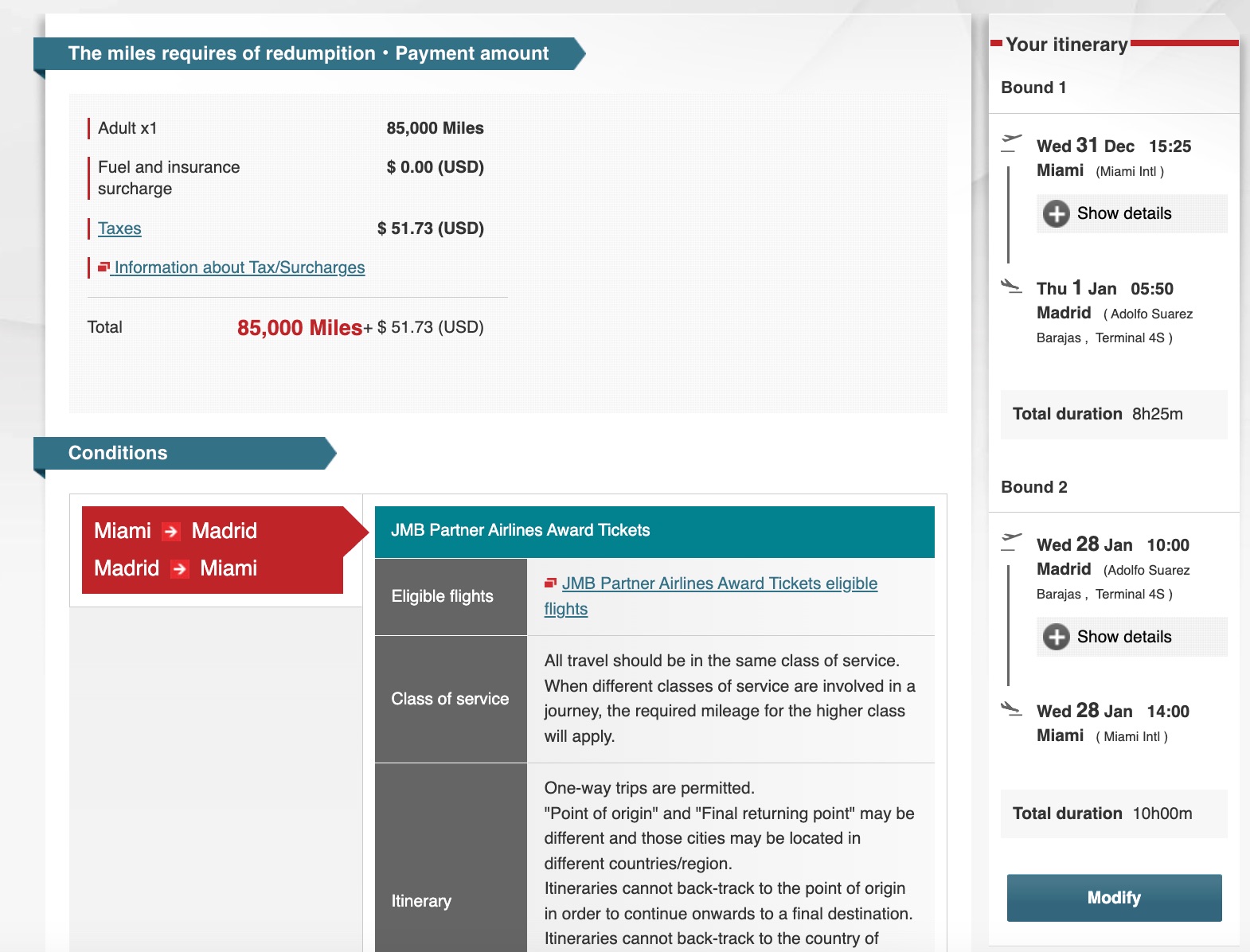

Or how about roundtrip business class flights to Europe for just 85,000 miles? With the current 30% transfer bonus, you'd only need to transfer 87,200 Capital One miles to JAL to book these flights with American Airlines! That's a steal …

Like many airline mileage programs, JAL uses a distance-based award chart for partner award redemptions: The longer your flight, the more miles it may cost. But unlike virtually every other airline, it doesn't tally each segment separately: It adds the distances together for the final price.

Because the Miami-to-Madrid flight clocks in at 4,424 miles (according to GCMap.com, an amazing resource for situations like this) JAL's award chart dictates that it costs 60,000 miles in each direction. But by doubling the distance with that return segment, it adds up to just under 8,900 miles total – falling into that 85,000-mile price bracket.

The possibilities are practically endless with this roundtrip sweet spot – in part, because Japan Airlines has a wonky worldwide network of partner airlines. Of course, there are fellow Oneworld carriers such as American, Alaska, and British Airways. But you can also book Air France, Emirates, JetBlue, and others using JAL miles.

Read more: JAL Mileage Bank is a Goldmine for Roundtrip Partner Awards

50% Bonus on Chase Transfers to Marriott Bonvoy

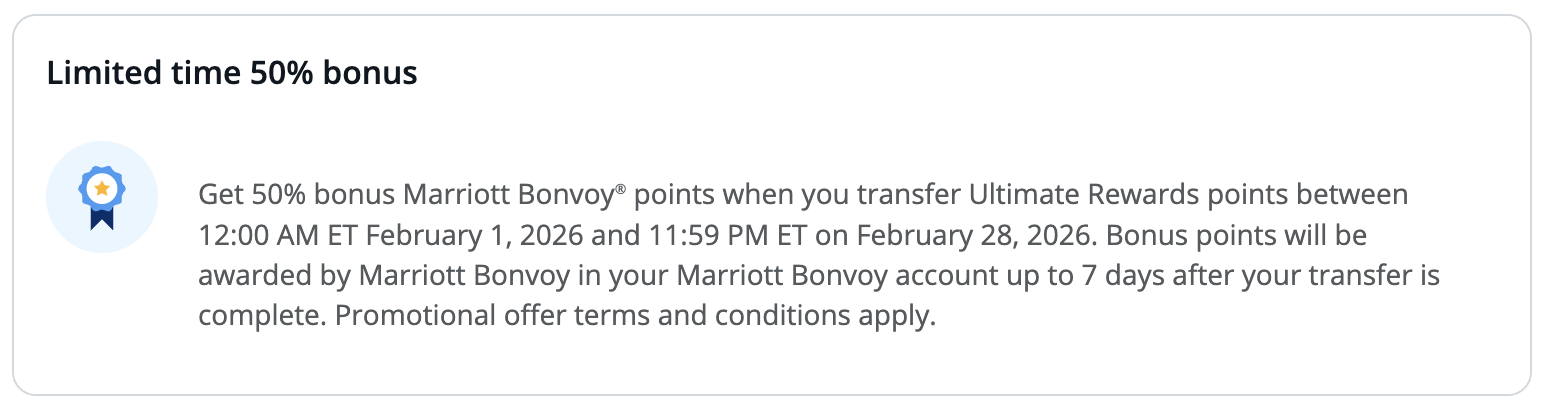

Chase is currently offering a 50% transfer bonus when moving Ultimate Rewards points to Marriott Bonvoy. This transfer bonus runs through Feb. 28, so you've got a couple of weeks remaining to take advantage.

It's easy to see a 50% bonus and get excited. But be warned that not all points are created equal … especially with hotel points like Marriott. Still, if you have a particular hotel in mind and need to top off your account with a few extra points in order to make it a reality, transferring Membership Rewards to Marriott with a 50% bonus is certainly better than the usual 1:1 ratio.

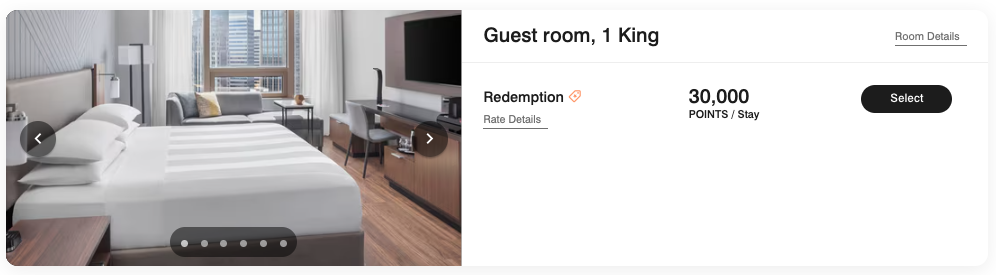

Looking at a one-night stay in downtown Minneapolis, you can book the Minneapolis Marriott City Center for 30,000 Bonvoy points per night. If you didn't already have any Bonvoy points in your account, you'd need to transfer 20,000 Chase points with the current transfer bonus in order to have enough points to book this stay.

That sure beats the nearly $300-per-night rate Marriott charges when paying cash. You'll find similar deals at other Marriott hotels around the world, but not all of them will be quite so good. Be sure to do the math to make sure you're coming out ahead.

Bottom Line

Transfer bonuses can be a great way to get more value from your points and help you realize your dream vacation even sooner. These bonuses are constantly coming and going, so it's important to stay up-to-date on the current promotions before moving your points to ensure you're not leaving any free points on the table.

But it's always best to keep your points flexible until you're ready to book. Due to constant loyalty-program devaluations, transferring points without an immediate plan to use them is rarely a good option.

Please advise when they are any good transfer bonus from Chase!

Hi we’ve accumulated a lot of Capital One Venture points over the years. Are they transferable or should I have the Venture X or Amex or other cards instead? Ty!

They are also transferrable – identical, in fact, to the Venture X. Capital One just isn’t quite as generous with transfer bonuses as other banks, which is why you don’t see them in this story. Here’s our guide on Capital One transfer partners.

Flying Blue charges as LITTLE as 50k for biz to Europe. Redemptions increase significantly from that amount.

Thanks for sharing! I didn’t realize my Citi card was ineligible for points transfer until I read “To take advantage of this bonus you’ll first need to have a card that earns transferable ThankYou points like the Citi Premier® Card.” So although I am disappointed to not have flexible use of those ThankYou points, now I know to spend instead on my more flexible cards!

Hi! This is super helpful, thank you! Quick question – do you simply need to transfer the points from the card to the hotel or airline stated above by the deadline/deal expiration, or do you need to actually travel between the transfer bonus announcement and their expiration date? Thank you!

Hi Amy. You just need to transfer them. No requirement to use them by the expiration date for the transfer bonus.