After dominating the headlines for the last three-plus years, inflation is cooling. The numbers keep trending down in federal inflation reports, culminating in the Federal Reserve's recent interest rate cut – the first in more than four years.

But with frequent flyer miles, it's accelerating: Airlines keep raising award rates, charging more and more miles while eliminating sweet spots and gutting valuable redemptions. Pointsflation is out of control – and there's no sign of it slowing down any time soon.

At home, major U.S. airlines like Delta and United and their dynamic award pricing based on the cash cost has led to exorbitant redemptions in economy and especially business class, where rates of 400,000 miles have become the norm. But even international airlines (where you can transfer credit card points for a better deal) aren't safe: A once-reliable workaround to fly Delta One to Europe for 50,000 points disappeared overnight, the best business class redemptions to Japan now cost you 25% more miles, and the best ways to book flights to Hawaii have all taken a hit.

Devaluations like these are inevitable in the world of points and miles, but they've become a constant in 2024. It's gotten so bad that the Department of Transportation launched its own probe of “potential unfair, deceptive, or anticompetitive practices” at the frequent flyer programs of the four largest U.S. airlines: American, Delta, Southwest, and United.

What's driving this constant onslaught of bad news for points and miles aficionados? And what can you do? Let's dive in.

Just How Bad is Pointsflation?

Really bad. But let's back up.

There are hundreds of airlines out there, and they each individually determine exactly how many miles you need to get from point A to point B. Many airlines use an award chart to lay out that pricing … but they can (and do) change them. And when they do, that rarely benefits travelers.

Here in the U.S., nearly all the major carriers have ditched their award charts in favor of dynamic award pricing that closely mirrors the cash value of a ticket. That makes it even easier to suddenly devalue these programs and make it much harder for travelers to book the trip they saved their miles for … or even understand how many miles they actually need in the first place.

Put it together, and airlines have all the power they need to charge you more miles – and that's what they're doing. Here's just a few of the many major airline devaluations we've seen:

- Avianca LifeMiles recently rolled out some overnight award rate increases last month, ranging from mild increases to a brutal 63% hike for international premium cabin flights like Lufthansa First Class between the U.S. and Germany.

- For the second time in just a few months, British Airways increased award rates to book Alaska and American flights by as much as 45%.

- Many flights booked with Alaska miles now cost more, like Fiji Airways business class flights jumping from 55,000 miles to as much as 75,000 miles.

- Southwest raised award rates by 4% across the board at the start of 2024.

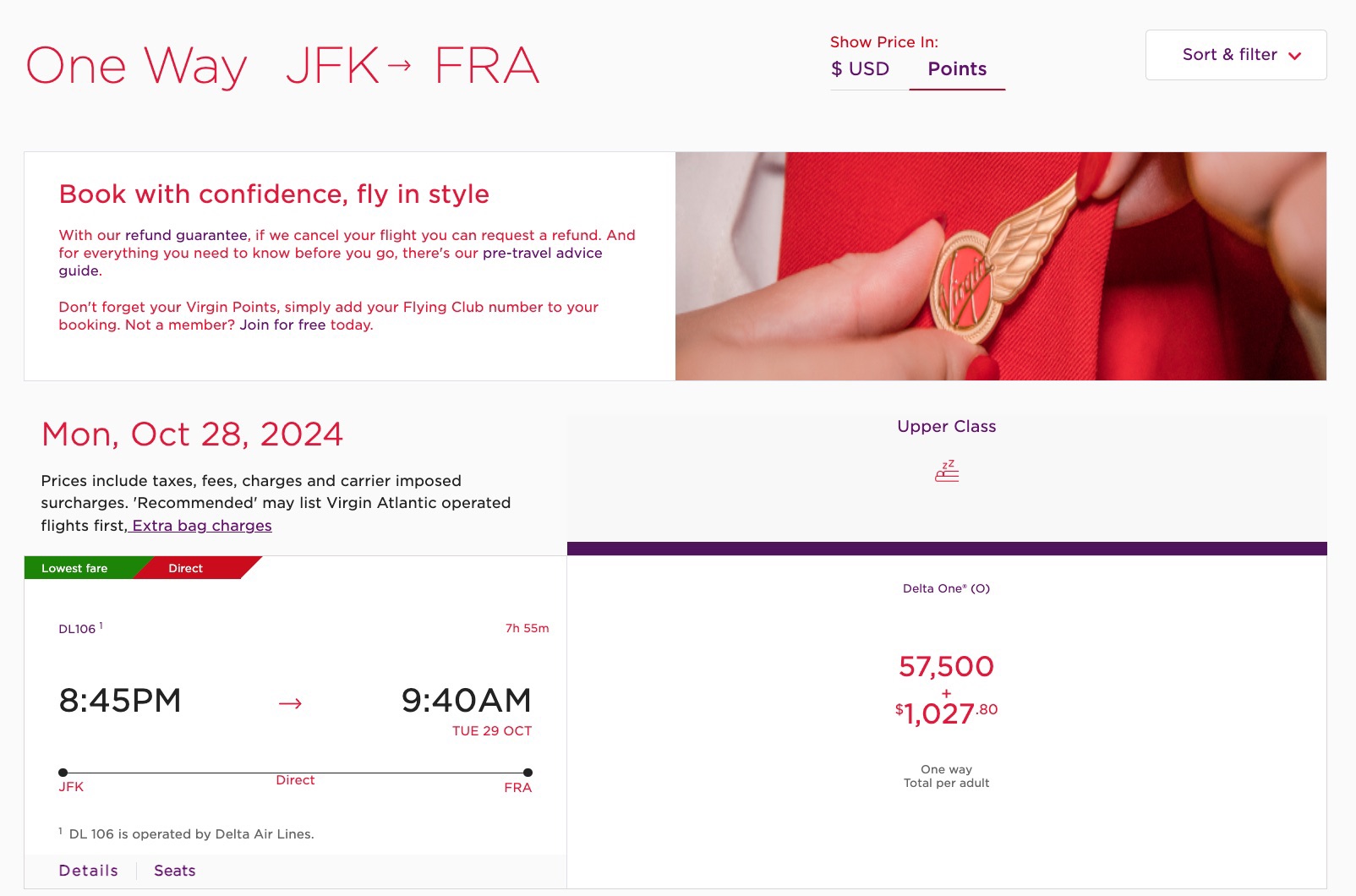

- Late last year, Virgin Atlantic raised award rates on most Delta flights by as much as 60% … only to follow up this summer by axing beloved 50,000-point redemptions to fly Delta One to Europe. Virgin has also raised award rates for ANA business and first class within the last 18 months.

- United hiked award rates to Europe, Asia, and beyond by 20% or more without a word of warning last year.

But Delta is still the poster child for exorbitant award rates.

Long before other major U.S. airlines, Delta did away with its award chart way back in 2015, removing a critical reference point for travelers to figure out how many SkyMiles it should cost to fly from point A to point B.

And those rates seem to keep climbing and climbing. While Delta is far from alone, the Atlanta-based carrier has practically turned devaluations into an art form.

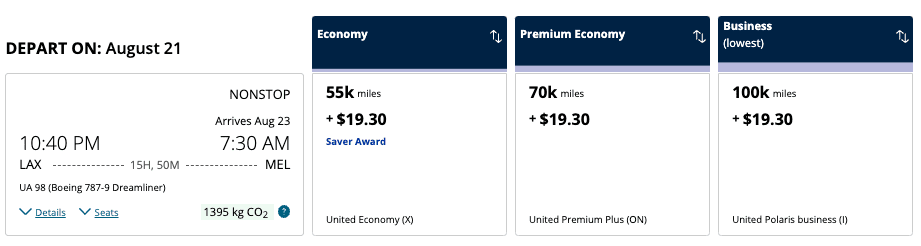

For years, our mantra was: “Forget what you've heard, SkyMiles are not worthless.” But they are, in fact, worthless if you want to fly business class: Delta One business class awards that were once bookable for roughly 60,000 miles each way have ballooned to 120,000 SkyMiles, then 200,000 SkyMiles, and now often 400,000 SkyMiles or more each way.

But it's not just business class anymore: Higher award rates to fly economy have spread to many routes across the globe, too.

And the ripple effects stretch beyond the U.S. airline industry. Delta's close partner airline, U.K.-based Virgin Atlantic, quietly raised award rates for many Delta One tickets to Europe from a flat 50,000 points and $5.60 in taxes to as much as 77,500 points … while adding a cash surcharge of more than $1,000 on each and every Delta business class redemption.

But why? Why has pointsflation spun out of control recently?

Look in your wallet.

The Rise & Fall of Flexible Travel Credit Card Points

Much of what we're seeing today all ties back to the early days of the pandemic.

With travel suddenly at a standstill in early 2020, airlines mortgaged their loyalty programs to stay afloat. In doing so, they pre-sold the banks millions and millions of points and miles for a quick influx of cash. At the same time, the big banks themselves were forced to up the ante with bigger and bigger bonuses in order to grab the attention of travelers who simply weren't traveling.

What was once a standard 60,000-point welcome bonus on *amex platinum* has steadily grown as large as 175,000 points. Chase has upped the ante with its most popular travel cards coming out of the pandemic, with bonuses of 75,000 points on the *chase sapphire preferred* after spending $5,000 in the first three months of card membership.

Read more: The 11 Best Credit Card Offers for Travelers in September 2024

As more and more points have flooded the market due to these huge credit card offers, airlines and hotel chains have responded by raising the award rates to book their seats and rooms for free. In isolation, each increase feels like a painful targeted devaluation.

But zoom out for the big picture, and it’s inflation … for credit card points. Yes, it's pointsflation.

The undeniable pattern continues today. Whether it's Alaska Airlines and British Airways hiking their award rates for Oneworld partner flights or Avianca LifeMiles and Turkish Airlines completely obliterating many Star Alliance sweet spots, no one is safe from devaluations.

The banks have responded too, adding additional restrictions to stop consumers from piling up points by hopping from one card to the next. Chase has its longstanding 5/24 rule while American Express has rolled out new rules: You can now only work your way up within a “family” of Amex cards, not down.

So while it's fine to get the American Express® Green Card and then get a bonus on the *amex gold card*, the reverse won't work. And if you start with *amex platinum card*, you've made yourself ineligible to get welcome bonuses on the other two cards. The same goes for Delta SkyMiles co-branded cards and many more.

Read more: Master Guide to Credit Card Applications: All the Rules You Need to Know, Bank by Bank

Banks and airlines may have lit the match that started this pointsflation … but others poured fuel on the fire to get us where we are today. And we share the blame.

The Emergence of Travel Influencers & Websites

For decades, points and miles aficionados were a small group. It was a niche hobby, confined to internet forums and chat rooms of a few travelers hellbent on squeezing every cent possible out of their points.

In 2024, points and miles are officially mainstream – or something close to it. There's an entirely new ecosystem of social media influencers hawking credit card bonuses or highlighting the best ways to redeem them. And there's a growing number of websites (including, admittedly, the one you're currently reading) devoted to doing the same.

Award travel has exploded into public view. So it's not just that the bonuses are bigger than ever – it's that more Americans are picking up those cards, earning and redeeming those points, than ever before.

Just look at the countless Instagram Reels and TikToks – some better than others – promoting credit cards to redeem premium cabin seats that typically cost $5,000 or more. Topics that you could previously only learn about on forums like FlyerTalk are now the subject of viral social media content, racking up tens of millions of views and gaining unprecedented exposure.

We're not saying that's a bad thing, and we're definitely not trying to gatekeep. We share the same goal: to help people travel more for less and to use those credit card points and airline miles wisely. The more, the merrier.

But if you're looking to pinpoint the causes of pointsflation, there's no question that the rise of social media has played a part in over-saturating the market with miles in the hands of savvier travelers.

And there's another place to look.

More Tools Mean Easier (But More Expensive) Redemptions

We run Thrifty Traveler Premium, a flight deal service that sends cheap airfare deals and points and miles alerts straight to members' inboxes. We're biased, but we're confident it's the best flight deal service on the market … but increasingly, we're not alone.

In just the last few years, there's been an absolute explosion of online tools with one purpose: Helping travelers zero in on that hard-to-find award space to put their points to use. There are more than a dozen, ranging from platforms geared toward beginners just getting started with earning and redeeming points to next-level tools that you need to be a seasoned pro to make use of.

A few others worth highlighting include:

- Point.me, a revolutionary tool with an easy-to-understand interface and step-by-step instructions to find and book award tickets

- Roame, a great tool with limited free functionality but an incredibly powerful paid product

- PointsYeah, a funnily named yet incredibly effective tool with the best free service on this list

- Seats.aero, one of the most popular award search tools out there and arguably the most powerful … but not for novices

Read more: 10 of the Best Award Search Tools to Use Your Points & Miles

Few (if any) of these tools even existed before the pandemic – not counting our service, of course. And they can all be a massive help to travelers hoping to get the best bang for the buck … I mean, points.

But that's also created a Catch-22. It's become a game of cat-and-mouse between travelers – who suddenly have some serious firepower to find the best redemptions – and the airlines, who want to limit how much they're losing in (nearly) free travel.

As it's gotten easier to find the best deals with these tools in hand, airlines have two solutions:

- Throttle award availability, making it increasingly harder to actually book those flights with points in the first place

- Raise award rates, charging more and more miles than they used to

Unfortunately for all of us, airlines are doing both.

How to Beat Pointsflation

Are credit card points and frequent flyer miles on their way out? It's easy to get negative, but the days of booking award travel are not drawing to an end.

Here's how to get an edge against the airlines in the never-ending story of pointsflation.

Stop Hoarding Your Points and Miles

I've said it before but I need to say it again: Do not hoard your points and miles!

That's it. That's the story.

Tempting though it might be to simply watch your balance of points grow, you won't just be missing out on worthwhile travel opportunities – those points will simply become less valuable as airlines continually raise award rates.

Plus, too many travelers obsess over squeezing every single penny out of each point for the most valuable redemptions … that they wind up not using them at all. We call it points paralysis. But you need to resist that urge. The purpose of points and miles is to use them.

If there's one maxim we can share, it's this: Use your points and miles for a trip you otherwise wouldn't take. Wait too long, and those miles are all-but-certain to get less valuable.

Trust me here. The best award deals will disappear. The ability to keep earning points won't.

Ask yourself what you would rather have: A million points? Or the memories from an amazing trip to Europe, Australia, Southeast Asia, or beyond using some of those points? To me, that's an easy answer.

Read more: Stop Waiting! Now's the Time to Use Your Points and Miles!

Keep Earning Flexible and Transferrable Points

Points and miles are not an investment … except for in one way: Just like with stocks, it's critical to diversify.

That's why we hammer the value of points from credit cards like Chase, American Express, Capital One, Bilt, and more – and urge travelers to stop swiping one of those co-branded airline credit cards for each and every purchase.

Flexible credit card points are simply more valuable than airline miles for one reason: You can transfer them to a dozen or more different airlines and hotel chains. But when you focus on earning miles with one carrier, you are locked into earning and using the miles through that one, single airline.

So if Delta devalues SkyMiles again (spoiler alert: they will), your big balance of Delta SkyMiles is suddenly far less valuable. But if you're earning Amex Membership Rewards points from cards like the *amex gold*, it doesn't hurt as much: You can transfer those points to Delta … as well as 20 other Amex transfer partners where you might find a much better deal.

Plus, wouldn't you rather spend 75,000 points on a business class flight to Asia through Air Canada Aeroplan …

… than spend roughly the same amount of Delta SkyMiles on an economy flight?

Read more: Quit Charging Everything to Your Favorite Airline Credit Card

Bottom Line

Pointsflation is here. It has been for years, and it's bound to get worse.

But all is not lost. There are still plenty of valuable ways to redeem your points before they get less valuable. And by earning the right points, you can keep your options open.

Would you say getting the SW Companion Pass is still a rare situation to continue swiping the airline CC for daily purchases?

There were always be specific situations where swiping an airline card can make sense. If you use the companion pass and get a lot of value out of it, and swiping your card is the difference in earning it or not, I would say it makes sense.

Why would the big banks issuing point earning credit cards be remotely agreeable with devaluations when they should be fighting to the death to avoid those devaulations. If United (for example) contracts to sell a mile to Chase for one cent a point then United devalues heavily, Chase is stuck on the hook paying one cent for something now worth half that (or similar). From a business perspective, buying expensive and selling for a lot less that’s a recipe for bankruptcy.