The *chase sapphire preferred* and the *chase sapphire reserve* are two of the best travel cards out there. Both earn incredibly valuable Chase Ultimate Rewards® points, and whether you plan to send those points to Chase's slew of transfer partners to book flights or hotels or redeem them directly through Chase TravelSM, it's easy to get ahead with either card.

Eventually, many travelers struggle to decide: Should they keep the simple (and relatively cheap) Sapphire Preferred Card? Or splurge for the ultra-premium Sapphire Reserve?

Both are powerful travel cards in their own right. From the annual fees to the benefits, here's what you should consider when choosing whether to open the Chase Sapphire Preferred or Reserve card.

Learn more about the *chase sapphire preferred*

Learn more about the *chase sapphire reserve*

Are You Just Getting Started With Travel Cards?

If you're on the fence, get started with the *chase sapphire preferred* … and its annual_fees annual fee.

Paying a annual_fees fee each year to hold the *chase sapphire reserve* can be a tough sell for someone just getting started with travel cards. It may be as simple as that.

But if there's a chance you'll want premium travel benefits later on down the line, you can start by opening the Sapphire Preferred card … and upgrade to the Reserve after year two rolls around (or later). This would allow you to keep any points you've still got while eventually taking advantage of all the extra perks that come with the Reserve, including some even better “Points Boost” redemptions on hotels and premium cabin flights through the Chase Travel portal.

And they may give you another reason to bump up: Chase recently hinted that upgrade offers to move from the Preferred to the Reserve are coming soon.

If you eventually decide to upgrade your Chase Sapphire Preferred to the Sapphire Reserve, the process couldn't be easier. After having the Sapphire Preferred for at least a year, simply call the number on the back of your card and let the Chase customer service representative know you'd like to upgrade your account to the Sapphire Reserve. You'll keep the same card number and credit history but get all the additional benefits that come with the Reserve.

One critical detail: You will need an available credit line of at least $10,000 in order to upgrade.

On the flip side, if you value a card with premium travel perks for the long run, it could make sense to go straight to the *chase sapphire reserve*.

Although both Chase Sapphire cards come with some travel perks, the Sapphire Reserve packs a much bigger punch in this department – especially after the recent card update earlier this summer.

Lounge Access

If airport lounge access is your reason for opening a travel card, the choice is simple. The Sapphire Preferred does not offer any complimentary lounge access, period.

The Sapphire Reserve, on the other hand, comes with a complimentary Priority Pass Lounge membership. This is the gateway for you (and up to two guests) to hang out in thousands of airport lounges worldwide.

Most importantly, Sapphire Reserve cardholders get free access to Chase's growing list of Sapphire Airport Lounges. So far, you'll find outposts in Boston (BOS), Hong Kong (HKG), New York City-LaGuardia (LGA), New York City (JFK), San Diego (SAN), Phoenix (PHX), and Philadelphia (PHL). Chase has plans for additional locations in Las Vegas (LAS), Dallas-Fort Worth (DFW), Los Angeles (LAX), and beyond.

Sapphire Reserve cardholders get unlimited complimentary access to Sapphire Lounges. They can also bring up to two guests with them on each visit, free of charge. Authorized users on the Reserve (which costs an additional $195 per year per card) receive their own access, plus another two complimentary guests.

One small hitch: It's not actually the Reserve card that gets you in, but the Priority Pass membership that comes with the card that gets you access. Just be sure to activate that Priority Pass membership, and you should be set.

Related Reading: Chase is Winning The Airport Lounge Wars … & It's Not Close

Travel Credits

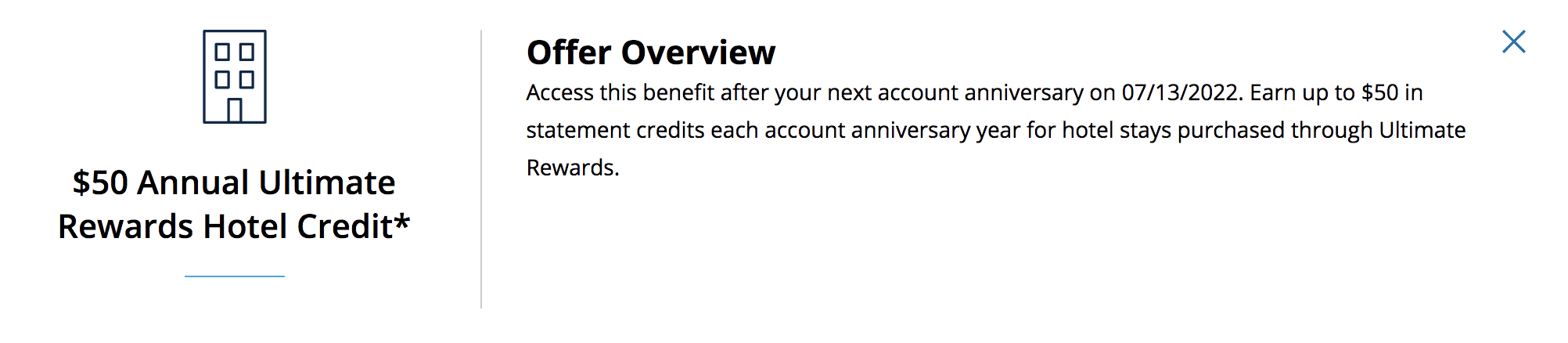

With a $95 annual fee, the Preferred Card doesn't offer a ton of money-saving credits. But there is one great perk: The card provides a $50 annual credit for hotel bookings made through Chase Travel℠.

As for the higher annual fee Reserve Card, you get more when you pay more.

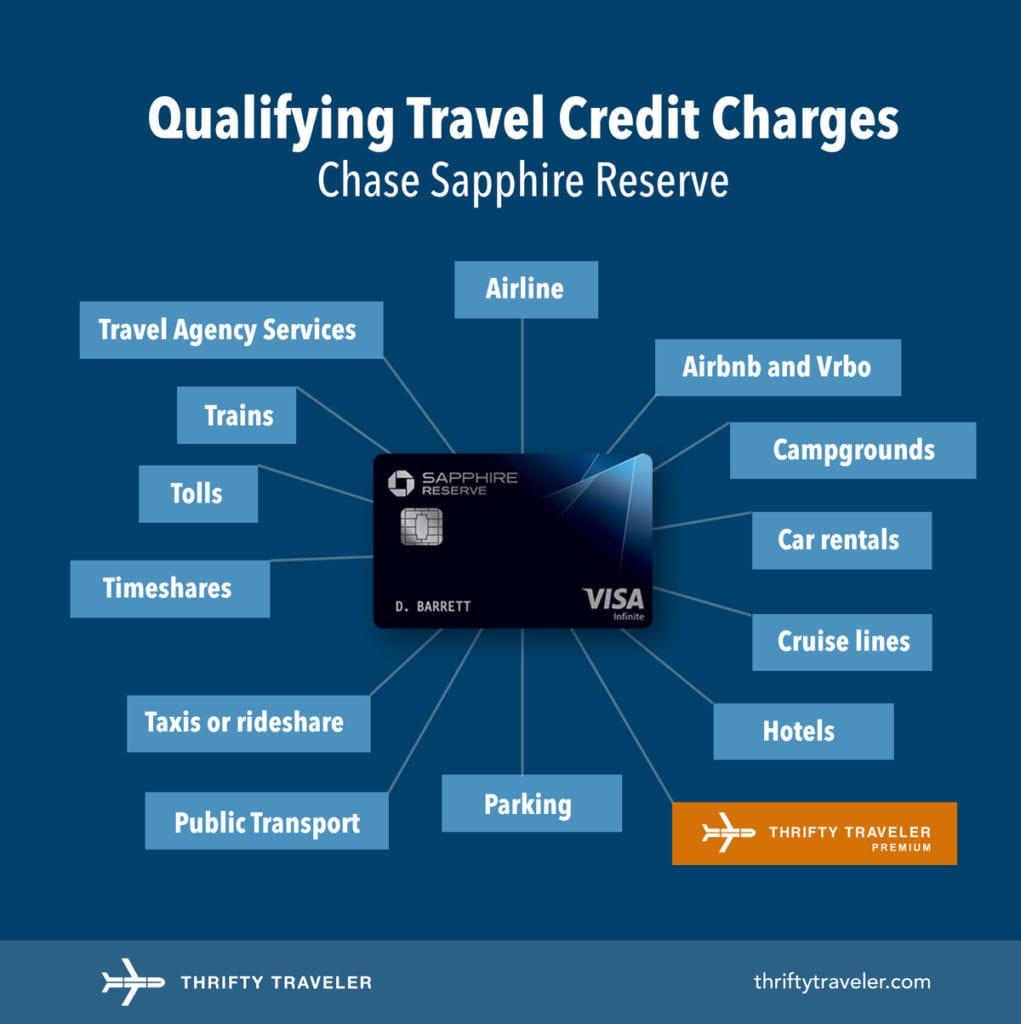

Just for holding the Chase Sapphire Reserve and paying its $795 annual fee, you get an annual $300 travel credit. This can be used for any charge that codes as travel – think flights, hotels, cruises, Uber, Lyft, taxis, parking, etc.

You don't have to do anything other than spend on travel to take advantage of the credit. Chase will automatically reimburse those charges with a credit back on your statement up to a maximum of $300.

If you spend at least $300 on travel in a year, this credit effectively makes the annual fee on the Sapphire Reserve card just $495: $795 annual fee minus the $300 annual travel credit. If you don't spend at least $300 on travel each year … well, then there's really no reason to get the Reserve card in the first place.

As with many most premium travel cards, you can get up to $120 in credits once every four years to cover the cost of either Global Entry or TSA PreCheck. The Sapphire Reserve also offers an application credit for Nexus.

Membership in these programs lasts for five years, so you're set with this credit. And since Global Entry includes TSA PreCheck, it's the obvious choice if you plan to do any international travel.

The Preferred card doesn't offer credit for Global Entry, TSA PreCheck, or Nexus.

New Sapphire Reserve Credits

Back in June, Chase revamped the Reserve card by adding several new benefits and increasing the card's annual fee from $550 per year to $795. Here are the other marquee benefits added to the card:

- $500 in annual hotel credits for 1,100-plus properties in Chase Travel℠'s “The Edit℠” portfolio with additional benefits like a $100 onsite credit, complimentary breakfast for two, space-available upgrades, and more

- Split into two, $250 credits available from January through June and again from July through December, so just one credit is available through the end of the year – and you must book at least a two-night stay

- $300 annual dining credit at select “Sapphire Reserve Dining” restaurants bookable through OpenTable

- Split into two, $150 credits available from January through June and again from July through December,.

- $300 annual StubHub credit for concert and event tickets

- Split into two, $150 credits available from January 1 through June 30, and again from July 1 through December 31 for purchases on StubHub.com and viagogo.com (activation required).

- Complimentary subscriptions to Apple TV+ and Apple Music – a $250 value

Those additions gave the Sapphire Reserve card a boatload of money-saving benefits … that practically require a spreadsheet to monitor and maximize.

Get our free travel card tracking tool to keep tabs on your Reserve card!

Travel Coverage

Both versions of the Sapphire card offer some of the best coverage for your travels.

The Chase Sapphire Reserve and Preferred cards will reimburse you for expenses you incur due to a delayed or canceled flight, train, bus, or other means of travel that you paid with your Sapphire card. That can be used for costs like meals, lodging, toiletries, etc. incurred because of the delay, and the delay must take place away from the cardholder’s primary city of residence.

The Sapphire Reserve card will reimburse you for any delay lasting six hours or more, while the Sapphire Preferred will reimburse you for delays lasting 12 hours or more. Cardholders will be covered along with their spouse or domestic partner and any dependent children under 22 for up to $500 for each purchased ticket.

If you check your bags and they’re delayed more than six hours, both cards can reimburse you up to $100 per day for up to five days. This coverage is meant to provide reimbursement for essential items like toiletries, clothing, and cell phone charging cables, for example. Additionally, the coverage will cover the primary cardholder, the cardholder’s spouse or domestic partner, and any immediate family members.

Finally, you'll get primary rental car insurance with either Sapphire card. So long as you waive the car rental company’s coverage when renting, these benefits will apply if your vehicle is damaged, lost, or stolen and you paid with a card offering primary insurance. Both cards provide coverage for the cardholder and any additional drivers permitted on the rental agreement.

The Sapphire Preferred will cover up to the actual cash value of the rental car for rental periods that do not exceed 31 consecutive days. The Sapphire Reserve will cover up to $75,000 for rental periods that do not exceed 31 consecutive days. That means if there is damage above and beyond the cost of the rental car, the Sapphire Reserve will provide a bit more coverage, assuming the rental car is not valued above $75,000.

Overall, both cards provide valuable travel protections, but the Reserve comes out slightly on top with how much it covers across travel situations.

Using Your Points

Depending on how you plan to use your points, one of these cards could be better than the other.

Transfer Your Points to Airlines & Hotels

Chase has an unbeatable array of transfer partners, allowing you to send your Ultimate Rewards points to more than a dozen different airline and hotel programs. Sometimes, you can even get a bonus of 20%, 30%, or even 40% when sending points to a specific partner.

Take a quick peek at the full list:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 24-48 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | Instant |

| Marriott Rewards | Hotel | 1:1 | Instant |

| Wyndham Rewards | Hotel | 1:1 | Instant - next business day |

But whether you've got the Preferred or Reserve Card, it doesn't matter: You'll get the same ratio when sending points to travel partners this way.

Considering this is almost always the best way to get maximum value from your Ultimate Rewards points, it's worth keeping that transfer parity in mind.

Booking via Chase Travel & ‘Points Boost' Benefits

Chase also offers a much simpler way to redeem points toward travel through the Chase Travel portal.

Whether you're booking a flight, hotel, a rental car, or even a cruise, it works just the same: The cheapest the price, the fewer points you'll need to book it. For years, Chase gave its cardholders an edge when redeeming points through the portal: You'd get a flat 1.5 cents per point booking through Chase Travel, ahead of a 1.25-cent redemption for Preferred Cardholders. That meant a $500 flight would cost Reserve cardholders 33,333 Chase points versus 40,000 points from the Preferred.

But those days are over – well, almost.

Going forward, only points earned on or before Oct 26, 2025 can be used for those flat-rate redemptions. And come October 2027, they'll disappear altogether.

In its place, Chase has created new “Points Boost” promotions, giving Chase cardholders even better value when redeeming points through the portal … but only select hotel and premium airline ticket redemptions. And yet again, Reserve cardholders get some extra value:

- You can get up to 2 cents per point on Points Boost redemptions with the Reserve Card

- That caps out at 1.75 cents per point for Preferred cardholders

Chase Will Sunset Portal Booking Bonus for Sapphire CardsRead more:

Weighing Bonuses & Annual Fees

No one wants to spend a bunch of money on annual fees. While we think you should always do the math before ruling out cards with an annual fee, the allure of paying less in annual fees is no doubt strong.

One of the biggest selling points of the Sapphire Preferred is its modest $95 annual fee. The Sapphire Reserve, on the other hand, costs a whopping $795 per year. This means you'll pay $700 more upfront each year just to hold the Chase Sapphire Reserve. At first glance, that might be hard to stomach.

Of course, you can easily offset a huge chunk of the Sapphire Reserve's annual fee with the $300 travel credit. It automatically reimburses you for up to $300 each year in travel expenses, from flights to hotels to Uber rides, and even parking fees. That instantly makes the annual fee more palatable – though perhaps not enough for everyone to justify paying that high initial price.

Still, the Chase Sapphire Preferred is far cheaper .

But the welcome bonuses offered on each card could be enough to tip the scales one way or another.

- *chase sapphire preferred*: bonus_miles_full

- *chase sapphire reserve*: bonus_miles_full

If you still want premium travel perks at a lower total cost, you could also consider the powerful two-card combination of the Sapphire Preferred paired with the *venture x*, which has a far more reasonable $395 annual fee. Put these two cards together, and you'd get many of the same benefits as the Sapphire Reserve for just $490 out of pocket at the start of every year – substantially less than the annual fee of the Reserve alone.

While we highly encourage you to be informed about each card's benefits and not let annual fees scare you, that yearly cost is always worth keeping in mind.

Bottom Line

You can't go wrong with either the *chase sapphire preferred* or the *chase sapphire reserve*. Choosing which one is best for you depends on your individual lifestyle and travel goals. Knowing exactly what each card has (and doesn't have) is key to making the right decision for you.

Learn more about the *chase sapphire preferred*

Learn more about the *chase sapphire reserve*