The *chase sapphire preferred* and the *chase sapphire reserve* have long been the gold standard in the points and miles world. Not only are they some of the best travel cards out there, but they're also the first cards we recommend for travelers getting started with earning points and miles.

But after the Sapphire Reserve's recent refresh, how do these two stack up against each other?

They may earn the same Chase Ultimate Rewards® points and share the Sapphire name, but there are major differences between the cards – now, more than ever – that leave many travelers asking: “Which Sapphire card is right for me?”

We'll break down all of the benefits you get on each card, picking a winner in each category to help you decide which is right for your travel goals.

Learn more about the *chase sapphire preferred*

Learn more about the *chase sapphire reserve*

Welcome Bonus

Chase recently upped the ante with both cards' bonuses, but you'll quickly see, one is far more valuable than the other. Here's what each card offers.

Chase Sapphire Preferred® Card Welcome Bonus Offer

bonus_miles_full

Chase Sapphire Reserve® Welcome Bonus Offer

bonus_miles_full

Winner: Chase Sapphire Reserve®

While both of these offers are good – much better than the old 60,000-point bonuses – the Sapphire Reserve's current offer is clearly best for anyone looking to earn a whole bunch of Ultimate Rewards in a hurry. Add in the $500 Chase Travel℠ credit and it's a no brainer … at least for the first year.

Earning Points

Beyond that initial bonus, both the Sapphire Preferred and Sapphire Reserve cards have bonus categories that allow travelers to keep racking up extra points for spending on travel and dining. But once again, one card has a clear edge here.

Chase Sapphire Preferred® Card

With the Sapphire Preferred card, you earn 3x points per dollar spent on dining, including eligible delivery services; 3x points per dollar spent on online grocery purchases (excluding Target, Walmart, and wholesale clubs like Costco and Sam's Club); and 3x points per dollar spent on select streaming services.

You will also earn 5x total points on travel purchased through Chase Travel℠ and 2x points per dollar spent on all other travel purchases.

Chase Sapphire Preferred cardholders will also earn 5x points per dollar on Lyft rides through Sept. 30, 2027. Plus, earn 5x total points on eligible Peloton equipment and accessory purchases over $150 through Dec. 31, 2027.

Finally, Chase Sapphire Preferred cardholders earn a 10% anniversary points bonus every year. At the end of every year, Chase will tally up all your spending throughout the year and give you an extra 10% bonus. It's based on the total amount you spend, without considering bonus categories: Spending $10,000 means you'll get an extra 1,000 points.

Chase Sapphire Reserve®

On the Sapphire Reserve Card, you will now earn 8x total points on travel when you purchase travel through Chase Travel℠ and 4x points per dollar spent on flights and hotels.

You will also earn 3x points per dollar spent on dining, including eligible delivery services.

Sapphire Reserve cardholders also earn 5x points per dollar on Lyft rides through Sept. 30, 2027. Plus, earn 10x total points on eligible Peloton equipment and accessory purchases over $150 through Dec. 31, 2027.

Both cards earn 1x point per dollar spent on all other eligible purchases.

Winner: Chase Sapphire Reserve®

This will obviously come down to where you spend the most. But there's no question that the bigger bonus categories on travel could help you pile up points faster with the Reserve.

Annual Fees

Chase Sapphire Preferred® Card

The Sapphire Preferred Card has an annual fee of $95 and it doesn't cost anything to add authorized users to your card.

Chase Sapphire Reserve®

The Sapphire Reserve has a whopping $795 annual fee and authorized users will cost an extra $195 apiece each year.

While $795 each year might sound steep, that's a bit misleading. There are plenty of extra perks and benefits on the Sapphire Reserve card that offset that cost – including one that can easily shave $300 right off the bat.

Winner: Chase Sapphire Preferred® Card

While other benefits are worth considering, there's a clear winner if a lower annual fee is important to you – and it's the Sapphire Preferred.

Travel & Lifestyle Credits

Chase Sapphire Preferred® Card

With a nominal annual fee, the Preferred Card doesn't offer a ton of “money-saving” annual credits … but there are a couple that are worth knowing about.

$50 Hotel Credit

This biggest and best perk is the card's $50 annual credit for hotel bookings made through Chase Travel℠. This was added a couple of years back without increasing the card's $95 annual fee, which is quite rare.

To take advantage, all you need to do is use your Sapphire Preferred Card to book and pay for a hotel stay of at least $50 through Chase Travel and you'll receive an automatic statement credit for up to $50 each year. Note that this credit is available on your cardholder anniversary rather than at the beginning of each year.

Unlike other credit cards offering benefits like this, there is no minimum spend or length of stay requirement. Best of all, no registration is required and this statement credit kicks in automatically!

DoorDash Credits & Complimentary DashPass

Through an enhanced partnership between Chase and DoorDash, Sapphire Preferred cardholders get a complimentary DashPass membership and a monthly coupon of up to $10 off on grocery, convenience, and other non-restaurant orders. This benefit largely replaces a previous partnership with Instacart that expired at the end of July 2024.

In addition to the 3x Ultimate Rewards points you'll earn on dining at restaurants and eligible delivery services like DoorDash, you'll also save on delivery fees and enjoy additional savings on each order with DashPass.

Simply add your Chase Sapphire Preferred as a payment method in your DoorDash account, and you should get a pop-up offering you a complimentary DashPass membership, good through Dec. 31, 2027. Considering DashPass typically costs $9.99 a month, you can save some decent money with this benefit.

If you'd otherwise be paying $96 per year for DashPass, this benefit alone is enough to cover the cost of carrying the Sapphire Preferred Card. Add in the new, up to $10 off monthly coupon for non-restaurant orders, and it's a clear win.

Chase Sapphire Reserve®

With a much higher annual fee on the Sapphire Reserve, you get a slew of credits to help recoup that high upfront cost – Chase pegs these credits at more than $2,700 in value. While you shouldn't expect to get anywhere close to that kind of value – at least not without working for it – there is a lot to love about the new-look Sapphire Reserve and it shouldn't be too tough to earn back your annual fee … and then some.

$300 Travel Credit

It all starts with a $300 annual travel credit. Just for holding the card and paying the annual fee, you'll receive a $300 credit each year that will automatically cover any travel expense: flights, hotels, Airbnb, Uber, Lyft, cruises, parking, a Thrifty Traveler Premium subscription, and so on.

As long as you plan to spend at least $300 on travel each year, you can think of the Chase Sapphire Reserve's annual fee as more like $495, after accounting for this easy-to-use credit.

$500 “The Edit” Hotel Credit

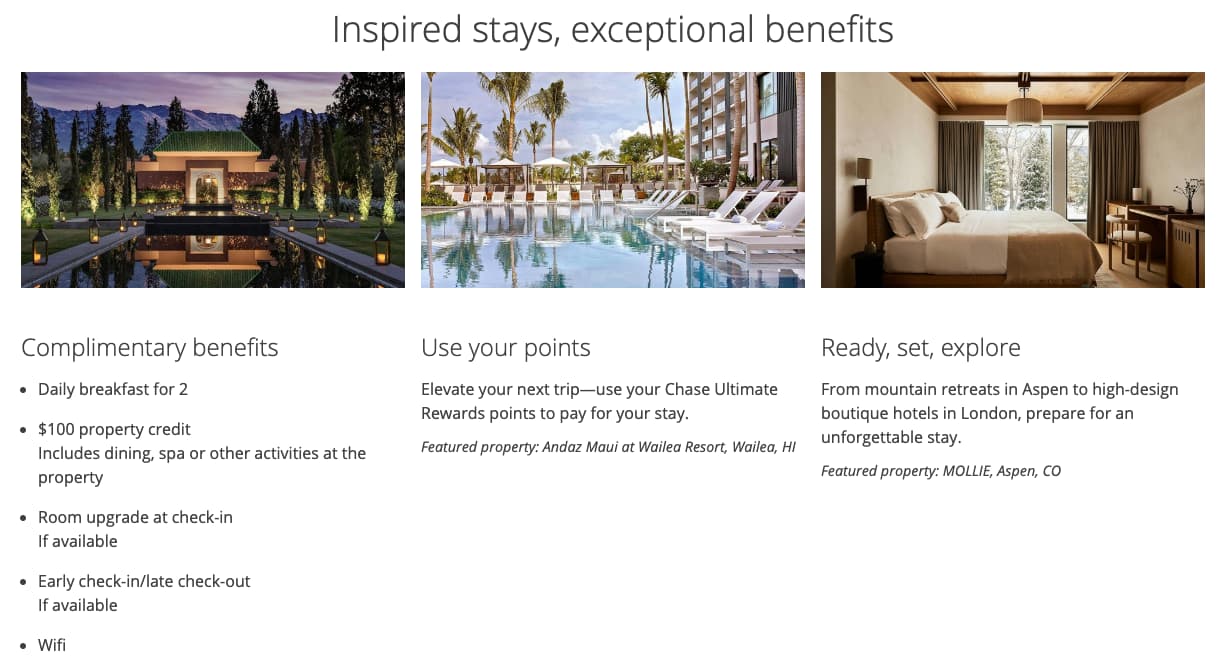

Sapphire Reserve cardholders get up to $250 in statement credits for prepaid, “The Edit” hotel bookings to use from January – June, and again from July – December, up to $500 per year.

This new hotel collection from Chase offers a curated set of upscale properties, similar to Amex's Fine Hotels + Resorts®. In addition to the card's semi-annual credit, you'll also get added benefits like complimentary breakfast, a $100 property credit, possible upgrades, and more. You must book at least a two-night stay.

Just keep in mind: This credit is only for the primary cardholder, requires a two-night minimum stay, and the credited amount won't earn any points. Still, it's a nice benefit with some really valuable perks. Being able to save up to $250, twice per year, at one of these properties will go a long way toward justifying the card's annual fee.

$300 Dining Credit

With the Sapphire Reserve, you'll get up to $150 in statement credits from January through June and again from July through December for a maximum of $300 annually for dining at restaurants that are part of our “Sapphire Reserve Exclusive Tables.”

You'll mostly find eligible restaurants in major cities like New York City, Chicago, and Los Angeles, but even some mid-sized cities like Charleston, Minneapolis, Nashville, Denver, and more have a handful of restaurants where you can use this credit. Since these restaurants skew higher end, you should have no trouble using your semi-annual $150 credit up in one fell swoop … or over multiple visits.

$300 DoorDash Credit & Complimentary DashPass

Sapphire Reserve cardholders get a $5 per month discount on DoorDash restaurant orders and two monthly coupons of up to $10 off on grocery, convenience, and other non-restaurant orders through Dec. 31, 2027.

These promos must be applied at checkout when placing an order on DoorDash using the Sapphire Reserve card enrolled in DashPass. Unfortunately, if you don't get around to using one of your promos, it won't carry over to the next month.

You'll also get a complimentary DoorDash DashPass membership, which provides access to free deliveries and lower platform fees. Just be sure to activate this benefit by Dec. 31, 2027, and it'll be good for a minimum of one year.

$300 StubHub Credit

You now get up to $150 in statement credits from January through June and again from July through December for a maximum of $300 annually for StubHub and viagogo purchases through Dec. 31, 2027.

If you regularly attend live events like concerts, sports, or even theater and comedy shows, this credit should be pretty easy to use and help you get some value back out of your card's high annual fee.

$120 Global Entry, TSA PreCheck®, or NEXUS Credit

With the Sapphire Reserve, you can receive up to $120 in credit once every four years to cover the cost of Global Entry – or $85 for TSA PreCheck. The Sapphire Reserve also offers an application credit for NEXUS.

Membership in these programs lasts for five years, so you're set with this credit. And since Global Entry includes TSA PreCheck, it's the obvious choice if you're planning any international travel.

Read our guide to enrolling in Global Entry!

$120 Lyft Credit

Sapphire Reserve cardholders get access to up to $10 in monthly Lyft credits (up to $120 per year) to use on rides – plus earn 5x total points on your purchase – through Sept. 30, 2027. Unfortunately, these credits are use-them-or-lose-them, so if you don't use rideshare services on a regular basis, you won't be able to stack the credits for a pricier ride later.

Complimentary Apple TV+ & Apple Music Subscription

You'll now get a complimentary Apple TV+ and Apple Music subscription, just for holding the Sapphire Reserve card (through June 22, 2027). If you're already paying for one (or both) of these services, that's an annual value of $250.

With tons of original content and access to music across all your devices, this will no doubt prove to be a useful benefit for many.

One thing to note about this credit is that it's not valid for Apple One subscriptions or even family subscriptions of Apple Music or Apple TV+.

$120 Peloton Credit

Get $10 in statement credits per month on eligible Peloton memberships through Dec. 31, 2027, for a maximum of $120 per year (activation required). Plus, you'll earn 10x total points on eligible Peloton equipment and accessory purchases over $150 through Dec. 31, 2027.

This is likely the least useful credit of all the new perks you get with the Sapphire Reserve, but if you're already paying for a Peloton membership, saving $10 per month isn't nothing.

Winner: Chase Sapphire Reserve®

This one isn't even close. The Sapphire Reserve comes with a much higher out-of-pocket cost up front, but there is tons of value to be had with all the credits the card offers. Even if you only make use of the annual $300 travel credit and a few of these other perks, it'll be quite easy to come out ahead with this card.

Airport Lounge Access

Chase Sapphire Preferred® Card

The Sapphire Preferred card does not currently offer any sort of complimentary airport lounge access.

Chase Sapphire Reserve®

The Sapphire Reserve, on the other hand, comes with a complimentary Priority Pass Lounge membership. This opens the door for you (and up to two guests) to hang out in 1,300-plus airport lounges all over the world.

Additionally, Sapphire Reserve cardholders will also get access to Chase's new Sapphire Airport Lounges. Chase currently has seven open in Boston (BOS), Hong Kong (HKG), New York City-LaGuardia (LGA), New York City (JFK), Phoenix (PHX), San Diego (SAN), and Philadelphia (PHL) … and more are on the way. These lounges are a big step above your typical Priority Pass space.

Sapphire Reserve cardholders get unlimited complimentary access to Sapphire Lounges. They can also bring up to two guests free of charge. Authorized users on the Reserve get their own access and guests, too.

One small hitch: It's not the Reserve that gets you in but the Priority Pass membership you get from your Reserve card that gets you access. Just be sure to activate that account and you should be set.

Read more: Chase is Winning The Airport Lounge Wars … & It’s Not Close

Winner: Chase Sapphire Reserve®

If lounge access is a priority, this should be an easy choice. Only one of these cards gets the job done.

Redeeming Points

Though the Chase Ultimate Rewards points you earn from both cards are the same, they can be worth drastically different amounts … at least when you use them to book flights, hotels, and more through Chase Travel℠.

Chase Sapphire Preferred® Card

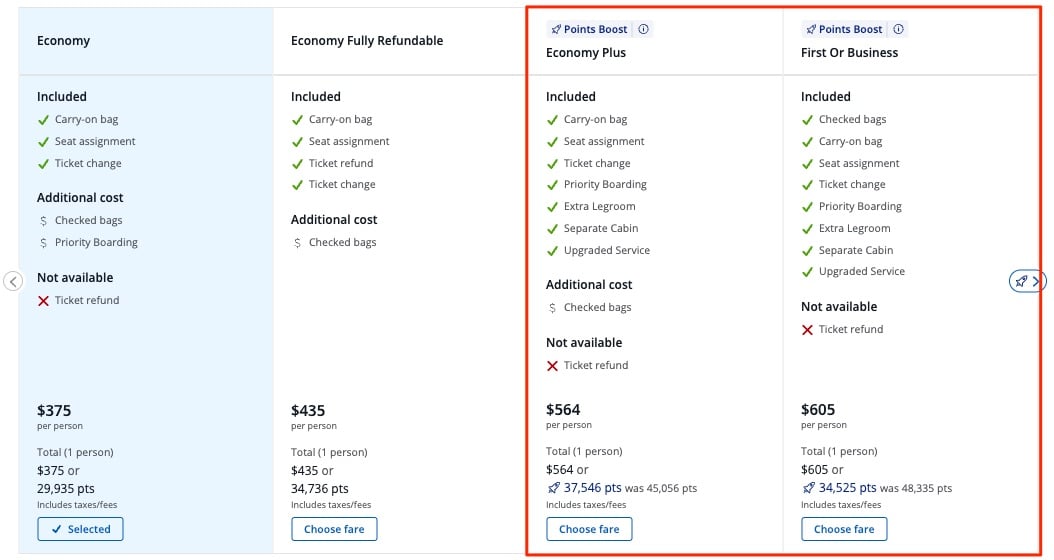

With Chase's new “Points Boost” offers, your points will be worth up to 1.5 cents each on thousands of hotels and flights with select airlines through Chase Travel – and up to 1.75 cents each on premium cabin tickets on select airlines.

For example, if you're looking to book an extra-legroom Economy Plus ticket on United and see one of these offers available, you could redeem 37,546 Chase Ultimate Rewards instead of paying the $564 cash that the airline is charging.

Since your points are worth more for premium cabin bookings, it would actually cost you fewer points to book first class with one of these offers. At 34,525 points for a first class seat, you're paying less than the airline's cheapest basic economy offering when redeeming points at 1 cent each.

If you got your Sapphire Preferred before June 23, 2025, you can also redeem any points earned before Oct. 26, 2025, for 1.25 cents each on all travel through the portal. This option will be going away entirely come late October 2027.

Note: The screenshot above shows a redemption rate of 1.25 cents each for “Economy” and “Economy Fully Refundable” because I have a legacy Sapphire Preferred card.

Chase Sapphire Reserve®

With the Sapphire Reserve, your points are worth even more – up to 2 cents each – on rotating offers through Chase Travel. Cardmembers can use Points Boost to maximize the value of their points on premium air cabin tickets and select hotels, including The Edit by Chase Travel.

In that same example from above, booking a $605 United first class flight would only require 30,250 points instead of the 34,525 points needed with the Sapphire Preferred.

If you had your Sapphire Reserve card prior to the relaunch on June 23, 2025, you can also redeem any points earned before Oct. 26, 2025, for 1.5 cents each on all travel through the portal. This option will be going away entirely come late October 2027.

With both cards, you can often get far more value out of your points by turning to Chase's slew of transfer partners – airlines, and hotel chains to which you can directly transfer your points. In this case, the value of your points are the same no matter which card you hold (all points transfer 1:1).

Here's the full list of Chase Ultimate Rewards transfer partners:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

There are plenty of ways to squeeze good value out of these points via transfer partners, including flying business and first-class or staying in all-inclusive resorts for free thanks to Chase's partnership with Hyatt.

- Hyatt is one of the best Chase transfer partners and one of the best ways to redeem Ultimate Rewards, period, with properties starting as low as 3,500 points per night

- You could book Virgin Atlantic Upper Class to London-Heathrow (LHR) for as low as just 29,000 points each way. If another 25% transfer bonus (or even bigger!) rolls around, you'll have nealy enough points for five roundtrip tickets!

- By sending your points to airlines like Southwest or British Airways, you could easily book several roundtrip flights to Hawaii with these Chase points

- Even after a recent devaluation, Iberia business class remains one of the cheapest ways to get to Europe in a lie-flat seat at 40,500 Avios each way – requiring even fewer points if you time it right with one of the frequent 20% or 30% transfer bonuses we see from Chase to Iberia or British Airways

See our top ways to redeem Ultimate Rewards Points!

Winner: Chase Sapphire Reserve®

Given the increased redemption value you get with the Sapphire Reserve when using Chase's Points Boost offers and redeeming through Chase Travel, it's the clear winner here.

Travel Protections

Rental Car Insurance Coverage

Both versions of the Sapphire card offer some of the best car rental coverage you'll find from a credit card.

Let's go back to basics for a bit. There are two categories of insurance coverage when it comes to rental cars: primary and secondary. The vast majority of travel rewards credit cards offer only secondary coverage, which typically comes with a deductible and only kicks in if you don’t have your own personal car insurance policy. It will likely not cover the entire loss of a vehicle, either.

Primary insurance, on the other hand, will cover all damage from collision or theft of most rental cars. And that's what you get with both Sapphire cards.

The only difference in the rental car coverage offered by the two cards is the amount that each will cover.

The Sapphire Preferred will cover up to the actual cash value of the rental car for periods that do not exceed 31 consecutive days. The Sapphire Reserve will cover up to $75,000 for rental periods that do not exceed 31 consecutive days. That means if there is damage above and beyond the cost of the rental car, the Sapphire Reserve will provide a bit more coverage.

One thing to note: The Sapphire Preferred's coverage does exclude “high-value motor vehicles” and exotic cars. Chase explicitly states that the following car brands are excluded: “Alfa Romeo, Aston Martin, Bentley, Corvette, Ferrari, Jaguar, Lamborghini, Lotus, Maserati, Maybach, McLaren, Porsche, Rolls-Royce, and Tesla”

Read More: All About the Chase Sapphire Rental Car Insurance Benefit

Delayed & Lost Luggage Coverage

If your bags get lost or delayed, you won't find better coverage than these two Sapphire Cards.

Both the Chase Sapphire Preferred and Reserve offer identical coverage for luggage. And since the Sapphire Preferred charges just a $95 annual fee, it's the clear winner here.

If you check your bags and they’re delayed more than six hours, both cards can reimburse you up to $100 a day for up to five days. This coverage is meant to provide reimbursement for essential items like toiletries, clothing, and cell phone charging cables, for example.

This will cover the primary cardholder, the cardholder’s spouse or domestic partner, and any immediate family members.

Trip Delay & Cancellation Coverage

The Chase Sapphire Reserve and Preferred cards will reimburse you for expenses you incur due to a delayed or canceled flight, train, or other means of travel for costs like meals, lodging, toiletries, etc. incurred because of the delay. But one card's coverage is slightly better.

The Sapphire Reserve card will reimburse you for any delay lasting six hours or more, while the Sapphire Preferred will reimburse you for delays lasting 12 hours or more. Cardholders will be covered along with their spouse or domestic partner and any dependent children under the age of 22 for up to $500 for each purchased ticket.

Either way, the trip must have been at least partially paid for with your Chase Sapphire card (or with Chase Ultimate Rewards points).

Read more: A Firsthand Experience Using Chase's Trip Delay Insurance

Travel Accident Coverage

You always hope you never need medical evacuation & travel accident coverage. But if you do, it’s invaluable.

Both cards will provide coverage for accidental death or dismemberment, or a combined loss of speech, sight, or hearing, experienced on a covered trip. You must have purchased some portion of your trip with your Sapphire Card or its Ultimate Rewards points.

The difference comes in the amount of coverage each card provides: The Preferred card will provide a benefit amount for the loss of life up to $500,000 while the Sapphire Reserve card will provide a benefit for loss of life up to $1 million.

Additionally, only the Sapphire Reserve card will cover medical evacuation.

Winner: Chase Sapphire Reserve®

Both cards offer solid travel protections but the Sapphire Reserve is clearly superior when things go really wrong. Not only does the card provide marginally better rental car coverage, but it also provides reimbursement for shorter trip delays and better accident coverage, too.

Which Card Wins?

By the numbers, the Sapphire Reserve wins in a landslide. But that lopsided win doesn't tell the full story.

Everybody can – and should – weigh these categories differently. Some of these categories could make the Chase Sapphire Reserve a no-brainer to one person, such as those set on getting lounge access or a Global Entry membership. Those same benefits might be meaningless to another person – especially someone who's looking to earn points at a low cost.

There's something else to keep in mind here: the cost. The Sapphire Preferred is the far more affordable option and that alone could make it the clear choice for many. It's also worth considering that even though the Reserve card has a much higher annual fee, it's possible to offset a big chunk (if not all) of that with the card's accompanying statement credits.

Bottom Line

While the Sapphire Preferred and Reserve share a name and earn the same points, what you will get with each card is vastly different.

The $795 annual fee on the Sapphire Reserve may be an automatic dealbreaker, but it is well worth it for travelers looking for lounge access and other travel perks. If a big bonus, low annual fee, and solid travel insurance are all you're after, the Sapphire Preferred card is likely an easy choice.

Learn more about the *chase sapphire preferred*

Learn more about the *chase sapphire reserve*

If I already have a Sapphire preferred, would it be beneficial to have my spouse get the Reserve or is there a more beneficial strategy?

If you plan on redeeming the points through Chase’s travel portal, it would be beneficial to have a Reserve as you would get 1.5 cents each in value with a Reserve (and only 1.25 cents if you have a Preferred). But in my opinion, two Sapphire Preferred cards is a great option.

I currently have the chase Sapphire Reserve card but am thinking of dropping it and getting the Preferred card. Any recommendations on how to do it and can I get the 80k miles bonus on the preferred?

Hey Kevin, as long as you haven’t earned the bonus on the card within the past 48 months you should be eligible to earn the 80k on the Reserve. I would suggest calling Chase and converting your Reserve to one of the Freedom cards. This will keep your points in tact. You can then apply for the Preferred Card.

Which airlines are the Chase Sapphire Reserve and Preferred cards good for? I apologize in advance as it’s probably spelled out somewhere, but I cannot find

Hi Jackie,

The Sapphire cards are good for a lot of different airlines as the points they earn are very flexible. Chase has a list of transfer partners that these points can be transferred to (including both United and Southwest), but you can also book through their travel portal on almost any airline.

https://thriftytraveler.com/book-flights-with-chase-ultimate-rewards-points/