With the calendar turning to 2024, many travelers are taking a good, hard look at what's in their wallets (or desk drawers) and asking themselves whether their cards are worth another year of of annual fees. With card benefits changing and annual fees going up, it's an important question.

But before rushing to cancel a credit card, there's another critical question you should be asking … even if you're not seriously considering canceling: “Can I get a retention offer if I keep it open?”

Retention offers are the banks' way of convincing you to stick around, hoping you'll remain a customer (and pay another year of annual fees) if they sweeten the deal. And they come in all shapes and sizes: Some banks will offer up a stash of bonus points or a statement credit for customers considering closing the card, while others will discount (or waive) the annual fee.

No matter the reward, these retention offers can take the sting out of paying another year of annual fees and make keeping the card a no-brainer.

Let's take a closer look at how these offers work and give you some talking points to maximize your chances of getting one. And even if you're not thinking of canceling one of your credit cards, inquiring about an available offer can make keeping your card open for another year an even easier choice.

Looking for a new card? Check out our monthly list of the best credit card offers!

What's a Retention Offer?

Whether you've got a card from Chase, Capital One, Citi, or American Express, every major bank has a department dedicated to keeping customers around.

But here's the critical thing: You typically have to ask to get one of these retention offers – or at the very least, threaten to close your card.

Banks don't go out of their way to offer new perks, points, or discounts to each and every customer. They're a last-ditch effort to retain customers who are considering dropping a card.

You can simply call up the customer service line on the back of your card – or chat online (when logged into your account) – and let them know you're thinking about canceling a credit card unless there's a discount or other incentive to keep your card open. The keyword here is “thinking” – this phrasing is crucial as some banks have an automated system that will begin the account closure automatically if you simply mention that you want to close your card.

If you prefer to call, most banks have a dedicated phone line for reaching the retention department:

- American Express: 1-800-528-4800

- Capital One: 1-877-513-9959

- Citi: 1-800-842-6596

- Chase: 1-800-432-3117

Keep in mind: Just because you ask doesn't mean you'll get a retention offer. It varies by bank, what card you have and how long you've had it, how much you spend on it per year, and other factors. If you've accepted a retention offer on a card in recent years, you may not get another one for a while.

Thrifty Tip: Wait until just before (or just after) your annual fee hits your account to maximize your retention offer. Banks typically give you at least a month after paying an annual fee to decide to cancel a card and get that fee refunded.

Nonetheless, it's always worth asking before ponying up for another annual fee – whether you're truly considering dropping a card or not. And that's especially true when banks make negative moves like removing benefits or raising the annual fee.

What are Banks Doing for Retention Offers?

During the height of the pandemic when travel was on hold, we saw banks get desperate to retain their customers. Credit card companies understood they needed to sweeten the deal to keep cardholders around and that meant going beyond the slew of travel perks and benefits their cards offered.

This meant dishing out some of the best retention offers we'd ever seen. And even though travel is back in full swing, we're still seeing some excellent offers on cards from Amex, Chase, and even Citi – not so much from Capital One.

- In the past month, a member of our team received a retention offer of 25,000 bonus Membership Rewards points for keeping *amex platinum card* open and spending $3,000 over the next three months. We've even heard of 50,000-point retention offers being given on the Amex Platinum with $4,000 of required spending.

- Co-branded credit cards like the Delta SkyMiles and Hilton Honors American Express credit cards seem less likely to receive the same eye-popping retention offers available with Membership Rewards earning cards. Still, we've heard from readers and Thrifty Traveler Premium members that have received bonuses of 7,500 SkyMiles on the *delta platinum* and 10,000 Hilton Honors points with the no-annual fee *hilton honors card* for $1,000 in spending on both cards.

- Several Thrifty Traveler readers have reported that Citi offered them a $95 statement credit or a 10,000 ThankYou point bonus when calling in to close their *citi premier*.

- Even Chase has gotten in on the act, offering statement credits of $150 on both the *sw priority* and the no-longer-available Ritz-Carlton credit card.

With travel demand reaching a new normal, we'd have guessed credit card companies would be less generous with retention offers than they were in years past. But generally speaking, that hasn't been true: Retention offers are still out there.

Your business is still important to the bank's bottom line and it never hurts to try for a retention offer. The worst they can say is no.

Once again, just what offer you get will depend on your bank, which card you hold, how much you spend on that card each year and more. Banks make these decisions based on how valuable your continued business is to them. And you may not get an offer, period.

What Should I Say During My Retention Call?

Asking a bank for a retention offer can feel daunting, but it's simple.

Start by firing up an online chat or dialing the number on the back of your card (or the retention numbers listed above). When it's time to get down to business, say something like:

“I'm considering canceling this card because I'm just not getting enough value to justify the large annual fee.”

Your customer service agent will almost certainly respond by diving into the card's current benefits – including any recent additions – in an attempt to get you to reconsider. Counter by saying something along the lines of:

“I'm aware of those benefits and have used some of them, but it's still not enough for me to justify keeping the card open for another year. Are there any additional incentives or offers available to convince me to renew my credit card?”

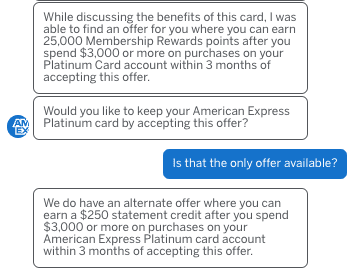

That's when you get into the potential retention offers. In some cases you'll be transferred to a different agent who will go over the available offers with you and in other cases, it will be the same person you initially got in touch with. Either way, it's typically a computerized process, so your agent will likely give you one or more retention offers – if any are available. And don't be afraid to ask if any others are available after you get the first one.

Here's an example from a recent Amex chat:

In this case, I chose the points over of the statement credit as I'm typically able to get more than one cent per point in value by leveraging Amex's transfer partners and redeeming them for travel.

Regardless of which you choose, a big points bonus, annual fee discount, or statement credit could make it an easy decision to renew. If you accept an offer, you're agreeing to pay the annual fee in exchange for whatever retention offer you landed on. Cancel the card before paying the annual fee, and you'll forfeit that offer.

If you're not liking your offers (or didn't get any), you can simply say you'll continue thinking about it and hang up.

What If I Don't Get a Retention Offer?

Don't despair: You're not alone. And you've still got options.

If you come up empty-handed, it may be worth trying again later on for a retention offer – but probably not. Unless you called well ahead of your card renewal date, the odds that a retention offer will become available on a second (or third) try are slim.

If you were never serious about canceling your credit card … well, your bluff failed. Better luck next year. But if you're still considering canceling the card, there are some important questions to ask yourself.

- Do the benefits on the card outweigh the annual fee? Don't just think about airline and travel credits, but the bonus earning categories that can add up fast on groceries, dining, and more.

- What will happen to your points or miles if you cancel your card?

- Will your credit score take a dive because you cancel your card? It might…

- Rather than cancel the account outright, can you downgrade it to a cheaper (or free) credit card?

Thrifty Tip: Amex is notorious for offering upgrade offers on their cards. If you decide to downgrade, this is a sneaky way to get a second welcome offer on your card – or you can think of it as a delayed retention offer.

Read more: Want to Cancel a Credit Card? Ask Yourself These Questions First!

Bottom Line

Retention offers can be the difference-maker between a straightforward decision to dump a credit card and a no-brainer to keep it open. Whether you're seriously considering canceling a card or not, make these retention calls part of your routine every time the annual fee comes due.

It's the epitome of a low-risk, high-reward play.

I just did it over chat for my Amex Delta Platinum and I got 70K miles if I spend $3000 in 3 months! I didn’t even mention the retention offer. I just said I was unhappy and I don’t use any of the new benefits so it didn’t make sense to keep the card.

Just called Amex regarding my Delta Reserve Card and received 30,000 Delta miles after spending $2000. Thank you guys for the information.

Amex gold uk just charged my annual fee £160 (you have 30 days to cancel and get a refund). I went online to cancel they offered 20,000 retention points which I accepted. It didn’t have any written agreement or state I cannot cancel within one year. So if I transfer the points to Avios and call back to cancel, will that work ?

I tried this in 2022 and got nothing for my Delta Skymiles Reserve, but this year I got 50,000 points after spending $3000 in 3 months. Definitely worth the time to do the online chat!

I called AMEX back in December for my Platinum card, and they provided me with a one time $500 credit. Considering that the annual fee was $550 last year, I felt that this was quite generous.

Excellent, thanks for sharing Brad!

Just called AmEx as my Platinum Card fee will be charged later this month. I followed your suggestions and they ponied up 50,000 Membership Rewards Points! I feel like I did when I was a starving college sophomore and I found $20 on the sidewalk. Call me King Midas!

Well done, Midas!

Hurrah! Just did this with Delta AMEX via chat and got 30,000 Skymiles. Free flight, here we come! Keep those Skymiles flash sales coming!

Excellent, Jen! Glad that worked. And we will absolutely keep the flash sales coming.

The annual fee on my Chase Sapphire Reserve is coming up next week. I called using the script in this article as a guide, and the rep immediately rattled off how I’ve been a customer since 2017 and it’s painful to see me go then quickly proceeded to offer me $250 in statement credit. I asked for other offers but they didn’t have others to share with me. It was quick and easy….they’ve got me for another year.

I called to cancel my Virgin Atlantic visa (BOA) and while they talked about the benefits of the card they did not offer any retention credit or miles. I had not been using this card much after the initial spend to get the miles and did not want to pay the annual again so I canceled.

It did hit my credit score for abut 20 points (Less available credit) but it should be back up in a few months.

Great article. I attempted this feat 2 months ago with the Citi Prestige card and got nothing; thus had to cancel the card because the $550 annual fee was coming due . Didnt make sense to me because I probably wouldve paid another annual fee if they gave me something. But with all of the lack of travel this year and in the coming year for me, there was no justification to hold it. Good to hear the insight from other cards/people