Keeping track of the best and biggest bonuses among travel credit cards can feel like a full-time job – especially when there are a handful of different bonuses circulating on the same popular card, like the Platinum Card® from American Express and the American Express® Gold Card. That's where the CardMatch tool comes in.

This tool is a one-stop shop to see what credit cards you can be prequalified – and without a pesky hard credit pull that could ding your credit score. But most importantly, it's the best way to find bigger, exclusive welcome bonuses like an unprecedented 175,000-point welcome bonus on the Amex Platinum Card or a 75,000-point bonus on the Amex Gold Card – both more than double the standard welcome bonus on each card.

As banks and credit card companies try to dig out of the economic slowdown, American Express is leaning heavily on tools like CardMatch to get new creditworthy cardholders. And it seems that American Express is being more generous with these special, targeted offers than ever before.

What does that mean for you? Your odds of getting targeted for one of these bigger welcome bonuses via CardMatch may have gone up.

So let's break down what the CardMatch tool is, how and why you should use it, and dive into even more of the exclusive offers available through CardMatch.

What is CardMatch?

CardMatch is a tool from creditcards.com, and it works like this:

Users enter some basic personal information, which CardMatch uses to match them with current credit card offers for which they have a high likelihood of being approved. In some cases, these offers can be higher than what consumers would be able to find through other public channels.

Enter your information like your name, address, email address, and the last four digits of your social security number, and the CardMatch tool will perform a soft credit pull on your credit report to pull up available offers. Soft credit inquiries do not impact your credit score because they aren't attached to a specific application for credit. It's worth noting that if you have a freeze on your credit profile, a soft credit pull is not possible. So you'll need to unfreeze your credit profile to use CardMatch.

Based on that information, CardMatch will make recommendations for credit cards that you are more likely to be approved for. Note that this doesn't guarantee you will be approved – it just improves your odds.

Read more: Four Credit Card Myths You Should Stop Believing

Exclusive Offers Available via CardMatch

One of the biggest reasons to use the CardMatch tool is that it is possible to pull up exclusive offers for both the Platinum Card® from American Express and the American Express® Gold Card.

With the Platinum Card from American Express, you can get matched with a welcome offer up to earn 175,000 American Express Membership Rewards points after spending $8,000 in the first six months. That's up significantly from the standard, widely available public offer of 60,000 points – with the same spending requirement. There is also a 100,000 point offer available.

Read more: Our Full Review of the Platinum Card from American Express

With the American Express Gold Card, it is possible to get matched with a welcome offer to earn 75,000 American Express Membership Rewards points after spending $4,000 in the first six months of card membership. Once again, that's up from the norm of 60,000 American Express Membership Rewards points with the same spending requirement.

Read more: Why the American Express Gold Card is Worth the $250 Annual Fee

There's no guarantee you'll get matched with these highly targeted offers, but you should absolutely check the CardMatch tool before applying for either card. There is no downside to checking – and based on what we've heard from readers, American Express is targeting more and more prospective cardholders with these exclusive offers.

Check with CardMatch to see if you’re targeted for a 175,000-point offer on the Platinum Card from American Express or the 75,000-point offer on the American Express Gold Card. These offers are subject to change at any time.

How to Use the CardMatch Tool

Using CardMatch is straightforward and simple. First, head to the CardMatch landing page. Once there, you should see a page that looks like the image below. Once you enter your name, address, the last four digits of your social security number, and your email address, you can proceed by clicking “Get Matches.”

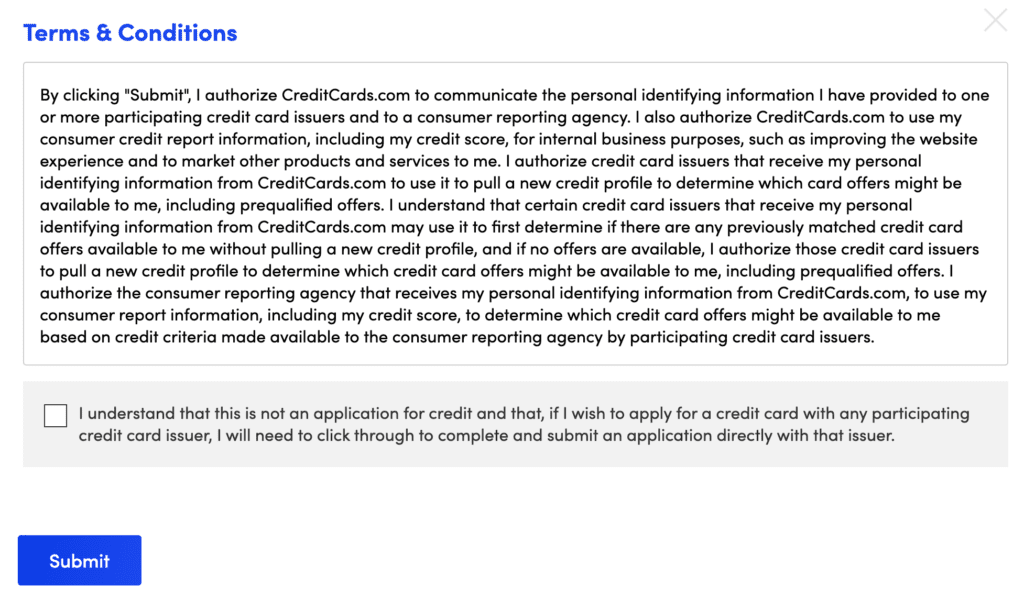

From there, you will see a screen laying out the terms and conditions that looks like this. By clicking that you agree, you are telling CardMatch that you are willing to share the personal information entered and allowing them to perform a soft credit pull.

Once you click Submit, you'll come to a page with your matched offers. And if you don't see the offers for either the Platinum Card from American Express or the American Express Gold Card, it means that you haven't been targeted to receive those exclusive offers.

What Banks Issue Cards Through CardMatch?

At the time of publication, you will find card matches from American Express, Bank of America, Citi, CreditOne, Discover, and Wells Fargo are available via the CardMatch tool.

In the past, you'd also find matched offers from Chase. But due to the COVID-19 pandemic, Chase pulled out of the CardMatch program as they look to limit their exposure to new credit card applications. It isn't yet clear if or when Chase card offers will be available via CardMatch again.

And creditcards.com has indicated that they are always looking for new partners for their CardMatch tool. So it may only be a matter of time before we see more banks available within the program.

Bottom Line

CardMatch is a great way to find credit card offers that you might be prequalified for, giving you a higher chance of approval once you fill out an application. But it's also the best way to find bigger bonuses than you'll get publicly on both the Platinum Card from American Express and the American Express Gold Card.

You won't find higher offers for either card anywhere else. And while there's no guarantee you'll get targeted for one of these bigger bonuses, the tide seems to be turning.

Just FYI, we are unable to get this link to complete… Won’t let us agree to terms from phone out computer…