Staying at Marriott hotels and wondering if you should get a Marriott co-branded credit card? With six different cards currently available from not one but two banks, there's plenty to pick from … almost too many. We're here to help you choose.

Marriott's dizzying array of credit cards stems from its merger with Starwood Preferred Guest (SPG) back in 2016, bringing several hotel loyalty programs and relationships with both American Express and Chase under the umbrella of a single new program: Marriott Bonvoy®. That doesn't just make it difficult to decide which card you want: You'll also need to figure out if you're even eligible for the card and its welcome offer.

Here's a look at all the surviving Marriott Cards:

Out of these dozen Marriott cards, just half of them are still available to new applicants – and a couple more can still be obtained through a conversion or product change. With cards ranging from the no-annual fee Marriott Bonvoy Bold® Credit Card (perfect for the occasional Marriott guest) to the ultra-premium *bonvoy brilliant* – complete with elite status, airport lounge access, and an annual free night award – they really do have a card (or maybe two) for everyone.

Let's take a closer look at all of the currently available Marriott Cards – and their sign-up rules – to help you determine which is right for you.

Related reading: Best Use of a Marriott Free Night Award

Marriott Cards Issued by American Express

As if deciding on a new Marriott Card wasn't hard enough, keeping them all straight is a whole other issue. In an annoying attempt at alliteration, Marriott's marketing department decided each of their cards should have a name that starts with the letter “B.”

There's the *bonvoy brilliant*, the *bonvoy business*, and who could forget the *bonvoy bevy*. Yes, really.

They may sound identical but with different benefits, rewards earning, and annual fees, there are all sorts of similarities and differences to dissect with the Amex Bonvoy Cards.

Marriott Bonvoy Brilliant® American Express® Card

- Welcome Offer: *bonvoy brilliant bonus*

- Free Night Certificate: Get a free night certificate each year on your cardmember anniversary, eligible at properties that cost up to 85,000 points. This benefit starts in your second year of card membership.

- Complimentary Marriott Bonvoy® Platinum Elite status.

- Get up to $300 in annual credits to use at restaurants worldwide. These will be available in up to $25 monthly increments and you will lose any amount not used each month.

- 25 elite night credits towards Bonvoy elite status each year you hold the card.

- Priority Pass Lounge Access: Enjoy unlimited airport lounge visits when you enroll in a Priority Pass Select membership. This comes complimentary with the card, and enrollment is required.

- Earn 6x Marriott Bonvoy® points per dollar spent at hotels participating in the Marriott Bonvoy rewards program.

- Earn 3x Marriott Bonvoy® points per dollar spent at U.S. restaurants and on flights booked directly with airlines.

- Earn 2x Marriott Bonvoy® points per dollar spent on all other eligible purchases.

- annual_fees Annual Fee (see rates & fees).

Learn more about the *bonvoy brilliant*

Marriott Bonvoy Bevy® American Express® Card

- Welcome Offer: *bonvoy bevy bonus*

- Earn 6x Marriott Bonvoy points per dollar spent at hotels participating in the Marriott Bonvoy rewards program.

- Earn 4x Marriott Bonvoy points per dollar spent on up to $15,000 spent in a calendar year on combined purchases at worldwide restaurants and at U.S. supermarkets.

- Earn 2x Marriott Bonvoy Points per dollar spent on all other eligible purchases.

- Get 1,000 Marriott Bonvoy Bonus Points with each qualifying stay.

- Complimentary Marriott Bonvoy Gold Elite status.

- Earn 15 elite night credits each calendar year toward Marriott Bonvoy Elite status.

- Earn a free night award certificate for properties that cost up to 50,000 points per night after spending $15,000 in eligible purchases each calendar year.

- $250 Annual Fee (see rates & fees).

Learn more about the *bonvoy bevy*

Marriott Bonvoy Business

- Welcome Offer: *bonvoy business bonus*

- Free Night Certificate: Get a free night certificate each year on your cardmember anniversary, eligible at properties that cost up to 35,000 points. This benefit starts in your second year of card membership.

- Earn 6x Marriott Bonvoy points per dollar spent at hotels participating in the Marriott Bonvoy rewards program.

- Earn 4x Marriott Bonvoy points per dollar spent at restaurants worldwide, at U.S. gas stations, on U.S. wireless telephone services, and on U.S. purchases for shipping.

- Earn 2x Marriott Bonvoy Points per dollar spent on all other eligible purchases.

- Complimentary Marriott Bonvoy Gold Elite status.

- Earn 15 elite night credits each calendar year toward Marriott Bonvoy Elite status.

- Get a 7% discount on standard room rates at hotels participating in the Marriott Bonvoy rewards program.

- $125 Annual Fee (see rates & fees).

Learn more about the *bonvoy business*

Marriott Cards Issued by Chase

On the Chase side of things, there's a bevy (wait, I think that's Amex's word…) of cards to choose from as well.

You have the Marriott Bonvoy Boundless® Credit Card, the no-annual fee Marriott Bonvoy Bold® Credit Card, and Marriott Bonvoy Bountiful™ Card.

To keep things fair, you'll find the Chase issued Marriott Cards to have many of the same benefits and earning structures as their Amex counterparts.

Marriott Bonvoy Boundless

- Welcome Offer:Earn 125,000 bonus points towards free stays at hotels participating in Marriott Bonvoy after spending $5,000 on purchases in the first 3 months from account opening.

- Free Night Certificate: Get a free night certificate each year on your cardmember anniversary, eligible at properties that cost up to 35,000 points. This benefit starts in your second year of card membership.

- Earn 6x Marriott Bonvoy points per dollar at hotels participating in the Marriott Bonvoy rewards program.

- Earn 3X Marriott Bonvoy points per dollar on the first $6,000 spent in combined purchases each year at grocery stores, gas stations, and dining.

- Earn 2x Marriott Bonvoy Points per dollar spent on all other eligible purchases.

- Complimentary Marriott Bonvoy® Silver Elite status.

- Earn 15 elite night credits each calendar year toward Marriott Bonvoy Elite status.

- $95 Annual Fee.

Learn more about the Marriott Bonvoy Boundless® Credit Card (for full disclosure: this is not an affiliate link).

Marriott Bonvoy Bountiful

- Welcome Offer Bonus: Earn up to 85,000 Marriott Bonvoy points after making $4,000 in purchases during the first three months of opening the card.

- Earn 6x Marriott Bonvoy points per dollar at hotels participating in the Marriott Bonvoy rewards program.

- Earn 4X Marriott Bonvoy points per dollar on the first $15,000 in combined purchases each year on grocery stores and dining.

- Earn 2x Marriott Bonvoy Points per dollar spent on all other eligible purchases.

- Get 1,000 Marriott Bonvoy Bonus Points with each qualifying stay.

- Complimentary Marriott Bonvoy Gold Elite status.

- Earn 15 elite night credits each calendar year toward Marriott Bonvoy Elite status.

- Earn a free night award certificate for properties that cost up to 50,000 points per night after spending $15,000 in eligible purchases each calendar year.

- $250 Annual Fee.

Learn more about the Marriott Bonvoy Bountiful™ Credit Card (for full disclosure: this is not an affiliate link).

Marriott Bonvoy Bold

- Welcome Offer Bonus: Earn 60,000 Marriott Bonvoy points and one free night award (up to 50,000 points) after spending $2,000 within the first three months of opening the card.

- Earn 3x Marriott Bonvoy points per dollar spent at hotels participating in the Marriott Bonvoy rewards program.

- Earn 2X Marriott Bonvoy points per dollar spent on travel (from airfare to taxis and trains).

- Earn 2x Marriott Bonvoy Points per dollar spent on all other eligible purchases.

- Complimentary Marriott Bonvoy Silver Elite status.

- Earn 15 elite night credits each calendar year toward Marriott Bonvoy Elite status.

- No Annual Fee.

Learn more about the Marriott Bonvoy Bold® Credit Card (for full disclosure: this is not an affiliate link).

How to Know if You're Eligible

Since both Chase and Amex issue co-branded Marriott Cards, you might find yourself at a loss for which bank to choose.

The good news is that both banks offer cards with comparable welcome offers, benefits, and annual fees. But there are some broader rules to consider when deciding which bank to go with.

Once you've pinpointed the bank that makes the most sense for you – or which bank you're eligible to apply with – you have to also consider the individual application rules for each of the Marriott Cards.

If this sounds like a lot to keep straight, that's because it is. Don't worry: We've done the research to help you figure out exactly which cards you're eligible for – keep reading.

Bank Specific Rules

First off, there's that pesky Chase 5/24 rule. What's the Chase 5/24 rule, you ask?

The Chase 5/24 rule is a hard-and-fast restriction rolled out years ago in order to limit card applicants from opening credit cards for the sole purpose of earning the bonus rewards.

Here's what it boils down to:

- If you have opened five or more credit cards in the past 24 months from any bank (not just Chase cards), you will not be approved for most Chase credit cards – regardless of your credit score or history with Chase bank.

- The rule does not count credit inquiries, but rather card products that you have applied and been approved for.

So if you have opened five or more new credit cards from any bank in the past 24 months, you won't be approved for Chase credit cards that are subject to the 5/24 rule. Nearly all of Chase's personal credit cards fall under this rule. If you're above 5/24, you can safely skip the Marriott Chase cards and move onto Amex.

While Amex doesn't have limitations quite as restrictive as the Chase 5/24 rule, they do limit consumers to having no more than five American Express cards open at any given time. So if you already have five Amex cards open, you would automatically be declined if you were to apply for another one. This includes both personal and small business Amex cards.

One important note: This five-card total doesn't include hybrid cards that don't have fixed spending limits – formerly known as charge cards. That means the following cards don't count towards that five-card limit:

- *amex platinum*

- *biz platinum*

- *amex gold*

- *biz gold*

- *amex green*

- The American Express® Business Green Card

If you already have five American Express credit cards and don't want to close one in order to pick up a co-branded Marriott Card, going with the Chase issued cards will be your only choice.

Additionally, no matter which cards you are applying for, you won't be approved for more than two American Express cards in a 90-day period. However, this restriction excludes hybrid cards without a fixed spending limit like ones mentioned above.

Thrifty Tip: Use Amex's ‘Apply with Confidence' tool to know if you're eligible for a new card welcome offer before pulling your credit and hitting submit on your application.

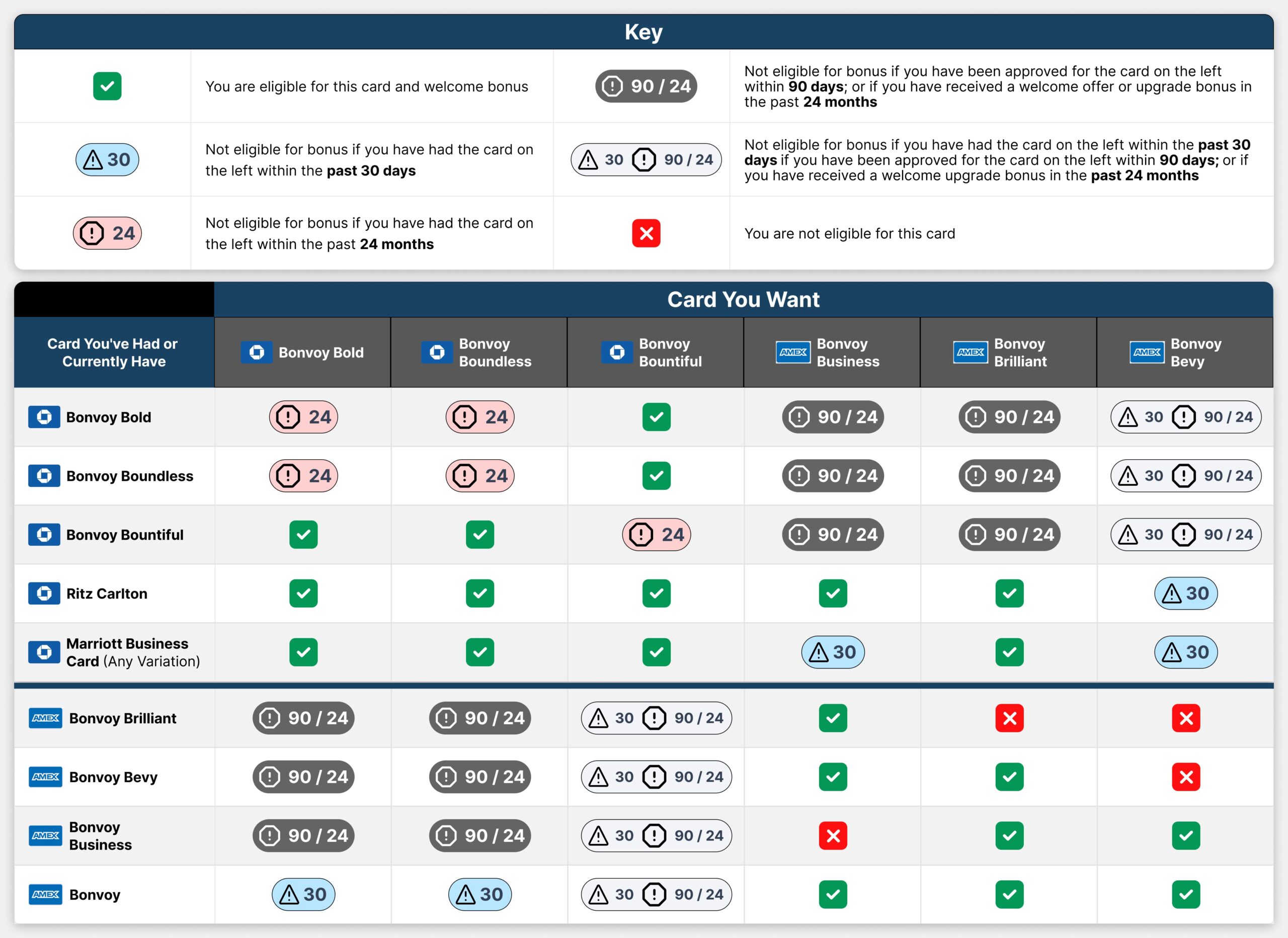

Marriott Card Rules

Now that we've gone over the options and cleared up the general bank application rules, we need to go deeper. Let's take a closer look at Marriott's rules for eligibility.

Do you currently have or have you recently (in the past 30 days) had a Marriott credit card? Have you received a welcome offer on a Marriott Card in the last 24 months? If the answer to both those questions is no, you're in luck! You'd qualify for any of the six currently available Marriott Cards.

However, if you answered yes to one of those questions we're going to need to do a little more investigating in order to determine just which cards you qualify for.

To help make sense of it all, we created a handy Marriott Card eligibility matrix to help you determine whether or not you're eligible for a new card offer. And yes, this is as simple as we could make it!

As you can see, figuring out whether or not you're eligible isn't exactly easy. Of the cards that are currently available, you can only have two personal Marriott Cards and one business card at a given time. Having said that, it's technically possible to add a third personal card by product changing to one of Marriott's grandfathered cards, like The Ritz-Carlton Card.

If you're after more than one personal card, it's worth noting that they'll all need to be issued by the same bank – either Chase or Amex. Since American Express is the only bank currently issuing a Marriott Business Card, they will be your only option on the business side of things.

Although it's not as simple as picking the best welcome offer, with six different options to choose from, there should be one that works for everyone!

Read more: Earn a Bunch of Points With These Marriott Bonvoy Card Welcome Offers!

Bottom Line

Marriott has an abundance of Bonvoy branded credit cards. Choosing which card is right for you might seem like a simple task, but the decision gets more complicated by Marriott and each bank's complex set of rules for card eligibility.

If you're considering a new Marriott card, be sure to read this post and consult our Bonvoy Card matrix before applying!

Hello! Looking into getting one of the AMEX Marriott Cards, however looking at the requirements, I was offered an upgrade offer from the Chase Boundless to the Chase Bountiful (Targeted) for 15k Marriott points. I did not take it, and so does that eliminate me from the AMEX welcome offers?