We've long considered the *chase sapphire preferred* to be one of the best cards for all travelers – beginners and experts alike. Scoring a big welcome offer bonus just makes that case even stronger.

Here is what's at stake with the current bonus offer: bonus_miles_full

But look beyond that mountain of points and you'll find some equally valuable card benefits that shouldn't be ignored. Some are permanent perks while others are temporary benefits (that could stick around for good). Either way, there are many reasons beyond the initial signup bonus to pick up and keep a Sapphire Preferred card … even if some of them aren't widely advertised.

Let's break down some of the lesser-known Chase Sapphire Preferred benefits that you should know about to get the most out of this card.

Learn more about the *chase sapphire preferred*

Bonus On Chase Travel℠ Bookings

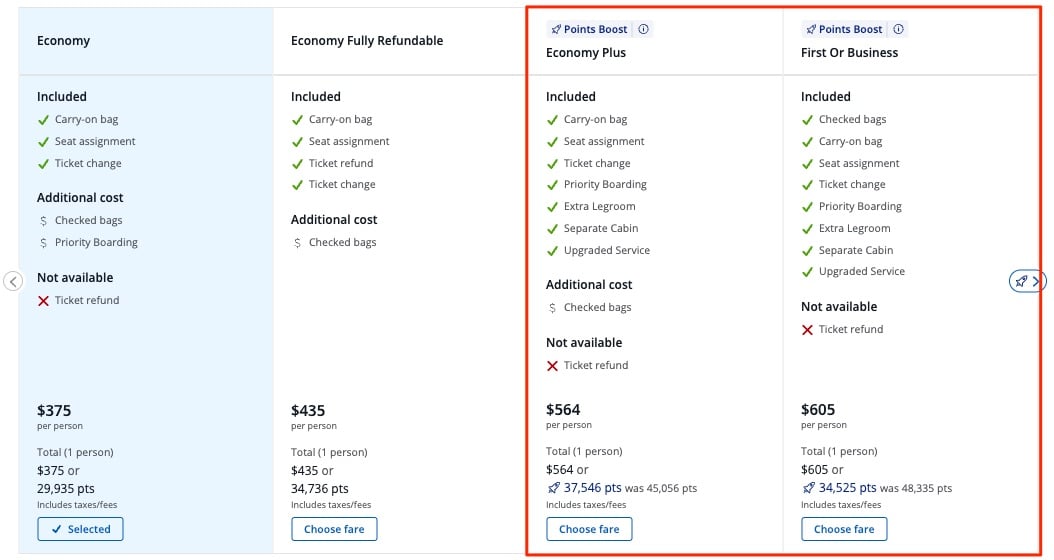

With Chase's new “Points Boost” offers, your points will be worth up to 1.5 cents each on thousands of hotels and flights with select airlines through Chase Travel – and up to 1.75 cents each on premium cabin tickets on select airlines.

For example, if you're looking to book an extra-legroom Economy Plus ticket on United and see one of these offers available, you could redeem 37,546 Chase Ultimate Rewards instead of paying the $564 cash that the airline is charging.

Since your points are worth more for premium cabin bookings, it would actually cost you fewer points to book first class with one of these offers. At 34,525 points for a first class seat, you're paying less than the airline's cheapest economy offering when redeeming points at 1 cent each.

If you got your Sapphire Preferred before June 23, 2025, you can also redeem any points earned before Oct. 26, 2025, for 1.25 cents each on all travel through the portal. As mentioned, this option will be going away entirely come late October 2027.

Note: The screenshot above shows a redemption rate of 1.25 cents each for “Economy” and “Economy Fully Refundable” because I have a legacy Sapphire Preferred card.

Free DashPass Membership and $10 Monthly Credit

Through an enhanced partnership between Chase and DoorDash, Sapphire Preferred cardholders get a complimentary DashPass membership and a monthly coupon of up to $10 off on grocery, convenience, and other non-restaurant orders. This benefit largely replaces a previous partnership with Instacart that expired at the end of July 2024.

In addition to the 3x Ultimate Rewards points you'll earn on dining at restaurants and eligible delivery services like DoorDash, you'll also save on delivery fees and enjoy additional savings on each order with DashPass.

Simply add your Chase Sapphire Preferred as a payment method in your DoorDash account and you should get a pop-up offering you a complimentary DashPass membership, good through Dec. 31, 2027. Considering DashPass typically costs $9.99 a month, you can save some decent money with this benefit.

If you'd otherwise be paying $96 per year for DashPass, this benefit alone is enough to cover the cost of carrying the Sapphire Preferred Card. Add in the new, up to $10 off monthly coupon for non-restaurant orders, and it's a clear win.

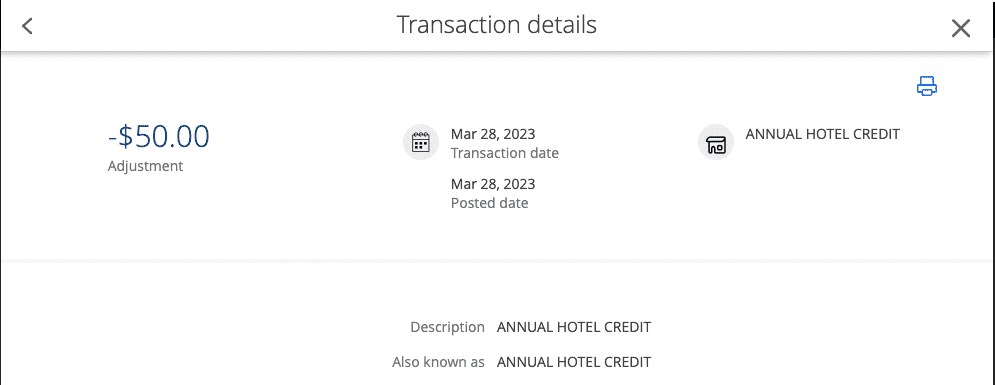

Annual $50 Hotel Credit

The Chase Sapphire Preferred Card offers a $50 statement credit to cardholders each year that can be used towards booking a hotel through Chase Travel.

To take advantage, all you need to do is use your Sapphire Preferred Card to book and pay for a hotel stay of at least $50 through Chase Travel and you'll receive an automatic statement credit for up to $50 each year. Note that this credit is available on your cardholder anniversary rather than at the beginning of each year.

Unlike other credit cards offering benefits like this, there is no minimum spend or length of stay requirement. Best of all, no registration is required and this statement credit kicks in automatically!

Read our guide to using the $50 Sapphire Preferred Hotel Credit

Primary Rental Car Insurance

The Chase Sapphire Preferred comes with primary rental car coverage – meaning if something happens to your rental, you can skip your own insurance and go straight to Chase for help.

In order to take advantage of this coverage, you need to charge your rental to your Sapphire Preferred card and decline the collision damage waiver that the car rental company tries to sell you. This policy will provide reimbursement for damage due to collision or theft on rental cars in both the U.S. and when traveling internationally. If you get into an accident, it will cover the costs of any damage up to the cash value of the vehicle.

Just note that this is not liability insurance. It will not cover medical bills, damage to another vehicle, or damage to property. Still, it's some of the best car rental coverage you can get.

Additional reading: All About the Chase Sapphire Rental Car Insurance Benefit

Bottom Line

Most of these Chase Sapphire Preferred benefits alone can help justify the card's annual fee. Add them all together and it's not hard to see why we think the card provides so much value for its modest $95 price tag.

Considering new cardholders will earn 75,000 Chase Ultimate Rewards points after spending $5,000 in the first three months of card membership … it's even more of a no-brainer.

Learn more about the *chase sapphire preferred*

Last time I checked, some countries like Ireland and Italy are excluded on the car rental coverage. Also there was a minimum number of days for your trip, like 5 maybe. And it doesn’t apply less than 50 miles from home (I like to do a one-way car rental to get to the airport). While I still use this card, after two claims that weren’t worth the hoops Chase requires jumping through, I much prefer the Amex primary rental car insurance which is under $20 for the length of the trip. Two easy p, no-hassle claims with them.

Hey,

Does car insurance cover car rentals in Europe?

Yes it does.