Membership Rewards – the points earned by many of American Express' top travel rewards credit cards – should be at the center of any points and miles earning strategy. They're some of the most valuable credit card points you can earn and having a stash of them can help you travel more for less.

While Amex has become known for its mainstream premium card, *amex platinum card*, the bank also has two cards that earn the same Membership Rewards points, provide great travel benefits, and have much lower annual fees.

Both the *amex gold card*, and the American Express Green Card® are great options for travelers, and in this article, we'll compare the Amex Green and Gold cards to help you make a decision on which is best for you.

Learn more about the *amex gold card*

All information about the American Express Green Card® was collected independently by Thrifty Traveler and has not been reviewed by the issuer.

Learn more about the American Express Green Card® (for full disclosure, this is a personal referral link.)

Amex Green vs Gold: Welcome Offer Bonuses

When you're looking at the welcome offer bonuses on both the Amex Green and the Amex Gold, you'll find they're very similar. Here's what each card offers.

American Express Green Card

*amex green card bonus_miles_full*

The current offer on the Amex Green Card is a relatively new one which Amex introduced back in May. No matter whether you're applying through a website like Thrifty Traveler, directly on Amex's website, or through somebody's personal referral link, the offer should be the same. Plus, if you have travel spending to do in your first six months with the card, you'll get a 20% statement credit for travel and transit purchases up to $200 back.

That means if you spend $1,000 on travel and transit purchases in your first six months of card membership, you'll get $200 back. That's more than you'll pay for the card's first-year annual fee of $150.

American Express Gold Card

*amex gold card bonus_miles_full*

That's the standard offer you'll find on the Amex Gold card.

Winner: Which Card Has the Better Welcome Offer?

If we are just looking at the standard offers on both the Amex Gold and Amex Green, the Gold Card takes this category with a typically bigger welcome offer.

However, if you are able to get an elevated offer on the Gold card to earn more than the standard welcome offer bonuses, it could get even better.

Winner: *amex gold card*

Learn more about the *amex gold card*

Amex Green vs Gold: Earning Points

Above and beyond the welcome offer bonus on both the Amex Green and Amex Gold, both cards earn bonus points in other categories that can make them very attractive options. Plus, since Amex doesn't restrict you from holding the Platinum, Gold, and Green cards together, one or both of these cards can be a great option to pair with the Platinum Card, which only earns bonus points on airfare or purchases through Amex Travel.

Here's what you'll earn with both the Amex Gold and Green cards.

American Express Green Card

With the American Express Green Card®, you'll earn 3x Membership Rewards points per dollar spent on travel, transit, and dining purchases. You'll earn 1x point per dollar spent on all other eligible purchases.

American Express Gold Card

With the *amex gold card*, you'll earn 4x points per dollar spent at restaurants worldwide on up to $50,000 spent each calendar year (then 1x). You'll also earn 4x points per dollar spent at U.S. supermarkets on up to $25,000 spent each calendar year (then 1x).

You'll also earn 3x points per dollar spent directly with airlines or at amextravel.com, and 1x points per dollar spent on all other eligible purchases.

Winner: Which Card is Better for Points Earning

Both of these cards offer a great return in their respective bonus categories, but when it comes to which card will capture more of your spending, this category has to go to the Amex Gold Card. You'll be hard-pressed to find a card that offers a better return at restaurants or supermarkets, period.

The earn rates in these categories alone can be reason enough to hold the card and make it worth the $325 annual fee.

Winner: *amex gold card*

Amex Green vs Gold: Annual Fees

While both cards charge an annual fee, there is no question that you can easily get that amount back in value each year, regardless of which card you choose. It's why we always encourage readers to do the math before ruling out a card with a big annual fee.

Here's what you need to know about both the Amex Green and Gold annual fees.

American Express Green Card

The Amex Green card has an annual fee of $150 each year. There is no fee to add additional authorized users to your account.

American Express Gold Card

The Amex Gold card has an annual fee of $325 each year. There is no fee to add additional authorized users to your account.

Winner: Which Card Wins on Fees?

Compared to the $695 annual fee (see rates & fees) on the *amex platinum card*, the annual fees on both the Green and Gold cards look quite attractive.

Of course, additional features and benefits are what drive the annual fees up on all three of these cards, but if we are just looking at which card has the lowest annual fee cost each and every year of card membership, there's a clear winner in this category.

Winner: American Express Green Card®

Amex Green vs Gold: Statement Credits

If you have an American Express travel card with an annual fee, there is a good chance that the card is going to offer statement credits. These credits are the key to getting value out of what you are paying for the card's annual fee and both the Amex Green and Gold cards are no different.

Here are the statement credits available on both cards.

American Express Green Card

Up to $189 for CLEAR Plus

If you hold the Amex Green Card, you'll get up to a $189 credit each and every year to cover the cost of a CLEAR Plus membership.

CLEAR Plus allows you to cut to the front of the line: On its own, you can skip to the front of the standard security line. In tandem with TSA PreCheck, you can skip to the front of that shorter, faster line – keeping your coat and shoes on and keeping electronics inside your bag, too.

If you're already paying for a CLEAR Plus Membership out of pocket, this benefit alone can more than justify the card's $150 annual fee.

Read More: Want CLEAR Plus? These 3 Cards Will Cover the $189 Annual Membership Fee

Up to $100 for LoungeBuddy (Airport Lounge Access)

The Green card also offers an annual credit of up to $100 to use on LoungeBuddy, a Priority Pass competitor. Lounge Buddy offers single-use airport lounge access passes starting at just $25 each. That means, the credit can get you into lounges up to four times each year at no additional cost. That makes it a decent option if you don't have any airport lounge access from another credit card.

American Express acquired Lounge Buddy back in 2019, but to date, the Green Card is the only American Express card with Lounge Buddy benefits.

Read More: LoungeBuddy: The Best App to Figure Out Which Lounges You Can Visit

American Express Gold Card

Up to $120 of Annual Uber Cash

With the Amex Gold, you'll get up to $120 each year of Uber Cash which can be used for both Uber rides and Uber Eats food delivery in the U.S. You'll get $10 to use each and every month, and you'll lose any unused balance.

Up to $120 of Annual Dining Credits

Amex Gold cardholders also get a $10 credit each and every month to use at the following retailers:

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Five Guys

Like the Uber Cash benefit, any unused amount at the end of each month will be forfeited. But if you can maximize both of these credits, that's up to $240 in value – almost enough to cover the card's entire $325 annual fee.

Winner: Which Card Has Better Statement Credits?

This one is tough. The Amex Green card has two credits that can be used in one fell swoop, while both of the credits on the Amex Gold card will require some diligence each and every month to make sure you burn them up.

That said, I think the Amex Green takes this category, as the CLEAR credit should be very easy to use, and if you do, the value of that credit should easily offset the card's $150 annual fee.

Winner: American Express Green Card®

Amex Green vs Gold: Travel Protections

If having some sort of travel protection is important to you, neither card provides an advantage here. You'll get the exact same coverage regardless of which card you have.

Both cards offer car rental loss and damage coverage which is secondary coverage. That means if you get into an accident or your car is damaged with secondary coverage, you'd have to file a claim with your personal insurance policy before turning to your credit card company for help. That means you'll have to pay your deductible – and your auto insurance premiums will likely go up, too.

Generally speaking, there are better card options for car rental coverage that offer primary rental car coverage, which allow you can skip your own policy and file a claim directly with the policy issuer. That's what you get on both Chase Sapphire cards as well as the *capital one venture x*.

Next, both the Amex Green and Amex Gold provide trip delay protection which allows you to be reimbursed up to $300 per eligible trip if it is delayed by more than 12 hours. The coverage is intended to cover any out-of-pocket expenses incurred for things like lodging, meals, and personal use items.

Finally, both cards will provide coverage for lost, stolen, or damaged luggage. However, the coverage is secondary to any coverage or reimbursement you receive from the airline or other insurance.

Winner: Which Card Has the Best Travel Protections?

Since both cards offer the same coverage, this category is a tie.

Winner: Tie

Amex Green vs Gold: Redeeming Points

Both cards earn the same Membership Rewards points and when it comes to redeeming them, neither card provides an advantage over the other.

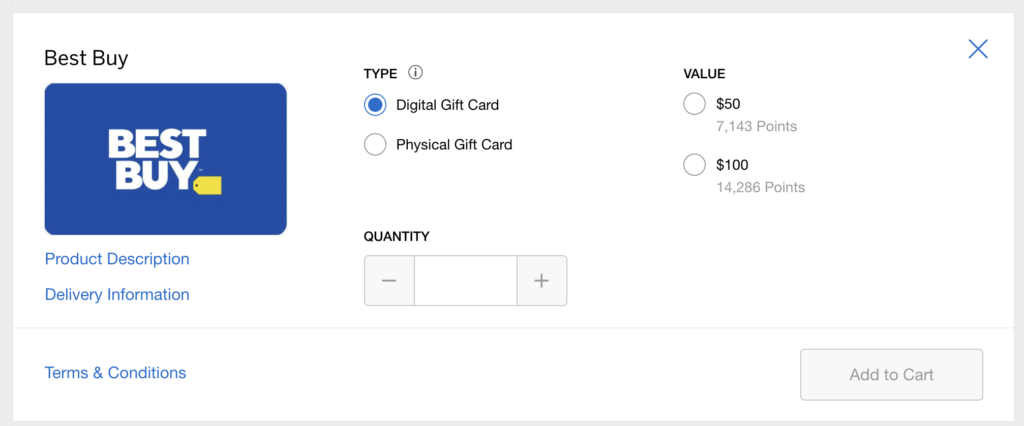

You’ll have a handful of options at your disposal, but let’s get the obvious out of the way: Using them for travel experiences will give you the best return on them by far. For example, while it is possible to redeem your points for charges, or even gift cards, many of those redemptions are at a very poor value in comparison. When it comes to gift cards, the value of your points will change depending on the gift card you're looking at.

For example, you can redeem points for a Home Depot gift card, getting one cent apiece for your points. That means 2,500 points would get you a $25 gift card.

But that value drops dramatically if you are looking at a Best Buy gift card.

Here's the bottom line: Use Membership Rewards for travel. Doing so will simply give you the best value out of your points.

When using them for travel, you have a few different options.

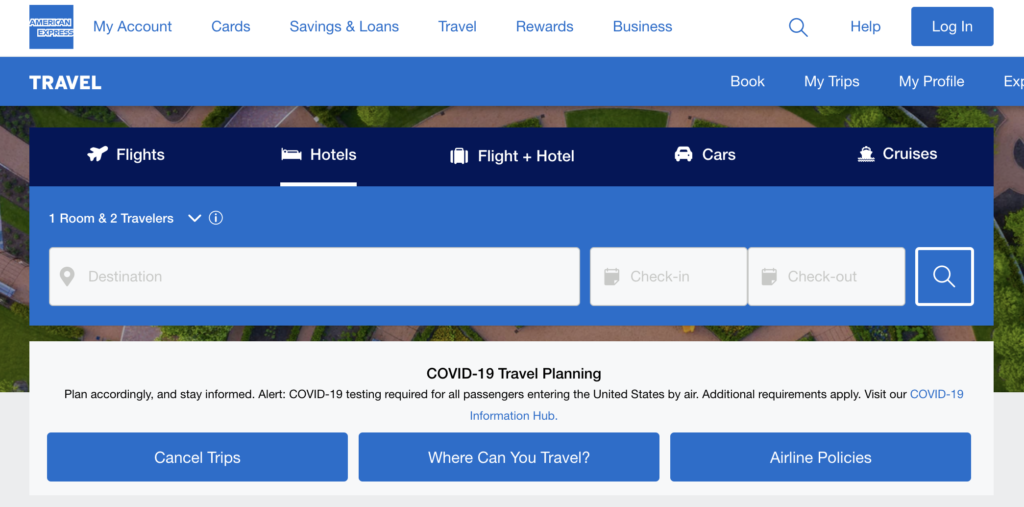

Book Travel Through the Amex Travel Portal

When booking travel with Membership Rewards points, the first and perhaps easiest is to use the Amex Travel portal. Through Amex travel, you'll have the ability to book flights, hotels, rental cars, and even cruises.

When you do, your points will be worth one cent each. That means 100,000 Membership Rewards points would get you $1,000 towards travel, regardless of which points-earning Amex card you have.

Transfer Membership Rewards Points to Partner Airlines & Hotels

The next – and perhaps best – way to use Membership Rewards points is by transferring them to partner airline and hotel programs. Just like Chase Ultimate Rewards, Citi ThankYou, Capital One Venture Miles, and Bilt Rewards points, you can transfer Amex points directly into your account with certain airlines and hotels.

Read more: Amex Transfer Partners: How & Where to Transfer Membership Rewards Points

Scope out the full list of transfer partners, and you'll see there are plenty of options to send your points.

Membership Rewards Airline Transfer Partners

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| Aer Lingus | 1:1 | N/A |

| AeroMexico | 1:1.6 | 2-12 days |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France/KLM | 1:1 | Instant |

| Alitalia | 1:1 | Instant |

| ANA | 1:1 | 1-2 days |

| Avianca | 1:1 | Instant |

| British Airways | 1:1 | Instant |

| Cathay Pacific | 1:1 | 1-7 days |

| Delta | 1:1 | Instant |

| El Al | 50:1 | Instant |

| Emirates | 1:1 | Instant |

| Etihad | 1:1 | Instant |

| Hawaiian | 1:1 | Instant |

| Iberia | 1:1 | 1-3 days |

| JetBlue | 1.25:1 | Instant |

| Qantas | 1:1 | Instant |

| Singapore | 1:1 | 12-48 hours |

| Virgin Atlantic | 1:1 | Instant |

Your Membership Rewards points will transfer to most airline partners instantly. That means as soon as you complete the transfer from your Amex account, they should arrive in your airline frequent flyer account.

That said, some transfer partners like Singapore, Cathay Pacific, ANA, Iberia, and more will take anywhere from 12 hours to 12 days.

And while the majority of airline transfer partners will transfer on a 1:1 basis – meaning 1 Amex point will equal 1 airline mile – that's not the case for all of them.

Membership Rewards Hotel Transfer Partners

On the hotel side of things, you'll have three options to transfer your points: Hilton, Marriott, and Choice Hotels.

Choice and Marriott will transfer at a ratio of 1:1 while Hilton transfers are a rate of 1:2. That means for every 1 Amex point transferred, you'll receive 2 Hilton Honors points.

| Program | Transfer Ratio | Transfer Time |

|---|---|---|

| Choice Privileges | 1:1 | Instant |

| Hilton Honors | 1:2 | Instant |

| Marriott Bonvoy | 1:1 | Instant |

While it's possible to transfer Amex points to hotels, you'll almost always do better by focusing on transferring points to airlines. In our minds, 50,000 Singapore or ANA miles are worth far more than 50,000 Marriott Bonvoy or Hilton Honors points.

Which Card is Better for Redeeming Points?

Whether you have the Amex Gold or the Amex Green, both cards will provide the exact same options for redeeming Membership Rewards points. Neither card has a leg up in this category.

Winner: Tie

Bottom Line: Amex Green vs Gold

Both the *amex gold card* and the *amex green card* are great travel rewards cards that earn Membership Rewards points and are worth a spot in your wallet.

Amex doesn't restrict you from holding both cards, so that's certainly an option. Both cards offer features and benefits that will appeal to different types of travelers, so use this guide to help you choose the best option for you.

Learn more about the *amex gold card*

Learn more about the American Express Green Card® (for full disclosure, this is a personal referral link.)

Hey Nick,

I assume the Uber credit on the Gold would stack along with my current credit that the Platinum gives already?

Hey Brian. It certainly does. I have both and get $25 each month.