In order to get ahead in the points and miles game you'll need to follow the golden rule: Thou shalt not carry a credit card balance. It's the number one thing we try to preach when writing about all the top travel rewards credit cards and the enticing welcome bonuses that come with them.

But what if you're already carrying a balance on an existing card?

In that case … let's talk about balance transfers. The name pretty much says it all: Balance transfers are a financial tool that allows you to move your balance from one credit card to another, usually in an effort to reduce your monthly payment by paying less interest. Most banks have credit cards that offer an introductory annual percentage rate (APR) on both purchases and balance transfers as part of their new card welcome offers.

While we spend most of our time dreaming about big points and miles sign-up bonuses that can help fuel our travels, these 0% intro APR welcome offers can be equally (or more) valuable to someone who is currently saddled with credit card debt. That low rate means you won't accrue any new interest for a period of time which can help you pay off your balance faster.

Let's take a closer look at what exactly balance transfers are and some of the best new card options for completing one.

Benefits of a Balance Transfer

With APRs on many cards approaching 30%, more and more Americans are finding themselves buried in an endless pile of credit card debt. It can be a truly helpless feeling.

Even if you're making more than the card's minimum payment each month, that high interest rate can make it tough to gain ground on any credit card debt you owe.

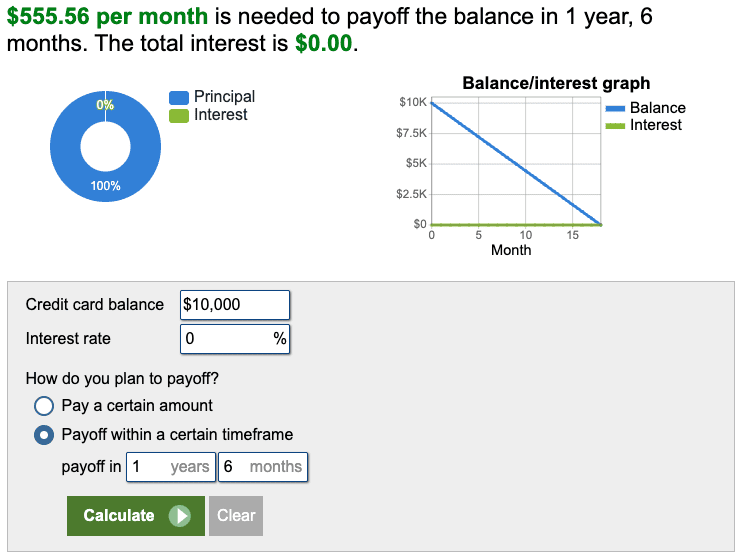

To illustrate how high-interest credit card debt can weigh down your monthly budget, let's take a look at someone with a $10,000 credit card balance at a 20% interest rate – and that's conservative given how high rates have gotten. In this example, if you planned to pay off that $10,000 balance over the next 18 months, you'd need to pay nearly $650 each month on your card and it would end up costing you around $1,650 in interest.

If you instead moved that $10,000 balance to a new credit card with a 0% introductory APR for balance transfers, you'd only need to pay about $550 each month to have it entirely paid off in the same 18-month timeframe. Without being on the hook for the bank's high interest rates, you'd save nearly $100 each month on your payment.

One thing to note: Balance transfers aren't free. Most banks charge a fee for completing the transaction – usually somewhere in the 3% to 5% range. So in the example above, if you saved the $1,650 in interest but paid a $300 (3% of $10,000) fee upfront for completing the transfer, your total savings with this offer would be $1,350. Not too shabby!

And while credit card debt has been a problem in our country for decades, it's gotten especially troubling over the past few years as the Federal Reserve has methodically raised banks' borrowing rates in an attempt to slow inflation. When banks' borrowing costs go up, they pass that burden on to their customers by charging higher interest rates on all types of loans – mortgages, installment loans, auto loans, and of course, credit cards.

All these interest rate hikes have made banks' introductory APR offers on balance transfers more valuable than ever.

Best Cards for Completing a Balance Transfer

When looking for a new card to move your existing credit card balance to, focus on those that offer a low introductory APR. There are several solid credit cards on the market that offer 0% introductory APR offers so anything above that isn't worth it in this case.

You'll also want to look for a card issued by a different bank than the one you're currently carrying a balance on. In most cases, banks won't allow you to move the balance from one of their cards to another in order to take advantage of an introductory balance transfer offer. Once they've got you on the hook at a high interest rate there simply isn't any financial incentive for them to do so.

Beyond getting a low introductory APR, it's important to find a card that's going to fit your needs in the long term. Once you have your balance paid off, you'll ideally be able to use the card to earn rewards for new purchases and then pay the balance in full each month in order to avoid that sky-high interest. Getting a card that provides solid rewards and benefits for your future spending would be an added bonus.

In deciding which card is best for completing a balance transfer you should first look at how long the offer lasts – the longer the better. This will give you more time to pay down the debt at a 0% APR and therefore lower your monthly payment amount. And consider what fees the card charges – annual fees, balance transfer fees, late fees, etc. You'll find that most banks will charge 3% for balance transfers as part of the introductory offer, but that rate often goes up to 5% after a few months so you'll want to transfer your balance as soon as you can. If you're able to combine a longer-term intro APR with a low transfer fee, that will be your best bet.

Keep in mind: The whole purpose of opening a new credit card and completing a balance transfer is to improve your financial picture. If the temptation of having more available credit is too much for you to handle, you'll be far better off sticking with your current card and working to pay it off as quickly as possible.

Worried about your credit score? Read our guide to understanding your credit score before applying for your next card.

Citi Simplicity® Card

- Introductory balance transfer APR: balance_transfer_intro_apr,balance_transfer_intro_duration

- Introductory purchase APR: intro_apr_rate,intro_apr_duration

- Regular APR: reg_apr,reg_apr_type

- Introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balance transfers completed within four months of account opening.

- Regular balance transfer fee of $5 or 5% of the amount of the transfer, which ever is greater for balance transfers beyond the introductory period.

- Sign-up bonus: None

- Rewards: None

- Annual fee: None

Learn more about the Citi Simplicity® Card (for full disclosure, this is not an affiliate link).

Citi Double Cash® Card

- Introductory balance transfer APR: balance_transfer_intro_apr,balance_transfer_intro_duration

- Introductory purchase APR: intro_apr_rate,intro_apr_duration

- Regular APR: reg_apr,reg_apr_type

- Introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balance transfers completed within four months of account opening.

- Regular balance transfer fee of $5 or 5% of the amount of the transfer, which ever is greater for balance transfers beyond the introductory period.

- Sign-up bonus: bonus_miles_full

- Rewards: Earn 2% cash back on all purchases: 1% when you buy and 1% as you pay for your purchases.

- Annual fee: None

Learn more about the Citi Double Cash® Card (for full disclosure, this is not an affiliate link).

Chase Freedom Unlimited®

- Introductory balance transfer APR: balance_transfer_intro_apr,balance_transfer_intro_duration

- Introductory purchase APR: intro_apr_rate,intro_apr_duration

- Regular APR: reg_apr,reg_apr_type

- Introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balance transfers completed within 60 days of account opening.

- Regular balance transfer fee of $5 or 5% of the amount of the transfer, which ever is greater for balance transfers beyond the introductory period.

- Sign-up bonus: bonus_miles_full

- Rewards: Earn 5% cash back on travel purchases through the Chase Travel portal, 3% cash back on dining (including takeout and eligible delivery service) and drug store purchases, and unlimited 1.5% cash back on all other purchases.

- Annual fee: None

Check out our full review of the Chase Freedom Unlimited Card!

Learn more about the *chase freedom unlimited*

Balance Transfer FAQs

How Much Does a Balance Transfer Cost?

Most credit card issuers don't offer balance transfers for free. In general, you'll be charged a flat fee or a percentage – usually 3% to 5% of the total amount transferred. But the amount of money you'll save in interest through your new introductory rate should more than make up for that balance transfer fee.

Will I Earn Points on a Balance Transfer?

No. Balance transfers don't count as purchases so you won't earn points on it nor will it get you any closer to meeting a welcome offer on a new card. The benefit of a balance transfer is solely to lower your interest rate.

What's the Difference Between a Balance Transfer APR and Purchase APR?

The balance transfer APR only applies to the amount of debt you're moving over from an existing card. The purchase APR will apply to anything new that you buy with your card.

What Happens After My Introductory Period Ends?

If your promotional balance transfer APR period ends and you still have a remaining balance owed, you'll be charged interest on what's left at the standard APR.

Since credit card interest rates have risen dramatically in the last couple of years, it's best to pay off as much of your balance as possible before the introductory offer is over. If you're unable to pay the balance in full, you may want to revamp your payment plan or even consider applying for a different card with another introductory balance transfer offer.

Can I Do a Balance Transfer With the Same Bank?

No. While there aren't any laws preventing this sort of thing, you're unlikely to find a bank that will allow you to move a balance from one of their credit cards to another in order to take advantage of an introductory interest rate.

The reason is pretty simple: Much like the eye-popping welcome offers we see on the top travel rewards credit cards, banks are using promotional interest rates as a way to lure in new customers. If you're already carrying a balance on one of their cards, they're currently making money off of you and have no financial motivation to allow you to move that balance to a different card at a lower rate.

What Happens to My Card?

After you transfer your balance to your new card, your old card should have a zero balance – assuming you moved the full amount over – and you won't need to make any further payments on it. In most cases, it's a good idea to keep that card open in order to help your total credit utilization and the average age of accounts. But if the card charges an annual fee or simply doesn't fit your needs anymore you can also close it.

When Shouldn't I Do a Balance Transfer?

If your outstanding balance is relatively low and you anticipate being able to pay it off in the next few months, a balance transfer likely isn't a good idea for your situation. What you'd pay in fees to complete the balance transfer probably wouldn't be worth the amount of interest you'd save over such a short period of time.

Bottom Line

Credit card debt can be more than just a financial burden, it can also take a toll on your mental and physical health as well. In most cases there's no easy (or quick) way out – but with an introductory balance transfer offer, there may be some light at the end of the tunnel.

If you're wondering whether to do a balance transfer, this guide can help you decide when it makes sense and which card you should open to complete it.