*amex platinum* and *amex gold* are two of the best travel cards you'll find, period. Both cards come with big welcome offers of at least 60,000 points (or much more) … but ensuring you earn the biggest possible bonus can be a real challenge.

Most banks offer the same bonus regardless of where you apply, but not American Express. Just how many points you earn (and how much you need to spend to get them) can vary wildly depending on where you apply. You may see a Platinum Card offer of 80,000 points after spending $8,000 in six months available directly with Amex or through sites like ours. Open that same page in an incognito browser, though, and it could be nearly double the points. Special offers through partners like Resy or CardMatch complicate things further.

That bonus guessing game has spread to small business owners eyeing *biz platinum*: While you typically see bonuses of 150,000 points, we've seen a slew of offers as high as 200,000, 250,000 or even 300,000 points, depending on where (and when) you apply.

It's up to you to track down the biggest bonus you can before hitting that “apply” button. And it's critical that you do: American Express only allows you to earn the welcome bonus offer on each of their cards once per lifetime.

But no matter the offer: Credit cards are serious business. Never open a new credit card unless you can pay off every dime you charge each month. Digging yourself into credit card debt simply isn't worth the big bonus.

We've rounded up all the methods you can use to make sure you're getting the biggest and best offer on the Amex Platinum and Gold cards. While we typically make a commission if you get approved for a credit card through us, that's not the case for most of these methods: We just want to make sure you get as many points as possible if one of these cards is on your radar.

Related reading: Amex Platinum vs Gold Cards: Which is Best for You?

The Best Welcome Offers Available on The Platinum Card from American Express

Personal Referral Offer

We saved the best for first. If you want to get the best offer currently available on the Amex Platinum Card, look no further than a record-setting offer you can find through certain personal referral links.

Some cardholders can earn up to 175,000 points with The Platinum Card® from American Express (for full disclosure, this is a personal referral link) after spending $8,000 within the first six months. Simply put, this is one of the best offers we have ever seen on this card – and earning so many points in the first year is bound to take some of the sting out of paying the card's $695 annual fee (see rates & fees).

Thrifty Tip: If you don't see the elevated offer at first, try opening the link in an incognito window instead.

Consider this: The standard offer on the Platinum Card is still 80,000 points for the same spending requirement. That's right: Open and apply through the wrong link and you'll earn half the points … for an identical amount of spending.

But just remember: Since this offer is only available through personal referral links from current Platinum cardholders, you'll need to use the link above or track down a friend to apply.

Since this offer is targeted, not every current cardholder will have the bigger offer to share. And even if your friend or family member has a link that supposedly works for a 175,000-point bonus, that might not be what you see when you click it.

Get Up To a 175K Offer via CardMatch

If you're not familiar with CardMatch, it is a tool from creditcards.com, and it works like this: Enter some basic personal information and the last four digits of your social security number, and CardMatch will return some current credit card offers that you're likely to get approved for – sometimes with bigger bonuses than what's available through public channels.

To generate all your available offers, CardMatch does a soft pull on your credit. This might sound scary but it's really not: Soft credit inquiries do not impact your credit score because they aren't attached to a specific application for credit. Just keep in mind that it's not guaranteed you'll be approved for the options CardMatch pulls in … but it does improve your odds.

There have been a few different targeted offers available through CardMatch for the American Express Platinum Card over the last few years. It's possible for CardMatch users to pull up a 100,000, 125,000, and 150,000-point offer for a similar spending requirement to what's publicly available. Recently, some have reported even getting a 175,000-point offer!

Long term, CardMatch is a great place to check for any targeted Amex offers. Just remember: the best offers won't be available to all CardMatch users.

See if you are targeted for a special offer on the Amex Platinum Card through CardMatch below!

See if you are eligible for a 175,000-point welcome bonus offer on the Platinum Card through CardMatch!

Try an Incognito Browser for a Bigger Amex Platinum Bonus

Sometimes, the key to getting the best bonus is simple: Just open an incognito window on your web browser, search for “Amex Platinum Card,” and open the page – or you can try opening this link in an incognito window. I did just that this morning and here's what I found:

It's a bit silly, isn't it? Try to open an Amex Platinum Card in a normal browser window and you'd get an 80,000-point bonus after spending $8,000 in six months. Open that same page in an incognito browser and you could earn almost double the points.

Those are the games that Amex plays. And still, it's no sure thing: Some members of the Thrifty Traveler team saw 80,000 points or 100,000 points using this same method.

But it's easy to check and surely worth a shot!

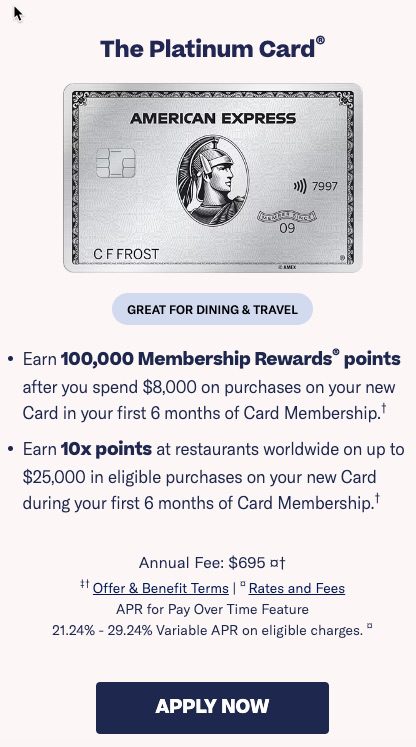

100K Points + 10x Points on Restaurant Spending Through Resy

Not familiar with Resy? It's a website and mobile app that allows users to discover new restaurants and make dining reservations. Back in 2019, American Express acquired Resy with plans to integrate exclusive dining access and rewards into the bank's mobile app.

One of the positives of this acquisition is targeted welcome offers for both the Platinum and Gold cards through Resy's website.

If you apply for the Platinum Card through Resy, you'll get an offer of 100,000 points after spending $8,000 in the first six months of card membership. But what makes this offer unique and (potentially) worth considering is that you'll also earn 10x points per dollar spent at restaurants worldwide on up to $25,000 on eligible purchases during your first six months of card membership. Considering the Platinum card only earns 1x point per dollar spent on restaurants normally, this could be a pretty sweet offer.

In fact, if you maximized that $25,000 in spending at restaurants in your first six months, you'd end up with another 250,000 points on top of the 100,000 points you would earn after spending $8,000 in six months. Add it all up and there is a potential 350,000 points on the table with this offer.

But even if you only spent $5,000 at restaurants in the first six months, that would be another 50,000 Membership Rewards points on top of the 100,000 you get as part of the welcome offer. It's an offer worth considering if you spend a lot at restaurants, making it simply one of the best offers you'll find on the Platinum Card.

Learn more about the welcome bonus offer on The Platinum Card through Resy (this is not an affiliate link).

Final Thoughts

If you apply for the Platinum Card through Thrifty Traveler or another travel website, or even through American Express itself, you might not be getting the biggest bonus available.

As you can see above, a bonus of 80,000 points is far from the best offer you can get right now … and Amex is hoping consumers don't know that before hitting apply. There are simply far superior welcome offer bonus points on the table so long as you know where to look.

Read more: A Full Review of the Platinum Card from American Express

The Best Welcome Offers Available on the American Express Gold Card

Looking for the best offers on the American Express Gold Card? You won't need to reinvent the wheel to find them. You'll want to start by looking in the exact same places where you'll find the best offers on the Platinum Card.

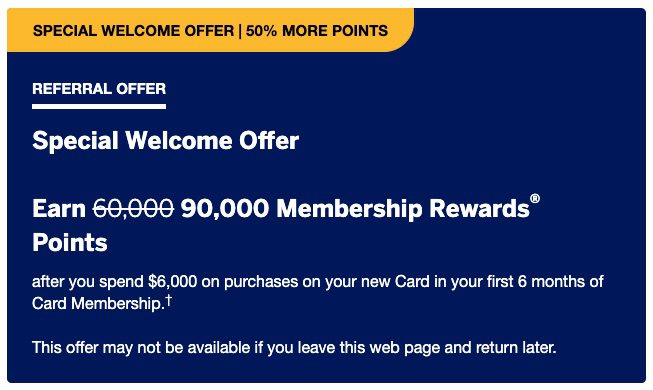

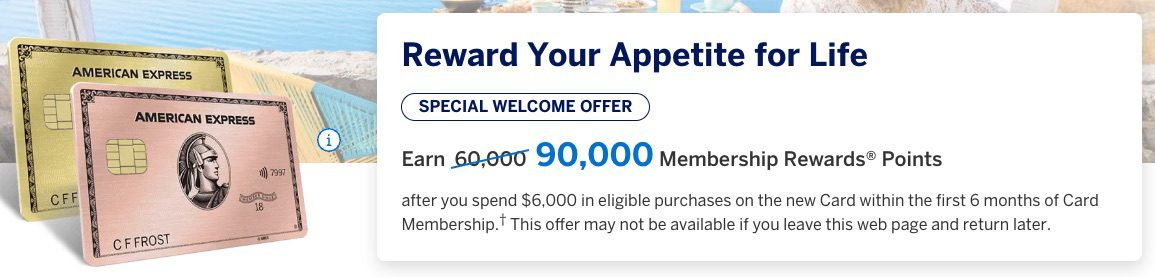

Personal Referral Offer

Like the Platinum Card, there is a targeted offer on the Gold Card available through personal referral links.

You can earn up to 90,000 points on the American Express® Gold Card after spending $6,000 within the first six months. Again, if you don't see the increased offer on the first try, open it in an incognito window instead.

Consider this: The standard offer on the Gold Card is still a decent offer but not as good as the referral. bonus_miles_full That's 50% more points just for using a referral link to apply.

But just remember: Since this offer is only available through personal referral links from current Gold cardholders, you'll need to use the link above or track down a friend to apply. Just like with the 150,000-point referral offer on the Platinum Card, this one is also targeted – not every current cardholder will have the offer to share.

No referral link? Some travelers are finding a 90,000-point offer directly on Amex's website!

Try an Incognito Browser (Again)

Amex loves to play games with these offers. Case in point: Sitting next to one another in the office, my three co-workers and I each searched for the Amex Gold Card in an incognito browser (or clicked this link).

One got the standard 60,000-point welcome bonus after spending $6,000 within the first six months of card membership while one of us got 75,000 points for the same spending requirement. Two of us lucked out with this: 90,000 points for spending $6,000 within three months.

If you can't get the 90,000-point offer with a $200 statement credit from a friend or family member, trying an incognito browser is easily the way to go.

75K Points + 20% Back on Restaurant Spending Through Resy

It's not just the Platinum Card that has a special offer available when you apply through Resy.

If you've been eyeing the Gold Card, you can get an offer of 75,000 points after spending $6,000 in the first six months of card membership by applying through Resy. But what makes this offer unique and worth extra consideration is that you'll also get 20% back as a statement credit on purchases made at restaurants worldwide for up to $250 in your first 12 months of card membership.

Considering the Gold Card has an annual fee of $325, you'll essentially get a free year of the Gold Card as long as you spend $1,250 at restaurants within your first year.

Learn more about the *amex gold*

Read more: 6 Reasons We Love the Amex Gold Card (and You Will Too)

Get a 75K Offer through CardMatch

Just like the elevated offer you can find on the Platinum Card through CardMatch, mentioned above, you can also find targeted offers on the Amex Gold Card.

In this case, the best you can do is earn 75,000 points after spending $6,000 in the first six months. That's much better than the 60,000-point offer for the same spending requirement you can find publicly, but not nearly as good as the 90,000-point offer available through personal referrals.

That said, it's still a decent place to check for a better offer if you strike out elsewhere.

Read More: How to Get the Amex Gold 75K Offer Through CardMatch

See if you're eligible for a 75K welcome bonus offer on the Gold Card through CardMatch!

Final Thoughts

Like the Platinum Card, if you apply for the Gold Card through Thrifty Traveler or another travel website, or even directly with American Express, you might get a bonus of 60,000 points after spending $6,000 in the first six months of card membership.

You can do much better. And it won't take much extra work to get a bonus of as much as 90,000 points.

Read More: A Full Review of the American Express Gold Card

The Best Welcome Offers Available on The Business Platinum Card

Apply Through an Incognito Browser or Referral Link for a Bigger Business Platinum Bonus

To get a bigger bonus on the Business Platinum, all you need to do search for “Business Platinum Card” on an incognito tab. Here's the highest offer we've found to date.

That's 50,000 more points than the typical 150,000-point offer after spending an identical $20,000 in the first three months. Bonuses of 200,000 or even 250,000 points have become more and more common – not by applying straight with Amex or through a site like ours, but via referrals, opening links in an incognito, and targeted emails or pop-ups online. And it can get even bigger.

Travel on Points reported that a member of their Facebook group was able to pull a whopping 300,000-point offer by searching for the Business Platinum card in an incognito browser and clicking Amex's first link.

Welcome bonuses this big are incredibly hit-or-miss: We haven't had any luck getting that same offer using this method for ourselves. Still, this bonus of 200,000 points with the same spending requirement isn't half bad!

A Bigger Bonus

If all else fails in your quest for a bigger bonus, Amex just rolled out a bigger bonus offer on *biz platinum*: bonus_miles_full

That's up from the previous norm of 120,000 points, though this bigger bonus now requires spending more to earn it.

This is a fantastic offer that deserves the attention of any small business owner. A $20,000 spending requirement in three months might seem steep, but earning 150,000 points (or more!) is tough to beat.

Learn more about *biz platinum*

Final Thoughts

Whether it's 150,000, 300,000, or somewhere in between, these are all truly massive bonuses that are worth your attention.

If you have a small business and can manage this kind of spending responsibly, this is a fantastic way to earn a ton of points. Just be sure you do a bit of digging to ensure you earn as many points as humanly possible.

Bottom Line

American Express has many different welcome offers available on their travel cards. The offers you'll find that are widely available through travel sites like ours (as well as American Express itself) are far from the best you can get.

These are the best options currently available on both cards. Make sure you don't leave valuable points on the table when you go to apply.

A couple days ago you had a referral link for the 150k bonus points? Is this link still available?

Hi Travis. Unfortunately that link is no longer available.