There are dozens of travel cards on the market, with a dizzying array of benefits, point bonuses, perks, and more. But we're just going to say it: The *amex gold card* is one of our favorite travel rewards cards, period.

Even after a facelift back in 2024 – complete with a higher annual fee and new credits – it's still a card that many travelers should consider having in their wallet … especially if earning points is a top priority.

It's packed with solid benefits and a new – potentially bigger – welcome bonus offer (more on that in a bit). Not to mention the recent increase in the spending required to earn the welcome offer bonus on the American Express Platinum Card®, really makes the Amex Gold shine.

But what really sets it apart is that it's so rewarding for everyday spending: the points you earn for groceries and dining out are second to none, helping you rack up more points at the places you spend most.

Add in some relatively easy-to-use statement credits, and you can easily come out ahead, even with the card's higher annual_fees annual fee (see rates & fees). So let's break down everything you need to know about the Amex Gold Card and whether or not it's right for you.

A Quick Overview of the Amex Gold Card

- Welcome Offer: bonus_miles_full

- Earn 4x points at restaurants worldwide (up to $50,000 in purchases per year, then 1x)

- Earn 4x points at U.S. supermarkets (up to $25,000 in purchases per year, then 1x)

- Earn 3x points on airfare booked directly with airlines or American Express Travel®

- Earn 2x points on prepaid hotels, car rentals, and cruises through American Express Travel®

- Earn 1x points on other eligible purchases

- $120 Dining Credit: Enroll and get up to $10 in statement credits monthly (up to $120 annually) when you pay with the Gold Card at Five Guys, Grubhub, The Cheesecake Factory®, wine.com, and Goldbelly

- $120 Uber Cash: Add the U.S. Consumer Gold Card to your Uber account to receive $10 in monthly Uber Cash (up to $120 annually) towards Uber Eats or Uber Rides in the U.S.

- $100 Resy Credit: Enroll and get up to $50 in semi-annual statement credits (up to $100 annually) after you enroll and pay with the Gold Card at U.S. Resy restaurants or on other eligible Resy purchases.

- $84 Dunkin' Credit: Enroll and get up to $7 per month (up to $84 annually) in statement credits after you enroll and pay with the Gold Card.

- No foreign transaction fees

- Annual fee: annual_fees (see rates and fees).

Learn more about the *amex gold*

Full Card Details

Welcome Offer Bonus

Amex has a massive welcome offer on the Amex Gold that instantly makes it one of the best offers on the market … if you qualify.

Here's what you can currently earn: bonus_miles_full

There's no way of telling exactly what offer you'll qualify for (if any) without starting an application. After you submit your application – but before you accept the card (if you are approved) and your credit score is pulled – Amex will let you know the exact welcome offer you are eligible for.

Just remember: Travel cards are serious business. No matter how many points you earn through a welcome bonus, they're not worth digging yourself into debt if you can't afford to pay off every single charge you make.

Earning Points

Earn 4x Points at Restaurants Worldwide

The American Express Gold Card earns 4x Membership Rewards points per dollar spent at restaurants worldwide (up to $50,000 in purchases per year, then 1x). For the average American, dining out is one of the biggest expenses – especially for the younger crowd that Amex is increasingly catering to.

Whether you're eating at a five-star, Michelin restaurant, at your favorite fast food spot, or stopping for coffee, you'll earn 4x points for every dollar you spend.

Related reading: The Best Cards to Use for Dining

Earn 4x Points at U.S. Supermarkets

The American Express Gold Card also earns 4x points per dollar spent at U.S. supermarkets (up to $25,000 in purchases per year, then 1x) – making this card a go-to for not only dining out but cooking at home, too.

But keep in mind that not all stores where you buy groceries will be eligible for bonus points. For example, Walmart, Target, and wholesale clubs like Sam's Club and Costco will not earn you bonus points.

Related reading: The Best Cards to Use for Your Grocery Shopping

Earn 3x Points on Flights

American Express Gold Card users earn 3x Membership Rewards points per dollar spent on flights booked directly with the airline or through American Express Travel.

Outside of dining and groceries, this is a great way to keep getting value from this card and maximize the points you earn on your spending.

Earn 2x on Prepaid American Express Travel® Purchases

While airfare gets a bigger bonus through Amex Travel, it's not alone. Prepaid hotels, rental cars, and cruises purchased through Amex Travel will earn you 2x points per dollar.

Other eligible spending on the American Express Gold Card will earn 1x points per dollar spent.

$120 in Annual Uber Cash

Much like the *amex platinum card*, the Gold Card comes with a monthly allotment of Uber Cash. Just be sure to add your Amex Gold Card to your Uber account as a payment option.

You'll get up to $10 per month in Uber Cash for use on either Uber rides or Uber Eats in the U.S. But just like other credits on top American Express cards, this is a use-it-or-lose-it benefit: If you don't spend $10 with Uber or Uber Eats in one month, it won't carry over to the next month.

Thrifty Tip: If you're using your Uber Cash for Uber Eats, opting for pick-up instead of delivery will make it much cheaper.

Related reading: Maximize Your Uber (& Uber Eats) American Express Benefits

$120 Annual Dining Credit

There's a separate credit of up to $120 a year for dining, which is doled out in $10 installments. It's also fairly easy to use, as it will kick in for orders through the following merchants:

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Five Guys

Enrollment is required for this benefit. GrubHub alone makes it relatively easy to use this credit each and every month. But remember, this is a use-it-or-lose-it benefit. If you don't use your $10 dining credit within the calendar month, it won't roll over to the next.

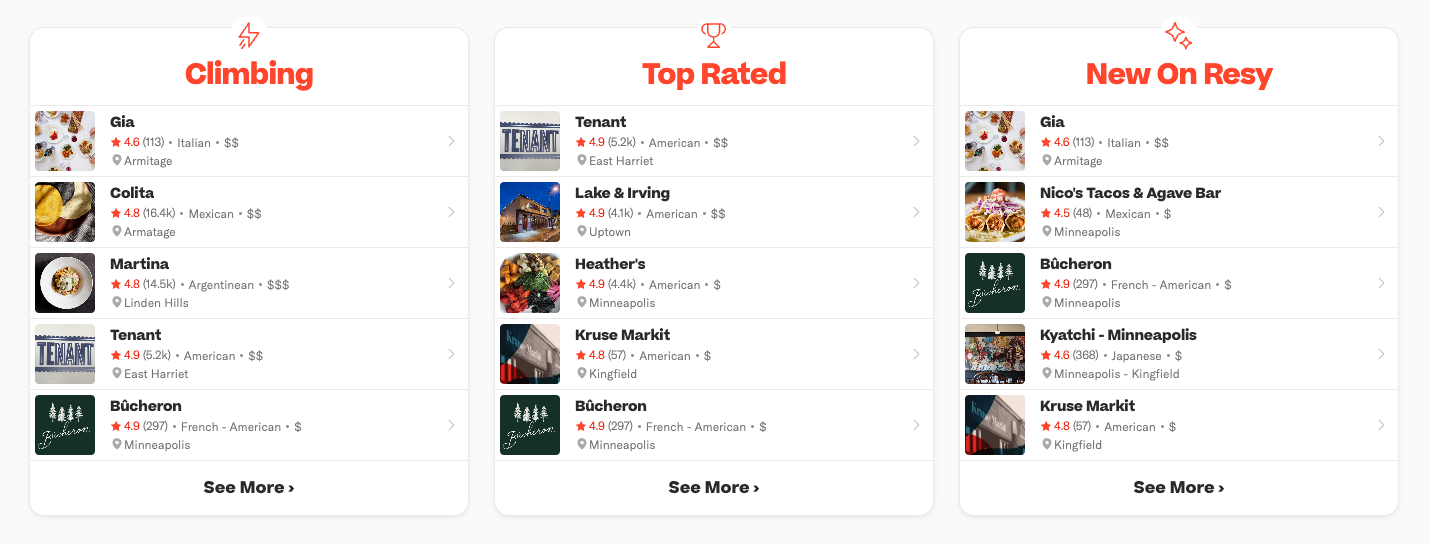

Up to a $100 Resy Credit

Each year, cardholders can get up to $100 in statement credits when dining at U.S. Resy participating restaurants. The statement credit is broken up twice a year: You have up to $50 to use from January through June, and another up to $50 from July through December.

Read more: How to Use Amex Resy Credits

One important detail: You'll need to enroll in this benefit online through your Amex account before dining at one of these restaurants. And like most other credits, this one is also a use-it-or-lose-it benefit. If you don't spend the full $50 in the first half of the year, it won't roll over to the next six months.

And only U.S. restaurants will qualify for these new credits, so don't count on putting them to use on your international travels, either.

$84 Dunkin' Credit

Gold cardholders also get up to $84 per year at Dunkin' – the coffee chain formerly known as Dunkin' Donuts. But that's split into installments of $7 a month.

Much like the Resy credit, you'll need to enroll your card in this benefit before taking advantage of it. Once you do, simply swipe your Gold Card when you purchase your morning coffee at Dunkin', and you're all set. Amex will automatically reimburse you up to $7 per month.

Or even better, download the Dunkin' mobile app, and you can load your digital wallet with $7 each month. Pay with your Gold card, and Amex will reimburse you, and you won't be tied to a monthly schedule for using this benefit.

Annual Fee

The Amex Gold Card has a annual_fees annual fee. While that's no doubt steeper than many other travel cards on the market, it's far from the most expensive.

If you can make good use of the majority of the card's semi-annual and monthly statement credits, you'll come out ahead. And earning bonus points in common spending categories makes it one you'll want to keep swiping all year long.

Using American Express Membership Rewards Points

When it comes time to redeem your American Express Membership Rewards points, using the stable of Amex transfer partners is your best bet.

With nearly two dozen Amex transfer partners at your disposal between airlines and hotel chains, the ability to transfer American Express points opens up a world of travel opportunities. But whether you're a newbie to points and miles or an old hand, these transfers are a whole new can of worms with confusing twists and considerations to keep in mind.

Here are the current options, as well as how long it takes to move points from your American Express account to an airline or hotel brand.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 5:4 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Our Take

The Amex Gold's big welcome offer makes it worth considering for just about any traveler. But now more than ever, it's a solid choice for those who spend a lot on groceries and dining … and that's most of us, isn't it? There aren't many other cards that can compete with the amount of points you'll earn in those categories, which makes it an immediate winner.

Add in the $120 in dining credits each year, $84 Dunkin' Credit, $100 Resy Credit, and $120 annually in Uber cash, and there's a lot of value to be had with this card.

These credits and bonus categories are a big reason why we feel the card is still worth the $325 annual fee.

Finally, Membership Rewards points are among the most valuable transferable points, as they can be transferred to airlines like Delta, Virgin Atlantic, and Air France/KLM, as well as to hotel partners like Marriott and Hilton.

Bottom Line

Foodie card. Travel card. Grocery card. Need we say more?

Even with a annual_fees annual fee, the Amex Gold Card is well worth having in your wallet as the new welcome offer, bonus categories, and statement credits can help you come out way ahead.

Learn more about the *amex gold card*