The rollout of the new *chase sapphire reserve* this week was supposed to be paired with even better news: Softening Chase's notoriously strict eligibility requirements, potentially making it easier for current Chase cardholders to open and earn a (record-setting) bonus on the bank's flagship travel card.

The reality, however, is that things are murkier than ever.

Chase has officially ended the longstanding “one Sapphire card” limit, allowing travelers to open and hold both the *chase sapphire preferred* and the new Sapphire Reserve simultaneously.

But that doesn't mean current Sapphire Preferred cardholders can go snag the new 100,000-point bonus (plus a one-time $500 Chase Travel℠ credit) after spending $5,000 in three months by applying for the Reserve. The same goes for current Sapphire Reserve cardholders looking to grab the new 75,000-point bonus after spending $5,000 in three months on the Sapphire Preferred.

Instead, Chase's terms and conditions indicate the bank is actually making it harder to earn more bonuses, including:

- “This credit card is unavailable to you if you currently have one open:” Current Reserve cardholders can't open another one – no surprise there.

- “The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open.” This appears to be the most significant sticking point so far. Nearly everyone who currently has a Sapphire Preferred has received a pop-up (or been outright declined) for the Sapphire Reserve. So while it's possible to have both cards, you probably can't earn a bonus if you currently hold a Sapphire Preferred.

- “The new cardmember bonus may not be available to you if you … previously held this card.” This one doesn't appear to be a major issue for most. We've seen many reports of people who downgraded (or closed) their accounts years, or even days, ago getting approved.

- “The new cardmember bonus may not be available to you if you … received a new cardmember bonus for this card.” Again, this one doesn't seem to be a problem for most. Several readers and others online have reported getting approved for the Sapphire Reserve, despite receiving a bonus (or multiple bonuses) in the past.

- “We may also consider the number of cards you have opened and closed, as well as other factors, in determining your bonus eligibility.” This is a nod to the bank's notorious 5/24 rule … without spelling out exactly what they're looking at.

But there are a lot of “mays” and “may nots,” leaving the door open for some applicants to get approved while others get turned away. So, what are the rules now, Chase?

The bank itself isn't spelling it out, telling Thrifty Traveler in a statement last week only that “New account bonus offer eligibility for either card will be based on factors including previously earned bonus offers and the number of cards opened and closed, among others.”

Still, enough data points have filtered in by now that we're starting to get a sense of what it takes to get approved. Here's what we know.

Related reading: Chase Sapphire Reserve® Hikes Annual Fee, Adds Tons of Perks

You'll Need Good-to-Excellent Credit

First and foremost, if you've never had a Chase Sapphire card and have good credit, you should be a shoo-in for either the Sapphire Preferred or Reserve … and eligible for the bonus.

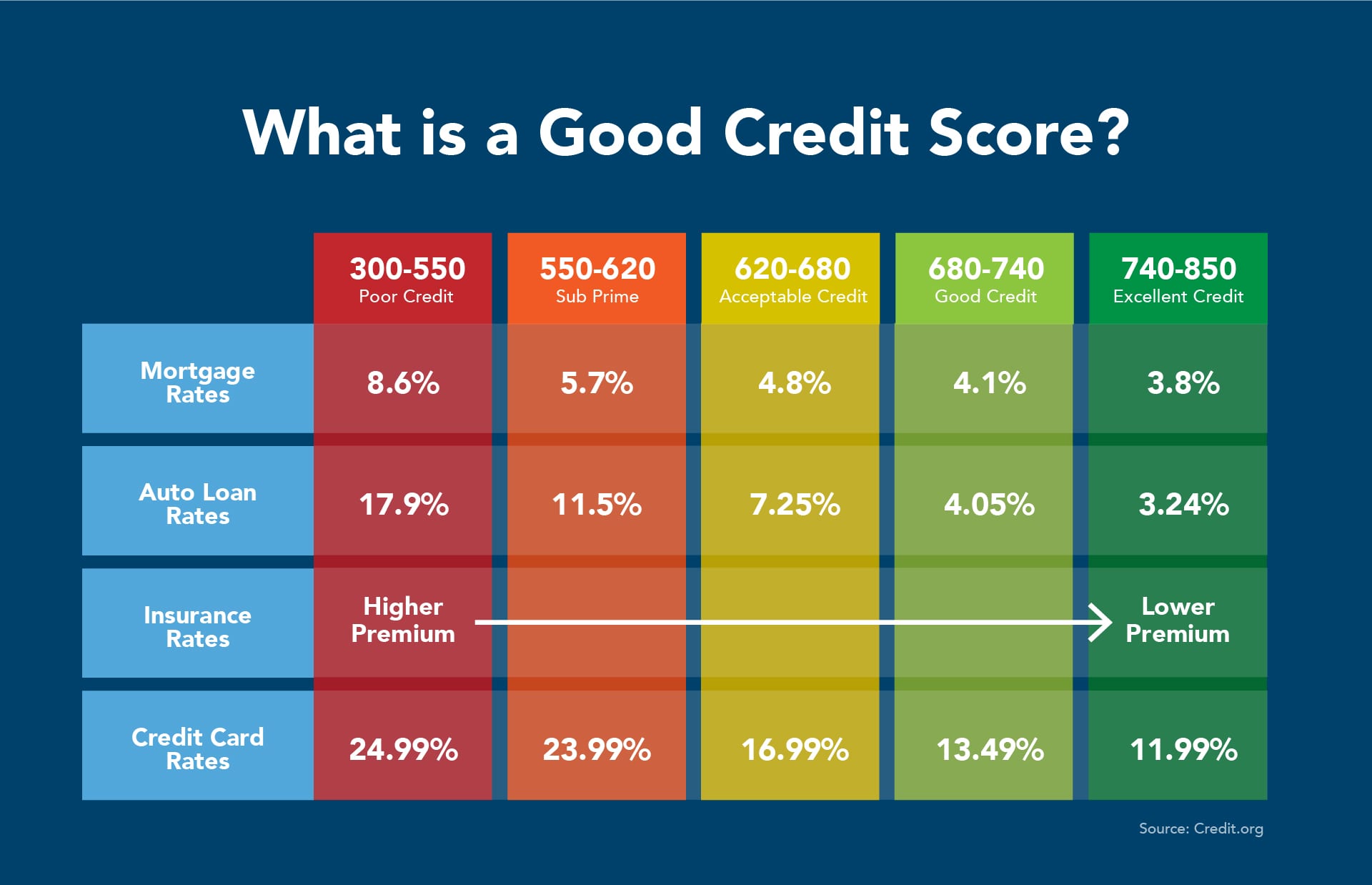

Chase indicates that you must fall into the “Good” to “Excellent” credit buckets to be approved. As you can see, that means you’d probably need at least a 680 credit score to get approved.

From our own experience, accounts from readers, and historical data from creditcards.com, anyone with a credit score below 700 will generally have a harder time getting approved for a Chase Sapphire card.

But this isn't a hard-and-fast rule. There are certainly exceptions, especially if you have a history with Chase. But your best bet for getting approved is having what the bank deems “good” to “excellent” credit. If your credit score is below 680, your odds of getting approved aren't great.

Read more: What Credit Score Do You Need for the Chase Sapphire Preferred?

What if You Already Have a Sapphire Card?

While it's now possible to have both the Sapphire Preferred and Reserve simultaneously, you're almost certainly not eligible for a bonus on either card if you currently hold one or the other.

Several members of the Thrifty Traveler team jumped at the opportunity to earn a 100,000-point bonus and $500 Chase Travel credit by applying for the Sapphire Reserve shortly after it launched. In all cases, these team members were current Sapphire Preferred cardholders. The result?

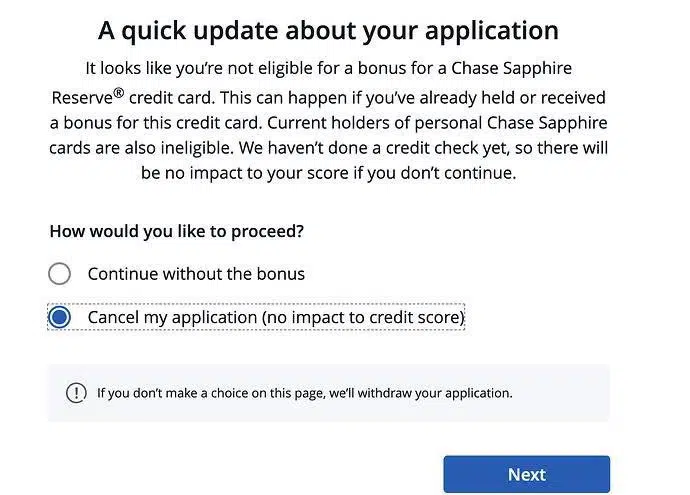

One was auto-declined with little explanation, and the others received Chase's new pop-up message letting them know they could proceed with the application but weren't eligible for the bonus.

While we haven't seen this ourselves, Frequent Miler reports that some of their readers backed out of applications after receiving a pop-up indicating they weren't eligible for the bonus, but still found a new Sapphire Reserve card showing up in their accounts. Ouch!

We'll chalk this up to growing pains with Chase's new pop-up tool and hope the bank rectifies the situation by removing the unwanted cards from these people's credit reports. Or better yet, offers them the bonus they supposedly weren't eligible for. But until then, keep a close eye on your Chase accounts if you recently applied for a Sapphire Card but backed out of the application due to not being eligible for the bonus.

What if You Recently Downgraded Your Sapphire Card … Or Plan To?

Just because you've been a longtime Chase Sapphire cardholder doesn't mean you're out of the running for this big bonus. It just depends on timing.

Chase previously had a 48-month rule (four full years) for Sapphire bonus eligibility: If you earned a bonus on either the Sapphire Preferred or Reserve in the prior 48 months, you weren't eligible. That's no longer in the terms—replaced with vague, new “lifetime” language—but it appears this isn't a hard and fast rule (at least not yet).

This means if you recently downgraded (or closed) your Sapphire Card to one of the no-annual-fee Chase Freedom cards, you could still be eligible … even if it's been less than 48 months since you last earned a bonus. In fact, we've seen reports of Sapphire cardholders downgrading (or closing) their Sapphire cards within the past week and still getting approved for both the Sapphire Reserve and Sapphire Preferred.

If you're thinking of doing this, downgrading to a Freedom card instead of canceling your current card outright is probably the best move. If you close a Sapphire card with a balance of Chase Ultimate Rewards points, they will be forfeited. Downgrading keeps them intact. Once you open a new Chase Sapphire card, you can then transfer those points back to your new Chase Sapphire card.

One other thing to keep in mind if you're planning to go this route is that you'll forfeit the ability to redeem points through Chase Travel℠ at an increased (fixed) rate.

For years, Sapphire cardholders have gotten extra value when redeeming their points through the Chase Travel portal on virtually any travel purchase: 1.25 cents apiece with the Preferred and 1.5 cents each from the Reserve. It was both valuable and straightforward: The cheaper the flight, hotel, rental car, or cruise, the fewer points you'd need to book it.

But Chase is officially sunsetting that perk, replacing it with new expanded “Points Boost” redemptions on select premium cabin flights and hotels. Chase began testing out earlier this year. While that will give cardholders even more value when using their points through the portal – up to 1.75 cents per point for Sapphire Preferred and 2 cents apiece for Reserve cardholders – it'll be far more limited in scope, and all other travel redemptions will be worth a flat 1 cent each.

Read next: The Chase Sapphire Preferred is My Oldest Card – Here's Why I'm Getting it Again

The Chase 5/24 Rule

The final thing you’ll need to be aware of is something called the Chase 5/24 Rule. And it can be a killer.

The Chase 5/24 rule was rolled out years ago to prevent card applicants from opening credit cards solely to earn bonus rewards. This is an unofficial rule (you won't see it in the application terms), and there's no sign that it's been relaxed yet.

Here’s what it boils down to:

- If you have opened five or more credit cards in the past 24 months from any bank (not just Chase), you will not be approved for Chase credit cards, regardless of your credit score or history with Chase Bank.

- The rule does not count credit inquiries, but rather card products you have applied for and been approved for. That also means mortgages and other lines of credit don’t count.

The rule is not officially published through any of Chase’s platforms. Case in point: If you ask about it in a Chase branch or on the phone with a Chase customer service representative, employees have likely not heard of it.

There have been some signs lately that Chase is relaxing this rule, but it's still hit or miss. Still, your best chance at getting the Sapphire Preferred Card is by being under that all-important 5/24 count.

Not sure where you're at on the 5/24 count? A great way to keep track of your status is by using the Travel Freely tool!

What Does All This Mean?

While Chase's new application rules are still evolving, and confusing at best, we're starting to get a clearer picture of what it takes to get approved for a big bonus on both of the Sapphire cards.

It's now possible to have both the Sapphire Preferred and Reserve at the same time, but it's highly unlikely you'll be eligible for a bonus if you currently hold one of these cards. If you've had one of these cards in the past, Chase's new application terms state you “may not be eligible” to earn a bonus again … but so far, that doesn't appear to be much of an issue. Being a current Sapphire cardholder seems to be the most significant sticking point for would be applicants.

If you currently hold a Sapphire card, you can try downgrading to a Freedom card or closing your account outright (just be sure to use your points or move them to another Chase card) before applying. It's best to wait a few days – or even a week – if you decide to go this route.

Furthermore, you'll need to make sure you've opened less than five new cards (not counting business cards) with any bank in the last 24 months to get approved and have good to excellent credit. If you meet all these qualifications, your chance of approval (and getting a bonus) is quite good!

Bottom Line

Chase has officially lifted its Sapphire-card family rule, allowing travelers to hold both the *chase sapphire preferred* and *chase sapphire reserve* – but that doesn’t mean you’ll earn a big bonus on both. Despite hopes of relaxed restrictions, Chase’s new terms are murky and may actually make it harder to get the new bonus offers.

If you currently have either Sapphire card, you’re likely ineligible for a bonus on the other. However, if you’ve recently downgraded or closed a Sapphire card (or plan to), you might still qualify – recent reports show many are getting approved. Just be sure you’re under Chase’s 5/24 rule and have good-to-excellent credit before applying.

Learn more about the *chase sapphire preferred*

Learn more about the *chase sapphire reserve*

Can you upgrade from a Chase Freedom Flex and still get the 100K Bonus on the Chase Sapphire Preferred® Card? If so, how can one go about it?

You won’t be eligible for a welcome offer bonus by upgrading an existing card. You will have to apply for the card as a new account.

It still shows 60K bonus on Chase website. Is there a trick to seeing this $100K offer?

The link wasn’t working earlier but should be updated now.

Just want to comment how clear and helpful your advice is. There are so many obscure rules regarding credit cards and bonuses. Thank you.

Thanks for reading, Allan! Glad you found it helpful.

I own the card as an authorized user so the sign up bonus received was not in my name. Can I sign up for this card? Does my authorized user card need to be cancel before that?

Authorized user cards will count towards your Chase 5/24 status. As long as that authorized user card doesn’t put you over the limit and you meet all the other qualifications, you should be eligible. There is no rule about not being able to get a Sapphire card if you are an authorized user on somebody else’s.

Hi there, I have a bit of an interesting situation, I believe I opened chase sapphire preferred in 2016, then upgraded to reserve in 2017, not realizing I wouldn’t get the reserve sign up bonus points. i believe i downgraded my preferred to a freedom unlimited.

Since it’s been 6-7 years, could i downgrade my reserve to a flex, then immediately open a sapphire preferred to get the 80k sign up bonus?

Hi Jonny, this absolutely should work as long as you are not impacted by Chase’s 5/24 rule.

Hi there,

We had Sapphire preferred (and received sign-up bonus) almost 4 years ago.

We called to cancel this card, and Chase’s moved us to the “no-annual fee” Sapphire card.

I understand that in order to receive sign-up bonus, we cannot have another sapphire card.

If we call and cancel / close this “no-annual fee” Sapphire card, are we allowed to re-apply the Sapphire preferred and receive it’s sign-up bonus in 2-3 months?

Thanks for your help~

Hi Steve, you absolutely should be. You could also request to move the card over to a Freedom Flex or Freedom Unlimited no annual fee cash back card. Those won’t impact your ability to get another Sapphire Card.

I applied for a credit card a few days ago with a reward of 60k points, but yesterday my friend told me that I could get a reward of 90k points by applying offline. I wonder if I can cancel my first card after receiving it and apply for a new card with the same value offline

What if your bonus was rescinded due to a cancelation because of COVID? Do you still have to wait the four years.

I am honestly not sure how that would be handled. It may be worth a quick call to Chase to see.

I’ve had my Sapphire Reserve card for more than four years. I just cancelled it. How long do I have to wait before I can apply for the Sapphire Preferred card?

Hi Melissa, being that the offer is now back at 60k, you have time. I would suggest waiting a full 30 days before applying again for the Sapphire Preferred.

I referred someone and they were accepted. How do both of us know if/when we get the bonus? Do they send notification emails or do you just need to watch your points to see if they are awareded?

I don’t believe you will get notified, but keep an eye on your account. Should post after a few weeks.

I was rejected even tho I have 800+ credit score. The reason they said was my retirement income was enough. I believe the real reason was even tho I own my condo, I’m a co-signer on my daughter’s condo.

I have had both Chase Slate and Chase Freedom cards for years. I applied for the Chase Sapphire and it was issued. 5 days after receiving the card, Chase moved the bonus from 80,000 to 100,000 points. Having been a Chase customer for numerous years, I called and asked for my bonus to be increased from 80,000 to 100,000. I was informed they will not increase the bonus, in a situation like this, for any customer or reason. Super disappointing.

If one spouse has a Sapphire Preferred card in her name, is it possible for the other spouse to apply for a card and receive the bonus points now being offered?

Hey Phil. Absolutely! There are no restrictions on that, as long as they meet the other requirements laid out in this list.