Chase's Freedom cards have long been considered two of the best fee-free credit cards on the market. Both the *freedom unlimited* and the Chase Freedom Flex℠ offer a respectable welcome bonus, solid rewards earning, and come with perks you wouldn't typically expect from cards in their weight class.

And if you hold either the *chase sapphire preferred* or the *chase sapphire reserve*, both of the Freedom Cards instantly become more valuable by unlocking additional ways to use the card's points.

Beyond the Freedom name, the two cards have quite a bit in common – but there are some stark differences that you should be aware of when deciding which version is right for you. To help with your decision, we'll break down all of the benefits you get with each card, picking a winner in each category to help you decide which is best for your wallet.

And if in the end you you still can't decide – you don't have to. Chase will allow you to carry both versions of the Freedom cards at the same time, so certainly don't feel like you have to pick a favorite.

Chase Freedom Unlimited vs. Chase Freedom Flex: Overview

With so much in common, how do you decide which Chase Freedom card is right for you?

When comparing the Chase Freedom Unlimited vs. Freedom Flex, take a look at what you spend most of your money on. If you think you will be able to take advantage of the rotating bonus categories, and the additional World Elite Mastercard benefits, the Freedom Flex is going to be the right card for you.

If your spending falls more in an “other” category. The Chase Freedom Unlimited, earning 1.5% on all other spending, is going to be the better option.

Here's a quick breakdown of what you get with each card:

| Chase Freedom Unlimited | Chase Freedom Flex | |

|---|---|---|

| Welcome Offer | *chase freedom unlimited bonus offer* | Earn a $200 (20,000 Ultimate Rewards points) bonus after spending $500 in the first three months. |

| Earning Points | Earn 5% on travel purchased through Chase Ultimate Rewards. Earn 3% on dining and drugstore purchases. Earn 1.5% on all other purchases. | Earn 5% on up to $1,500 in combined purchases in rotating categories each quarter you activate. Earn 5% on travel purchased through Chase Ultimate Rewards. Earn 3% on dining and drugstore purchases. Earn 1% on all other purchases. |

| Redeeming Points | Earns cashback in the form of Chase Ultimate Rewards (one point = one cent). Points can be combined with premium Ultimate Rewards earning cards to be transferred to partners and used to book travel. | Earns cashback in the form of Chase Ultimate Rewards (one point = one cent). Points can be combined with premium Ultimate Rewards earning cards to be transferred to partners and used to book travel. |

| Foreign Transaction Fees | 3% of the amount of each transaction in U.S. dollars. | 3% of the amount of each transaction in U.S. dollars. |

| Annual Fee | $0 | $0 |

Full Benefits of the Chase Freedom Unlimited Card

- bonus_miles_full

- Earn 5% cashback on travel booked through Chase Travel℠

- Earn 3% cashback on dining, including takeout and on eligible delivery services

- Earn 3% cashback at drugstores

- Earn unlimited 1.5% cashback on all other purchases after your first year with the card

- Subject to the Chase 5/24 rule, so you won't get approved for the Chase Freedom Unlimited if you've opened five or more credit cards (from any bank, not just Chase) in the last 24 months.

- No Annual Fee!

Related reading: Chase Freedom Unlimited Card Review

Learn more about the *freedom unlimited*.

Full Benefits of the Chase Freedom Flex Card

- Welcome bonus: Earn $200 (20,000 points) after spending $500 within three months of opening the card.

- Earn 5% cashback on rotating categories each quarter (up to $1,500 in spending).

- Earn 5% cashback on travel booked through Chase Travel℠.

- Earn 3% cashback on dining (including takeout and delivery services).

- Earn 3% cashback at drugstores.

- Earn 1% cashback on all other spending

- Subject to the Chase 5/24 rule: You won't get approved for the Chase Freedom Flex if you've opened five or more credit cards (from any bank, not just Chase) in the last 24 months.

- World Elite Mastercard Benefits

- No Annual Fee

All information about the Chase Freedom Flex was collected independently by Thrifty Traveler and has not been reviewed by the issuer.

Learn more about the Chase Freedom Flex℠ (for full disclosure, this is our personal referral link).

Chase Freedom Unlimited vs. Chase Freedom Flex: Welcome Offer

Let's face it: The welcome bonus offer is a key component to picking out any new credit card. Typically, we see banks require a large minimum spending amount in order to earn the bonus points but luckily, that isn't the case with either of the Chase Freedom Cards.

And if you hold either the Chase Sapphire Preferred or the Chase Sapphire Reserve, that extra cash back can be turned into Ultimate Rewards points at a rate of one cent to one point. So that means that both of these cards bonuses have the potential to be even more lucrative than they seem at face value.

Chase Freedom Unlimited

*chase freedom unlimited bonus offer*

Chase Freedom Flex

Right now, Chase is offering new cardmembers the opportunity to earn a $200 bonus after spending $500 on purchases in the first three months of account opening.

Winner: Which Card Has the Better Welcome Offer?

With identical bonuses, this category is a draw.

Chase Freedom Unlimited vs. Chase Freedom Flex: Annual Fee

Both the Chase Freedom Unlimited and the Chase Freedom Flex Card come with a $0 per year price tag. Not having an annual fee to worry about is a big reason why both cards are so popular. And because they make a great compliment to either of the Chase Sapphire cards, adding one to your wallet can be an easy decision that won't set you back any extra money in annual fees.

Winner: Which Card Wins on Annual Fees?

You'll need to look beyond the annual fee to decide which of these cards makes the most sense for your wallet. Since neither card charges an annual fee, this category is a clear draw.

Chase Freedom Unlimited vs. Chase Freedom Flex: Earning Points

Earning points is an area where both the Chase Freedom Unlimited and the Freedom Flex shine. Both cards come with a handful of lucrative bonus categories that will provide extra cashback (or points) for every dollar you spend.

With the Freedom Unlimited, you'll earn a bare minimum of 1.5% cashback on all your purchases so you can rest assured knowing you're getting a decent return everywhere you shop. On top of that, there are some additional bonus categories for earning extra points to be aware of.

The Freedom Flex takes a different approach and rewards cardholders with 5% cashback on rotating categories of up to $1,500 in spending each quarter. There's no telling which categories Chase will choose, but in the past, we've seen them pick things like Grocery stores, gym memberships, streaming services, gas stations, and more. Outside of the 5% quarterly earning, cardholders can also earn additional points in set bonus categories and get 1% cashback on non-bonus spending.

Let's take a closer look at what each card offers in terms of earning points.

Chase Freedom Unlimited

- Earn 5% cashback on travel booked through Chase Travel℠

- Earn 3% cashback on dining (including takeout and delivery services)

- Earn 3% cashback at drugstores

- Earn an unlimited 1.5% cashback on all other purchases

Learn more about the *freedom unlimited*.

Chase Freedom Flex

- Earn 5% cashback on rotating quarterly categories on up to $1,500 of spending which could include:

- Grocery stores, gym memberships, streaming services, gas stations, etc. See our guide of the rotating Chase Freedom bonus categories.

- Earn 5% cashback on travel booked through Chase Travel℠

- Earn 3% cashback on dining (including takeout and delivery services)

- Earn 3% cashback at drugstores

- Earn 1% cashback on all other purchases

Learn more about the Chase Freedom Flex℠ (for full disclosure, this is our personal referral link).

Winner: Which Card is a Better Earner?

The additional rotating quarterly categories allow you to earn 5% cashback with the Freedom Flex. This has the potential to be very lucrative if you're able to max out the spending in these categories each quarter. But on the flip side, if you're someone who spends a lot everywhere you might be better off earning a minimum of 1.5% cashback on all your purchases.

Which card earns more points will vary from person to person making this category too close to call. It's a draw.

Chase Freedom Unlimited vs. Chase Freedom Flex: Redeeming Points

You can use the points earned on your Freedom Cards for a statement credit or even redeem them directly to your bank account. When cashing out your points with either of these methods, You Chase Ultimate Rewards are worth one cent per point.

If you'd prefer to go a different route, you can also use your points for gift cards or to book travel through Chase Travel℠ at the same rate of one cent per point.

You can also use your points to pay for purchases at Amazon, but you'll be getting less than one cent per point in value and you'd be better off just using them as a statement credit to offset the purchase after it posts to your account.

Thrifty Tip: Be on the lookout for discounts at Amazon when using Ultimate Rewards to pay for your purchase. Just be sure to use the bare minimum amount of points needed to trigger the offer!

If you also have a Chase Sapphire Preferred or Chase Sapphire Reserve Card, you can get even greater value out of your points by transferring them to travel partners or redeeming through Chase Travel℠ for travel at a greater value.

Winner: Which Card is Best for Redeeming Points?

Both Freedom Cards come with the same redemption options – meaning there's no clear winner in this category. It's a tie.

Read More: How to Transfer Points Between Your Chase Cards.

Chase Freedom Unlimited vs. Chase Freedom Flex: Perks & Benefits

Unlike most Chase cards, the Freedom Flex is not issued by Visa – instead, it's issued by Mastercard, and it's a World Elite Mastercard at that. While the average person probably doesn't care whether their card is issued by Visa or Mastercard, it actually matters … a little.

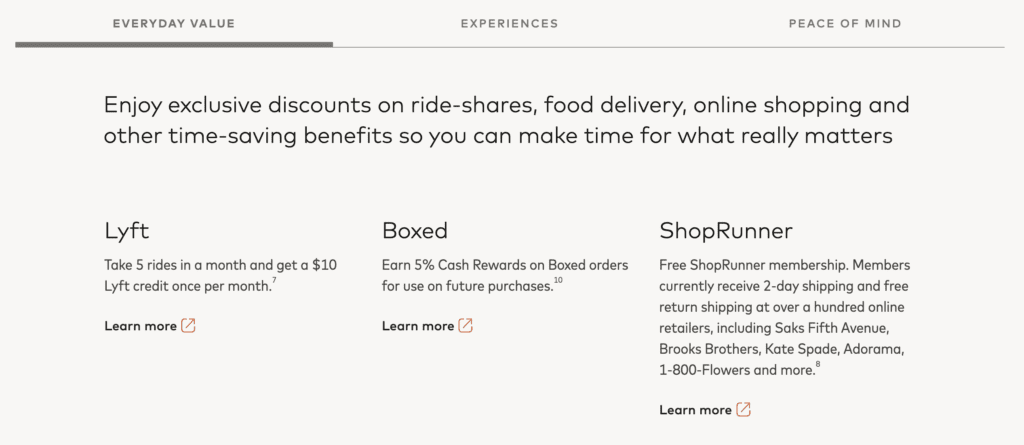

Since the Freedom Flex is a World Elite Mastercard it opens up even more benefits like Lyft credits, discounts on Postmates deliveries, and gets a complimentary ShopRunner membership.

But perhaps the best World Elite Mastercard benefit is the complimentary cell phone insurance it provides. You'll get $1,000 in yearly coverage ($800 max per claim, 2 claims per year) should your cell phone get stolen or need certain repairs. All you need to do to take advantage is simply pay for your cell phone bill with your Chase Freedom Flex℠ World Elite Mastercard to activate coverage.

Beyond the specific benefits that the Freedom Flex gets for being a World Elite Mastercard, both of these cards provide trip cancellation and interruption protections, secondary car rental insurance, and roadside dispatch benefits.

Read more: Car Broke Down? Your Travel Credit Card Might Have Roadside Assistance

Winner: Which Card Offers Better Perks & Benefits?

The Freedom Flex has all the same benefits as the Freedom Unlimited, plus the added benefits of being a World Elite Mastercard. Getting some extras like a monthly Lyft credit, complimentary ShopRunner membership, and cellphone insurance make the Freedom Flex the winner here.

Learn more about the Chase Freedom Flex℠ (for full disclosure, this is our personal referral link).

Why You Should Pair a Chase Freedom with a Sapphire Card

The one-two punch of holding a Chase Freedom card with a Chase Sapphire Preferred or Sapphire Reserve credit card is undeniable.

When you’ve got a Chase Sapphire card, the cashback your Freedom Flex or Freedom Unlimited card earns can be turned into Chase Ultimate Rewards points. Every cent you earn equals one Ultimate Rewards point. That means earning 5% cashback is also like earning 5x Chase points.

Let’s say I hold the Chase Freedom Flex and the Chase Sapphire Preferred Card. Just for spending $500 in the first three months of card membership on the Freedom Flex, I’ll earn a $200 cash back bonus. And since I also have the Sapphire Preferred Card in my wallet, that $200 can be turned into 20,000 Chase Ultimate Rewards points to use towards travel.

Both The Freedom Flex and Freedom Unlimited cards will earn more points (3% back or 3x points) on dining than you would earn with the Chase Sapphire Preferred Card on its own. Holding one of the Freedom cards is a great way to make sure you squeeze the most value out of your everyday spending.

And if you don't already have a Sapphire Card, you'd also be eligible for its bonus offer: *csp bonus offer*

Learn more about the *csp*.

Bottom Line

Is Chase Freedom Unlimited or Freedom Flex Better? By the numbers, it's a draw. Both of the cards won a category and all the others were too close to call.

Deciding which card is best will come down to your own personal situation and spending habits. If you often spend money on categories that historically are not covered by the rotating bonus categories, you may be better off with the Freedom Unlimited. That being said, if you can maximize those 5% categories each quarter on the Chase Freedom Flex, you can earn a ton of additional cashback (or Chase Ultimate Rewards points).

The best part is you really don't have to choose. Both of these cards offer great value and should have a place in your wallet – especially if you can pair them with a Chase Sapphire Preferred or Sapphire Reserve Card.

After reading the response about Chase Freedom Unlimited having rental auto insurance, I checked and it does have rental auto insurance which is secondary to your regular Auto insurance in the US. I provides full coverage overseas.

The same is true for the Freedom Flex Mastercard.

You are correct Jerry! After some more digging, we found that yes they both do! Thank you for pointing out our error.

Do neither of these cover auto rental insurance? In the past the freedom and freedom unlimited both have.

Only the Chase Sapphire Preferred and Reserve cover car rental insurance. To my knowledge, the Freedom cards have never offered auto insurance being no annual fee cards.

Bre we were incorrect and both cards do provide secondary car rental insurance.